for expert insights on the most pressing topics financial professionals are facing today.

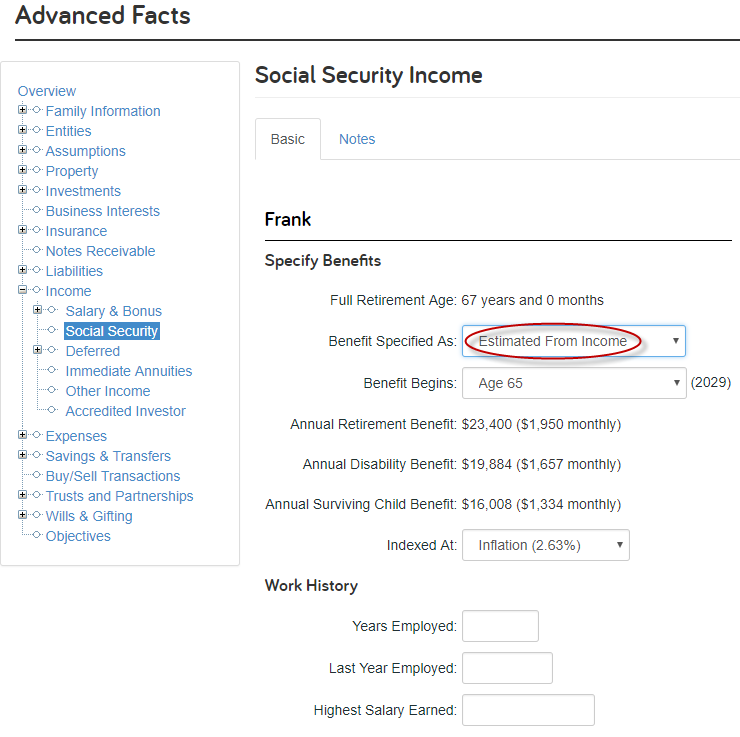

Learn MoreeMoney has a number of different options available when entering Social Security benefits into your Fact Finder. The initial default setting for Social Security income is “Estimated from Income.”

When you select “Estimate from Income” the system calculates an estimated benefit value based on the client’s salary and potential growth. This is the most efficient option if the client is young, has several years left in their career and hasn’t reached their highest earning potential. They may not yet even have a statement with the Social Security Administration (SSA) or if they do, it will likely change in the future. Because of this, you can save time by populating our estimation. Make sure you fill out the “work history” section in the advanced facts, as it will make our estimation a lot more accurate.

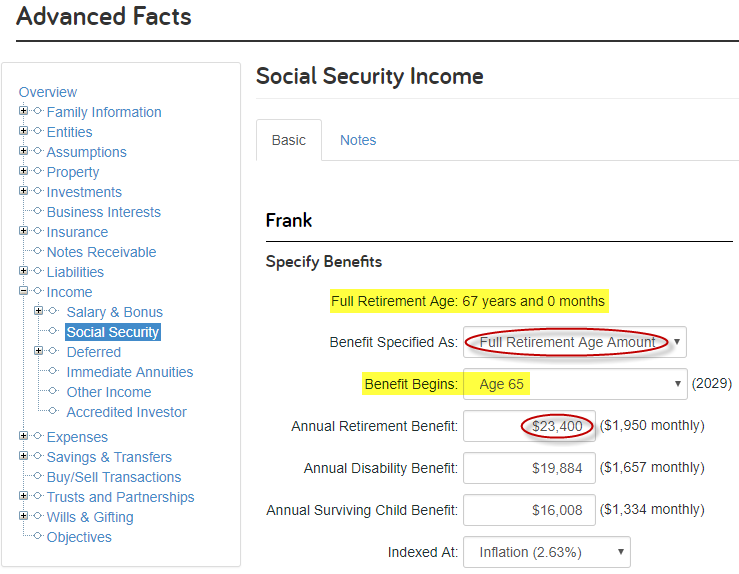

If your client is further along in their working career, you may want to use “Full Retirement Age Amount.”

This client’s statement from the SSA will be a lot more accurate and should at least provide the benefit amount that they would receive at their full retirement age. That is the number you should type into the social security annual amount field.

When using this method enter the benefit amount the client would receive on their SSA statement at Full Retirement Age.

From there, you can then adjust the age of retirement and at eMoney will apply the discount or credit difference automatically. This allows you to more easily play around with different social security strategies even if the client does not know what their benefit amount would be at every age option.

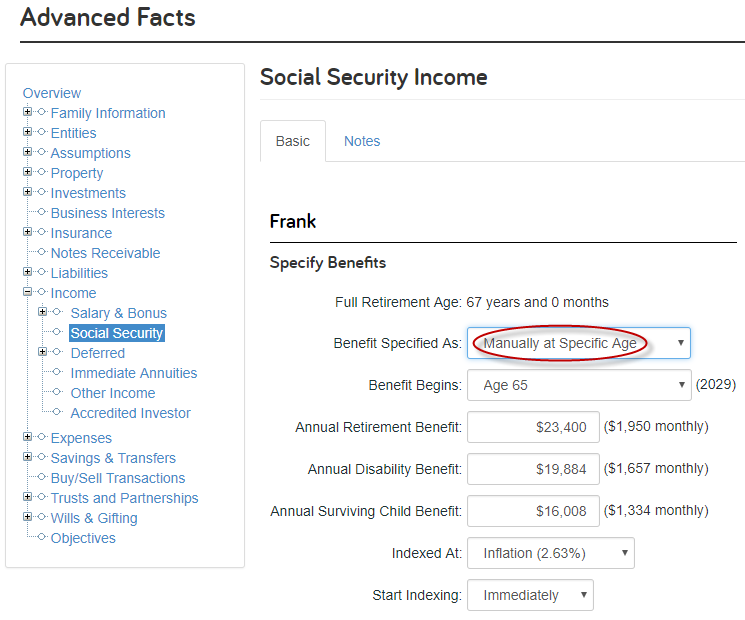

The Manually at Specific Age option is the best for anyone nearing or in retirement; a client who already knows exactly when they plan to take their benefit and how much they will receive.

With this option, you are able to choose the exact benefit amount and timing with no automatic calculations happening on the back-end by the system. You even control whether or not the eMoney inflates the benefit.

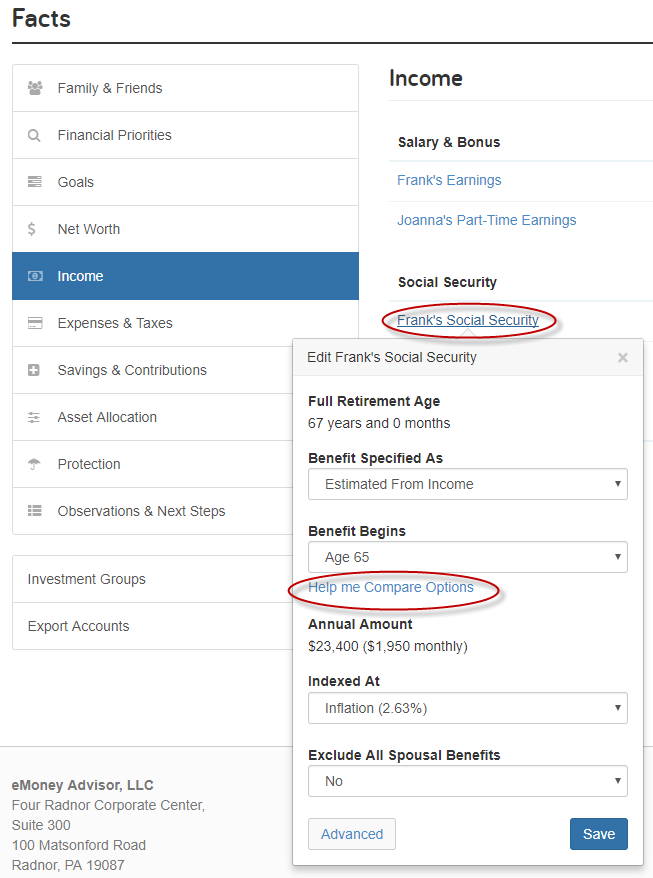

If Social Security is part of the planning conversation for the client, there is a little-known report within the facts that will allow you to quickly compare other options once you have entered the client’s current strategy into the fact finder. It can be found after clicking on either client or spouse’s social security in the basic facts through a link that says “Help Me Compare Options”

While not comprehensive, this report gives you a quick and easy way to examine which age would be best for the client to take their social security benefits based on their life expectancy.