December Updates

November Updates

October Updates

Remind me of all recent updates from last quarter!

ADDED SEPTEMBER 16 | The One Big Beautiful Bill Act (2025 Budget Reconciliation Bill) introduces changes that could impact client strategies. We recommend bookmarking this post, as it will serve as your central hub for tracking how and when these updates go live in eMoney. You can listen to this short podcast episode about how eMoney has responded to the new tax legislation with Senior Financial Planning Consultant, Michelle Riiska (Posted August 12, 2025).

Releases December 1

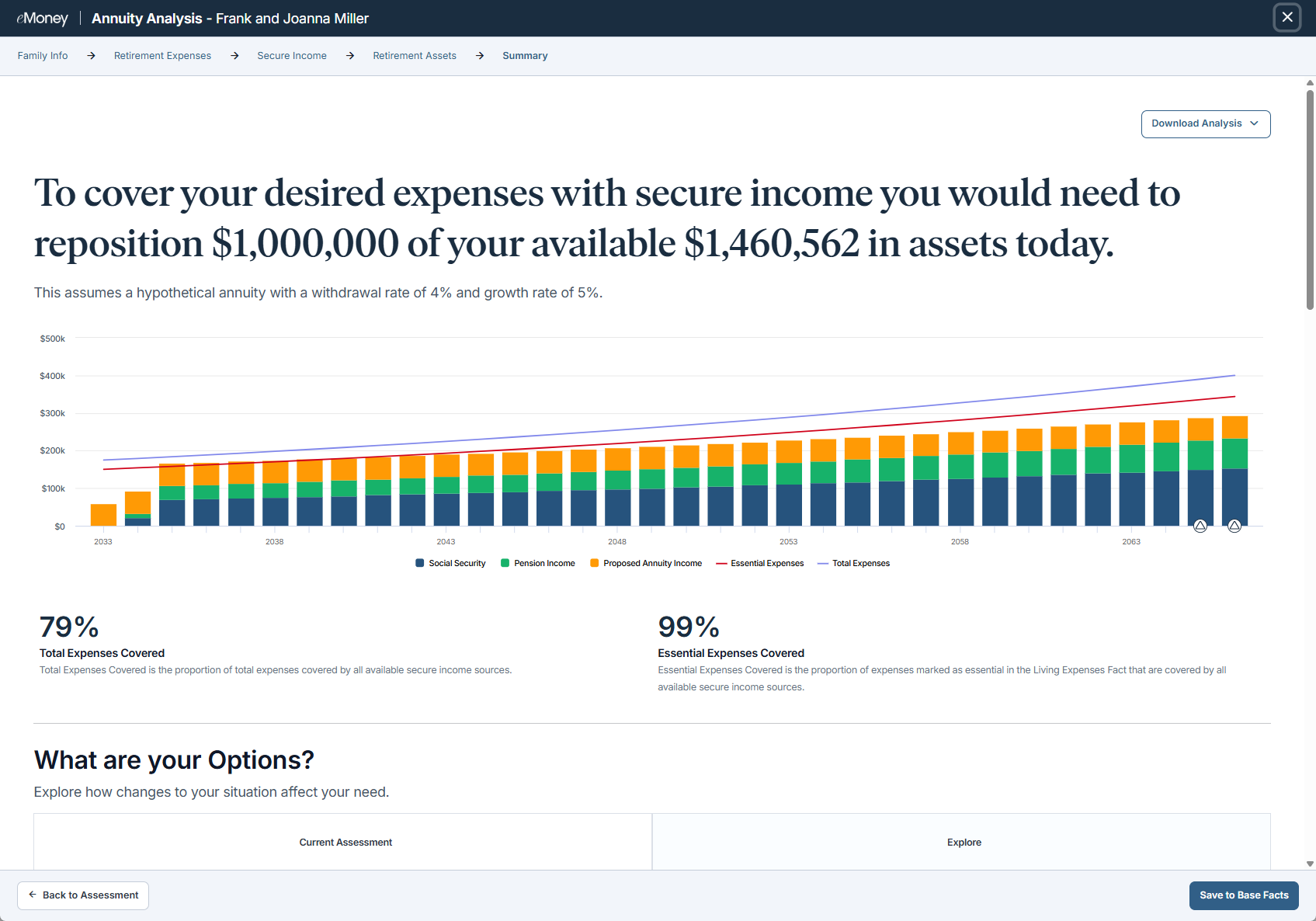

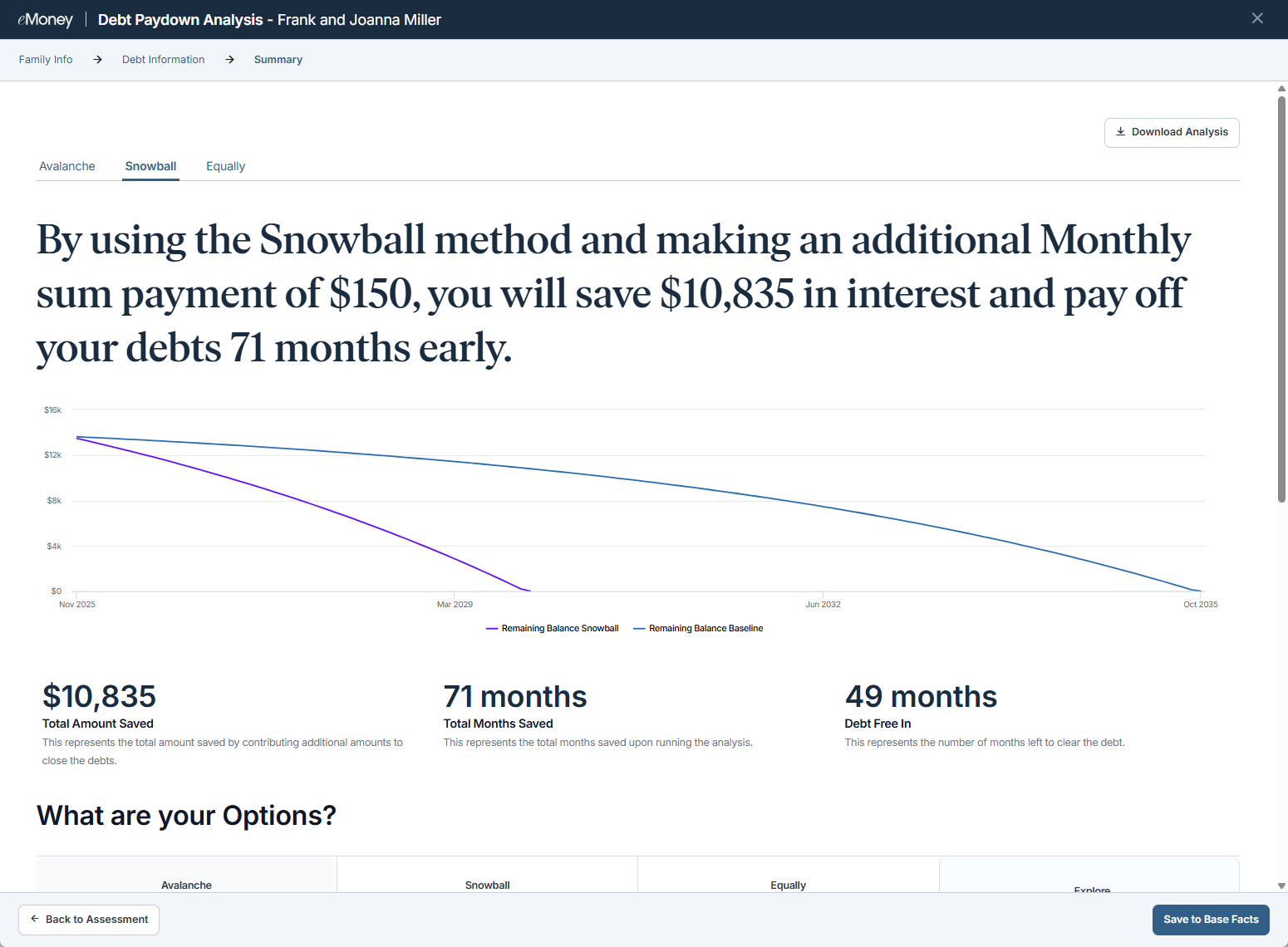

Enhance client conversations and deliver more personalized strategies with two brand-new Needs Analysis topics: Annuity Income and Debt Paydown. These additions expand the Needs Analysis suite to seven modules, giving you even more flexibility to engage with clients in meaningful ways. Other recently added reports include these four updated modules released in September 2025, along with the recently released Long-term Care.

Strengthen Retirement Confidence with Annuity Income

Help clients understand how secure their retirement income really is. The new Annuity Income module empowers you to:

Guide Smarter Debt Strategies with Debt Paydown

For the first time, simplify complex debt decisions with clear comparisons. Use the new Debt Paydown module to:

This marks the first time Needs Analysis includes a module focused on debt, bringing a brand-new capability to support smarter, stress-reducing financial decisions.

Please note, the classic version of Needs Analysis will be retired in the fourth quarter of 2026. Ahead of this change, please request a printable presentation for any reports you want to save for your records.

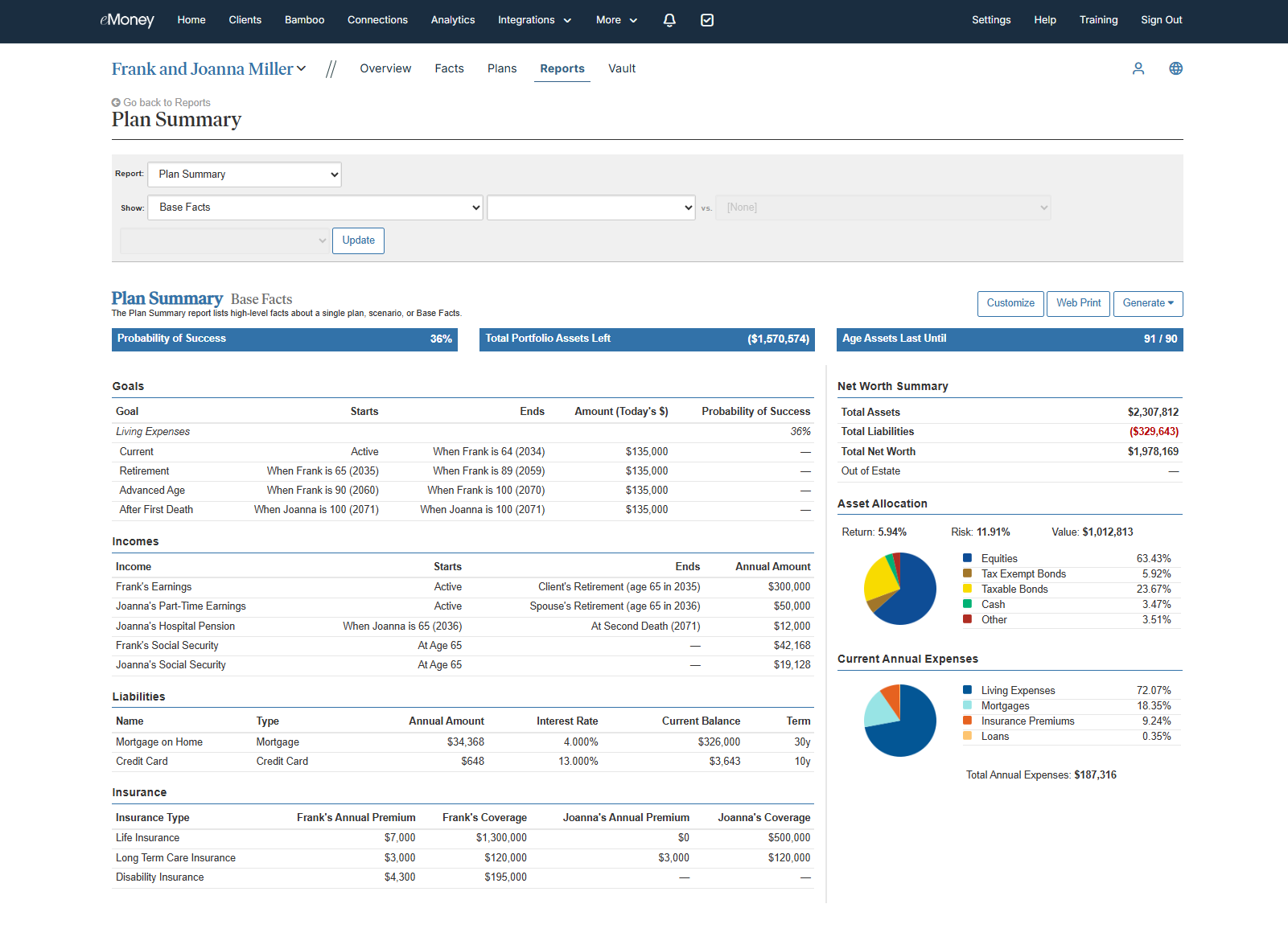

Releases December 1

Recent enhancements to the Plan Summary Report will enable you to deliver clearer insights and engage in more meaningful planning conversations. These updates, informed by advisor feedback, make it easier to organize and present goals, expenses, and liabilities, helping clients see the full picture of their financial plan.

What’s New:

These refinements make the Plan Summary Report a stronger tool for delivering confidence and clarity, so every conversation feels more personalized and actionable.

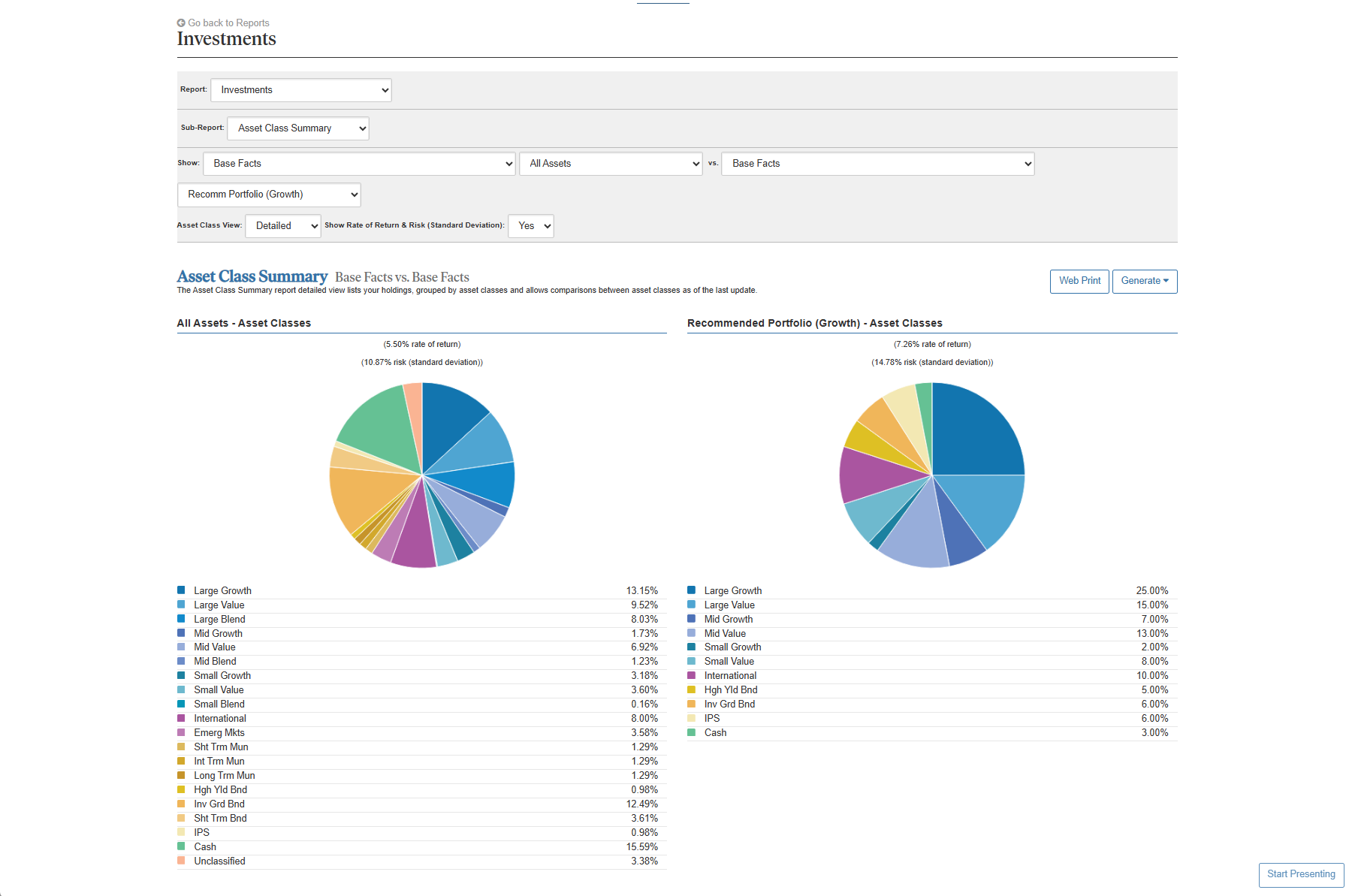

Releases December 1

Provide a clearer, more modernized way to present and demonstrate the impact of your recommendations with the new Comparison Mode within the Asset Class Summary Report.

What’s New:

These enhancements make it easier to deliver tailored, professional presentations—no matter how complex your client’s portfolio may be.

Releases December 1

As we continue to look to the future of your eMoney experience, we’ve made changes to 16 reports to improve performance and styling and enhance chart interactivity.

Most Visible Differences

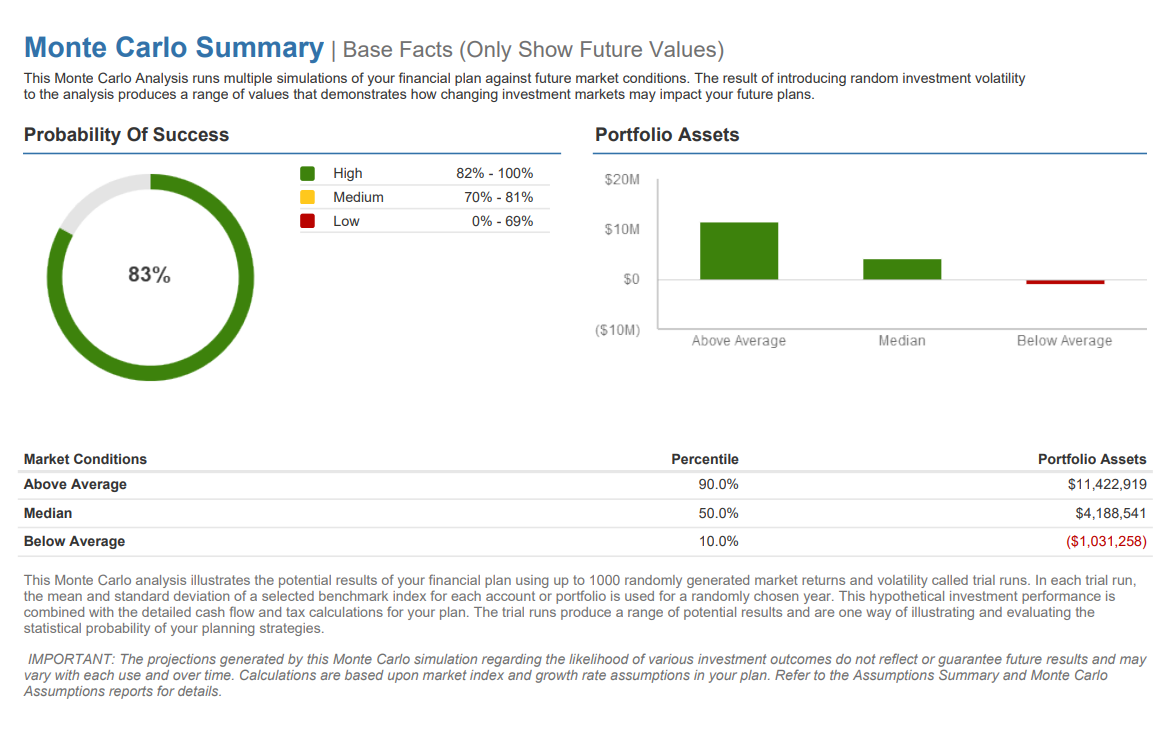

Example: Monte Carlo Summary report

Before:

After:

List of Reports Enhanced by Report Family

Releases December 1

In our ongoing effort to expand our integrations and make it as simple as possible to learn more about them, a new FP Alpha tile along with a designated support page, has been added to the Integrations page.

Please note that the functionalities are set up within the integration partner.

More About FP Alpha and Why We Chose to Integrate

This integration enables advisors to seamlessly access eMoney client data within FP Alpha, streamlining workflows and unlocking advanced planning insights in minutes.

eMoney integrated with FP Alpha in response to strong advisor demand. FP Alpha is recognized as a top innovator for tax and estate planning, offering AI-powered tools that help advisors deliver deeper, more scalable advice.

eMoney users of this integration can…

Are you an FP Alpha user? Join them on December 4th at 1 p.m. ET, for a brief webinar that reveals:

HOLIDAY BONUS: All attendees will receive FP Alpha’s agentic AI Checklist—a must-have guide for selecting trustworthy AI in planning.

Releases December 2

With Fidelity Bond Beacon®, now accessible through single sign-on from eMoney, you can seamlessly integrate fixed income strategies into personalized financial plans, helping you deliver better outcomes and strengthen client trust.

How It Works

With this integration, you can confidently incorporate fixed income strategies into holistic plans, strengthening client trust and improving outcomes.

Releases November 19

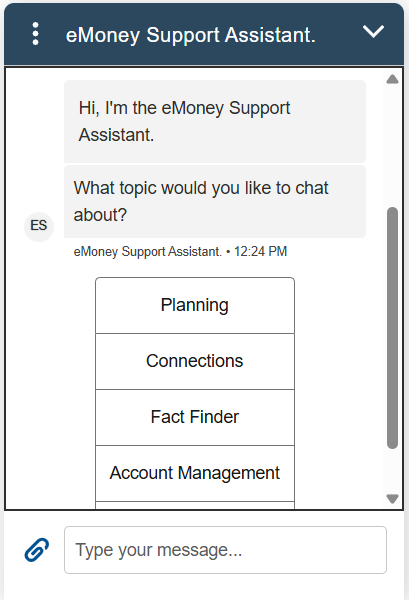

Receive faster and more efficient support for routine tasks with our improved automated chatbot workflows, available for self-service 24/7.

What’s Improving:

The Client Support Chatbot—triggered via the existing client support chats and the support link in your footer—now supports the following four key areas of automatic service:

1. Client Connections

2. Advisor Connections

3. Advanced Planning

4. Account Management

For all other issues, you’ll be routed to a live agent, or an email case may be created. We look forward to continuing to improve your experience so you can get back to what matters most, helping your clients plan for every possibility.

Releases Early 2026

As part of our commitment to delivering best-in-class digital experiences, eMoney is modernizing our platform and strengthening our security program in collaboration with Okta, a trusted partner and industry leader in identity management.

To further strengthen protection, eMoney is enabling Okta Adaptive Multi-factor Authentication for all users who login directly, adding an additional layer of security that safeguards confidentiality, integrity, and availability of client information while providing seamless, user-friendly access.

What’s Coming

Note: If you and your clients directly sign into eMoney, you may see a login message over the coming weeks about this.

Protecting your and your clients’ data remains our top priority. For any questions, feel free contact us at 888-362-8482 or email customerservice@emoneyadvisor.com.

Your clients count on you for clarity—and that starts with complete, accurate data. So far this year, we made big strides to help you deliver just that. Catch the highlights below:

These improvements mean less time troubleshooting and more time focusing on what matters: helping clients reach their goals. And we’re just getting started.

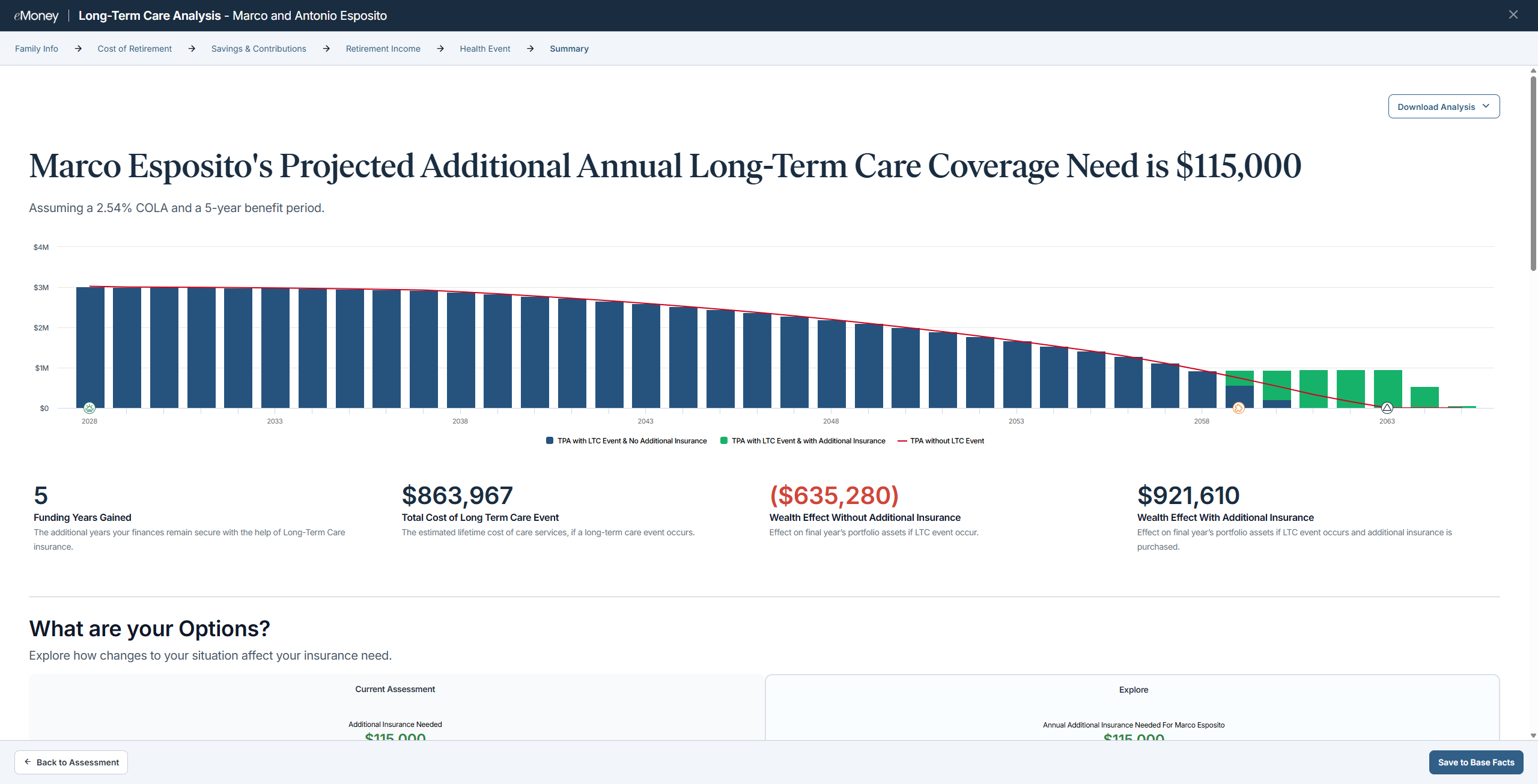

Releases October 23

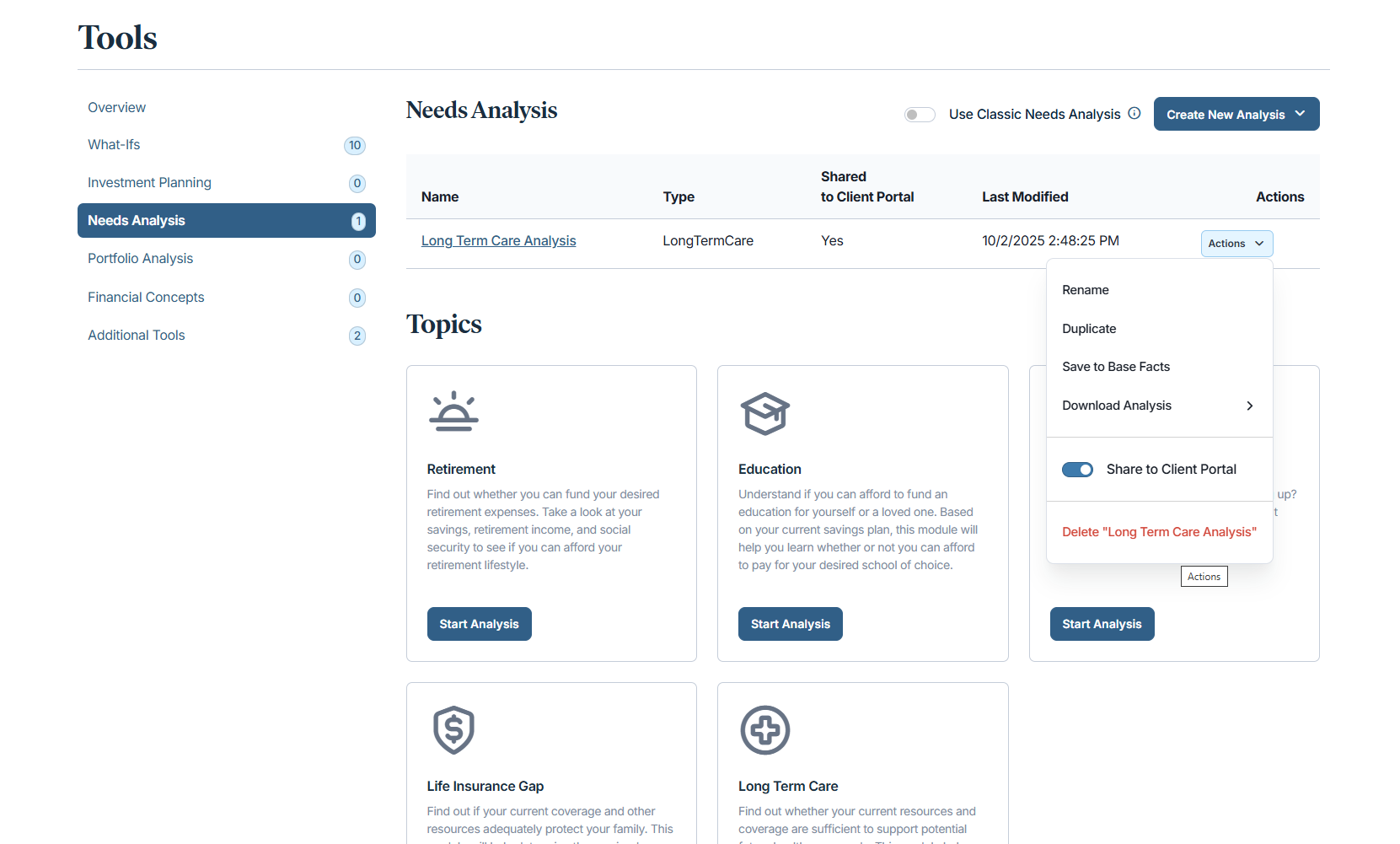

Support Meaningful Conversations Around Long-term Care.

Now you can easily show clients how future care needs could affect them financially with the new Long Term Care topic in Needs Analysis. Once the analysis is complete, you can share it to the Client Portal, so clients can revisit the conversation when they’re ready for deeper planning.

This new topic empowers you to:

Long-term care is a growing concern for aging clients and a major risk to retirement security. With the latest release, you now have simple, clear tools at your fingertips to confidently bring this topic into client conversations.

How to Share a Completed Needs Analysis Module to the Client Portal:

Please note, the classic version of Needs Analysis will be retired in the fourth quarter of 2026. Ahead of this change, please request a printable presentation for any reports you want to save for your records.

Releases October 23

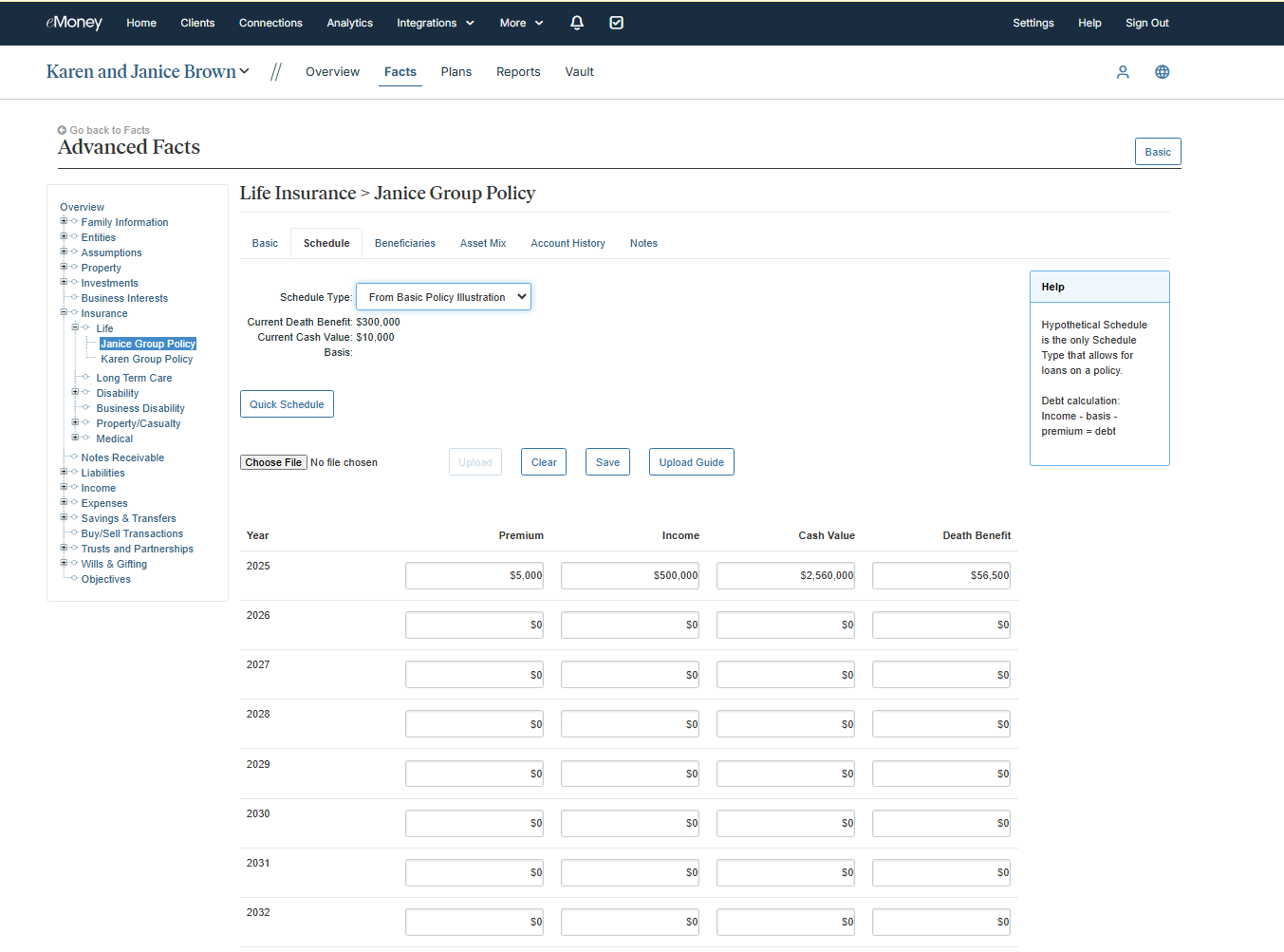

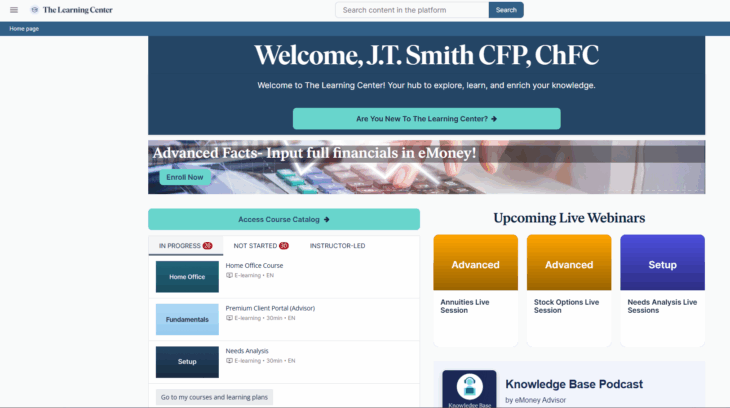

Reduce time and avoid manual entry errors by uploading life insurance schedule policy data via a .csv file in Advanced Facts when using a Basic Policy Illustration type.

Once uploaded, this data will automatically populate the life insurance schedule, saving up to 30 minutes per policy entry or more!

Where can I find this?

Click into the Schedule tab of the Life Insurance page for a select client, selecting From Basic Policy Illustration schedule type from the drop-down selection. You’ll see a Choose File upload button as seen below:

Important Notes

Releases October 23

In our ongoing effort to expand our integrations and make it as simple as possible to learn more about integrations, Zocks and YCharts tiles and support pages have been added to the Integrations page.

Please note that the functionalities are set up within the integration partner.

More about Zocks and why we chose to integrate:

Zocks is an AI meeting assistant for financial advisors that automates meeting notes, intake forms, client emails, and more. Integrations with Zocks and other AI assistants enable advisors to work more efficiently and better serve their clients.

eMoney users of this integration can…

If you’re interested in learning more about how Zocks and eMoney integrate, join their webinar on Wednesday, December 10th at 2:00 p.m. ET!

More about YCharts and why we chose to integrate:

YCharts is an investment research and client engagement platform that helps advisors make data-driven decisions and improve client relationships. It offers intuitive tools for investment analysis, risk profiling, and proposal creation, with AI-powered features and integrations that streamline workflows.

The integration with eMoney was driven by user demand, enhancing the platform’s capabilities in investment data and economic analysis. Advisors can now easily import client holdings from eMoney into YCharts to conduct research, run analytics, and deliver personalized recommendations more efficiently.

eMoney users of this integration can…

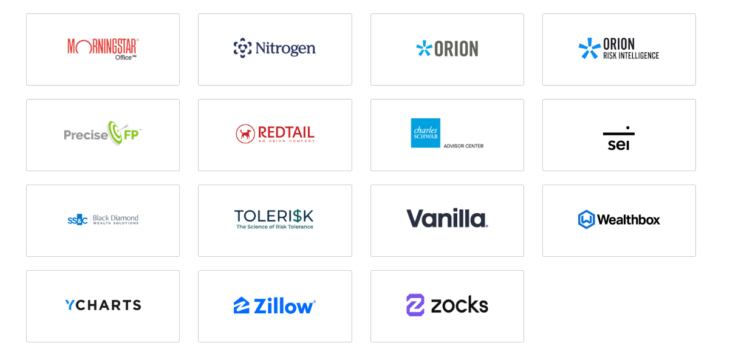

Releases October 1

Save time planning your training calendar by enrolling in upcoming workshops through the new scrolling banner. You can also access featured live webinars quickly using flip cards on the right side of your Learning Center homepage.

Access The Learning Center by clicking Training from the top right-hand side of your navigation bar anywhere within the eMoney experience.