January Updates

Remind me of all recent updates from last quarter!

Releases January 28

Plan Comparison builds on the existing Goal Planner experience to enable deeper, more meaningful plan comparisons in a faster, more intuitive way. See richer information in a single, streamlined view, edit key data, and evaluate multiple options side by side. Clearly surface trade‑offs and outcomes, collaborate with clients in real time, and align on the right path forward—without slowing the planning conversation.

Watch this video walkthrough to see how the new Plan Comparison experience helps you compare plans faster, collaborate more easily, and guide confident client decisions.

With the new Plan Comparison, you can:

Start using Plan Comparison today to save time, strengthen collaboration, and help clients move forward with confidence.

Important Note: Don’t worry, you’ll continue to have access to the classic Goal Planner plan comparison experience via the right-hand toggle through December 2026.

Releases January 28

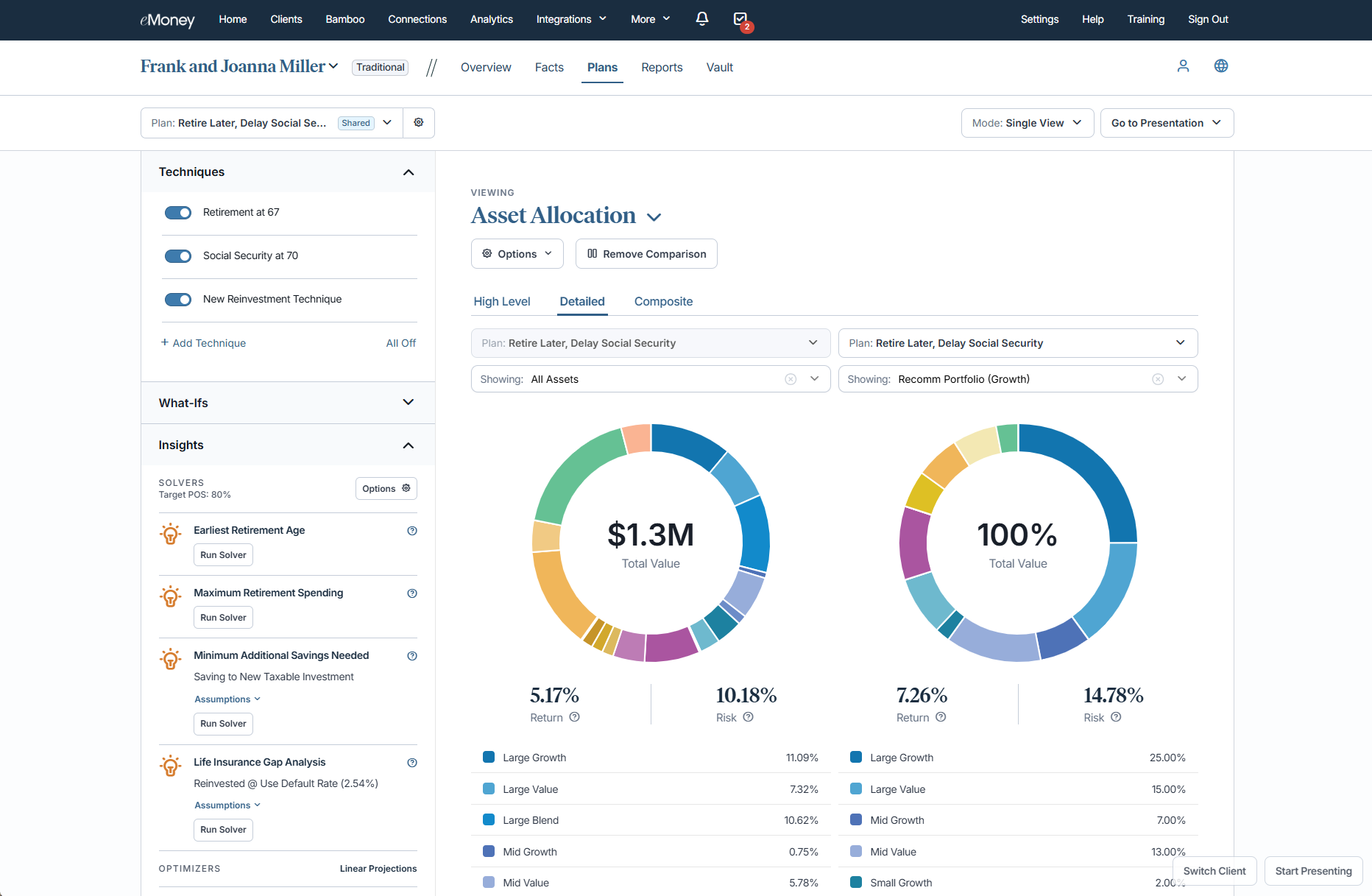

To ensure a comprehensive, interactive planning experience as part of our ongoing goal of creating a more centralized planning hub in Decision Center, we’ve expanded the report library to include Asset Allocation.

What’s New

We hope this new report helps to streamline your workflows by reducing the need to switch between tools within eMoney, while supporting more collaborative, real-time planning conversations with your clients.

Keep an eye out for more reports coming to Decision Center in 2026!

Releases January 28

In our ongoing effort to expand our integrations and make it as simple as possible to learn more about them, the Asset-Map integration now has a new support page along with a button to “Turn On” the integration directly.

More About Asset-Map and Why We Chose to Integrate

This integration streamlines advisor workflows by connecting eMoney’s robust financial planning capabilities with Asset-Map’s visual planning capabilities.

We chose to integrate with Asset-Map in direct response to strong customer demand and interest from large enterprise clients.

Integration Features for Asset-Map and eMoney Users

Coming Early March

As part of our commitment to delivering best-in-class digital experiences, eMoney is modernizing our platform and strengthening our security program in collaboration with Okta, a trusted partner and industry leader in identity management.

To further strengthen protection, eMoney is enabling Okta Adaptive Multi-factor Authentication for all users who login directly, adding an additional layer of security that safeguards confidentiality, integrity, and availability of client information while providing seamless, user-friendly access.

What’s Coming

Note: If you and your clients directly sign into eMoney, you may see a login message over the coming weeks about this.

Protecting your and your clients’ data remains our top priority. For any questions, feel free contact us at 888-362-8482 or email customerservice@emoneyadvisor.com.

Coming March 25

Imagine a tool that simplifies planning by automatically assessing all client data and presenting actionable strategies in real time. With eMoney CoPlanner, coming March 25, you can build plans faster while remaining fully in control, so you can spend less time modeling and more time advising. Check out how it’ll work below!

We look forward to sharing more details about CoPlanner next month!

Coming March 25

Holistic goals-based financial planning is getting much easier. Work in one streamlined experience that will save time, improve consistency, and help deliver plans more efficiently with our newly reimagined Foundational Planning.

Take a look at few screenshots of the new Foundational Planning experience!

Key New Features:

Foundational Planning is currently available for those with the eMoney Plus and Premier packages. We look forward to sharing more information about the enhanced Foundational Planning soon!

Coming March 25

⚐ HIGHLY REQUESTED FEATURE

Run onboarding your way by gathering client data first and introducing the Client Portal later, when (or if!) it fits your workflow and client relationships. Standalone Data Gathering arrives March 25.

What’s Coming:

New Client Experience Options:

Client Portal access can be enabled later, allowing you to grow efficiently without forcing a one-size-fits-all client experience. That means less operational friction and more time focused on meaningful client conversations.

Coming March 25

Spend less time managing settings and more time delivering a consistent, high‑quality client experience. With the Client Portal settings enhancements coming on March 25, you can easily manage settings from one centralized location, ensuring faster, easier, and more consistent configuration. This builds on existing options to manage settings client‑by‑client, for all clients, or as a default via the Globe icon in client settings.

What’s Coming:

These enhancements make it easier to scale Client Portal management without sacrificing flexibility. Whether you’re standardizing settings firm‑wide or tailoring experiences for individual clients, centralized controls help ensure efficiency, consistency, and confidence as your client base grows.