The eMoney platform is evolving to be more connected, intuitive, and right-sized—providing advisors with solutions that meet their clients where they are. Our latest updates advance this vision by enhancing collaboration, streamlining workflows, and equipping financial professionals with new tools to deliver greater value to their clients. From enhanced single-goal planning capabilities to more seamless client engagement, these enhancements help advisors strengthen relationships and drive better outcomes.

Released March 25

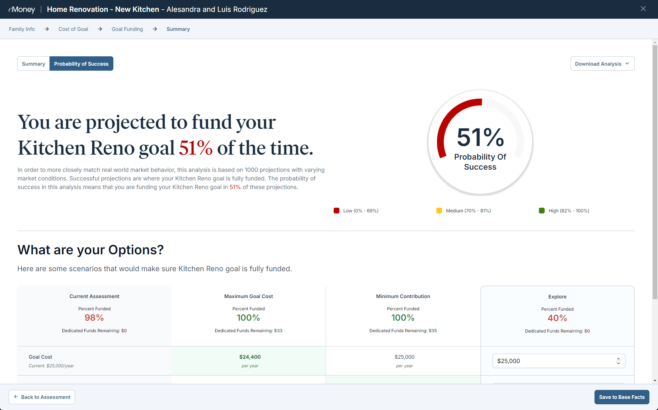

Enable focused single-goal conversations while providing a quick and easy way to help clients make impactful, informed decisions with the new Needs Analysis.

What is Needs Analysis?

Needs Analysis makes it simple to engage clients on what matters most to them. It’s a streamlined solution for addressing individual goals while supporting you in building a foundation for future opportunities with your clients.

Three New Topics at Launch

Begin with targeted conversations on retirement, education, and spending goals, with even more topics like life insurance and debt strategies coming throughout 2025 to expand planning capabilities.

Streamlined, Linear Workflow

Navigate a new single-page layout with in-context data entry fields. The right-hand drawer menu offers a modern approach to capturing details quickly and efficiently.

Easily Save to Base Facts

Show clients a summary of their goals, including a robust probability of success analysis and different options for meeting their needs. Then, save all the data captured in the module directly to Base Facts, ensuring continuity for ongoing client relationships and future planning needs.

Rest assured advanced planning users—the classic version of Needs Analysis it’s still accessible for now through an easy toggle.

Ready to experience the new Needs Analysis?

Log in and check it out today to see how it can elevate your client conversations and drive lasting engagement!

Now Available!

Boost engagement with your clients, foster deeper collaboration, and drive business growth with the Premium Client Portal.

Where to learn more:

Join our upcoming live webinar, Tuesday, April 8 from 2:00 – 3:00 p.m. ET, where we’ll explore the intersection of client experience and technology, and how a client portal is a key component of client satisfaction.

This webinar will help financial professionals who want to:

What will be included upon release:

Note: If you don’t have a direct contract with eMoney, you may need to connect with your home office team before purchasing Premium Client Portal.

Released March 25

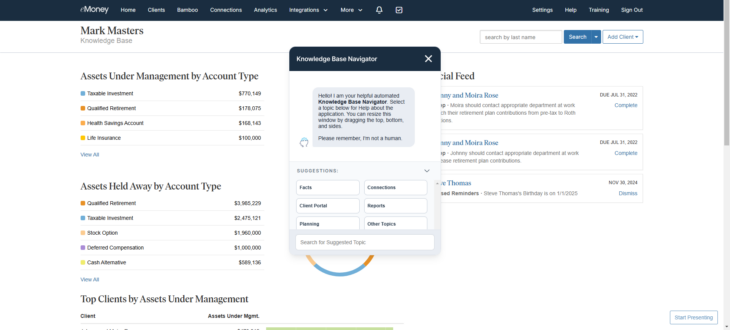

Finding the resources you need has never been easier! The Knowledge Base Navigator is a virtual assistant trained in our full library of resources. It’s designed to save time by getting you answers quickly—without having to wait for support.

How to Use the Knowledge Base Navigator:

This feature aligns with our goal of helping you save time, so you can focus on what matters most!

Released March 25

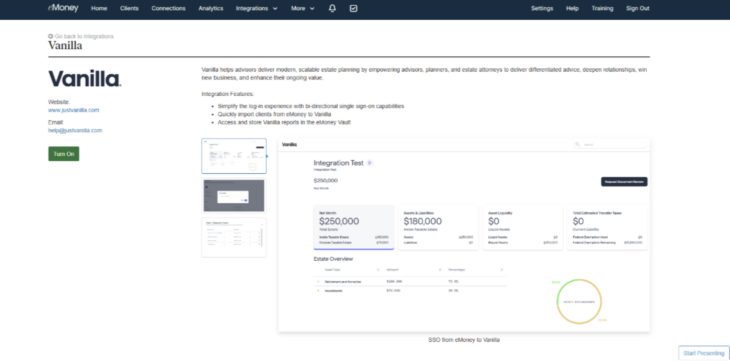

Boost your workflow efficiency and simplify access to Vanilla with seamless single sign-on (SSO) integration. Once enabled, you can instantly access Vanilla from the Integrations tab, streamlining your tasks and enhancing productivity.

Vanilla enhances the understanding of estate plans through simplified dynamic visualizations, providing in-depth insights into assets, provisions, beneficiaries, and fiduciaries. Simplify your workflow and quickly import clients from Vanilla into eMoney, and securely store Vanilla reports in the eMoney Vault.

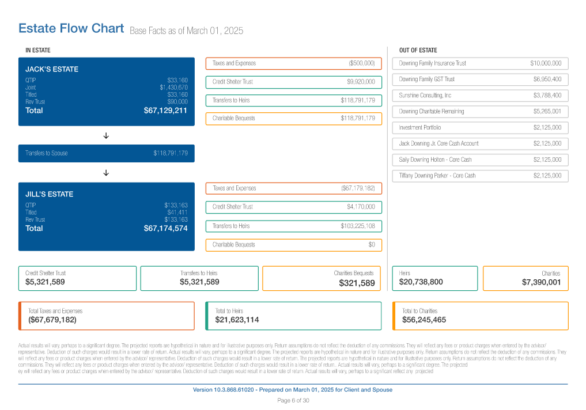

Released April 10

Soon, your Estate Flow Chart and Detailed Estate Flow Chart reports will be updated with improved aesthetics and readability—consistent with our other enhanced reports.

These enhancements are part of our ongoing commitment to modernizing existing reports and presentations within eMoney to provide a clean, updated experience.

Where will these updates be visible?

These enhancements will be visible in the online and printed presentations within Plans and Reports.

Released February 25

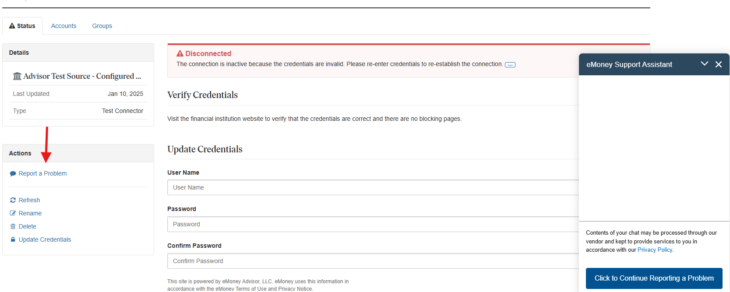

Reduce the time it takes to resolve connection interruptions with eMoney Support Assistant, our new automated response tool, now included as a step in the existing ‘Report a Problem’ workflow.

What’s New

How It Works

If you have a connection issue, click Report A Problem to activate the automated response tool.

The eMoney Support Assistant will assess if your issue fits into one of our self-service scenarios. If it does, it will guide you through a self-service workflow. You’ll be transferred to a Connections Support Specialist if the assistant can’t resolve the issue or understand your input. If no representatives are available, a case will be opened for follow-up.

If the case must be escalated, you can expect an email update from a representative within one business day. Additionally, you can continue to track your case through the Update Reported Problem feature, just like before.

Our top-notch customer service team is committed to providing quick and effective support so you can get back to what you do best.

A helpful tip for a quicker resolution: Expedite troubleshooting by providing any information related to the issue the assistant couldn’t resolve such as the URL you were using, the steps the client took, etc.

Coming Soon

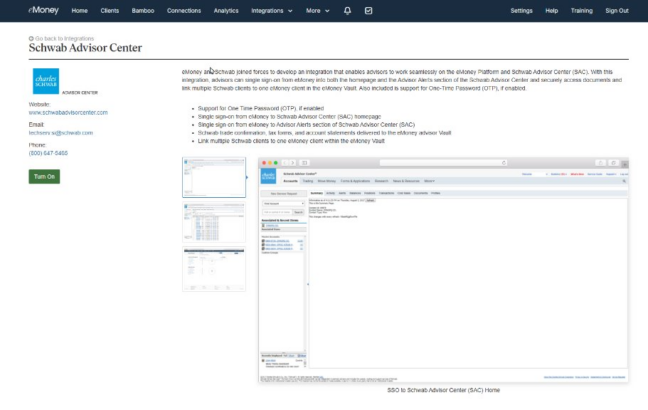

Soon, the Schwab integration will unlock faster, more efficient document sharing by enabling seamless access to Schwab statements directly within the Client Vault. This enhancement streamlines your workflow by eliminating the need for manual downloads and uploads to share these documents in eMoney.

Coming Enhancements:

To ensure a smooth transition once the Schwab Vault feature becomes accessible, please take a moment to enable the Schwab integration and link your clients beforehand. This will help ensure you’re ready to take full advantage of the new functionality as soon as it’s available.

When the feature goes live, linked clients will see a notification banner prompting them to log in to Schwab and enable document sharing. Informing your clients about this coming enhancement is a great way to instill continued confidence that you have their best interests in mind!

Released January 28

Enhance efficiency and streamline your workflow with Tolerisk, which is now accessible via single sign-on (SSO). Once enabled, these tools can be quickly accessed to align client portfolios with risk directives.

What Is Tolerisk?

Tolerisk simplifies risk assessments by effortlessly syncing client data, quickly importing new clients, and connecting client accounts to calculate portfolio risk. By aligning portfolios with targeted risk directives, you can provide tailored advice.

Explore the integration today to enhance your risk assessment workflow.

Sign in to eMoney more efficiently with an improved multifactor authentication process.

What’s New?

Who Will Experience This New Authentication Process?

Assuming your office has not disabled eMoney default security settings which include adaptive multifactor authentication, and we have a valid SMS phone number, you and your clients will be able to perform this self-unlock feature. Otherwise unlock will happen the way it does today, after a 10-minute timeout, “forgot password” flow, or with the assistance of an advisor or admin. Learn more about adjusting RSA two-factor authentication here.

Why Is eMoney Enhancing Security?

As a market leader in financial planning technology that helps people talk about money, fulfilling this mission requires constant vigilance and attention to the security of our clients’ information. Learn more about our ongoing effort to enhance security here.