NEW UPDATES ADDED SEPTEMBER 16 | The One Big Beautiful Bill Act (2025 Budget Reconciliation Bill) introduces changes that could impact client strategies. We recommend bookmarking this post, as it will serve as your central hub for tracking how and when these updates go live in eMoney. You can listen to this short podcast episode about how eMoney has responded to the new tax legislation with Senior Financial Planning Consultant, Michelle Riiska (Posted August 12, 2025).

September

August

July

Releases September 23

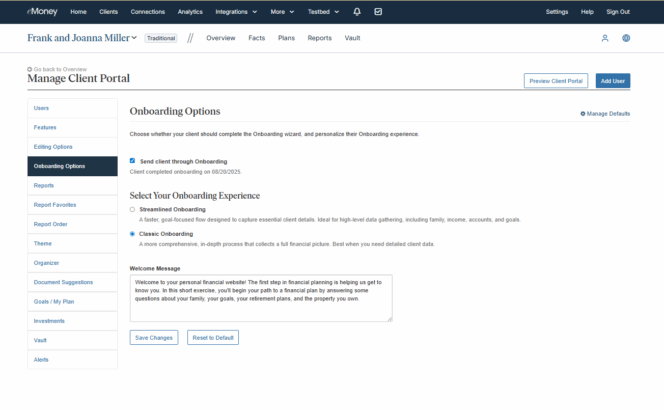

Now you can introduce a redesigned Getting Started experience to your new clients—an intuitive, modern onboarding flow that empowers them to build a basic financial plan at their own pace.

What’s New:

Important to Note:

This improvement marks a continued investment in enhancing your client experience, focusing on easing the onboarding process for your clients.

Releases September 23

Improve client engagement, strengthen collaboration, and streamline client communication using the new ability to share the following Needs Analysis modules directly with your clients:

How It Works:

How Your Clients Can Access Shared Modules:

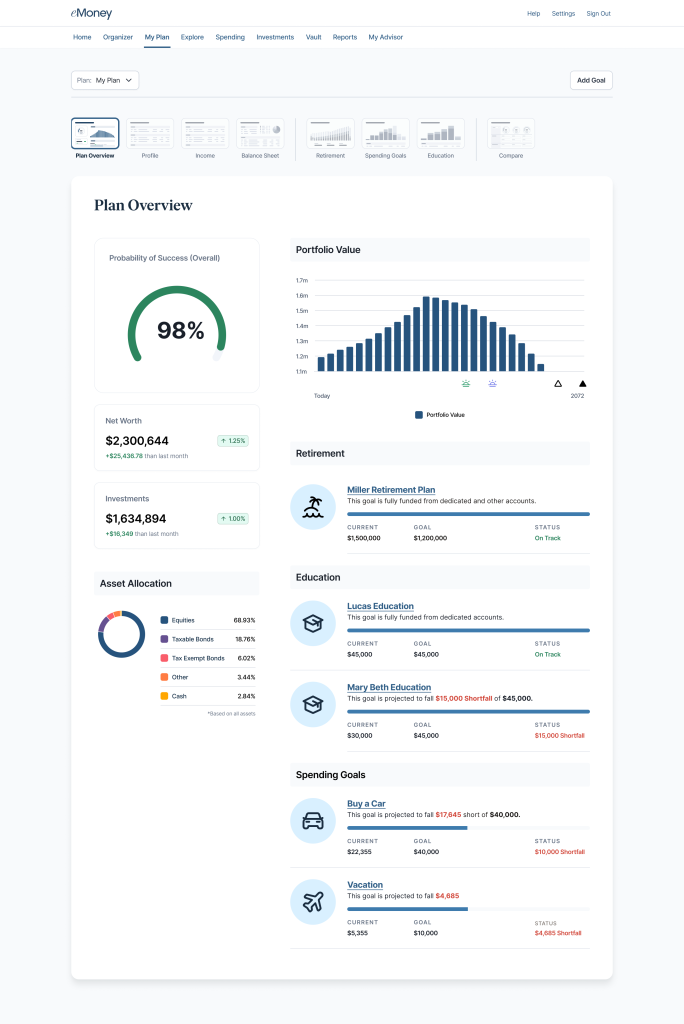

Once shared with your client, modules can be accessed by navigating to the My Plan tab within the Client Portal. The new Needs Analysis section within My Plan provides a view of all shared analyses.

Please note, the new Needs Analysis section under My Plan will not appear for your client unless at least one analysis has been shared.

A Few Callouts:

Releases September 23

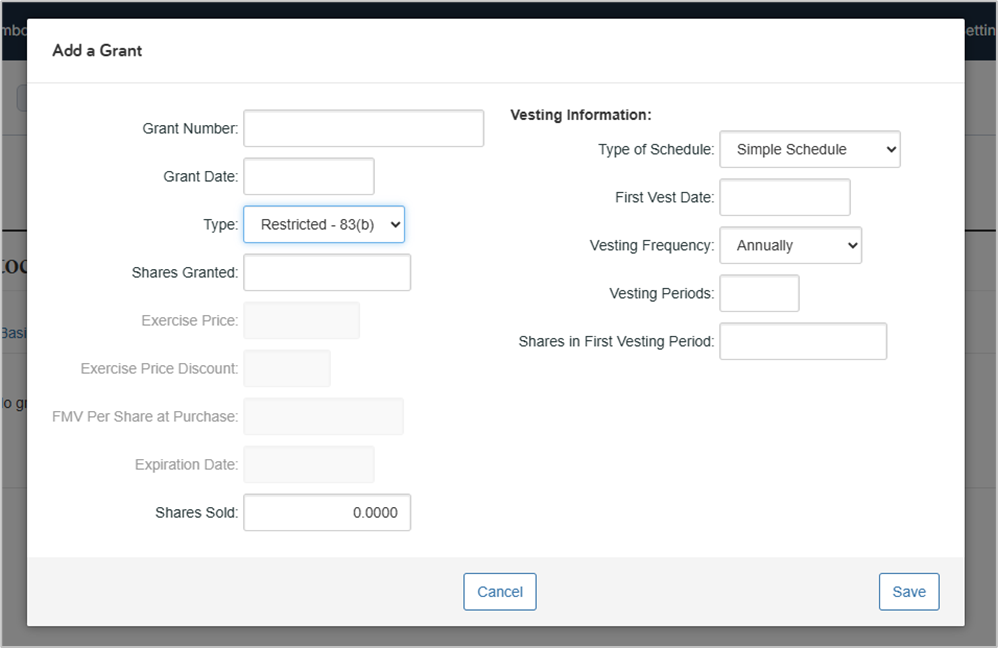

We’ve made it easier to enter restricted stock grants by automatically disabling fields that don’t apply, such as Exercise Price, Exercise Price Discount, and Expiration Date.

These updates also carry through to reports, ensuring cleaner, more accurate data from initial entry to presentation.

Releases September 30

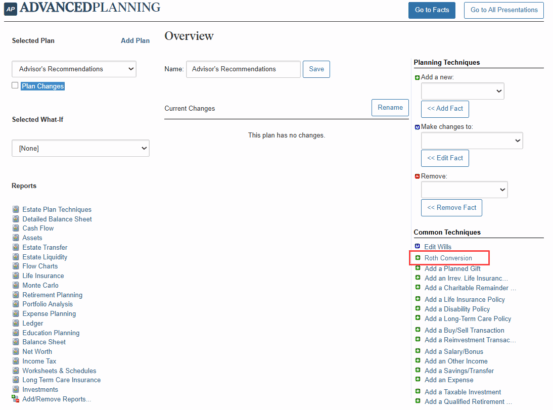

Due to high demand, Advanced Planning users will see an additional “Common Techniques” support link for Roth Conversions in the bottom right-hand corner of the Advanced Planning Overview page. These hyperlinks help make your desired action more actionable and discoverable when creating a plan.

Releases September 23

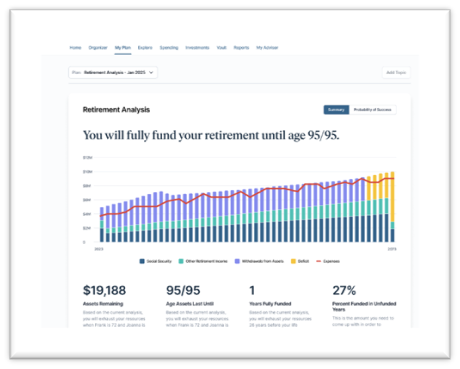

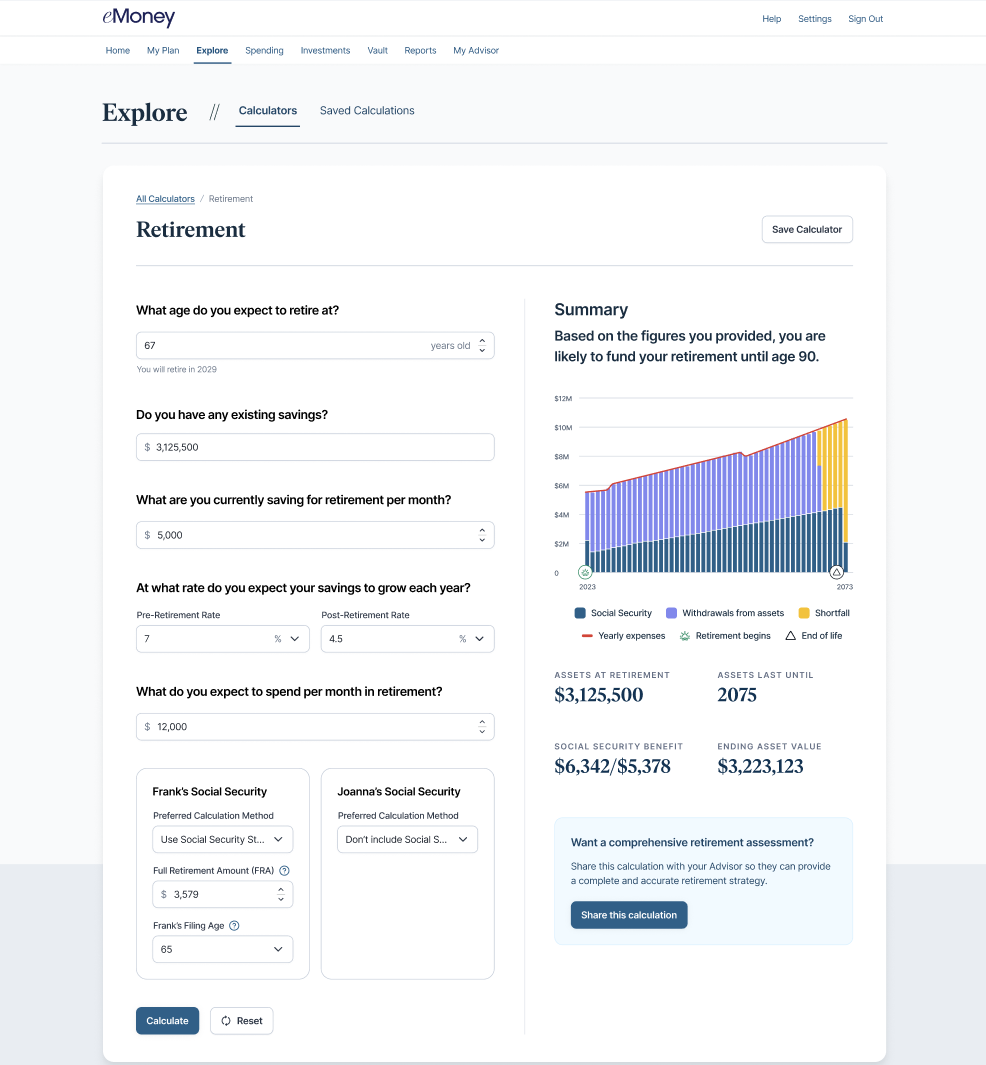

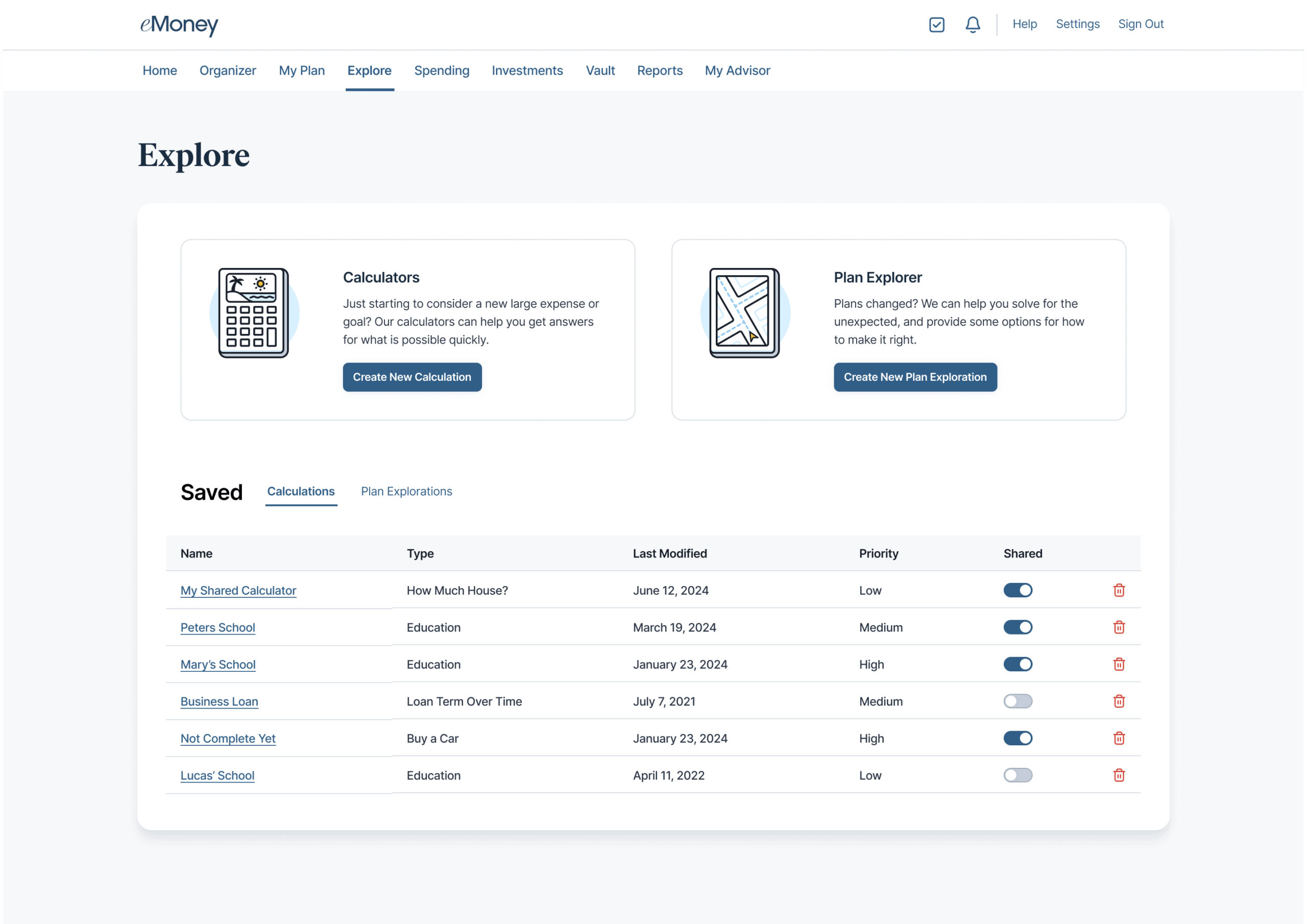

Encourage deeper engagement with financial planning topics while empowering your clients to model retirement scenarios without it impacting their base plan. The new Retirement Calculator is now available within the Explore tab for Premium Client Portal users.

The Retirement Calculator is the seventh calculator available as part of the Explore feature, which was launched in March 2025 with the release of Premium Client Portal.

Curious about Premium Client Portal for your business? Learn how you can deliver a more personalized experience and strengthen client relationships here.

Releases October 14

Clients are seeking tools that allow them to take a more active role in their financial planning. Premium Client Portal users can now build a more personalized scenario without affecting their base financial plan by adding new income sources and recurring savings contributions.

Curious about Premium Client Portal for your business? Learn how you can deliver a more personalized experience and strengthen client relationships here.

Releases August 26

In our ongoing effort to expand our integrations and make it as simple as possible to learn more about integrations, Jump and Luminary tiles have been added to the Integrations page.

Please note that the functionalities of these integrations exists entirely on the Jump and Luminary side.

More About Jump and Luminary

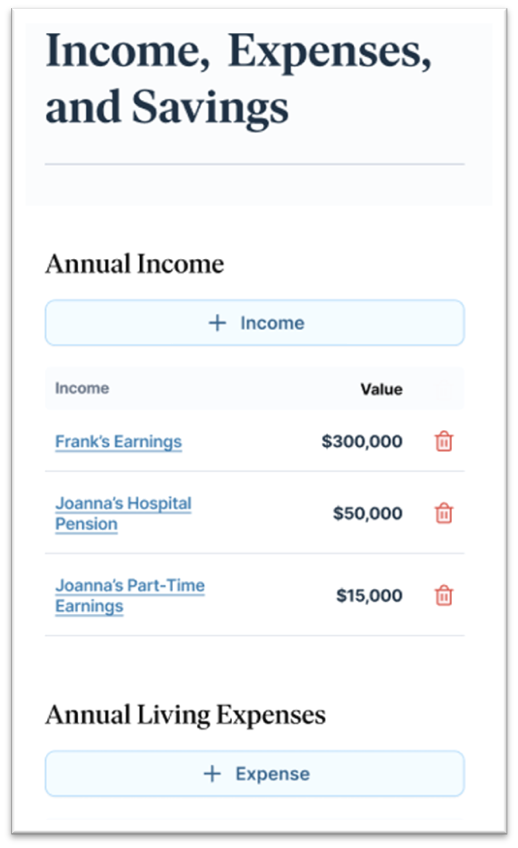

As the world continues to shift to mobile-first, your Client Portal experience is evolving along with the shifting landscape. Our latest uplift for the Client Portal takes place on the Income, Expenses, and Savings page of the Organizer Profile for a better mobile experience.

These experience improvements have been optimized for the mobile app and browser-viewing via mobile device for all clients. This update does not impact any existing functionality.

Releases July 15

Our product strategy focuses on continuously investing in the Client Portal to benefit advisors and their clients. We’re enhancing capabilities, building new features, and removing outdated technology to deliver modern, efficient tools that improve client engagement and help grow your business.

What’s Changed

We look forward to continuing to be your partners in achieving strong client engagement. We believe in the value of the client experience and are committed to the continuous improvement of your Client Portal, including the June release of Presentation View*.

If you’re interested in enhancing your client’s experience, learn more about the Premium Client Portal here.

*Please note, feature availability and launch dates may differ based on custom configurations..

Releases July 29

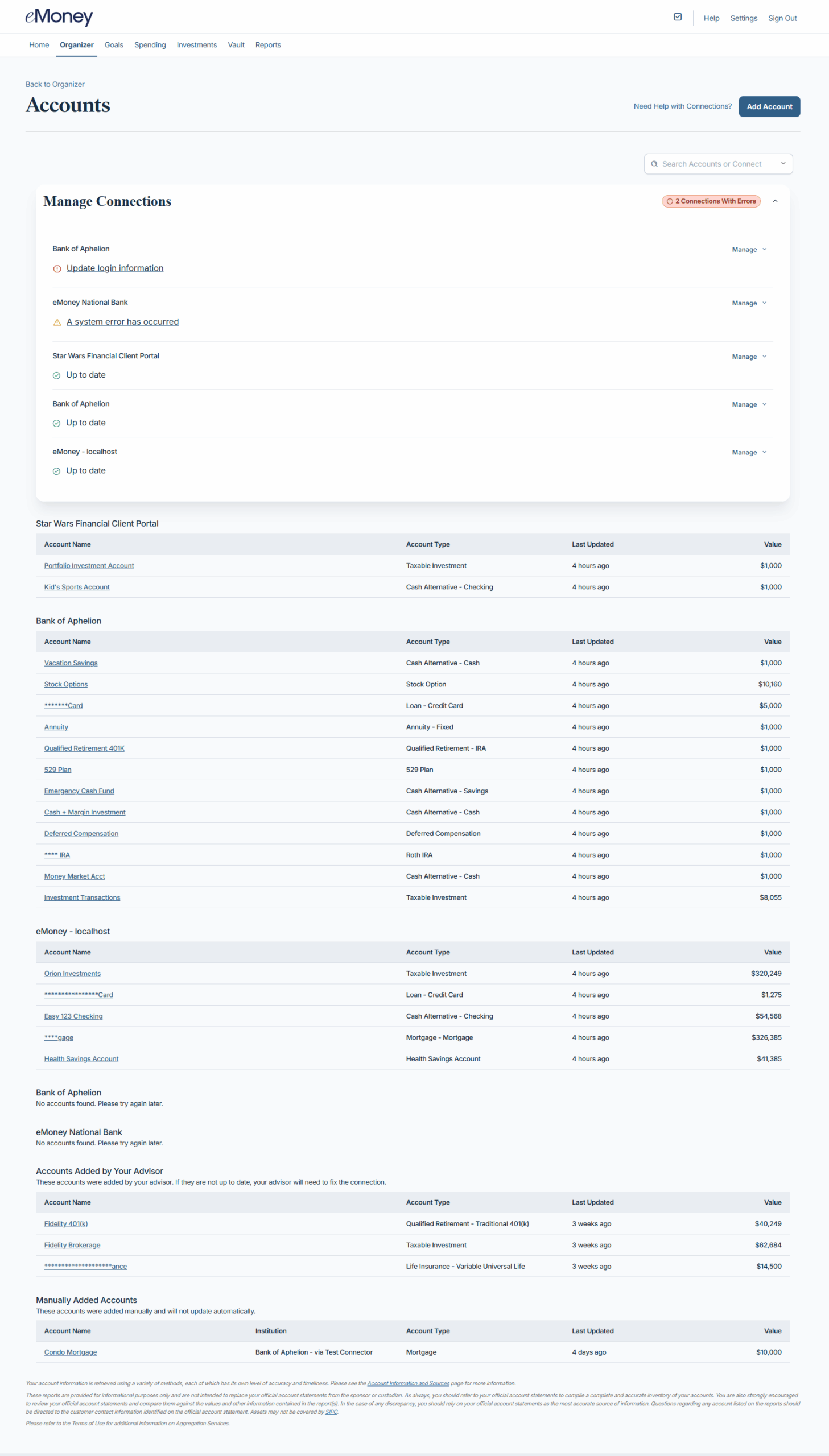

As part of our ongoing effort to enhance account aggregation in the Client Portal, your clients can now experience a more intuitive and organized view of their linked accounts.

What’s New:

Because of the above experience enhancements, clients no longer need to filter retired connections.

We look forward to continuing this effort to enhance your clients’ experience with improved onboarding and ongoing usability. We recommend mentioning these enhancements to your clients in an upcoming meeting so they feel supported.

Releases July 29

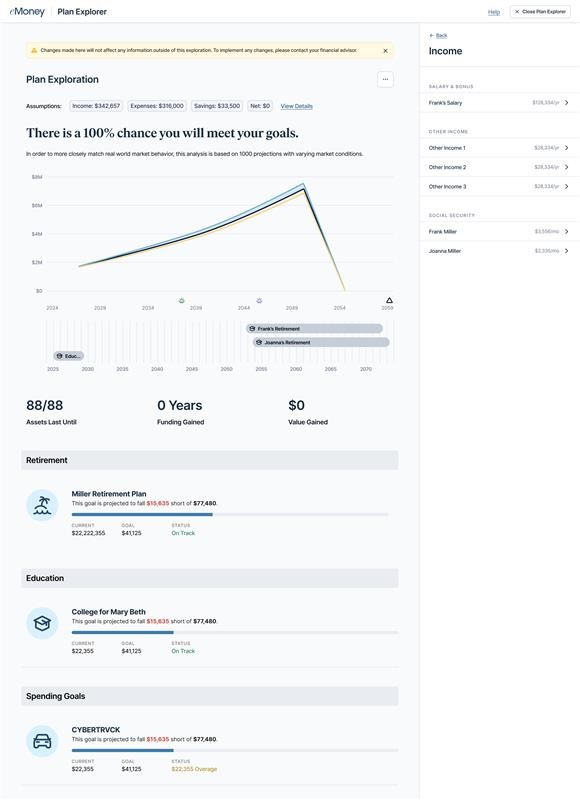

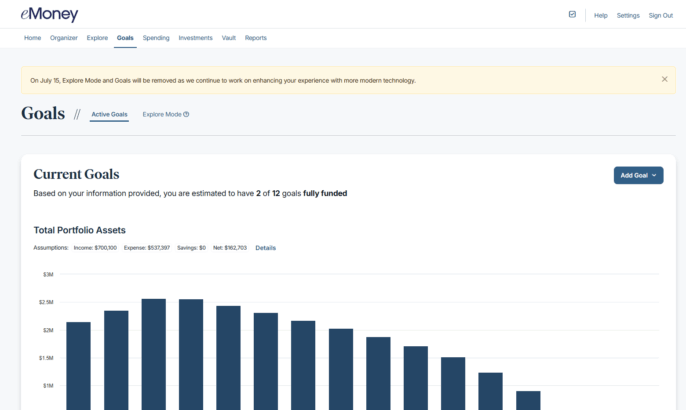

Premium Client Portal clients now have greater flexibility and control when engaging with their financial plans—helping them better understand their goals, options, and potential outcomes.

What is Plan Explorer?

Plan Explorer, now available in the Explore tab of the Premium Client Portal, introduces a more interactive and customizable planning experience, whether clients access their plans from their mobile app or computer.

This feature allows clients to create multiple scenarios, adjust their data, and explore how different decisions could shape their future—without affecting their base plan. It offers a worry-free way to engage with their finances, fostering deeper understanding and collaboration with their advisor.

What Are the Benefits?

Curious about Premium Client Portal for your business? Learn how you can deliver a more personalized experience and strengthen client relationships here.

A Look Back at Q2 2025

As the leader in data aggregation, we remain focused on helping you unlock the full potential of your clients’ financial data. In Q2, we continued our commitment to delivering stable, secure, and seamless connections—empowering you to provide more personalized, informed advice.

Recent Additions

We added 75 new sources this quarter, including several high-value institutions:

Connection Upgrades

To ensure more reliable performance, we also upgraded 19 existing connections, including:

Keep Exploring:

Check out the updated aggregation slick to see how we’re supporting more connected, client-centric planning.

We’re expanding how eMoney can support your business through new integrations built by our technology partners. While these integrations don’t change the eMoney interface, they create new ways for you to access and apply your client data across complementary tools—unlocking time-saving efficiencies and enhancing your overall planning experience.

Work smarter after every client meeting.

Jump AI is an intelligent assistant that integrates with eMoney to help Jump users streamline post-meeting workflows. Using natural language processing and contextual understanding, Jump connects to your eMoney client data to automate administrative tasks and surface helpful insights.

Key Capabilities:

Connect planning and portfolio management in one view.

The Black Diamond integration surfaces eMoney plan insights directly within the Black Diamond platform, giving both advisors and clients easier access to critical planning data, without logging into eMoney.

Key Capabilities:

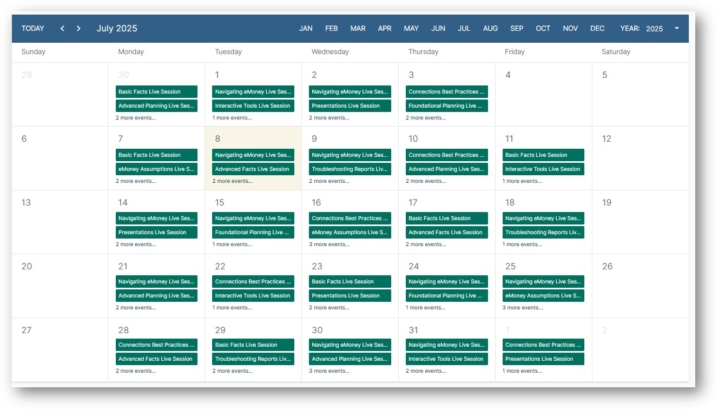

Released July

Plan for your upcoming eMoney training sessions by viewing the months ahead in a new calendar view, available now within your Learning Center.

What’s New:

How to Access: