Explore the latest updates in eMoney, featuring The Learning Center, an update to managing Client Portal settings, and more! Take a look back at releases from Q3 here.

Releasing December 3

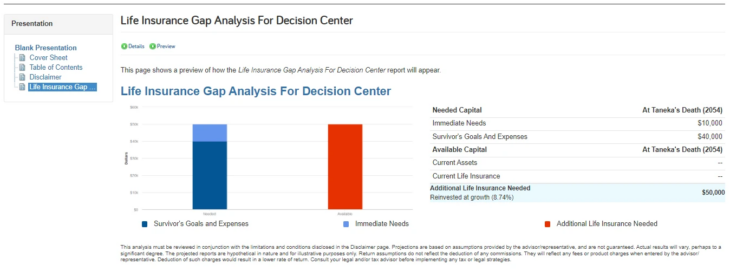

You’ve become a pro at creating collaborative plan recommendations in Decision Center. After your client meeting, you can now send clients home with a freshly redesigned Life Insurance Gap Analysis report matching the Decision Center experience. Check it out today!

Releasing December 3

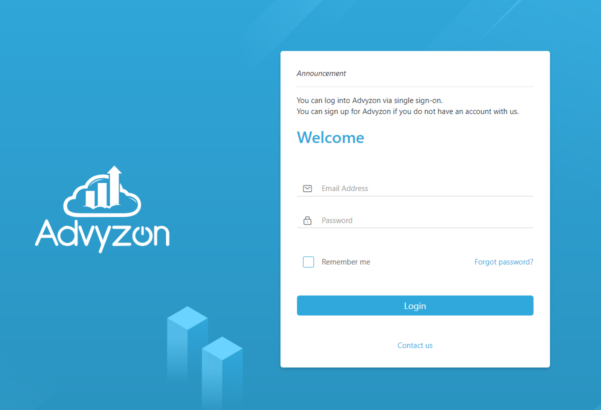

Clients can now seamlessly access Advyzon while in eMoney via single sign on (SSO) from the Client Portal. If enabled for clients, they will see an Advyzon icon.

Learn how to enable SSO for your clients with Advyzon by reviewing this Advyzon Integration Guide. This resource can also be found in your Help menu.

Released October 24

Unlock the full potential of eMoney with The Learning Center, designed to provide smart, self-paced, and consolidated training. Whether you’re an advisor or support staff, our streamlined, personalized training experiences directly address your needs, boosting your success and helping you deliver value to your business and clients more quickly.

What’s New:

The Learning Center can be accessed by clicking Training from your navigation bar. We look forward to continuing to support you and your firm as you deepen your expertise with eMoney.

Retired October 24

To standardize contribution management across all account types in eMoney, we removed the option to add contributions to sub-accounts under qualified retirement and deferred compensation accounts.

From now on, the Contributions tab will be available for all qualifying accounts and serve as the single source of truth. This update aligns these accounts with others, such as taxable and cash accounts, creating a more consistent experience across account types and reducing confusion from account consolidation.

Will This Update Impact Any of My Clients’ Plans?

To ensure your clients’ plan data remains consistent with this update, on the evening of Sunday, November 3, we will process an automated data update to reallocate any sub-account contributions to the corresponding primary account contributions.

Strengthen user engagement with an enhanced version of the eMoney Client Portal, called the Premium Client Portal, available in early 2025. Its advanced set of interactive planning tools will foster collaboration, boost client satisfaction, and drive business growth.

What will be available in 2025:

Stay tuned for more information, including pricing and packaging details in the new year!

Sign up here to get notified about our Premium Client Portal, launching in 2025.

Released October 24

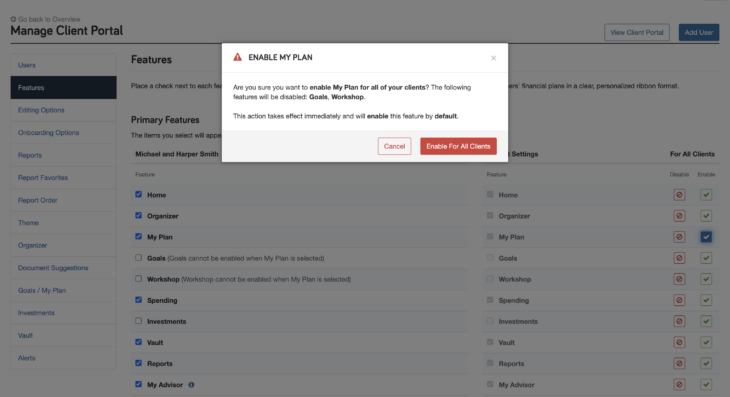

To streamline you process in establishing Client Portal settings for your clients, you now have the ability to enable or disable a single feature for all clients at once while configuring what appears for your client in their Client Portal.

.

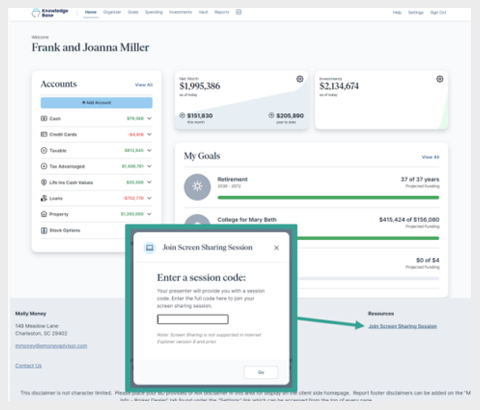

Retires November 12

To adapt to updated industry standards and due to low usage, the Screen Share function will be discontinued this November.

Our research has shown that financial advisors prefer using well-known screen-sharing technologies due to their popularity, ease of use, and robust security features. This preference has resulted in low usage of the Screen Share feature. To allow our team to focus on the capabilities that are most impactful to you, this function will be discontinued in November.

After November 6, Screen Share will no longer be available, however, Present Mode, which protects clients’ information by locking in a single client’s facts, will remain accessible.