Discover this year’s most impactful releases and take moment to watch an on-demand webinar with eMoney Head of Product, Jess Liberi detailing our Product Vision for 2022 and beyond.

Released December 7, 2021

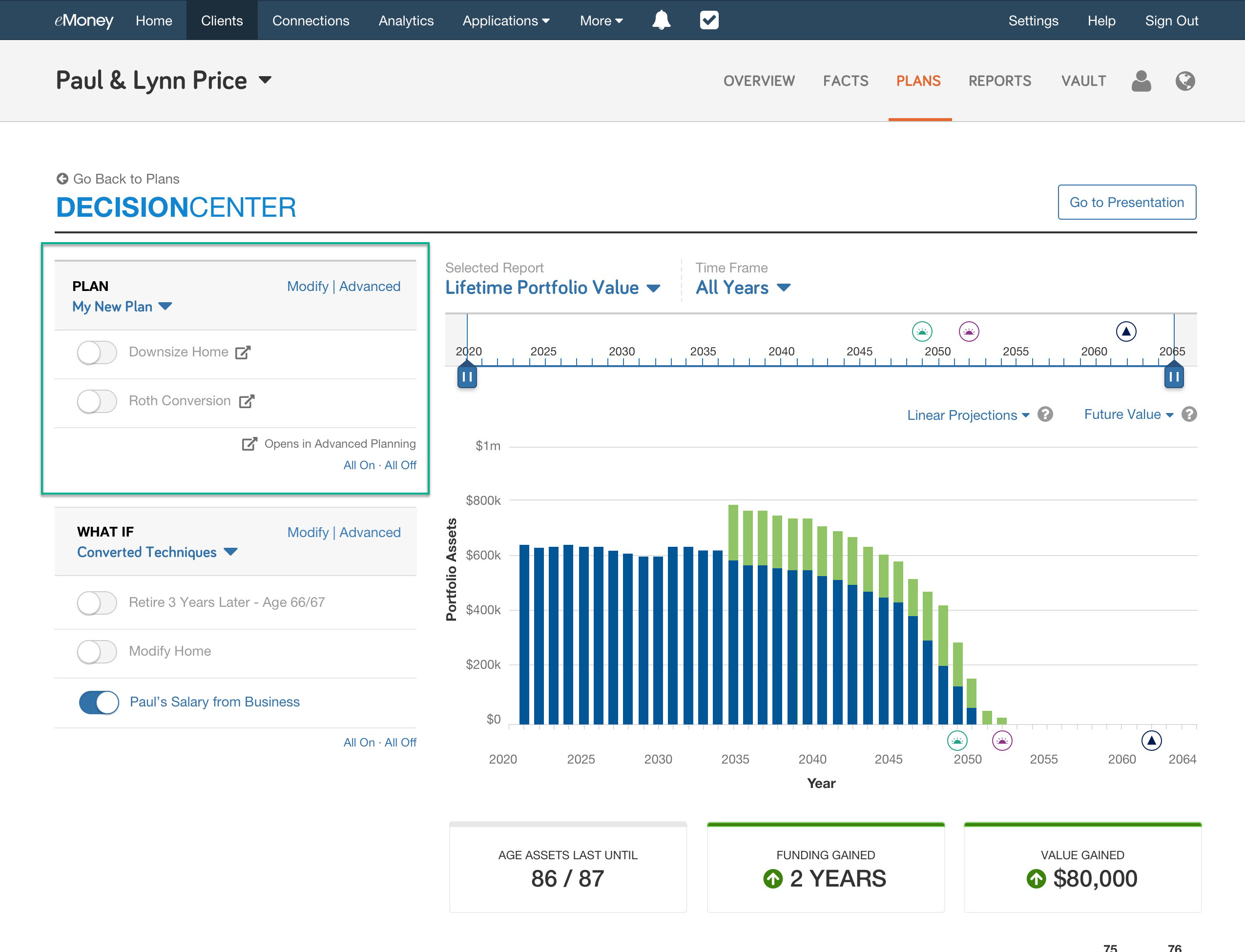

Our highly anticipated Decision Center updates designed to make creating, editing, and presenting plans easier were made available to all eMoney Pro and Premier users this month.

Watch our recent training webinar about the Decision Center to learn more about these enhancements or keep reading below.

First, we moved the Advanced Techniques section up, situating it immediately beneath the menu that controls it. We also retitled this section to Plans.

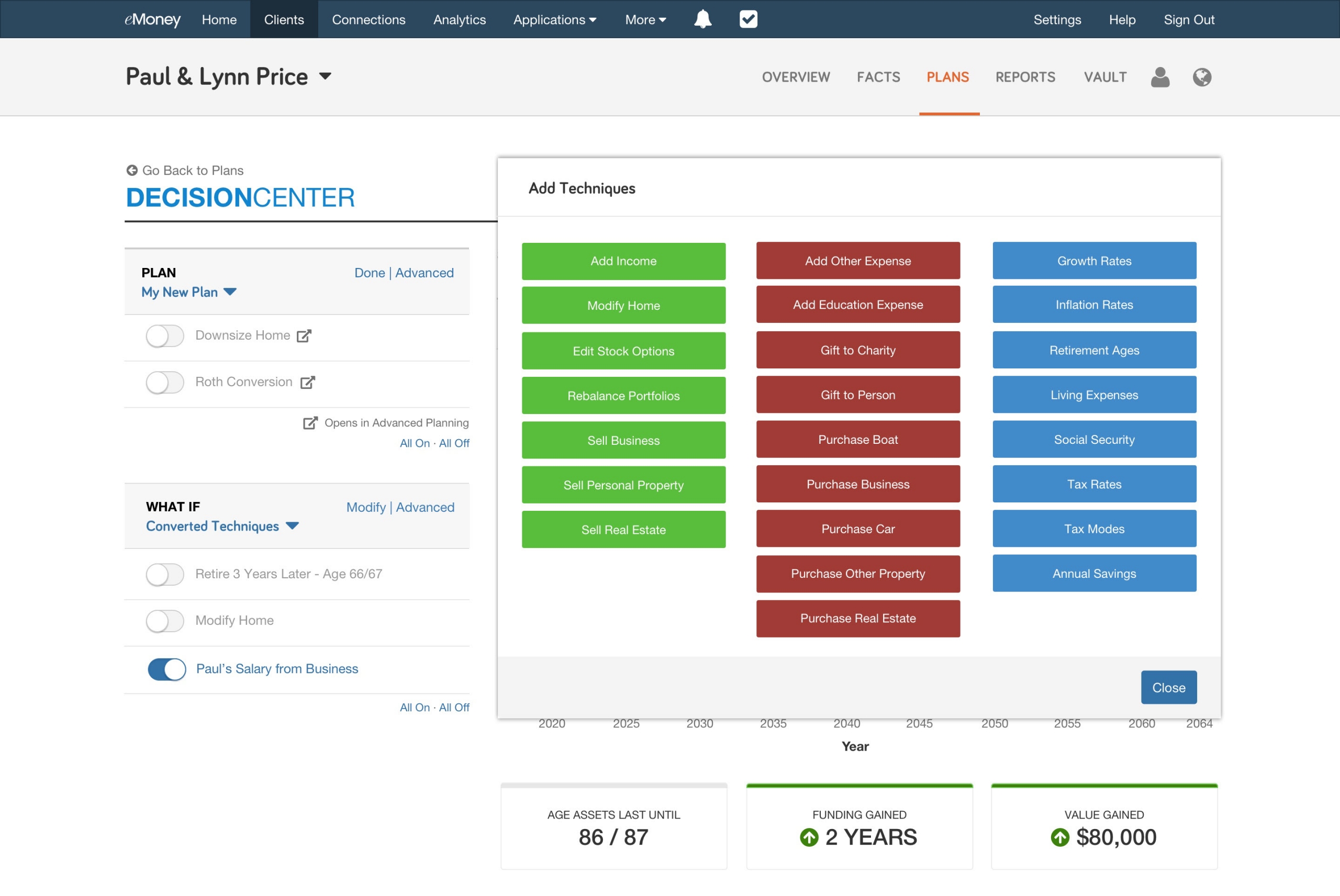

Next, we made it easier than ever to create or edit plans from Decision Center by letting you add basic techniques directly into plans. These changes will be applied to the Plan just as if you’d made them via Advanced Planning and will appear in all eMoney reports.

Click Modify from the Plans section and add your selected techniques using the same panel you’re familiar with under Techniques today.

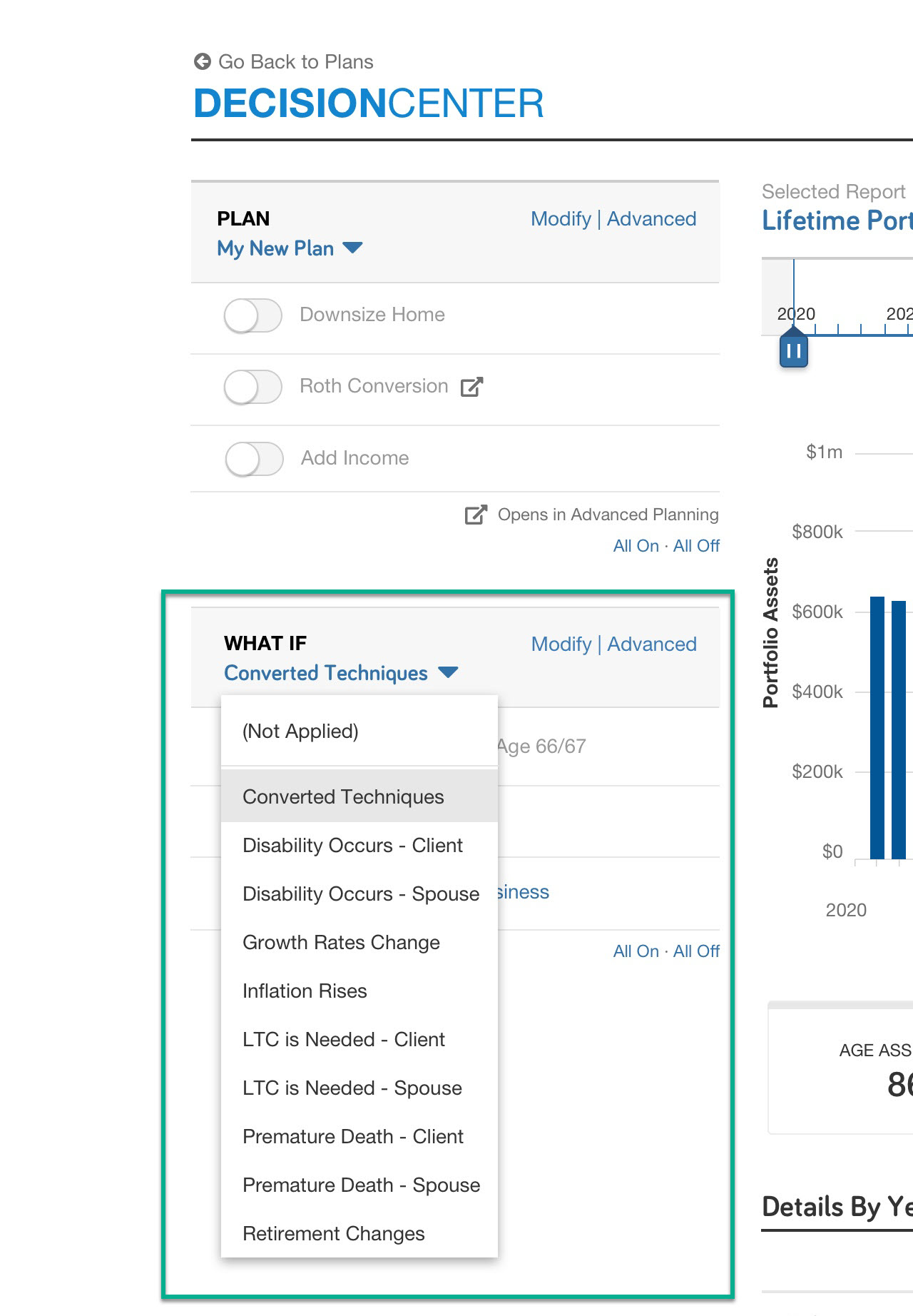

You’re now also able to add What-ifs directly within Decision Center—a popular user request that adds a new layer of flexibility so you can create even more interactive and compelling planning experiences for your clients.

The selected What-if will also automatically flow through to your Decision Center presentations.

Speaking of Presentations, we’ll also be unlocking any of the currently locked report-leveling settings within the Decision Center presentation—providing even more flexibility with the presentations you create.

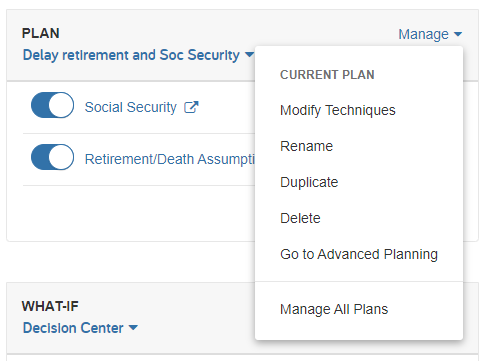

Finally, we’ve simplified the process for creating, duplicating, renaming, and deleting Plans and What-ifs within Decision Center. All these actions are now consolidated within the new Manage menu, removing the need to move between tools.

Released March 30, 2021

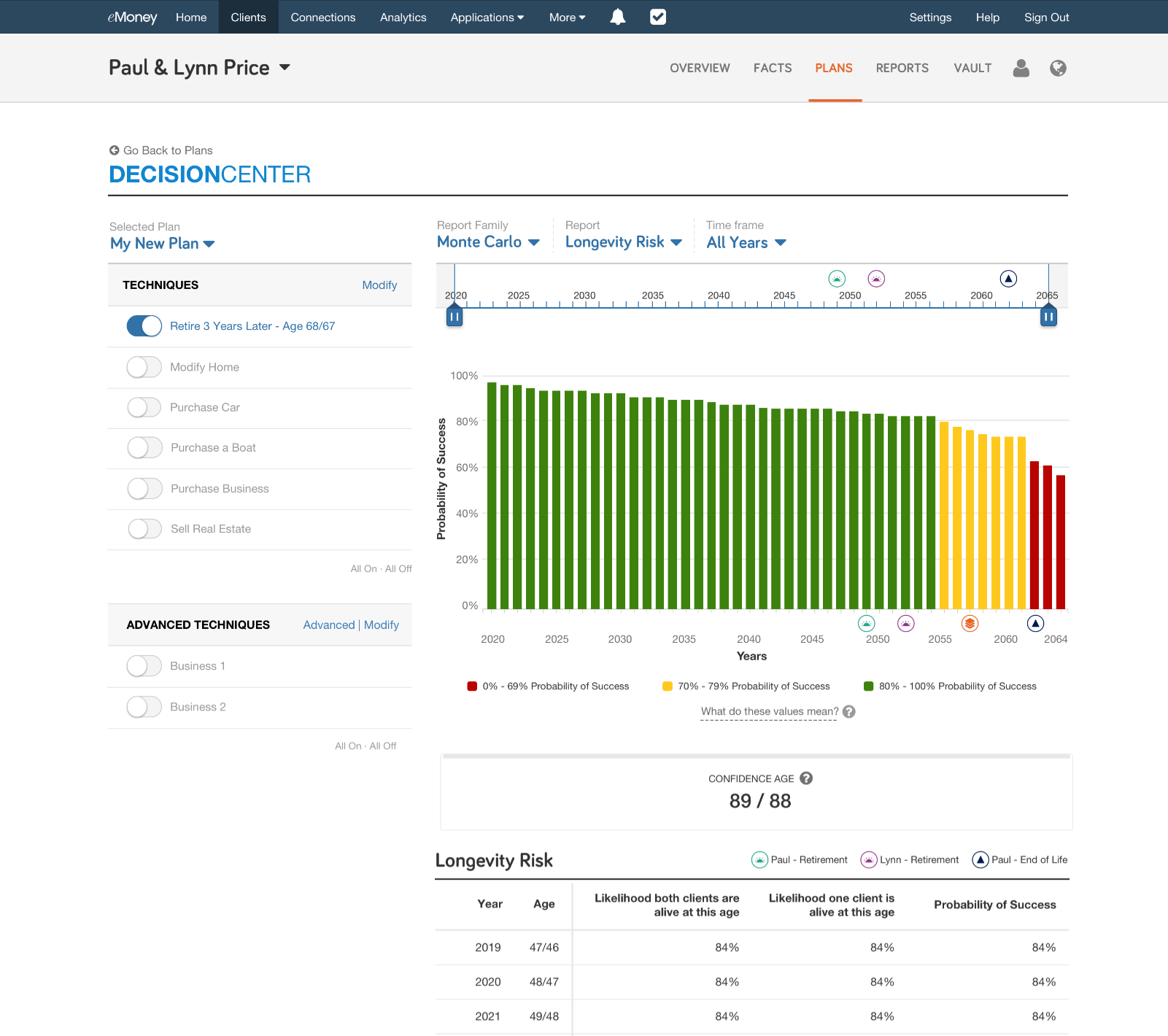

Life expectancy is hard to predict. Our new Monte Carlo features make it easier than ever to provide a comprehensive and personalized analysis of longevity risk so you can have more engaging conversations with clients.

Watch the video below to learn more about our Longevity Risk Analysis and latest planning metric–Confidence Age.

We have been investing heavily in our Monte Carlo capabilities over the past year and have recently added the ability to infuse Monte Carlo into all interactive cash flow and asset experiences within Decision Center. Longevity Risk Analysis and Confidence Age reflect the next phase of our Monte Carlo evolution.

To learn more about these enhancements and how to incorporate them into your financial plans check out this fifteen-minute on-demand webinar or keep reading below.

As longevity risk becomes an increasing concern for many clients and advisors, this new feature helps you improve the client experience by showing them the strength of their plan over their entire lifetime and provides a more holistic view of a client’s financial health.

The Longevity Risk Analysis in Decision Center quickly identifies whether the client can fund their cash flows over a longer period, providing a comprehensive picture of how sensitive their plan is to the risks of longevity. It eliminates the need to re-run the plan for multiple life expectancy ages and displays results in one interactive visual.

This innovative and customizable Monte Carlo metric takes client conversations a step further by demonstrating their financial health in a more humanized and intuitive way, helping to increase engagement.

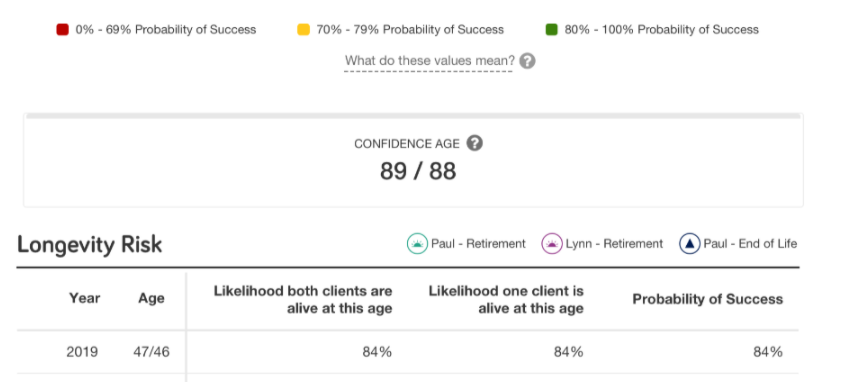

Confidence Age is determined by identifying the age at which the Monte Carlo success rate is projected to drop below the confidence threshold you set. For example, if you identify 85+ percent as the success rate that inspires confidence in the plan, then the Confidence Age is the last age in which the success rate remains at 85 percent.

Check out a demonstration of Longevity Risk Analysis and Confidence Age and visit Decision Center to see them in action.

Released April 27, 2021

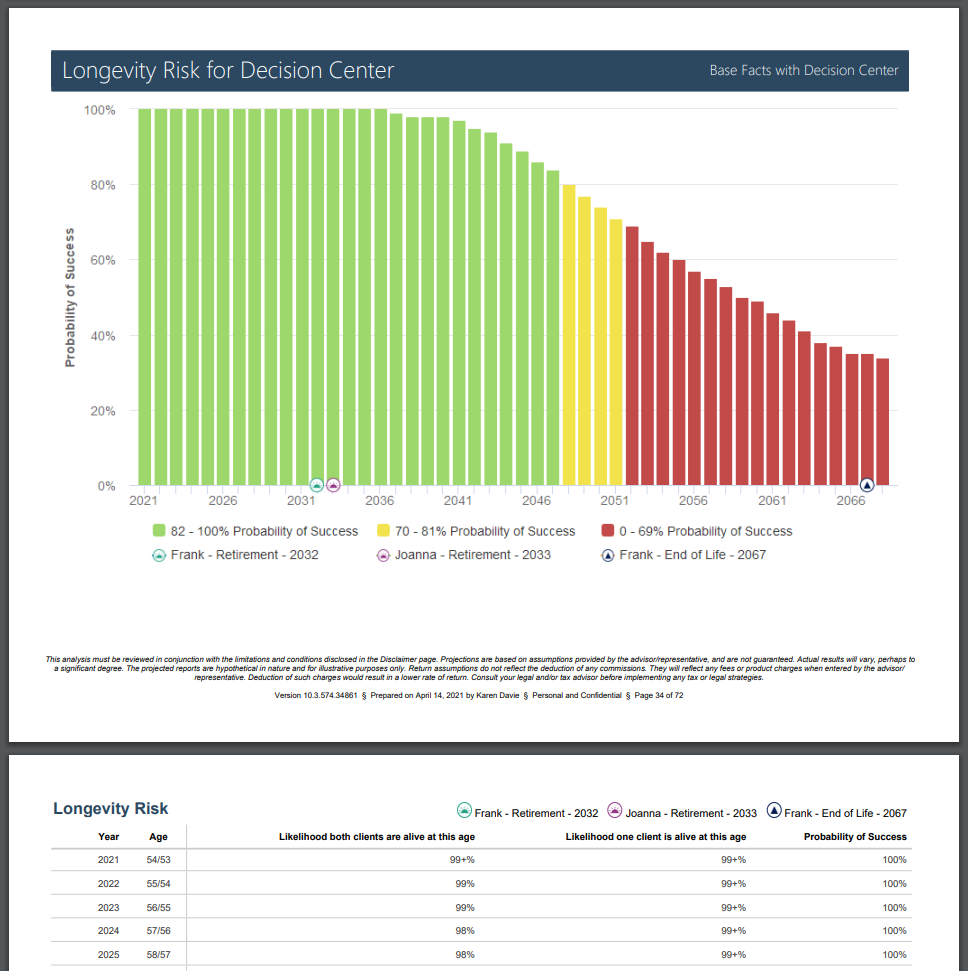

Last month, we released the new Longevity Risk analysis report in Decision Center along with a new planning metric—Confidence Age. We expanded this enhancement by adding a printable version of the Longevity Risk report to the Decision Center Presentation.

Learn more about Longevity Risk and Confidence Age in this 15-minute on-demand webinar.

Released April 27, 2021

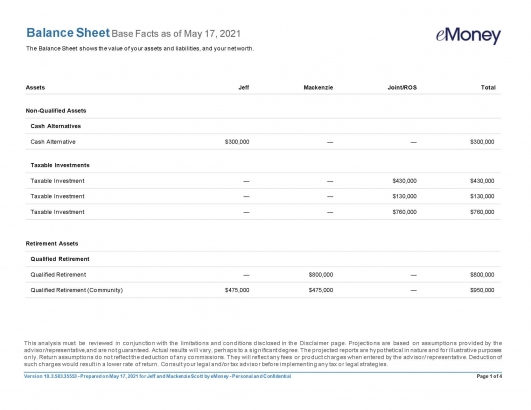

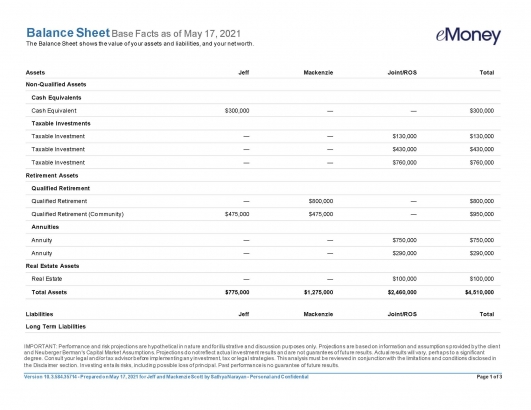

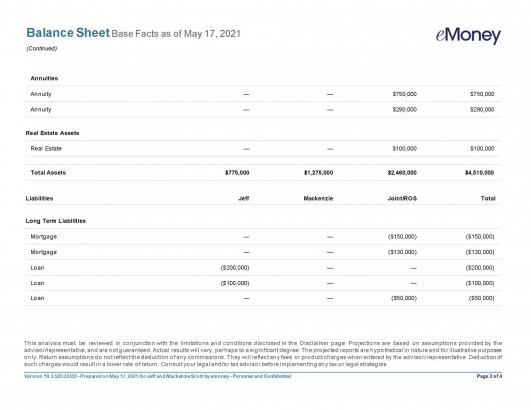

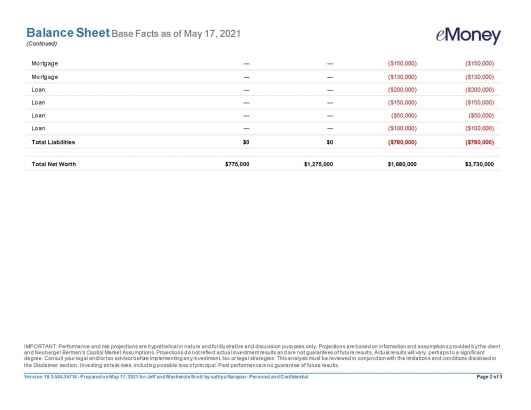

As part of our commitment to modernizing the existing reports and presentations within eMoney, we’ve released the first set of uplifted Reports. This uplift focuses on creating a consistent aesthetic across both the online and printed versions. To achieve this goal we standardized landscape orientation across the updated reports, enabling the addition of your branding to all presentation reports, and updating the tables and charts with new colors and formatting.

This first phase of this initial uplift focuses on the following pages and report families:

It’s important to note that this is the first step in the process. We’ll continue to update reports throughout the course of this year starting with our most widely used reports. During this transitional period, you may experience some co-mingling of reports using legacy and modernized aesthetics.

Note: Presentations currently saved to the Vault will not be updated with the new look and feel.

Released May 18, 2021

In April, we released our first set of modernized reports using the report guidelines from the latest Decision Center and Foundational Planning Reports. Our goal with this version is to provide a modern and consistent aesthetic across all online and printed reports. Following the release, we received a wealth of feedback from our users. Feedback like this helps ensure we deliver the most effective, modernized reports in the future.

Effective May 18, we completed work to address crucial feedback on the length of the new Reports by:

In addition, liabilities are now clearly defined with red font color. These changes address the most immediate feedback we received and are live in the eMoney application today.

However, we are planning additional updates as we continue to work through your responses. Areas of focus include returning the client’s name from the bottom to the top of the report for additional visibility, streamlining the ability to edit in Microsoft Word, and more.

As always, our goal is to ensure we provide a superior experience for you and your clients as we modernize these reports—so please continue to add your feedback to the Request a Feature page.

November 9, 2021

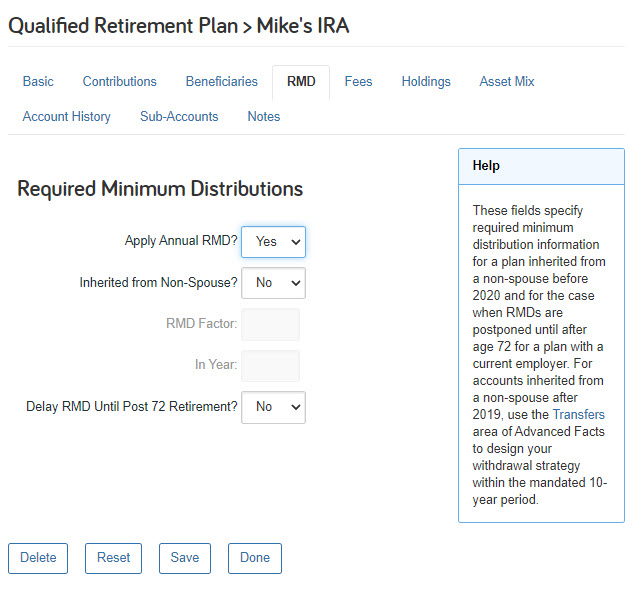

Based on user feedback, we’ve relocated Required Minimum Distributions from the Beneficiaries tab to a new dedicated RMD tab for relevant accounts.

Released March 30, 2021

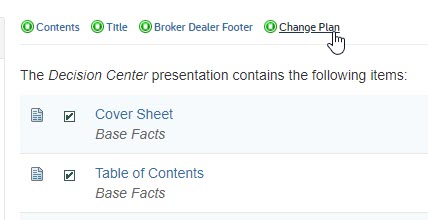

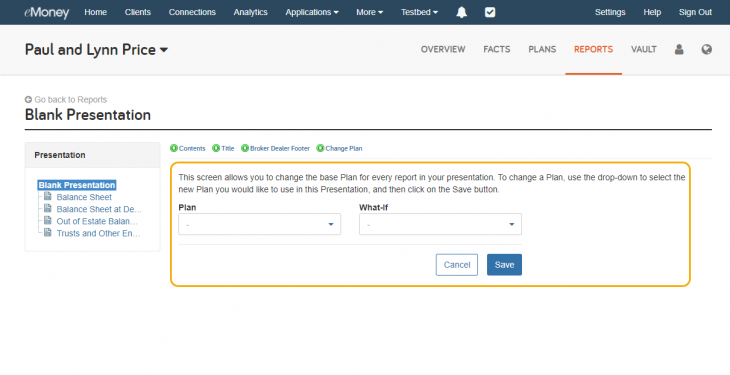

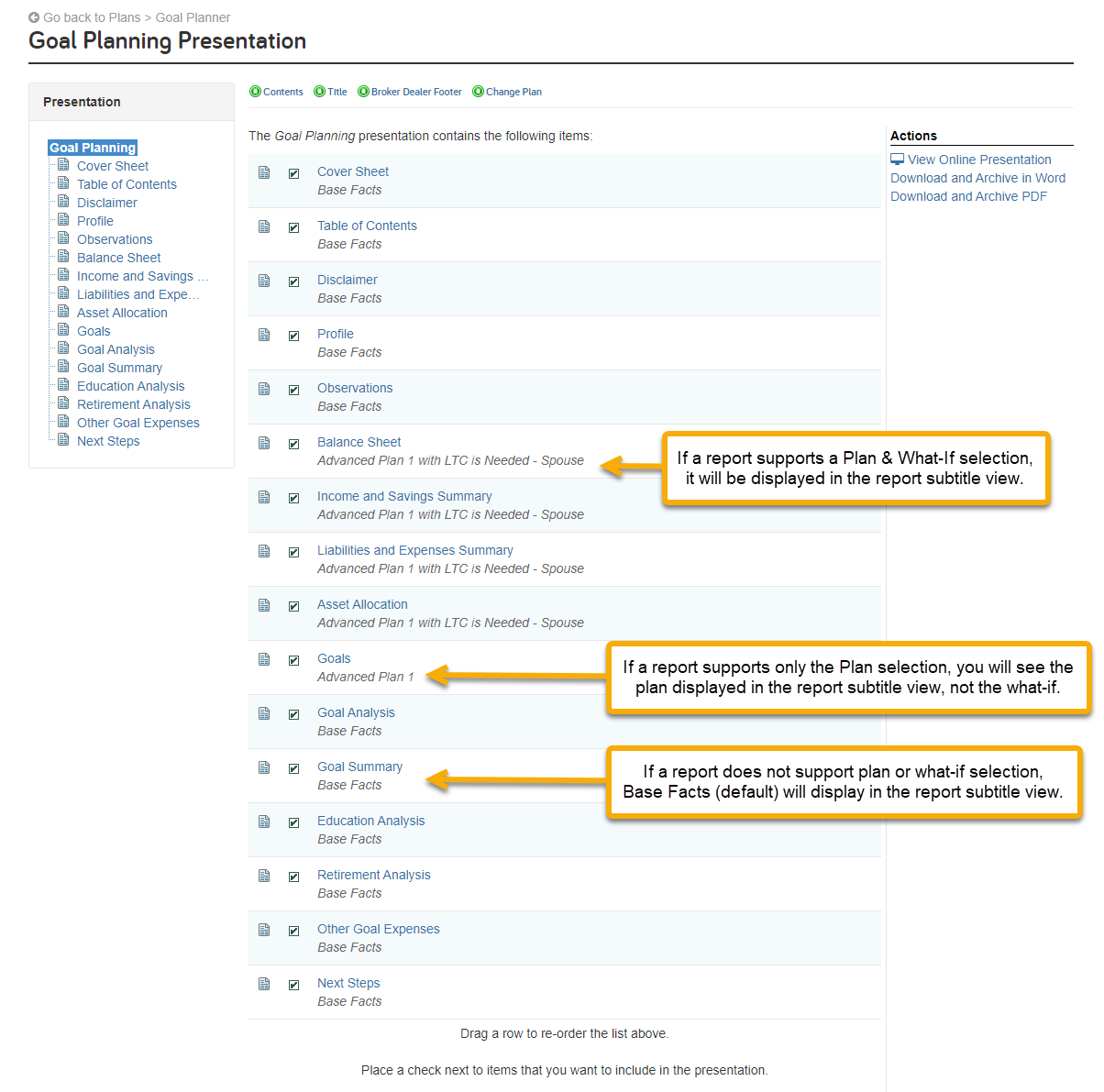

Save time and increase your efficiency with our new Change Plan feature now available for Presentations! This highly requested feature allows you to quickly select a Plan and What-If to apply to all reports in your presentation with a single click – instead of needing to adjust the plan and what if setting under each report individually.

Select a presentation, and the Change Plan button will now be available alongside Contents, Title, and Broker-Dealer Footer. The new Change Plan feature is available in the Presentation Center, Facts Presentation, and Goal Planning Presentation.

Click Change Plan and use the drop-down menus to select from available Plans and What-Ifs. Next, click Save to apply the Plan or What-If to each report within the presentation that supports the plan changes.

Note: Change Plan will not update reports that do not support plan changes (e.g., introductory, supplemental) and individual reports with locked Plan or What-If settings.

You can see what Plan is applied to each report page under the report name, and you can override selections on individual reports by clicking into the report page and selecting custom Plan and What-If settings.

Released January 25, 2021

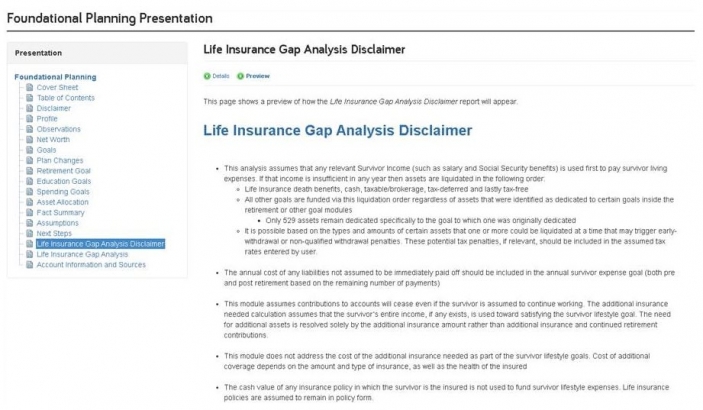

A new disclaimer page has been added to the Foundational Planning – Life Insurance Gap Analysis presentation. The disclaimer will provide context on the assumptions used within the analysis.

Released September 28, 2021

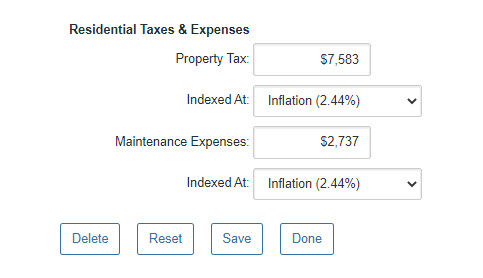

We’re addressing one of our top feature requests by streamlining the way you work with real estate in eMoney by adding the ability to attach property taxes and maintenance expenses—that automatically adjust based on ownership or removal—directly to real estate properties.

Note: If you’re currently accounting for property taxes or maintenance expenses using Other Expenses or the Living Expense Worksheet, please remove these expenses before using the new feature.

When you open a piece of real estate property in Advanced Facts with the property type Residence, you’ll see the new Residential Taxes and Expenses area. Here you can quickly assign the annual property taxes and maintenance expenses. You also have the ability to index the tax and expenses as required.

These fields will also be available when using Buy/Sell Transactions or making changes to real estate with advanced planning. Finally, the designated property taxes and expenses will be visible in all essential reports and sub-reports like Fact Details, Cash Flow, Income Taxes, and the Ledger.

Released August 31, 2021

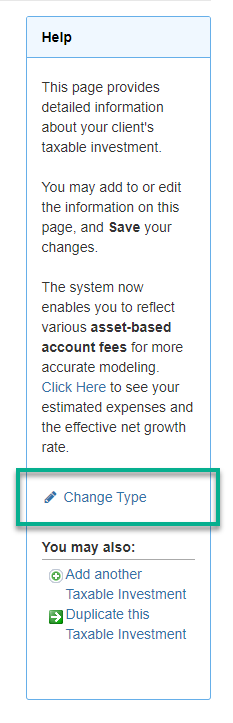

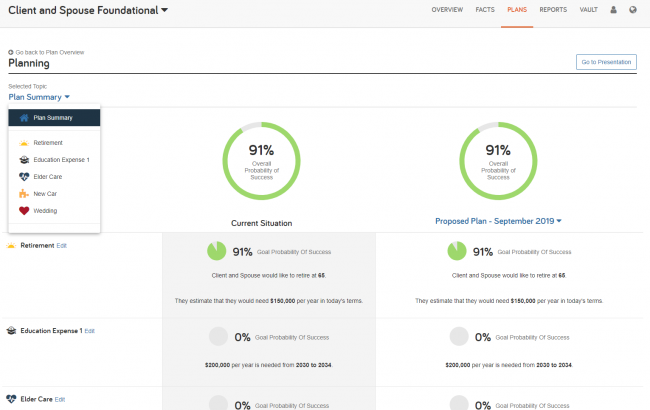

Based on your feedback, this release will allow you to easily change the account type for manually entered investment accounts (excluding stock options) and insurance policies from within the Advanced Facts.

When viewing the investment within Advanced Facts, select Change Type within the Help box on the right side of the page to change to a new account type within its group.

When viewing the investment within Advanced Facts, select Change Type within the Help box on the right side of the page to change to a new account type within its group.

Select the new account type from the menu. Click Change Type to confirm the change.

It’s important to note that the fact will lose data if the new account type does not include an existing data field.

Released January 25, 2021

Based on user feedback, we are changing the behavior of our growth rate assumptions only in the case of a premature client death being assumed. This change will more realistically model what was considered typical client behavior in such a circumstance.

When a premature death is assumed for someone that is not yet retired, we will continue to use the pre-retirement growth rate until the survivor’s retirement age, when it then switches to the retirement growth rate.

Currently, the asset growth rate switched to the retirement growth rate immediately upon the assumed premature client death. This will, for most cases, result in a higher growth rate for the survivor’s pre-retirement years and thus a smaller life insurance gap analysis need than previously calculated.

Released February 16, 2021

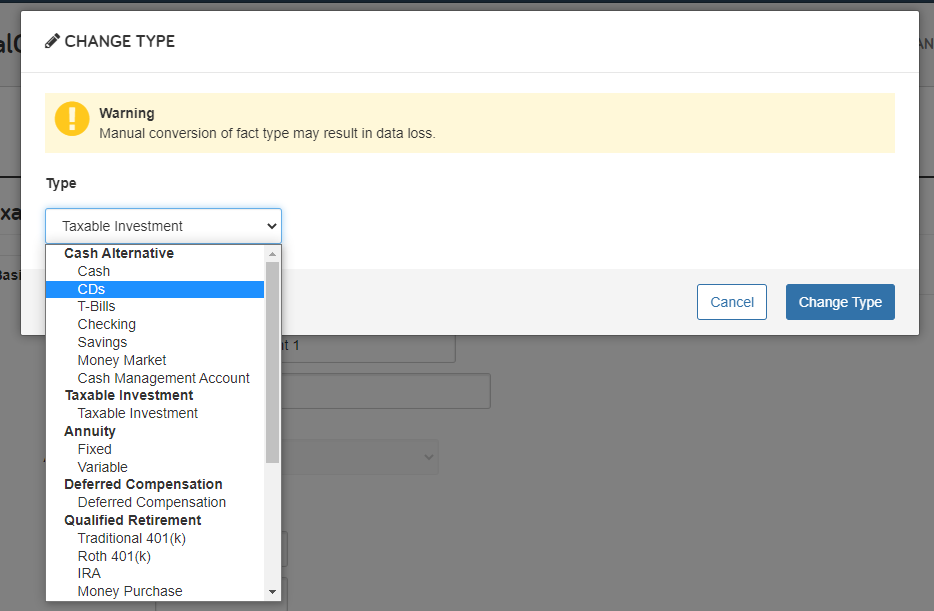

To streamline your experience, we’ve added drop-down navigation to the Topics area within Foundational Planning. The drop-down menu simplifies Topic selection and provides more onscreen real estate for your client’s Plan Summary comparison.

Released March 30, 2021

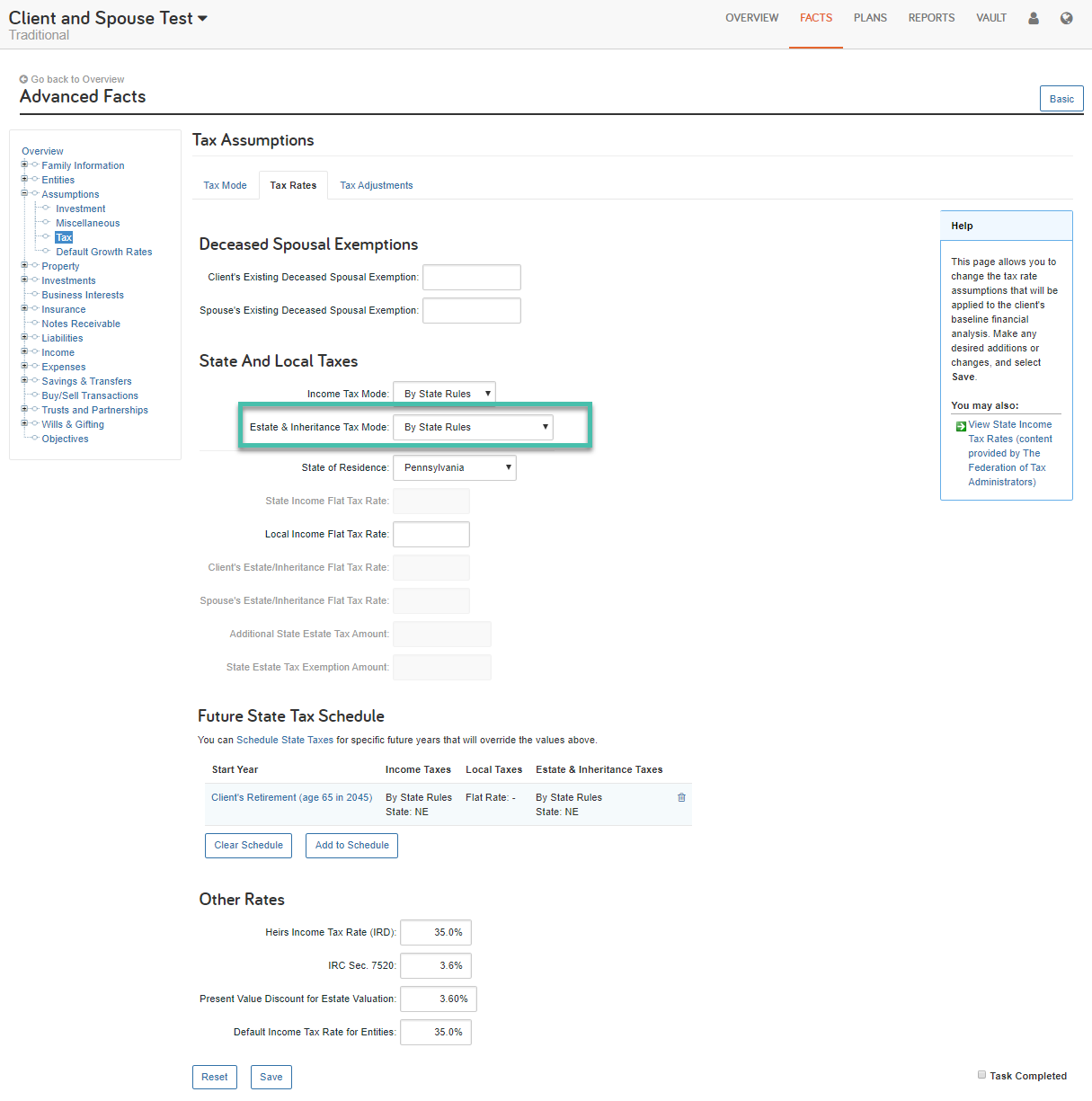

Building off the release of State Inheritance taxes last year and improving the accuracy and depth of our estate planning functionality, we have added the ability to simulate state estate taxes into our planning assumptions.

Simply open the Advanced Fact Finder and go to Assumptions > Tax > Tax Rates and select the By State Rules option under Estate & Inheritance Tax Rules.

Note: While accurate for 2021, we do not recommend enabling this feature for clients located in Connecticut and Washington D.C. at this time due to recent updates to tax laws not captured by this release. We appreciate your patience while we work to update the handling for these locales. We expect this update to be completed shortly.

Released January 12, 2021

The most recent market value data available within eMoney will now be used to estimate the null values for the cost basis for accounts with holdings that include a mix of null and non-null basis values.

For connected accounts, this estimation will happen automatically. For manual accounts, this estimation will take place when you visit the accounts Holdings page. The Holdings page has been updated to include a note regarding this functionality:

Grayed-out and italicized basis values indicate no basis information was received for that holding from the vendor. In this case, the basis is set to equal the current market value of the holding. Additionally, any totals or subtotals of the cost basis will also be affected.

Released March 1, 2021

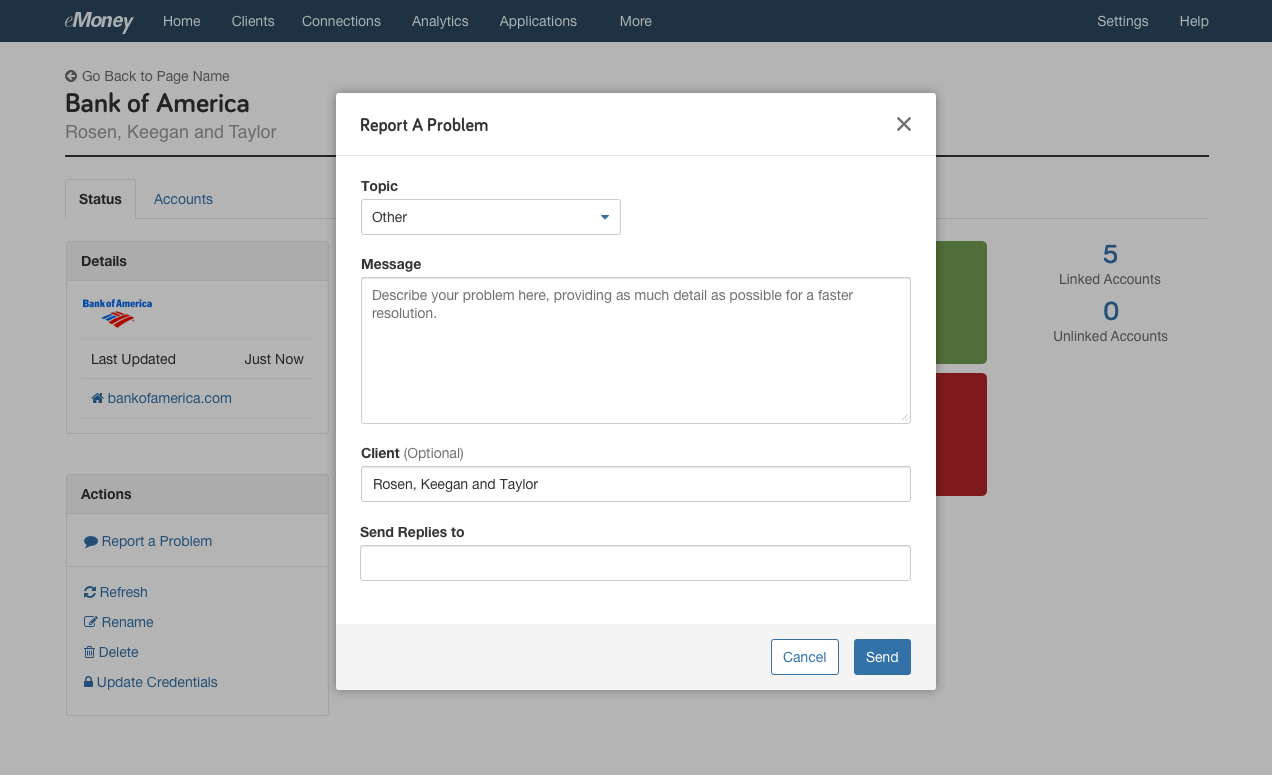

We transitioned our ticket management system to Salesforce to enhance the experience for our clients when reporting a connection-related issue.

This means more visibility and flexibility regarding open service tickets and the ability to follow up via email and from any device.

Click the Report a Problem link as usual to begin your support request and complete the form by selecting a Topic from the included list, providing details regarding the issue in the Message field, telling us which Client (optional) is being impacted, and entering one or more email addresses in the new Send Replies To field.

It’s essential to add as much detail as possible in the Message field to help expedite our ability to resolve your issue.

Once you click Send, you’ll receive a summary that includes your Case Number and Contact Email(s).

It’s important to note that the connections Support tab will be sunset as part of this enhancement. Ticket history previously available through the Support tab will be unavailable following this change. You’ll receive updates on your connection support requests via the provided Contact Emails—rather than being required to track updates within the application—as we work to resolve your request.

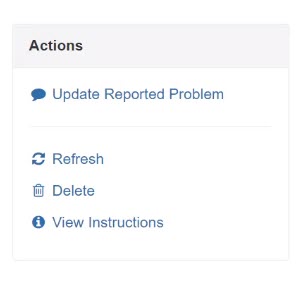

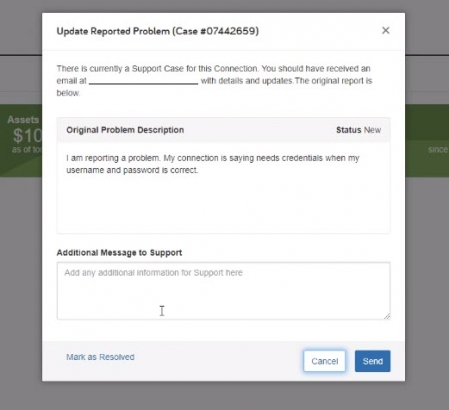

When you update a request using the Update Reported Problem link you’ll receive an email for your records.

Here you can Mark As Resolved, provide additional information to our support team, or view the status and details from the original request.

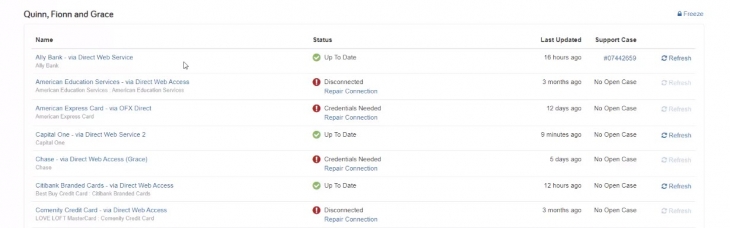

We will also make minor adjustments to the Advisor Connections Dashboard to make finding information about your case easier. When there is an open Support Case you’ll be able to update the request through a case number link on the dashboard—otherwise, No Open Case will be displayed.

Finally, as part of this update, we will sunset the datasupport@emoneyadvisor.com inbox— to ensure all connections related issues are tracked properly, they should be submitted using the Report a Problem workflow within the eMoney application.

Released April 6, 2021

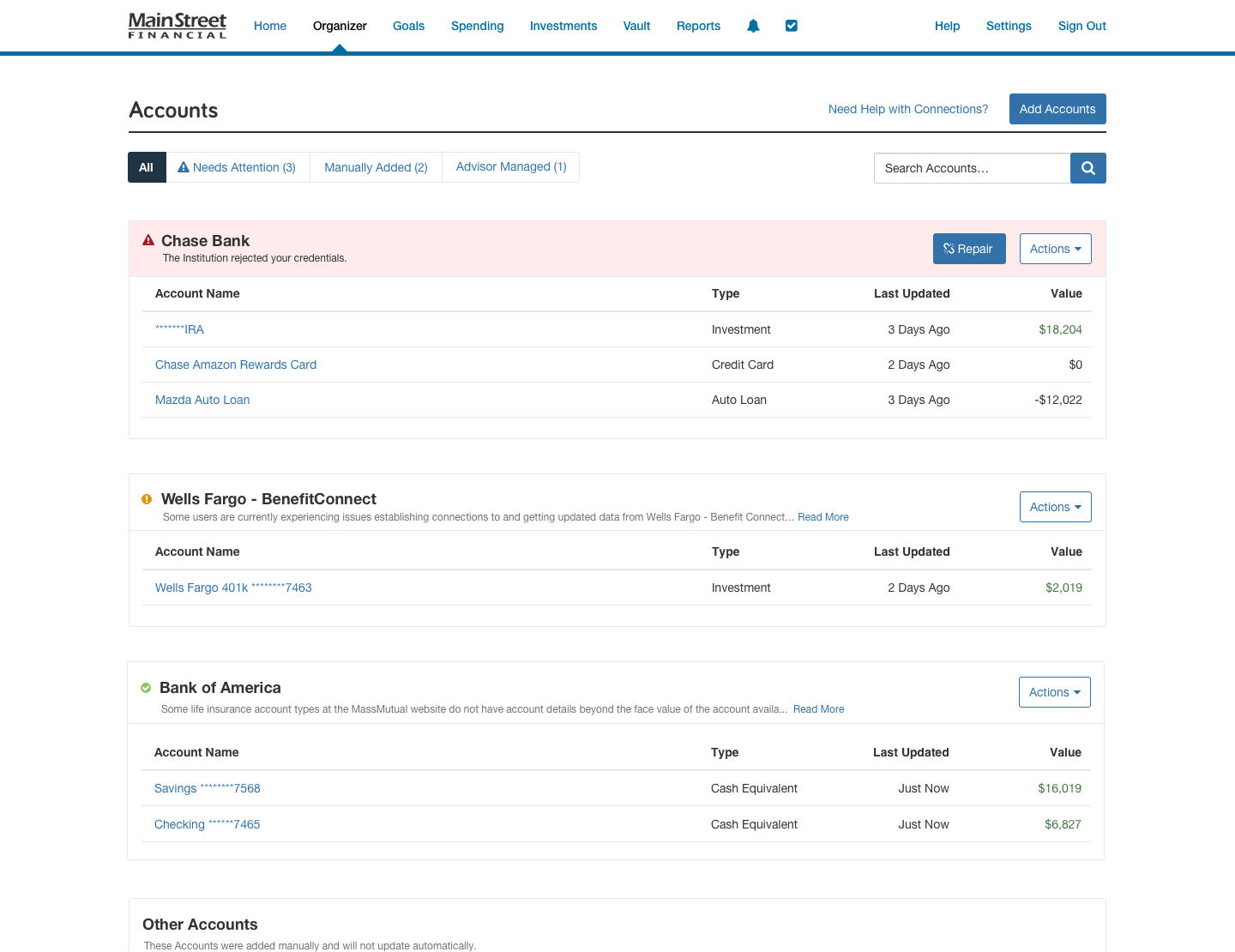

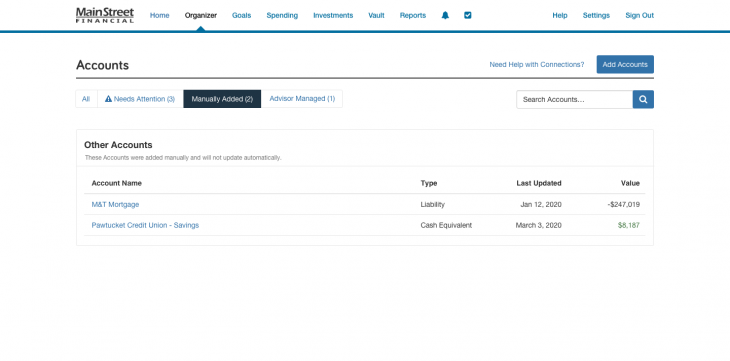

To help you gain a clear picture of the health and status of your connections, we simplified the Client Site account view to easily identify connections that may need attention.

We also created this guide to help communicate this change to your clients.

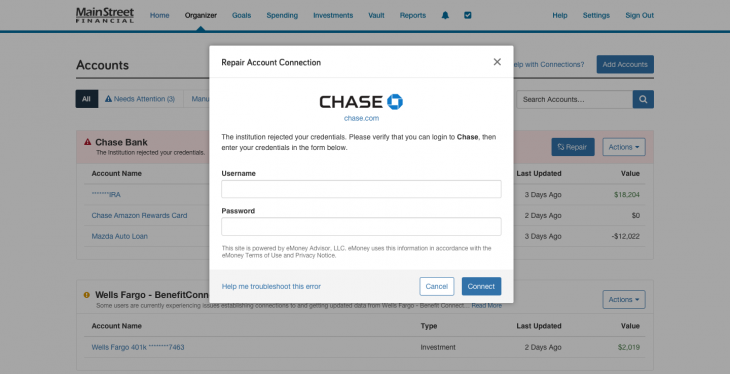

New color-coded institution statuses will help your clients easily identify connections that they can repair, such as by updating credentials (in red), versus errors that are outside their control, such as institution errors (in yellow).

Using the new account filters, you and your clients can easily identify connections with errors that are actionable. Clients will even have more insight into manual and advisor-managed accounts.

Filter by:

We made it easier than ever for clients to identify and troubleshoot connections with user fixable errors—such as updating credentials, access codes, and security questions.

As opposed to institutional outages and technical issues where there is nothing for them to correct and where we will work with the institution to resolve.

These updates are designed to streamline your clients’ connections experience and reduce their need for your support.

November 9, 2021

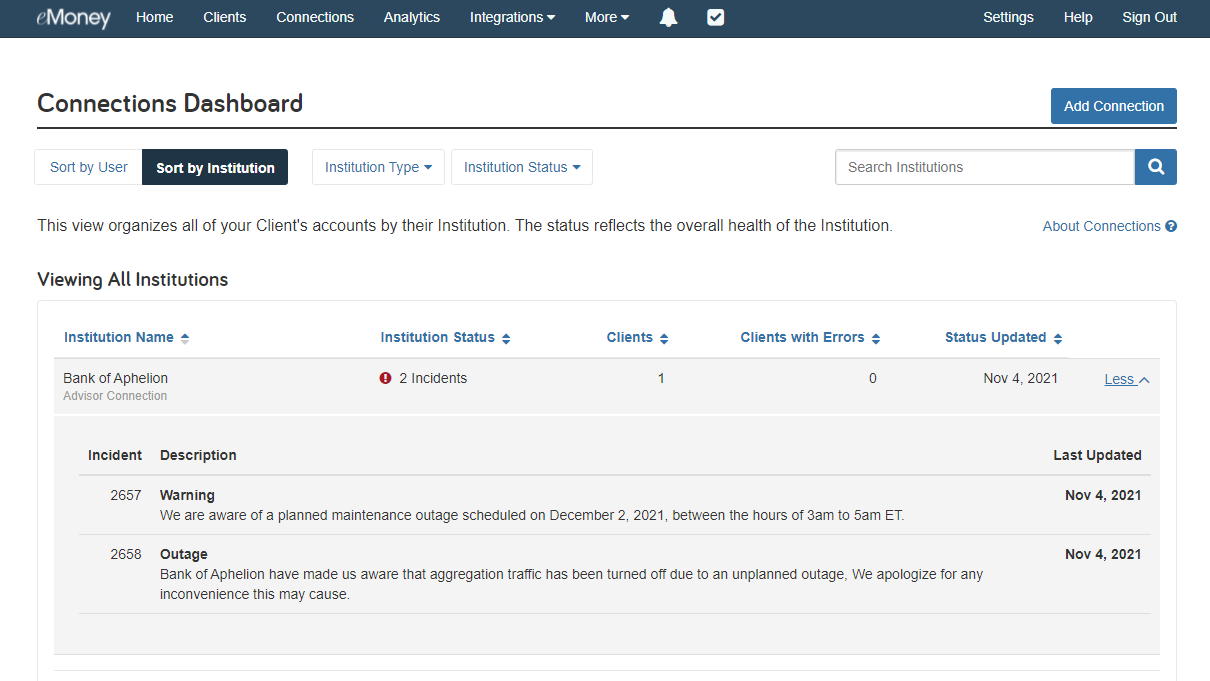

We updated how the Connections Dashboard reports incidents to provide more clarity when there are multiple issues—such as when an outage at an Institution overlaps with an existing credentials-related notification.

The Connections Dashboard now shows all issues impacting a connection—not just the most critical. With greater insight into aggregation-related issues, you can gain a deeper understanding of when the connection error is related to the financial institution and when you should contact the eMoney Client Support team.

November 9, 2021

We streamlined the approval process for Direct Feed connections to provide you with immediate access to your data (once it’s approved by your financial institution). Now, when you add a Direct Feed connection, it will go into a “Pending Approval” status that requires you to notify eMoney Support for verification by “Reporting a Problem.”

We automated this mandatory approval step so you can immediately add accounts if the financial institution has approved access and started sharing your account data. Set-up instructions for all Direct Feeds will be updated to reflect this new approval flow.

A Pending Data status can still occur if we have yet to receive data from the financial institution. In this case, re-enter your unique identifier (e.g. Rep Id) to ensure it has been entered correctly. Once you confirm the identifier is correct, wait 48 hours to allow the institution to begin delivery.

If after 48 hours the Pending Data status has not been resolved you can Report a Problem on the connection.

Released December 7, 2021

Your next meeting isn’t for another few months, but your client’s finances are top of mind. She’s been toying with the idea of purchasing a beach house for years where she can vacation with her future grandchildren. And with her daughter’s recent pregnancy announcement, she’s ready to do whatever it takes to make her dream a reality.

So she logs into her client portal and adjusts her savings goals to see how it impacts her readiness to make the purchase. She has some other ideas and questions she’s jotted down to discuss with you. She’s ready to enter her next meeting engaged and empowered to discuss her financial goals.

Meanwhile, alerts keep you notified about her changes and you’re prepared with a corresponding plan created on the advisor side based on her aspirations so you’re just as ready to have a productive, meaningful conversation.

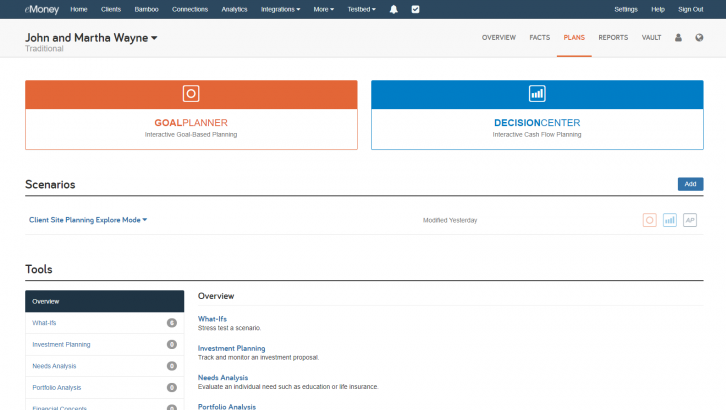

With the latest Explore Mode release to the Client Portal, this interactive scenario can come to life for you and your clients.

Explore Mode not only provides a sandbox where clients can test and explore the impact of changes on their finances, but it also creates a corresponding Client Site Planning Explore Mode Scenario under Plans on the advisor side of eMoney. This Explore Mode plan gives you even more insight into your client’s financial priorities that will help you spark conversations with them about their goals.

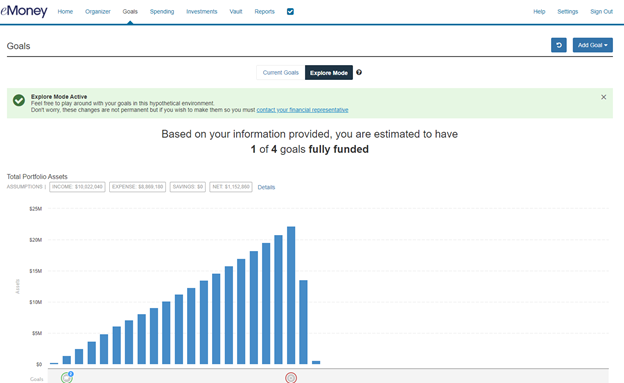

When Explore Mode is enabled, end clients will see a new toggle option for Current Goals or Explore Mode at the top of the Goals summary page. Clients can simply toggle over to Explore Mode and they’ll gain the ability to edit their current goals.

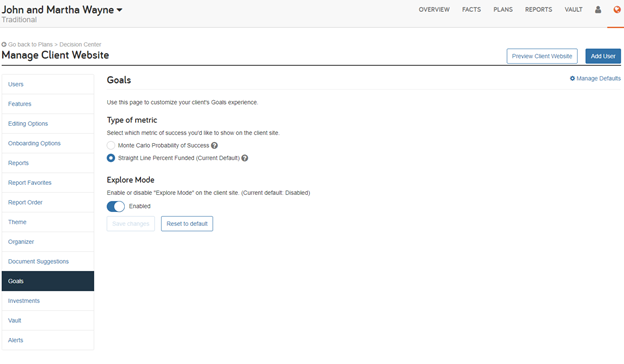

Explore Mode is disabled for existing Client Site users by default. To enable the feature for these clients follow the steps below.

From the Client Overview, go to Manage Client Website and select the Goals page settings. Here you can toggle Explore Mode to Enabled before clicking Save Changes.

Note: Explore Mode setting is enabled by default for all newly created clients after December 7. You can also update your default settings by clicking Manage Defaults on the top-right of the page.

To help you communicate this new feature to your Client Site users, we’ve created a client-facing email template and user guide you can repurpose for your firm below.

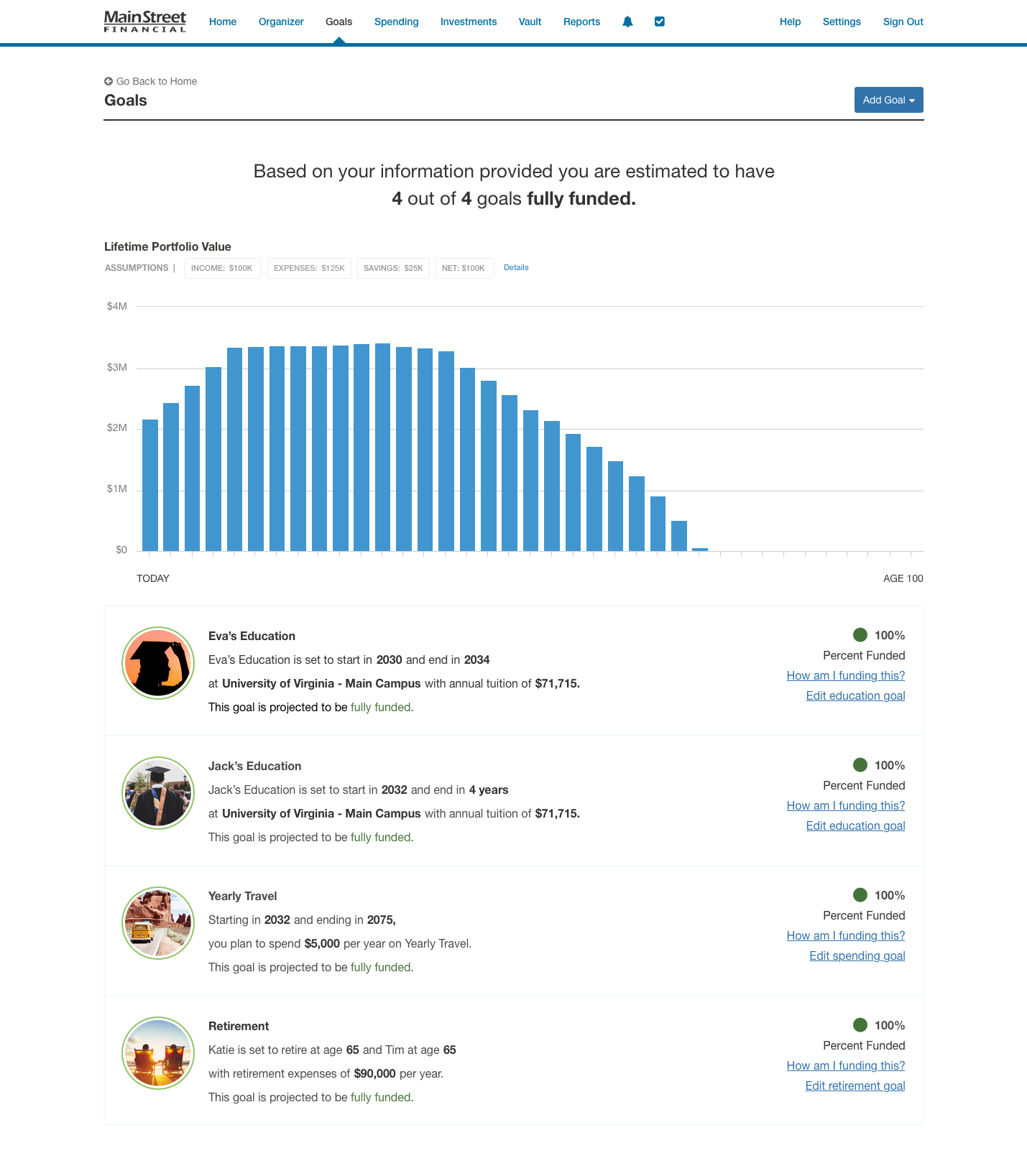

Released April 27, 2021

We redesigned the Goals Page on the Client Site to provide a more personalized and streamlined experience for your clients.

This enhancement enables your clients to view all their goals details simply and efficiently on a single page. It will also provide consistency between the financial plan visuals and charts that they are already accustomed to seeing throughout other areas of your financial planning experience.

Released May 18, 2021

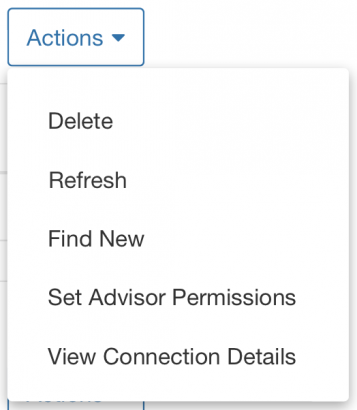

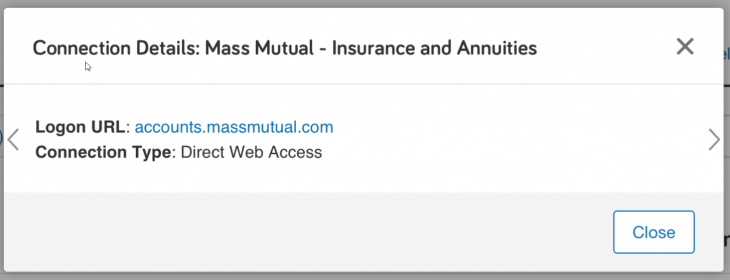

Based on your feedback, we’ve added a View Connection Details option to the Actions menu. Now when troubleshooting an issue you can easily show clients how to view the logon URL for their connection, the connection type, and connection name.

Just go to the Organizer > Accounts page and click the Actions drop-down menu on the desired connection.

Then, click View Connection Details and a modal window will appear that displays the relevant information for their connection.

November 9, 2021

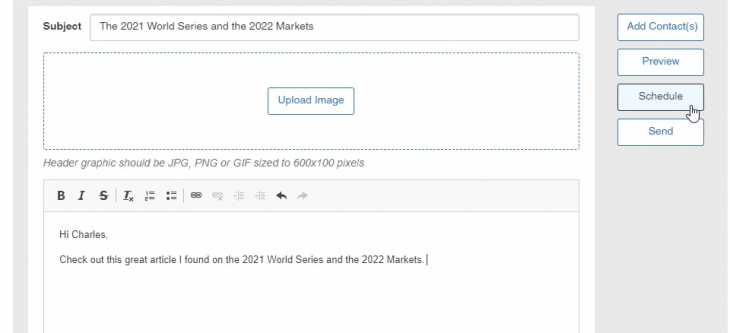

This November, we released popular feature requests to the Bamboo digital marketing platform designed to add even more flexibility in how you communicate with clients and prospects.

The Email Scheduling feature allows Bamboo users to schedule one-off emails for distribution at a later date and time, thus making it easy to build and organize a marketing calendar.

Here’s how it works

Select one of our existing email templates or the Email option on a piece of content you’d like to share. The email builder will open and you’ll see a new Schedule button that is available once you’ve selected the recipient(s) and entered your email content (e.g., subject line, body copy).

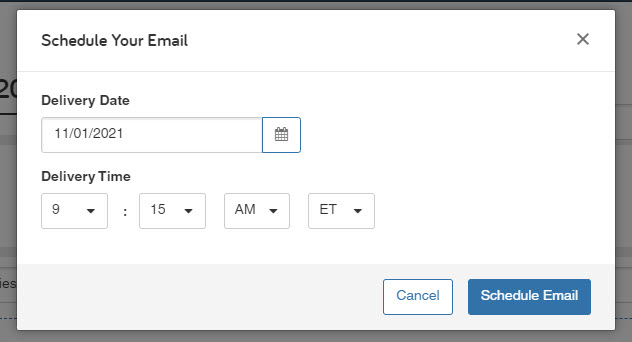

When you click Schedule, a modal will appear where you can select the email’s delivery date and time.

The Custom Email Attachments feature allows Bamboo users to attach custom files and marketing materials from their computers to the one-off emails sent from Bamboo.

Here’s how it works

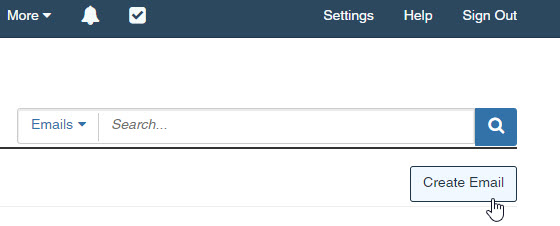

Click View Emails from your Bamboo Dashboard, then select Create Email.

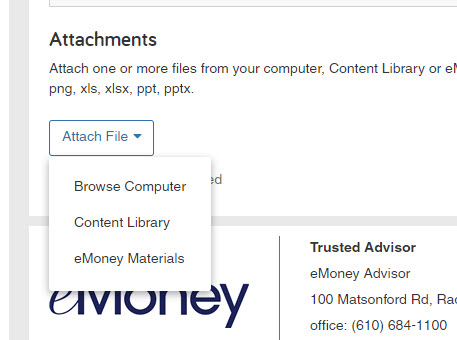

From here, you can customize your email content and select Attach File to browse your computer, the Bamboo Content Library, and eMoney Materials for your desired content.

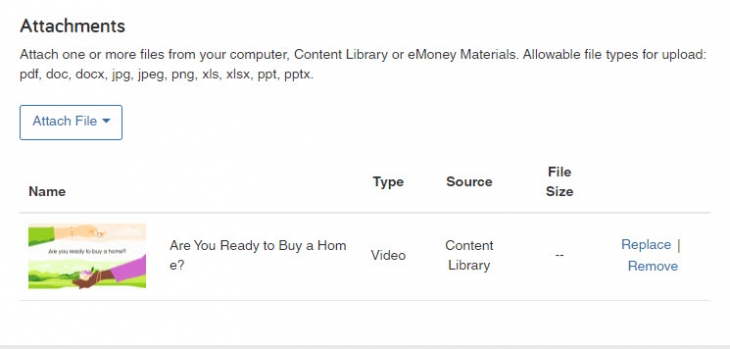

Your attachments will be added to the content grid where you can easily remove or replace files.

Note: Due to common email domain restrictions, attachments are limited to 14 MB per email. A maximum of 20 attachments can be added to an email (this includes both custom files and Bamboo content).

Not a Bamboo subscriber? Learn more about the marketing platform here.

Released December 7, 2021

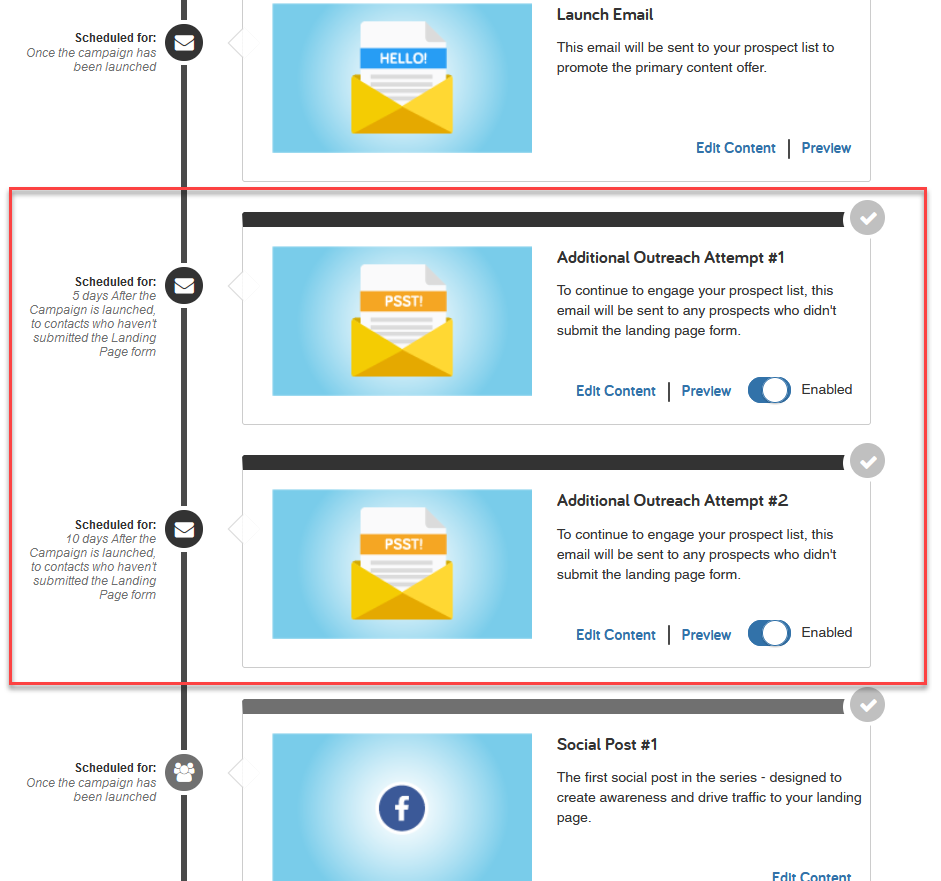

Sometimes prospects miss emails so they need an extra nudge. In the latest Bamboo release, automated lead generation campaigns now include additional outreach emails to increase engagement with prospects.

These additional outreach emails are controlled from the campaign customization dashboard and will only be sent to prospects if they have not completed the Landing Page form.

When enabled, just like launch emails, outreach emails will include tracking information that feeds into campaign analytics.

Released December 7, 2021

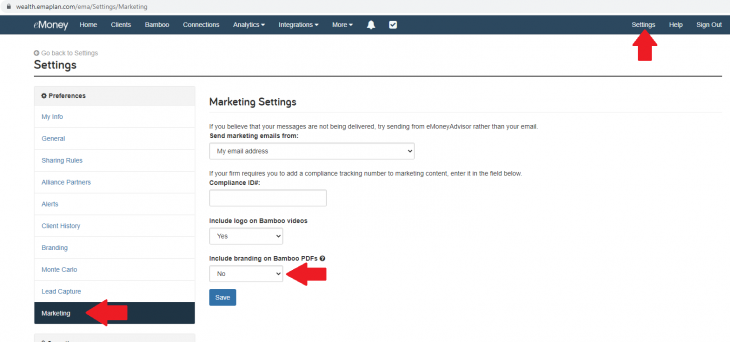

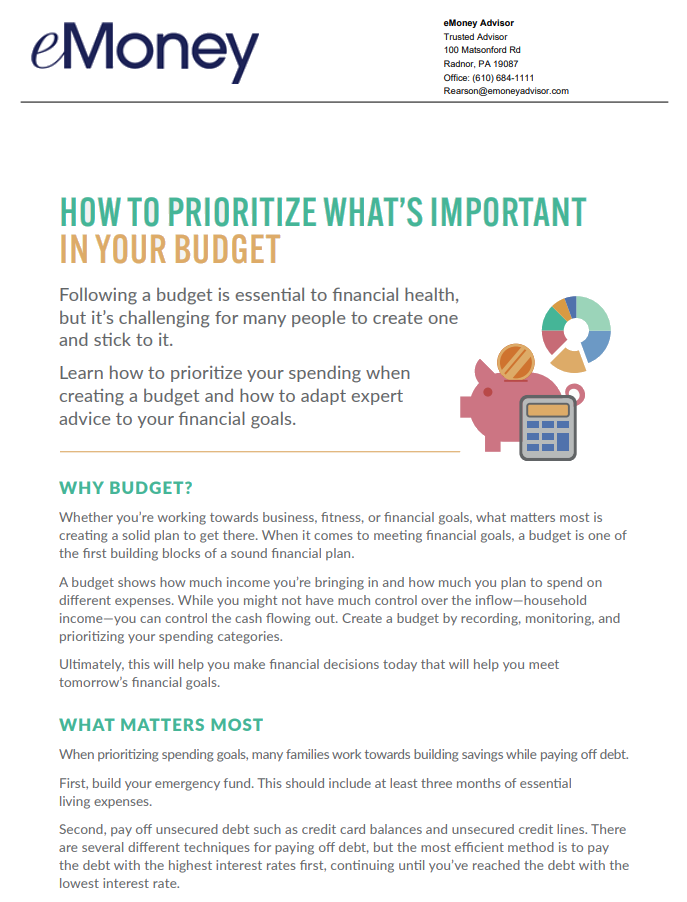

Branding is an essential aspect of any marketing effort. As advisors, you strive to create a unique brand that your clients and prospects can trust. Now with Bamboo, you can add your branding to all PDF content in the Content Library and eMoney Materials—so the content you send looks and feels like it belongs to your firm.

Go to Settings > Marketing and make sure the Include branding on Bamboo PDFs setting is set to Yes.

Once enabled, all PDFs available through the Bamboo content library will automatically include your logo and contact on the top of page 1.

Not a Bamboo subscriber? Learn more about the marketing platform here.

Released January 28, 2021

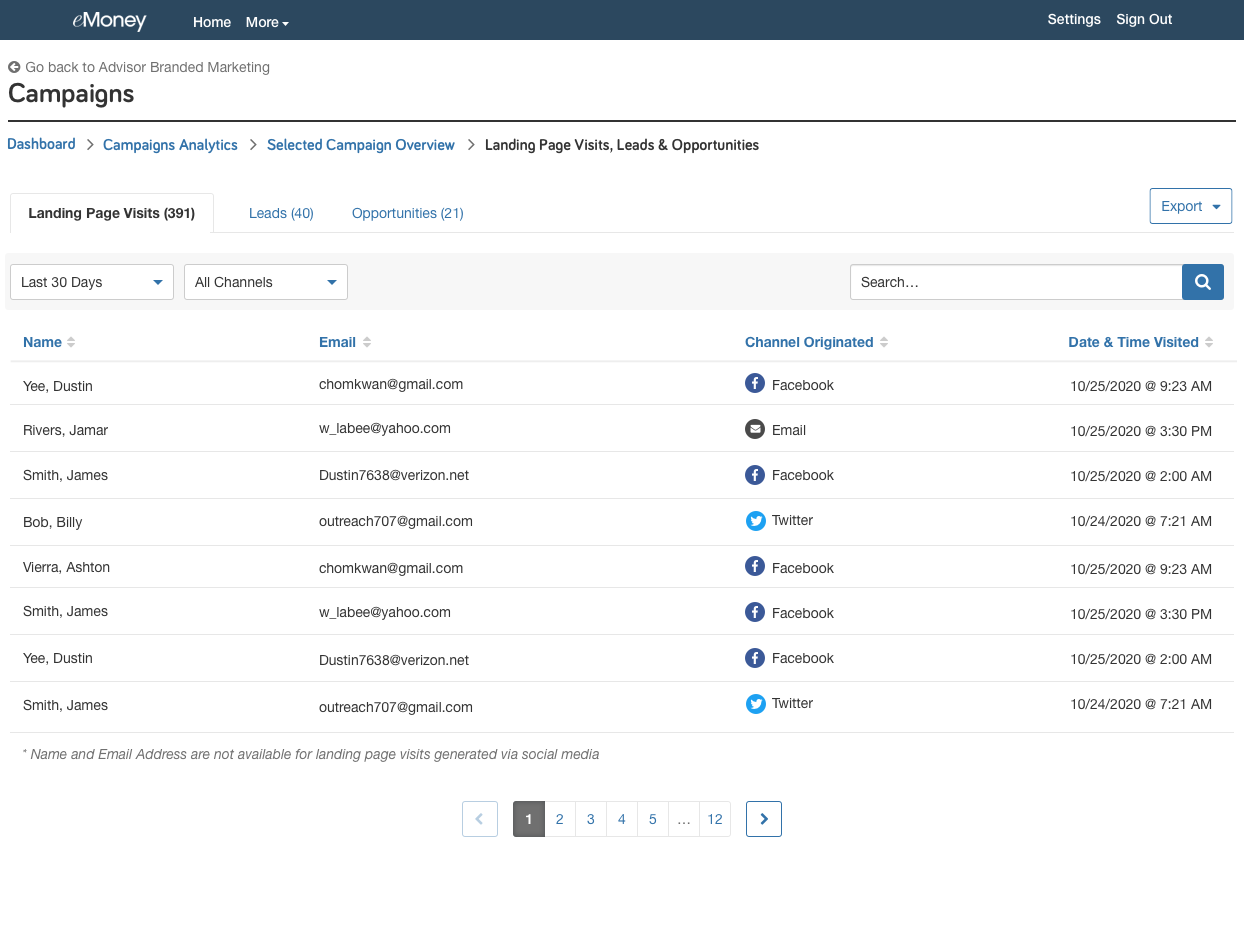

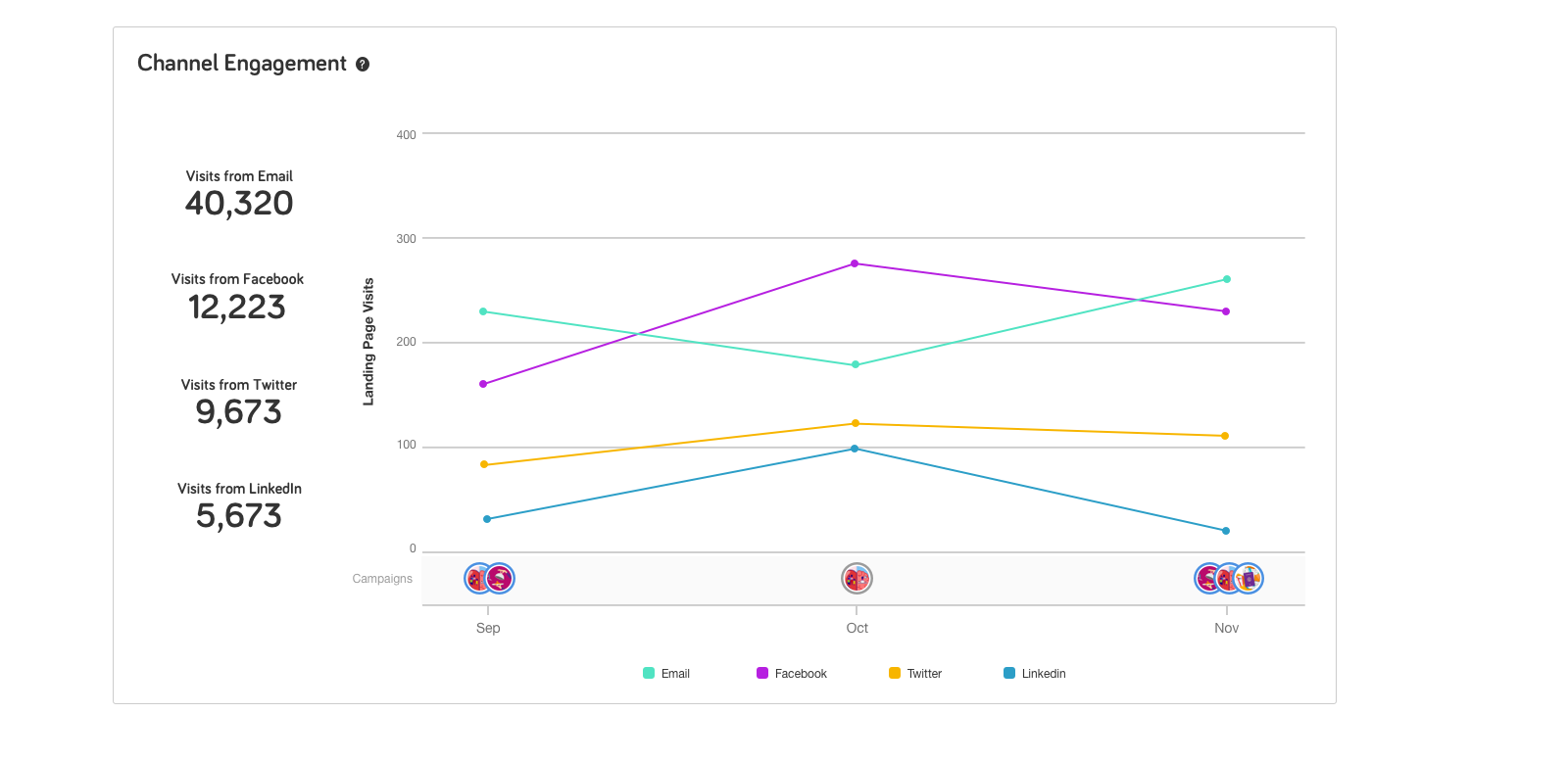

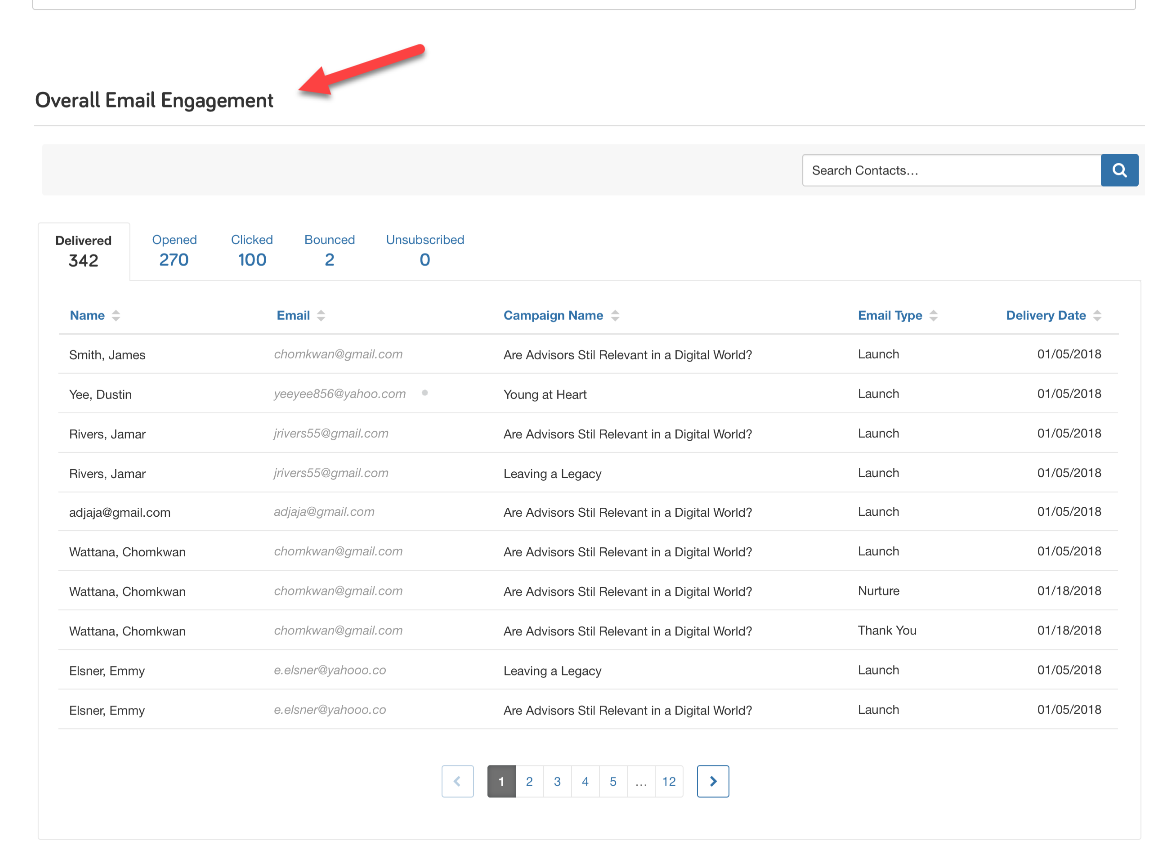

Gain more in-depth insight into who is engaging with your campaign, where they’re seeing your marketing messages, and when. This release enhances the experience by adding an overall email engagement view, additional details on leads and opportunities, and channel engagement data.

Keep reading below to learn more about the latest enhancements to the Landing Page and Generated Leads, Channel Engagement, and Overall Email Engagement charts.

From the Landing Page and Generated Lead chart, you can now access a detailed table of who is engaging with your marketing campaigns. Simply click on the total number beneath Landing Page Visits, Leads, or Opportunities to view.

Note: Name and Email Address data are not available for landing page visits generated via social media. However, this data is available for leads and opportunities.

This chart shows which channels (including email and social) are the most effective for driving landing page visits. You can leverage this data to understand where you’re having success and which channels have success with the associated campaign. We mark the associated campaigns on the timeline for reference.

Now available within Campaign Analytics, you can view a consolidated table of email engagement across all campaigns.

November 9, 2021

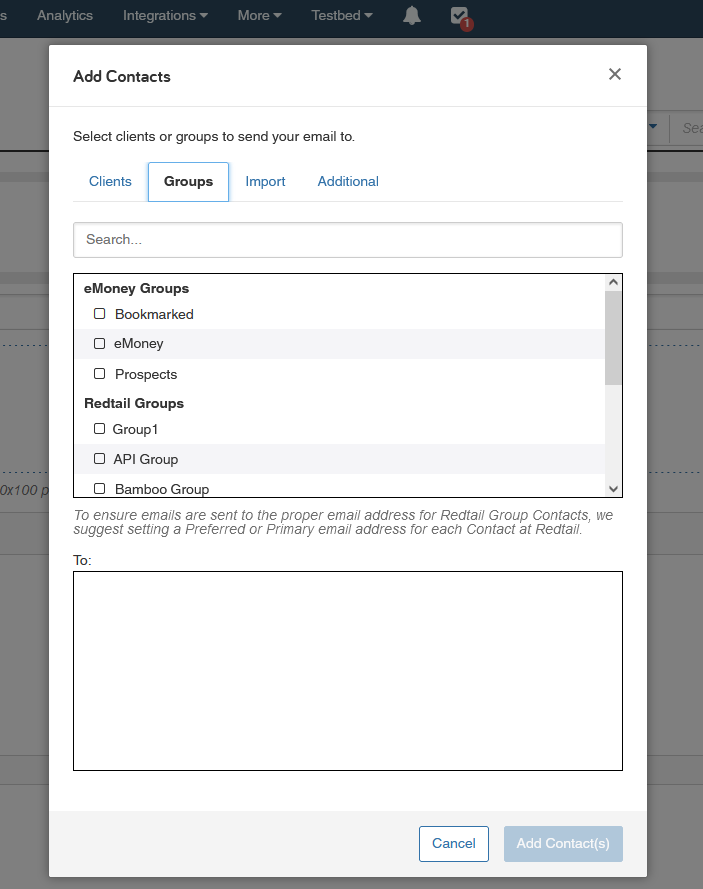

Bamboo now integrates with Redtail CRM to streamline your ability to send campaigns and emails to Redtail groups. Streamlining the ability to communicate with CRM contacts without the need to import or link them to eMoney.

First, ensure that the Redtail integration is enabled under Integrations on your navigation bar. Then open Bamboo and select an email to send. Within the email click Add Contact(s) > See eMoney Groups and Redtail Groups.

Select your desired group(s) and click Add Contact(s). You’ll see your selected groups added to the To field of the email. The same Add Contact(s) flow is also available for Campaigns.

When the email is sent it will go to the Sent folder like all other emails where you can click into Recipients to view individual tracking information!

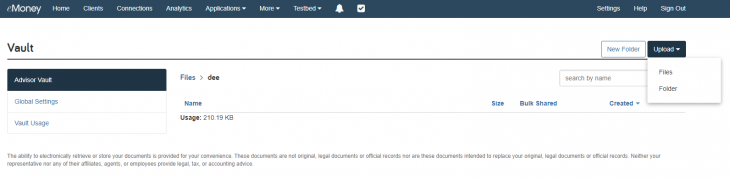

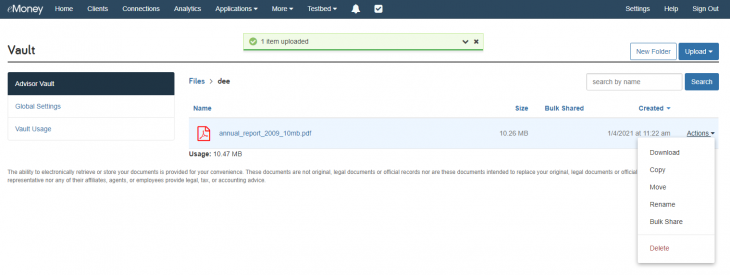

Released January 19, 2021

We’ve added the ability to mass upload Vault documents quickly. This feature saves you time by streamlining your ability to quickly share documents—like privacy policies or Form ADV—with all your clients.

Access the Advisor Vault under the More drop-down menu on your Navigation Bar. Then upload the document that you’d like to share with your clients

Now click the Actions menu and select Bulk Share and click Share.

That’s it!

You also have the ability to unshare bulk shared files using the same Actions menu on the currently shared file.

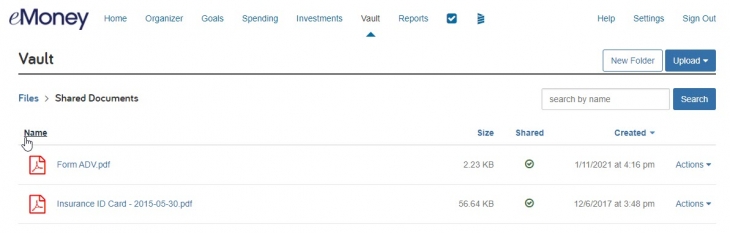

Released January 19, 2021

In alignment with the new Bulk Share feature, we’ve updated the Vault default file sorting to sort files by their Created Date. This ensures that the most recent documents are easily visible to you and your clients.

You and your clients can easily adjust how files are sorted by selecting the Name, Size, Shared, and Created filters within the Vault folders.

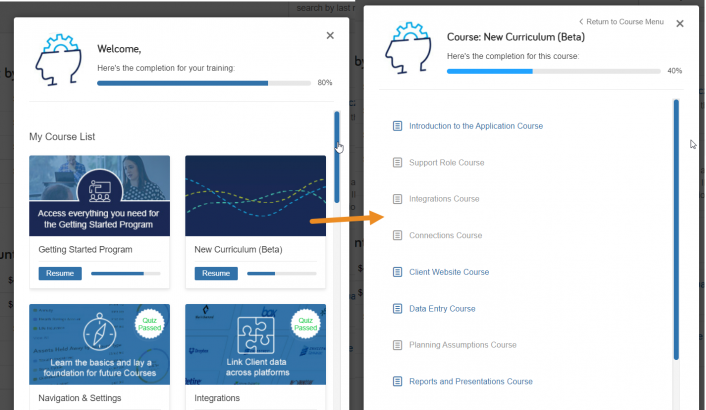

Released December 7, 2021

This December, we’ve released a new training course curriculum covering all the materials in our existing course catalog with a modernized flow and structure.

Today these courses are available within the Knowledge base under New Curriculum (Beta).

We’ve kept the existing coursework available at this time to allow current users who are mid-way through their training to complete their coursework.

However, we recommend new users complete the new curriculum to get the most modern and updated course design. The legacy courses will be discontinued in early 2022.

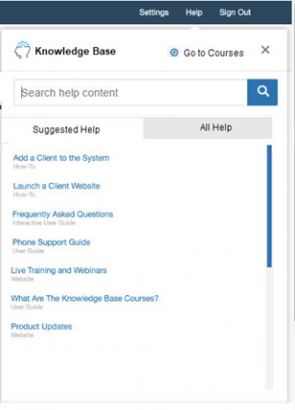

Released February 19, 2021

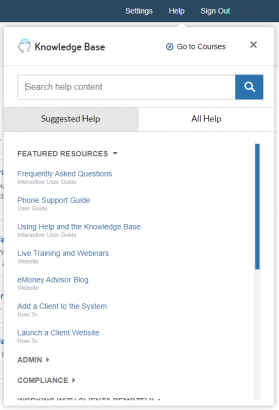

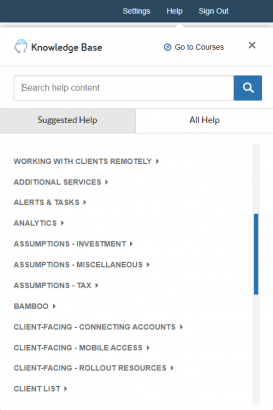

On February 19, 2021, the Help menu is getting an upgrade to support contextual help resources depending on where you are in eMoney. The new Suggested Help tab will showcase resources specific to the page you’re on.

On February 19, suggested resources will be available for the following pages:

Sub-pages will inherit the help items from the main page category. For example, each Facts page will have help about Facts not specific to Liabilities or Insurance.

Your second tab, All Help, allows you to take a deeper dive into all the available help resources. The search box function has not changed and will continue to allow users to search the entire Help repository no matter where they are in eMoney.

Courses Prominently Displayed

In addition to the two-tab interface, we added the Courses link to the Help menu heading when expanded. This update will help streamline how you access our dynamic training courses, which we anticipate will be especially helpful for new users.

Note: This update does not impact the Client Site.

We will continue to enhance our help resources with even more specific pages in the future.

Released January 27, 2021

We relabeled our Applications drop-down menu to Integrations to better align with intended usage and clarify navigation for new users.

Released April 27, 2021

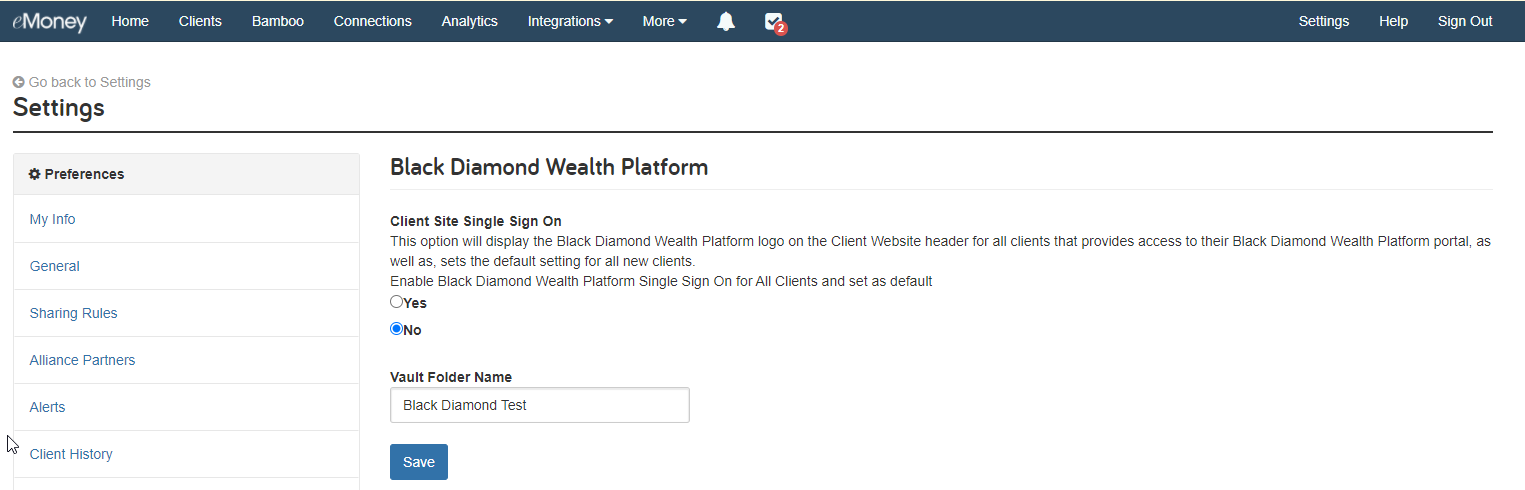

In efforts to provide a more centralized experience for Client Site users, we added the ability for clients to access Black Diamond through single sign-on directly from their Client Site.

With the Black Diamond integration enabled, go to Settings on your navigation bar and scroll down to Black Diamond under the Integrations menu. Here you will find the option to enable Client Site Single Sign-on.

To enable the integration for all Black Diamond clients, toggle this setting to Yes and click Save.

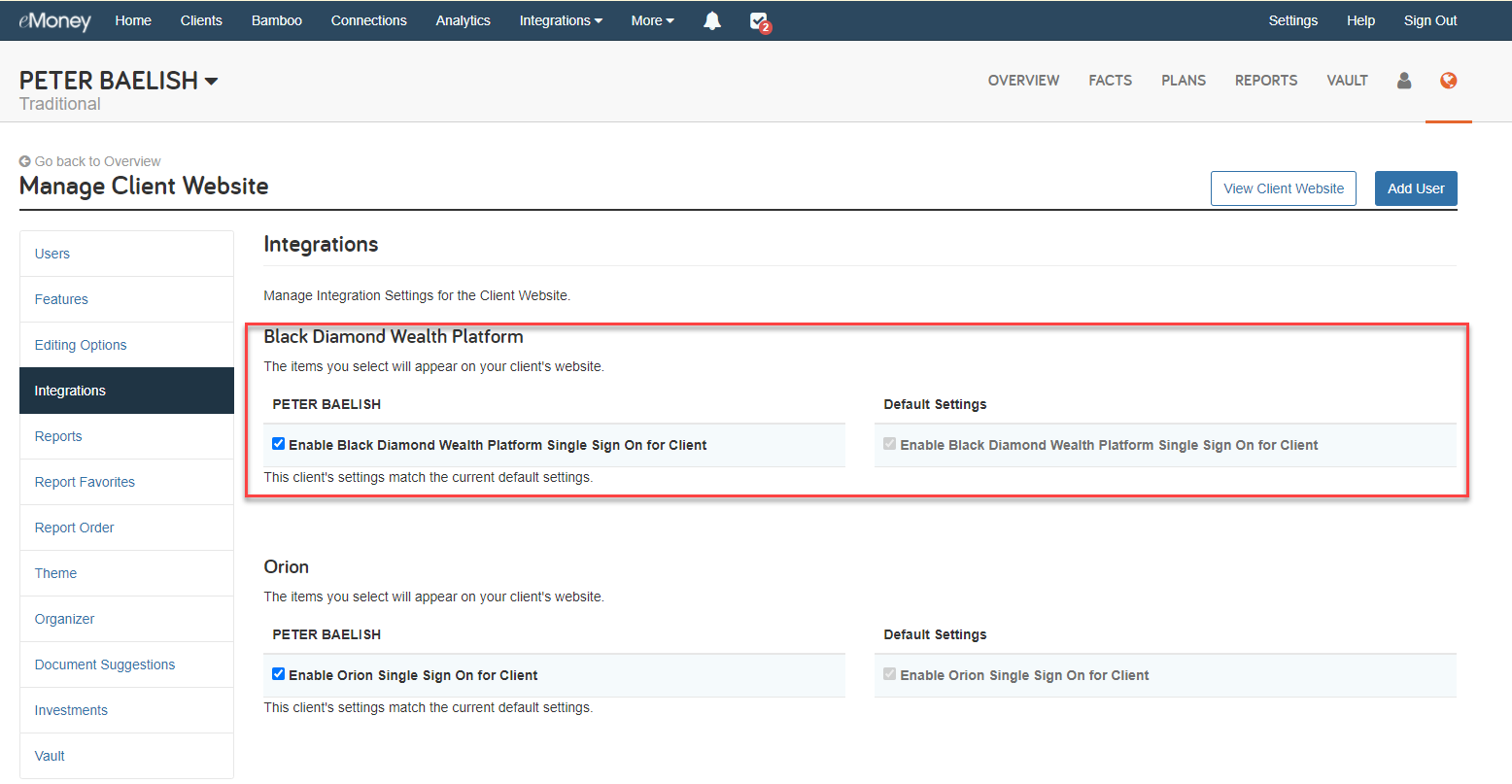

If you’d prefer to only enable this feature for some clients you can also open the Client Overview and go to Manage Client Website – Integrations. Here you can enable the Black Diamond Wealth Platform Single Sign-on functionality on an individual basis.

Once enabled the client can access Black Diamond in a new window by clicking the icon on their Client Site navigation bar. They’ll be prompted to enter their credentials the first time they access Black Diamond.

Black Diamond is also adding the ability to single sign-on from their platform to eMoney. So once enabled, they can have streamlined access to either platform from wherever they are.

Note: Advisors and Support users viewing the Client Site through impersonation will be unable to access the Black Diamond integration through single sign-on. This functionality is limited to the client login. Clients require their own credentials to access Black Diamond through this integration.

Released May 25, 2021

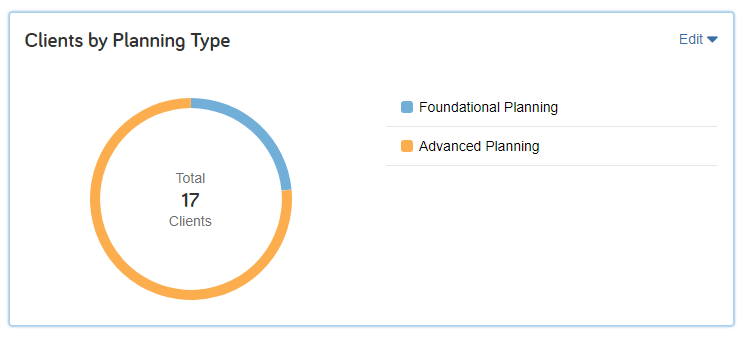

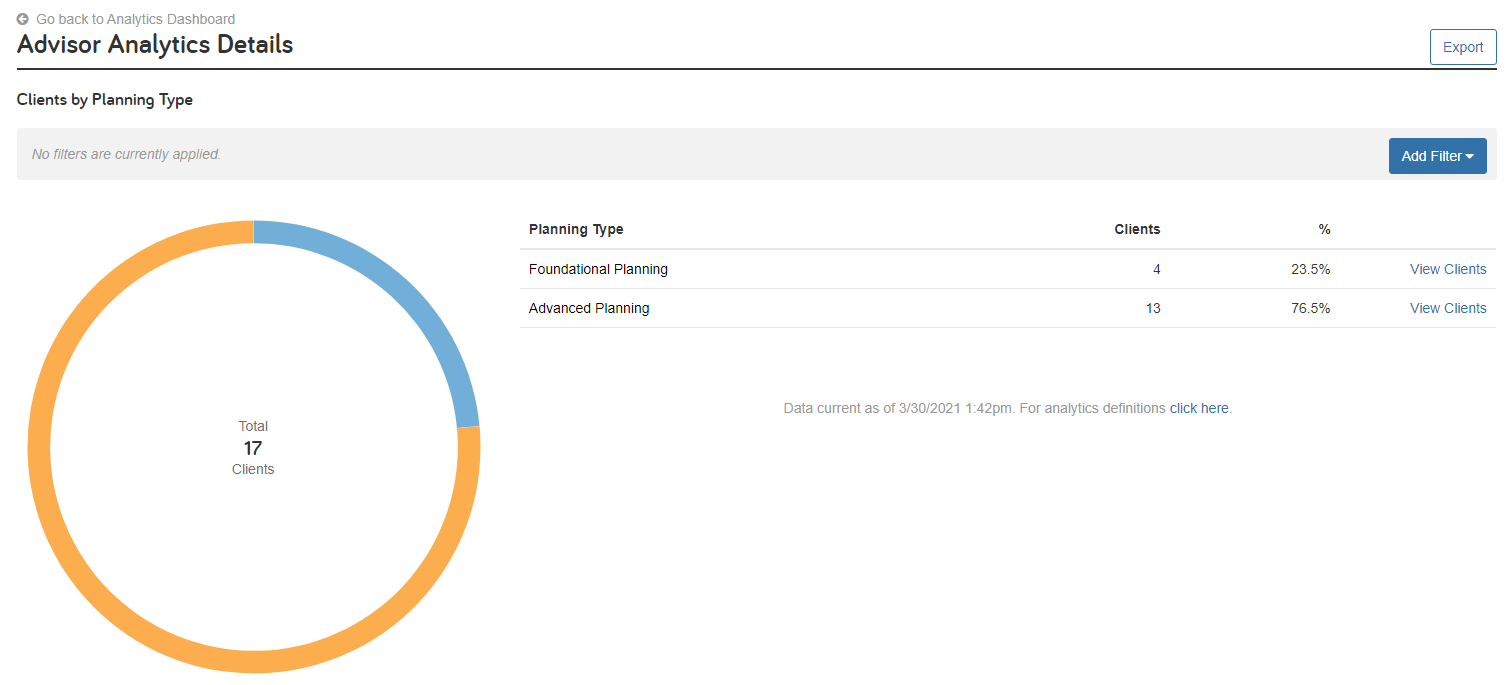

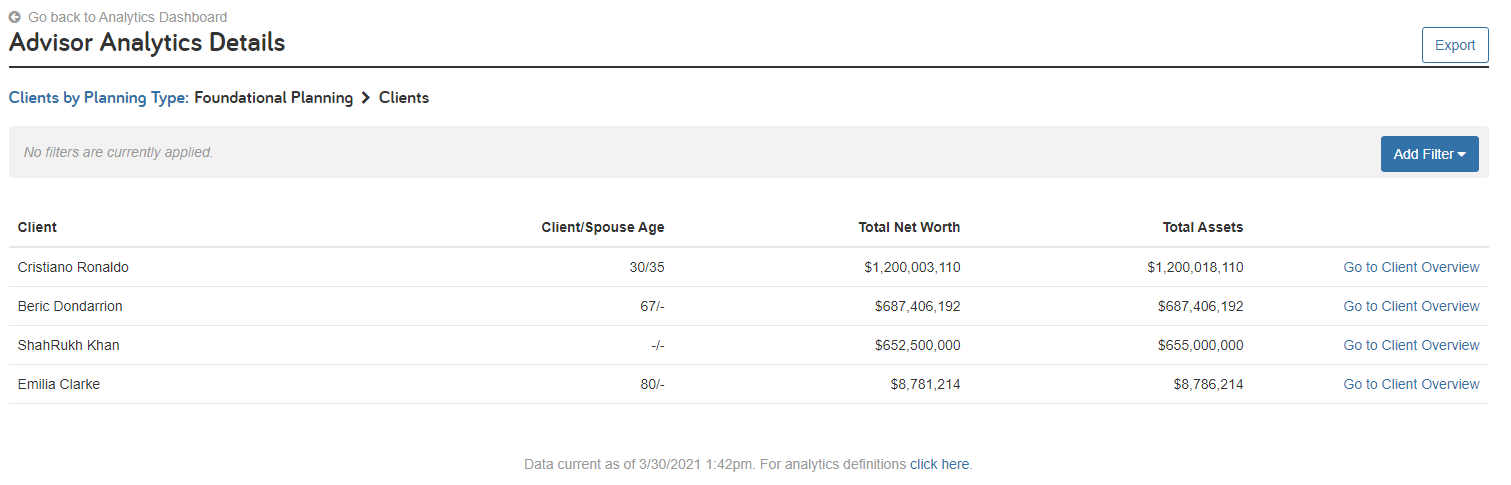

Available in Advisor and Office Analytics, the new Clients by Planning Type chart will provide a clear and concise way to view the total number of clients using Foundational and Advanced Planning.

Users can expand the chart to gain insights into the percentage of clients using each planning type.

Or click View Clients to see a more detailed breakdown that includes the Client Name, Age, Net Worth, and Total Assets.

This new chart is available by default as part of Advisor Analytics in our eMoney Plus, Pro, and Premier packages.

In addition, to the new Clients by Planning Type chart, we’ve released six new filters to Advisor and Office Analytics.

Finally, a new Planning Type field has been added to the Client Export Template.

Released April 19, 2021

Building on February’s enhancements to the eMoney Help resources, we added even more suggested Help resources for integrations and Reports.

New Integration Help content will include suggestions for:

Suggested Help content will also be provided for the following Reports:

Released August 23, 2021

We streamlined our All Help menu to create a more intuitive experience for users searching for resources within the Knowledge Base. New and updated categories with realigned content make it easier than ever to find the help you need quickly.

Legacy All Help Menu

Updated All Help Menu

Following Microsoft’s lead, eMoney has discontinued support for Internet Explorer version 11 effective October 1, 2021. Because of this, we suggest that if you use Internet Explorer 11, you upgrade your browser as soon as possible.

End of support means there will be no more security updates, non-security updates, free or paid assisted support options, or online technical content updates for Internet Explorer version 11 from Microsoft.

For eMoney, it means we will no longer test the application for compatibility with the non-supported browser.

While the end of support won’t have an immediately visible impact on eMoney users we recommend everyone currently using Internet Explorer 11 to upgrade to the latest version of a supported browser (e.g. Microsoft Edge, Chrome, Safari) to ensure they’re up to date with the latest security and technical updates.

Released July 20, 2021

We’ve added a new field to our Advanced Analytics data export to the Insurance Policy export for the Policy Number.

If you’re using Analytics export data in custom reporting we’ve provided a sample data export here you can use to adjust your reports to accommodate the new data column.

Released December 14, 2021

In coordination with the recent enhancements to Decision Center, later this month we’re updating our Sample Clients templates with new planning scenarios and names in addition to the standard annual updates.

These enhancements will continue to follow the existing narrative designed for their personas. However, we’ve changed the existing basic techniques and scenarios to better align with the enhanced Decision Center experience.

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.