In Q1 2022, we added new efficiencies for solving for liquidation strategy and retirement age to Decision Center within a new Insights section, enhanced our Bamboo | Redtail integration to generate notes documenting email sends, and much more.

Released February 15, 2022

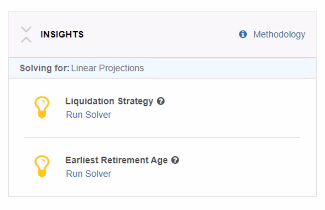

We created a more intuitive and streamlined planning experience by adding solvers to a new Insights section of Decision Center. These solvers help to automatically maximize plan success by running simulations and implementing changes to achieve your desired plan results.

This release includes two new solvers for Liquidation Strategy and Retirement Age.

Note: You can learn more about how each solver works by clicking Methodology within Insights or by clicking the tooltip next to each solver.

Open Decision Center and select your desired Plan and Techniques. Then go to the new Insights area accessible below What-Ifs in Decision Center. Here you’ll find two new solvers for Liquidation Strategy and Retirement Age.

Click Run Solver and it will begin the calculations. Once the calculations are complete, toggle the solver on to see the impact on the Plan.

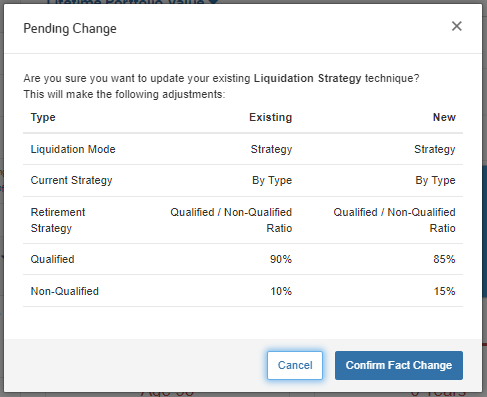

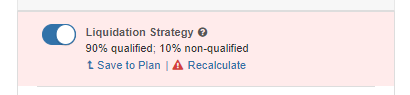

You can then save the results by clicking Save to Plan (or Base Facts). Saving will either create a new technique or, when updating the client’s Facts or a similar technique, display a confirmation message indicating the existing and new values prompting you to confirm the change.

It’s important to note that if you update the current scenario by changing the Plan or modifying a Technique, the solver will display Recalculate to show its calculations have not been run against the current dataset.

Stay tuned for even more Decision Center updates coming this year as our planning product roadmap continues to focus on expanding and deepening planning capabilities, offering more streamlined and intuitive workflows, and supporting collaborative planning conversations.

Released March 29, 2022

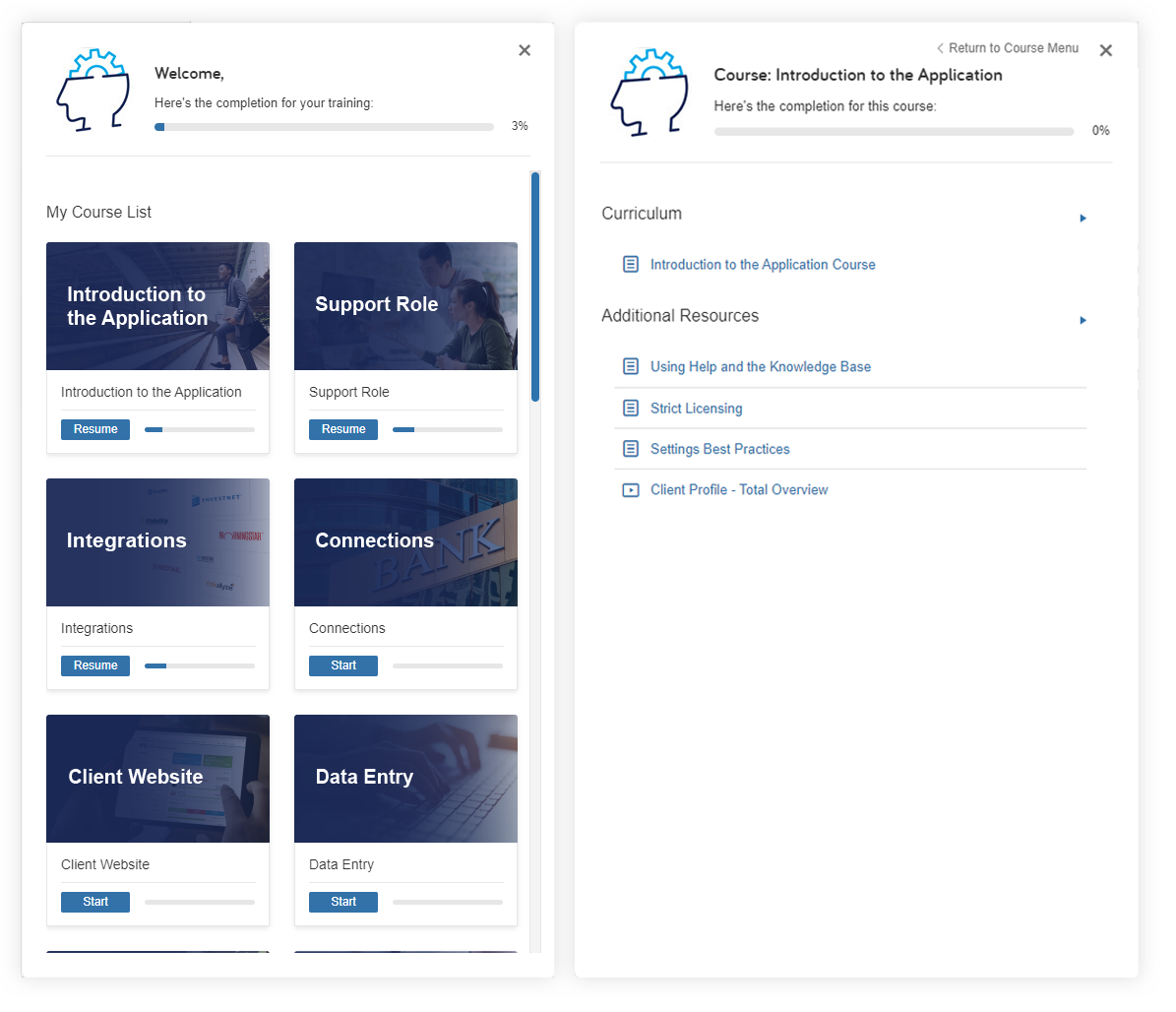

We have officially launched a new series of courses with streamlined and enhanced educational content accessible under Help. These replace the existing courses within the eMoney Knowledge Base.

These courses will cover the same material as the current courses but have been streamlined and are more interactive.

Instead of having courses broken down into individual progress for each video, guide, and how-to, you’ll now have access to a singular interactive course that includes all the requisite content. With this update, you no longer need to open a new tab for each piece of coursework, allowing for seamless navigation.

While the look and feel of the courses are similar to the previous versions, you will notice a slight change to the thumbnail images. As the previous courses have been removed, you’ll also notice that course progress has been reset.

To access courses in eMoney, simply click Help on your advisor navigation bar and select Go to Courses. This will launch the menu modal where you can browse and select from what is available.

Released March 29, 2022

Based on your feedback, we’re adding the ability to save emails you create and send as templates. This feature will help you save time when preparing essential communications for your business.

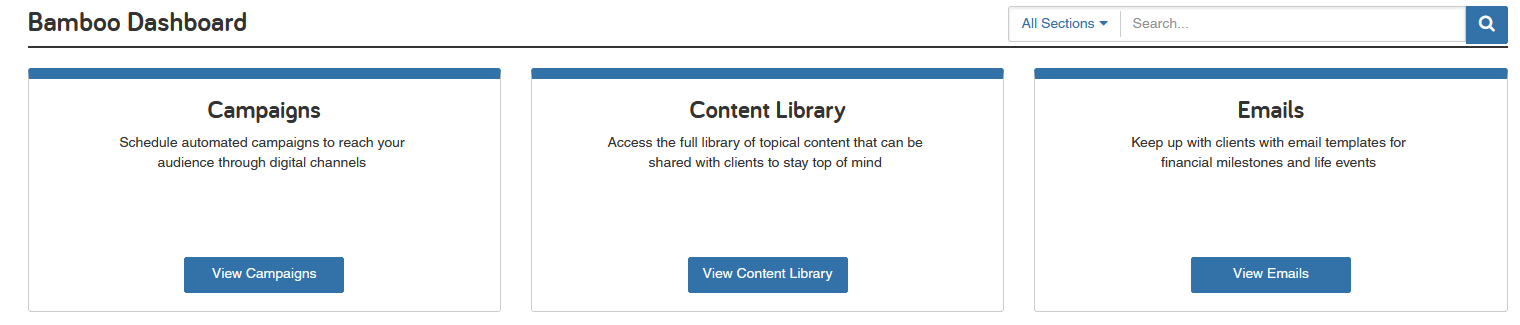

Log in to the Bamboo Dashboard and click View Emails to open the Emails tile. Now select the Sent category to view the emails you’ve sent to your clients and prospects. Here you’ll see a new Save as Template option to the right of your sent emails.

Click Save as Template and confirm your selection, and a new template will become available in the My Templates folder.

Select Use Template under the Action menu to the right of each template to create a new mail with the pre-populated subject, body, and eMoney content.

Note: Custom attachments are not saved to email templates.

Now you can add the recipients and send the email and send.

Working with first-time homebuyers? Provide essential advice to clients entering the market with new campaigns and articles in Bamboo.

Keep reading below for a summary of what’s new and updated this month.

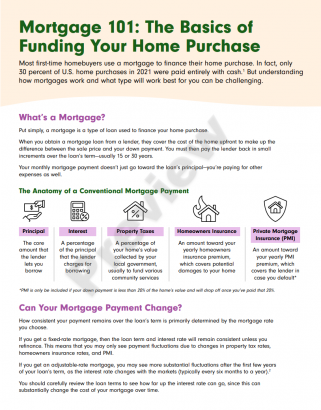

Mortgage 101: The Basics of How to Buy a Home

Share this article to break down the different home financing options for first-time homebuyers.

Take These 5 Financial Steps Before Buying a House

Provide your clients with an overview of how they need to prepare financially for buying a home.

5 Modifications to Make to Your Finances After Buying a Home

Share this high-level overview of what aspects of your client’s financial plan need to be revisited after buying a home.

6 Wise Ways to Use Your Tax Refund

Show clients financially responsible ways to use their tax refund, such as paying down debt, contributing to an IRA, or building an emergency fund.

Financial Advice for First-Time Homebuyers

Help first-time homebuyers understand how purchasing a home fits into their greater financial picture and how advisors can help them better understand the actual cost of owning a home.

Financial Advice for Home Sellers

Guide potential home sellers by walking through the primary factors they should consider when deciding if it’s the right time to sell and what they can do to get the best price for their home.

Finally, we’re updating the videos below to be more diverse and inclusive.

Not a Bamboo subscriber? Click here to learn more about our marketing automation platform.

Released March 23, 2022

The market index data in your eMoney application has been updated with the latest historical data, as of December 31, 2021.

For advisors, not using custom capital market assumptions, search Compare / Update Market Indices under Help for step-by-step instructions on how to update your capital market assumptions with the latest data.

Note: If you use custom capital market assumptions, this update does not apply to you.

Your capital market assumptions are the core of eMoney’s powerful simulation. They are the foundation of all of your client’s financial plans. That’s why eMoney makes new historical data available quarterly, so you can keep these building blocks up-to-date.

We recommend reviewing existing plans and the changes to your capital market assumptions prior to updating your indices.

Use the Compare / Update Market Indices How-to under Help or follow the steps below to update your capital market assumptions:

To update the market indices across your advisor assumptions:

To update the market indices for a single client:

Released February 15, 2022

Building on the Bamboo | Redtail integration launched last year, we’re streamlining email documentation by automatically creating a Redtail Note when a Campaign or Email is sent to a client from Bamboo.

A Redtail Note will be created for all contacts within a Redtail Group regardless of whether they are linked to an eMoney Client. For Redtail contacts linked to eMoney clients, a note will be added within the eMoney’s Notes and Tasks.

The notes will show that an email was sent and will include the subject line, date, and time sent (in Eastern time).

Released January 25, 2022

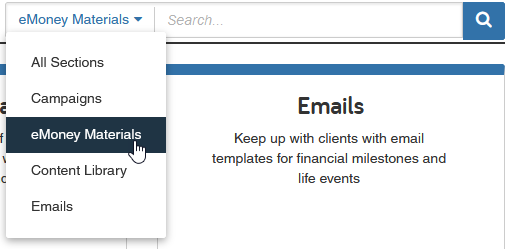

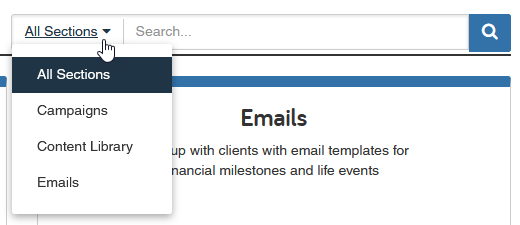

To streamline the content management experience, we are moving eMoney Materials into the Content Library section on January 25. Once consolidated, all video, email, and PDF content available within Bamboo can be accessed in one location.

Two new Content Library categories will be created to accommodate this change—eMoney Client Site and Digital Planning.

You can find all content from the previous Client Site Best Practices and Client Site Onboarding area of eMoney Materials under the new eMoney Client Site category and all the materials from Showcasing Your Value under the new Digital Planning category.

What do the new Content Library categories represent?

In coordination with the content relocation, we’ll update the Bamboo Dashboard to remove the eMoney Materials. All links to eMoney Materials within the platform have been removed or replaced with links that take you directly to the Content Library.

Not a Bamboo subscriber? Learn more about the marketing platform here.

Released January 3, 2022

We’ve updated all of our Federal tax, contribution limit, and social security settings with the latest values for 2022 and beyond. These updates include marginal taxes rates and brackets, deductions, phaseouts, tax credits, exemptions, exclusions, and more.

Released December 7, 2021

Your next meeting isn’t for another few months, but your client’s finances are top of mind. She’s been toying with the idea of purchasing a beach house for years where she can vacation with her future grandchildren. And with her daughter’s recent pregnancy announcement, she’s ready to do whatever it takes to make her dream a reality.

So she logs into her client portal and adjusts her savings goals to see how it impacts her readiness to make the purchase. She has some other ideas and questions she’s jotted down to discuss with you. She’s ready to enter her next meeting engaged and empowered to discuss her financial goals.

Meanwhile, alerts keep you notified about her changes and you’re prepared with a corresponding plan created on the advisor side based on her aspirations so you’re just as ready to have a productive, meaningful conversation.

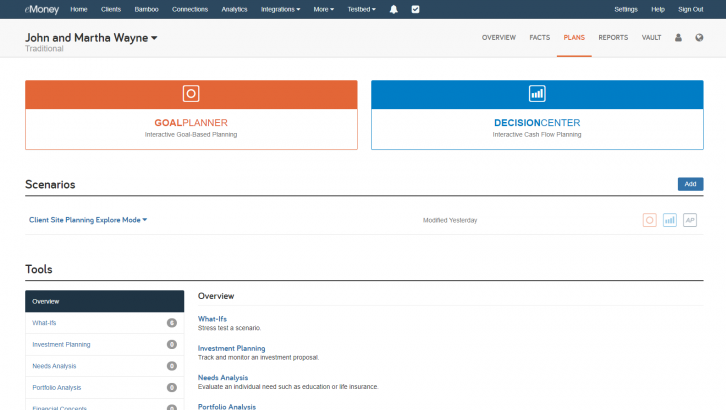

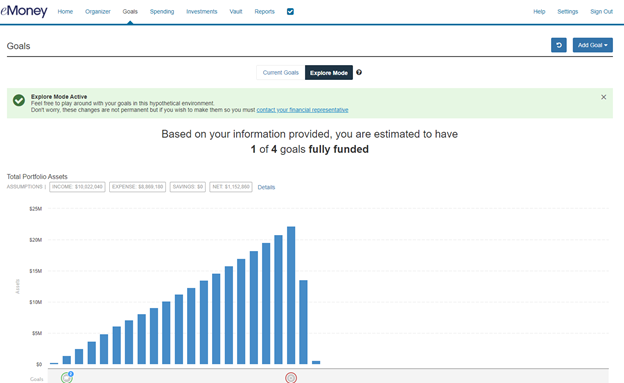

With the latest Explore Mode release to the Client Portal, this interactive scenario can come to life for you and your clients.

Explore Mode not only provides a sandbox where clients can test and explore the impact of changes on their finances, but it also creates a corresponding Client Site Planning Explore Mode Scenario under Plans on the advisor side of eMoney. This Explore Mode plan gives you even more insight into your client’s financial priorities that will help you spark conversations with them about their goals.

When Explore Mode is enabled, end clients will see a new toggle option for Current Goals or Explore Mode at the top of the Goals summary page. Clients can simply toggle over to Explore Mode and they’ll gain the ability to edit their current goals.

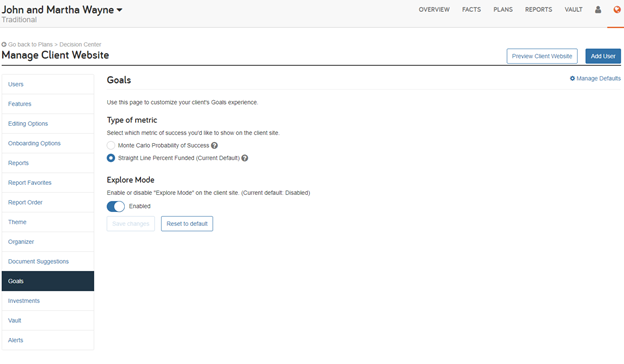

Explore Mode is disabled for existing Client Site users by default. To enable the feature for these clients follow the steps below.

From the Client Overview, go to Manage Client Website and select the Goals page settings. Here you can toggle Explore Mode to Enabled before clicking Save Changes.

Note: Explore Mode setting is enabled by default for all newly created clients after December 7. You can also update your default settings by clicking Manage Defaults on the top-right of the page.

To help you communicate this feature with your clients, we created this one-page guide (accessible through the Help menu) that explains how to use the new feature.

You can also touch on these talking points:

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.