Learn more about the latest eMoney updates, including the new Financial Priorities Report, an Update on Connections, and more. Also check out our Mid-year eMoney Product Update Check-in!

For more information on these updates, sign up for the latest product update webinar.

Released June 20

⚐ REQUESTED FEATURE

Present and share an up-to-date list of priorities that are most meaningful to your client, so you can spend time developing plans for the things that matter most.

How Does It Work?

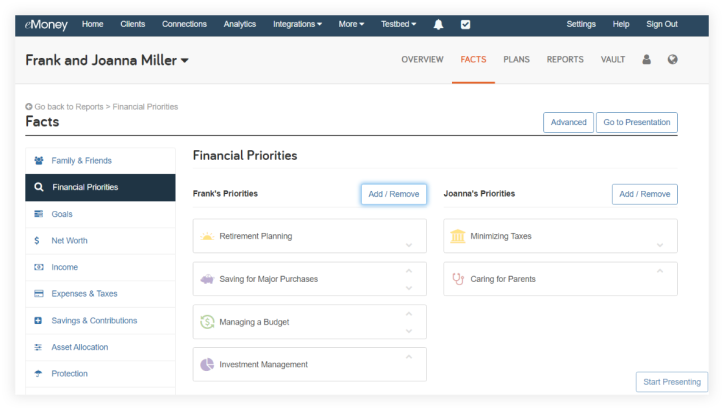

The new Financial Priorities Report draws data directly from Facts to provide you with an up-to-date view of your clients’ financial priorities. This data can then be seamlessly integrated into presentations and downloaded outputs, allowing you to tailor your recommendations and deliver compelling reports to your clients.

Where Can I Access This Report?

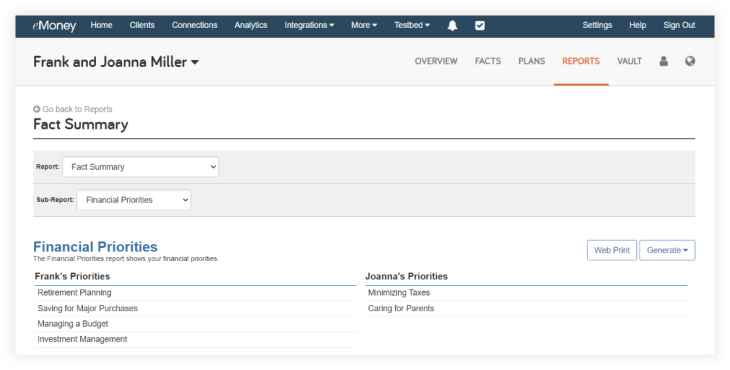

Access the report via the Reports tab, locate and select the Fact Summary report, and choose the sub-report labeled Financial Priorities.

Can My Client Also See This Report?

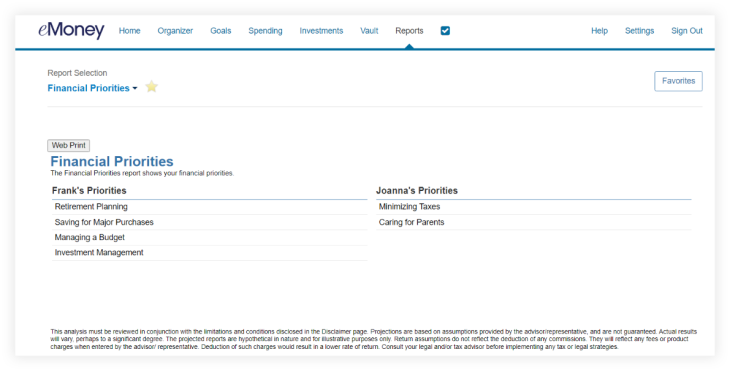

Your client will be able to access this report from their Client Site. From there, the client can select Reports, and then Financial Priorities.

Gain valuable insights into your clients’ top financial priorities today with this new report!

Updated June 21

We’re pleased to inform you that we have recently improved the popular Fill-Up Tax Bracket option inside our Roth Conversion facts to increase the accuracy of the conversion amount. We encourage you to try it and experience the improvements firsthand.

Updated June 20

Connections play a crucial role in the planning experience and are one of the most frequently requested and utilized features.

Q2 Connections Updates:

Between the months of April and June of this year, we continued to add the following:

What’s to Come:

We look forward to continuing to provide you with the best planning experience possible. To learn more about the different types of connections we offer please check out the Help menu resources Your Guide to Data Aggregation.

Updated June 21

New capital market assumptions data for Q1 2023 is available! If you have an advisor license and aren’t using custom market assumptions, search Compare / Update Market Indices under Help for step-by-step instructions on how to update your capital market assumptions with the latest data.

Please note: Our vendor no longer provides data for the BNYM Emerging Markets Index. We have added the FTSE Emerging Markets Index as a replacement. We chose this index as it closely resembles the BNYM index in terms of coverage and returns. You do not need to take any action for this replacement to take effect other than updating your indices as per usual.

Updated May 23

At eMoney, our vision has always been to provide financial advisors with a comprehensive planning experience that is both engaging and effective. That’s why we’re thrilled to announce our latest update, which adds two more advanced planning reports to Decision Center—our most interactive planning tool—taking one more step toward creating a flexible, consolidated hub for all planning activities.

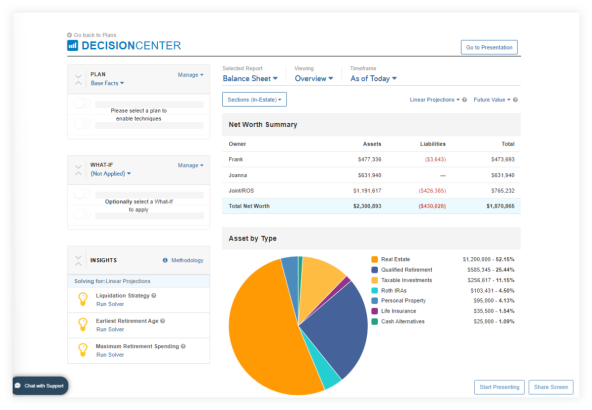

The Balance Sheet report provides a clear and concise overview of your client’s assets and liabilities. Meanwhile, the 5-Year Cash Flow report allows you to create a detailed projection of your client’s cash inflows and outflows over the next five years or any five-year period. The layout of this report allows you to show certain key cash flow details without having to use other reports or drill-downs.

Released May 23

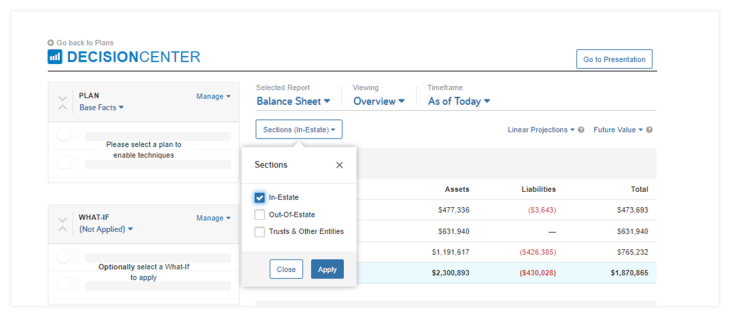

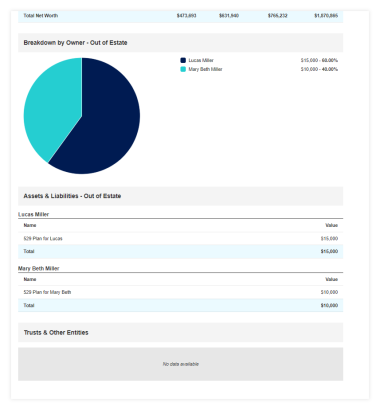

The new and enhanced Balance Sheet report in Decision Center offers a clear and concise overview of your client’s assets and liabilities.

How Can I View the Report Within Decision Center?

Simply select Balance Sheet from the Selected Report category, choose the timeframe and viewing options, and you’re ready to engage your clients with valuable insights.

With the latest enhancements, you can now easily add Out-of-Estate assets, Trust assets, and assets owned by Other Entities such as a business. This provides you with more flexibility in how you want to use this report with clients.

Released May 23

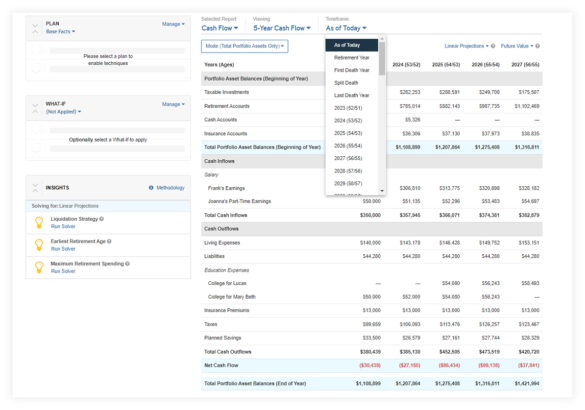

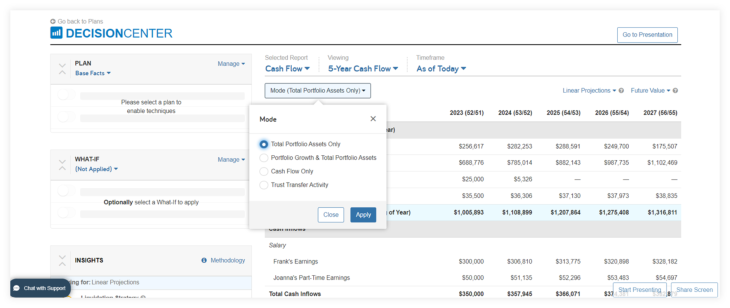

The 5-Year Cash Flow report in Decision Center allows you to see your client’s cash flow, including key details and subcomponents without having to refer to other reports to get those details. Your client’s cash flow is a critical element of any financial plan and this report’s layout allows for a more detailed discussion.

How Can I View the Report Within Decision Center?

Select Cash Flow under the Selected Report category in Decision Center. Then choose the 5-Year Cash Flow report from the Viewing category.

Similar to the existing 5-Year Cash Flow report, you can toggle through additional Modes including Portfolio Growth & Total Portfolio Assets, Cash Flow Only, or Total Transfer Activity.

Start using these new reports with your clients directly through Decision Center today!

Released April 25

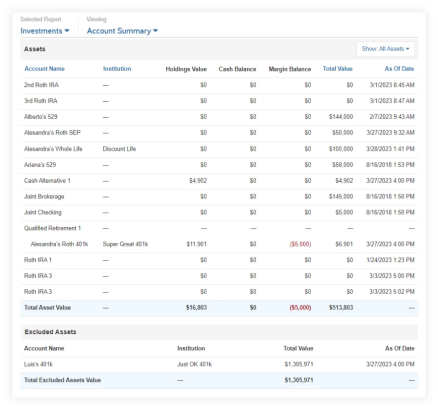

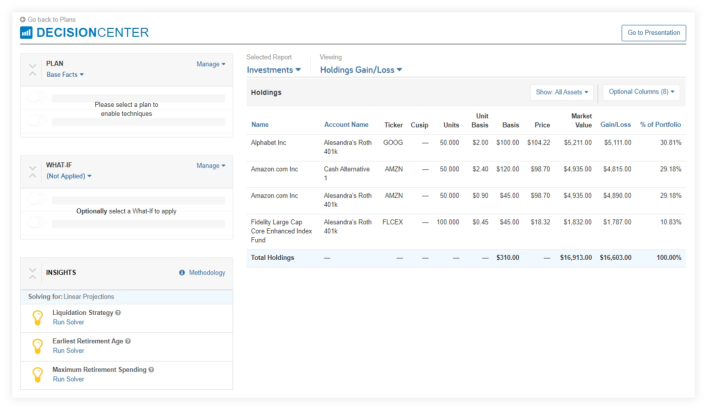

Every client deserves easy access to their account information. And now with the Account Summary report available directly in the Decision Center, you’ll see a clear and accurate snapshot of the value and updated status of your clients’ accounts.

How Can I View the Report Within Decision Center?

The Account Summary report will display under the Viewing category when you choose Investments under the Selected Report category as shown below.

From there, you can filter the report by all available assets for a particular client, making it easy to get the information you need when you need it.

Access this top-used report now available in Decision Center, and start seeing key account data in one place and with new filtering capabilities.

Released April 25

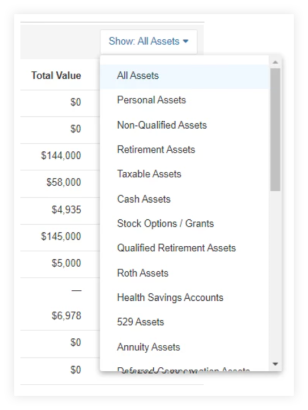

Do you want to make informed decisions about your clients’ investment portfolios? Look no further than the Holdings Gain/Loss Report available in Decision Center—now with new filter capabilities!

How Does It Work?

This powerful report provides quick insight into the gains and losses of each investment in your portfolio. The Holdings Gain/Loss is free from the influence of other techniques and solvers, allowing you to make informed decisions with confidence.

How Can I View the Report Within Decision Center?

The Holdings Gain/Loss report will display under the Viewing category when you choose Investments under the Selected Report category as shown below.

From there, you can filter the report to narrow results to a specific asset type, as well as select Optional Columns to show only the desired information. With the new filter capabilities, you can focus on the specific data that is most important to your planning conversation.

Take control of investment conversations without leaving Decision Center with the powerful insights and actionable information of the Holdings Gain/Loss report.

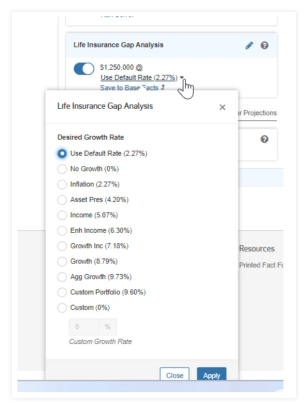

Released April 25

“Will my family be okay if something happens to me?” is one of the most common questions financial professionals receive.

That’s why this month, we’re releasing the first in a series of enhancements to Decision Center that make it easier to identify your client’s life insurance coverage gaps and provide recommendations for the additional coverage they’ll need to fully protect their families in the event of their premature death.

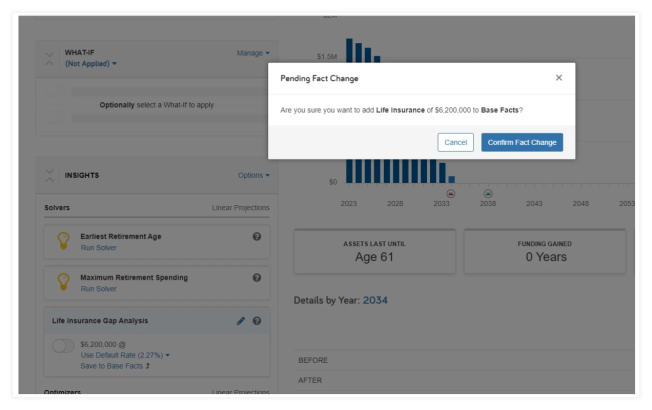

How Does It Work?

With the new Life Insurance Gap Analysis solver, you can now apply a premature death What-if to show your clients the impact on their families, then immediately solve for any gaps in coverage. You can run the solver using either straight line growth rates or solve for a coverage amount that achieves a desired Monte Carlo success rate.

Be sure to choose an appropriate growth rate for the death benefit proceeds. This can have a significant effect on the additional need.

What Happens After I Run the Solver?

Toggle on the solver to show your clients how additional coverage can help ensure their family’s financial security in the event of their premature death.

Once you’ve discussed the need with your client, quickly apply the new coverage by clicking Save to Base Facts/Save to Plan.

With this tool, you can confidently answer your clients’ common question and help them protect their loved ones. Try the Life Insurance Gap Analysis Solver in Decision Center today!

Then stay tuned for a new Decision Center report designed to support the new solver and life insurance gap conversations in the coming months.

Released March 28

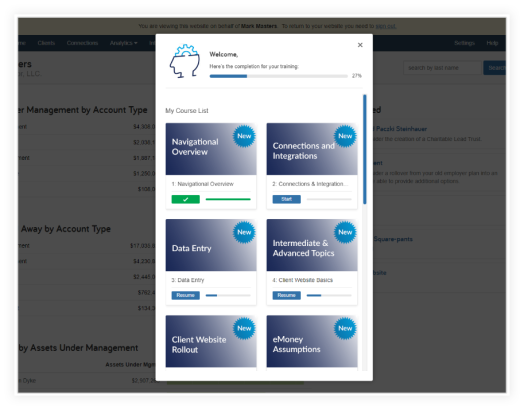

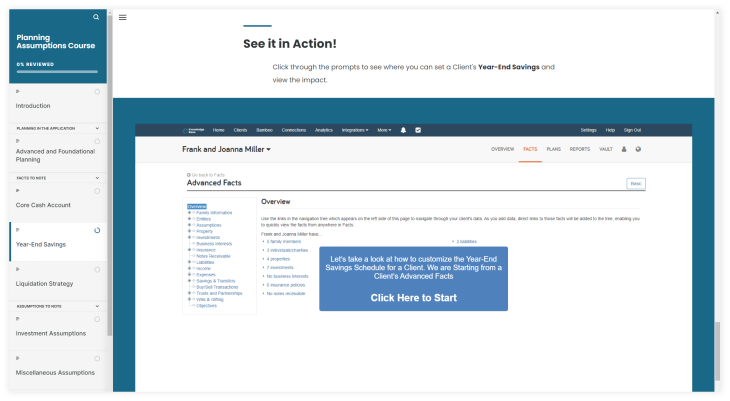

Learn how to use eMoney quickly and efficiently with our enhanced interactive training experience.

How Does It Work?

Recently, a Training link was added to your navigation bar, giving you faster access to new and revamped courses as well as webinar opportunities. Now you’ll notice a new set of courses that have been meticulously designed with instructional best practices in mind, using materials from eMoney eLearning, Training, and Coaching teams to engage learners at every step of their journey.

What Enhancements Were Made to the Courses?

Take the first step towards professional development and explore the new courses, now available in the Training tab!

Updated April 5

Available as part of our ongoing alignment with the SECURE Act 2.0 of 2022, use the new Simplified Employee Pension (SEP) IRAs, allowing the ability to contribute to and grow Roth funds has been added to SEP IRAs.

Learn about everything that has been updated using the blog post below:

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.