Discover the latest eMoney advancements, showcasing the new Minimum Additional Savings Solver, as well as Streamlined Income Order on Reports and an enhanced login experience.

For more information on these updates, sign up for the latest product update webinar.

Released March 26

To align with our broader product vision of scaling planning to become a more intelligent technology partner, the new Savings Solver will:

How Does It Work?

The Additional Savings Solver determines additional savings needed to achieve a successful outcome. With the solver, you can easily adjust the target account and growth parameters for your client’s savings and then have it automatically adjust living expenses proportionally to meet the required savings.

Review the short video below to learn how to set the additional savings to a specific account and how it impacts your clients’ financial plans.

Released April 23

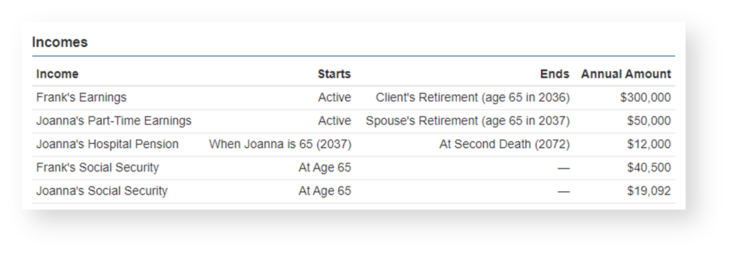

To simplify the review of reports with your clients, we’ve reordered all income streams chronologically by the income start date.

This change is represented on all reports displaying income data:

Coming Soon

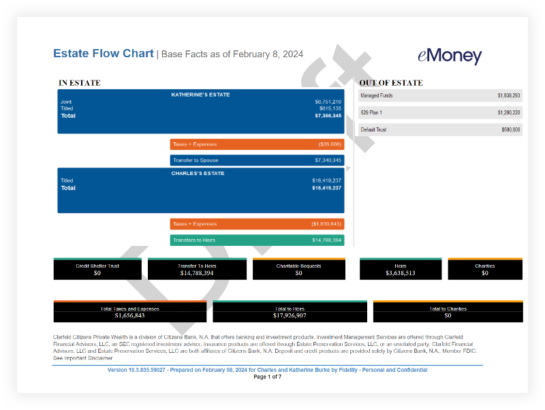

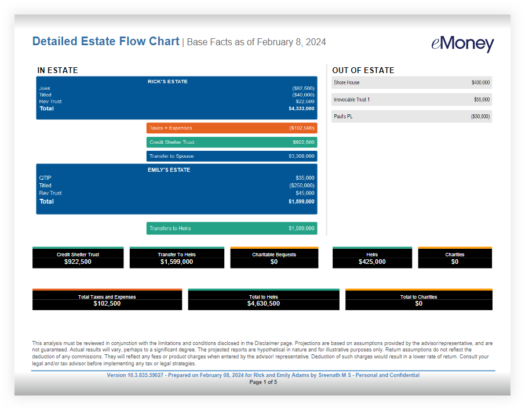

Soon, your Estate Flow Chart and Detailed Estate Flow Chart reports will be updated with improved aesthetics and readability—consistent with our other enhanced reports.

These enhancements are part of our ongoing commitment to modernizing existing reports and presentations within eMoney to provide a clean, updated experience.

Where will these updates be visible?

These enhancements will be visible in the online and printed presentations within Plans and Reports.

Updated March 26

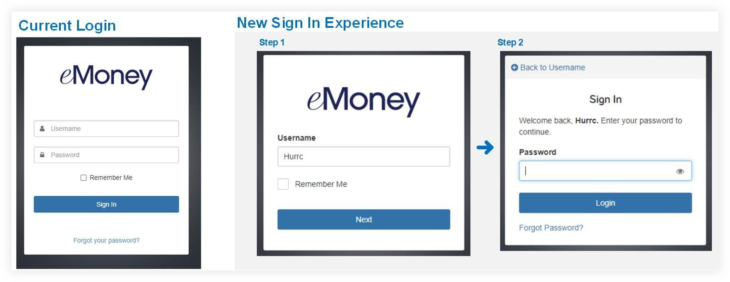

In the coming weeks, the new two-screen login process will launch, ensuring heightened security and streamlining your experience.

All existing functionalities of the login process will remain unaffected, including users who leverage SSO.

Released February 27

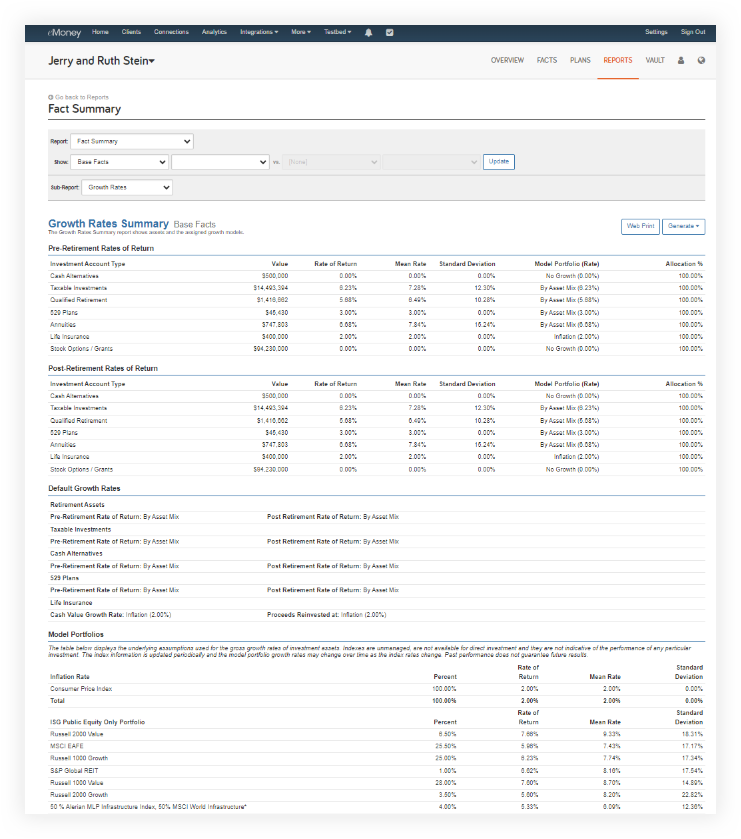

Experience improved ways to evaluate investment performance with enhanced Rate of Return (ROR) data now available in select reports. By incorporating ROR data into some of your most-used reports, you’ll find deeper analysis and enriched data for comparison.

The data that has been enhanced includes Compound Annual Growth Rate (CAGR) and Annual Rate of Return (AROR).

These new insights are now integrated into several reports across the application.

Which Reports Show This Change?

Where Can I See This in Decision Center?

Search Display Rate of Return Data in your Help menu to learn how to enable the setting to display ROR data in reports.

Released February 27

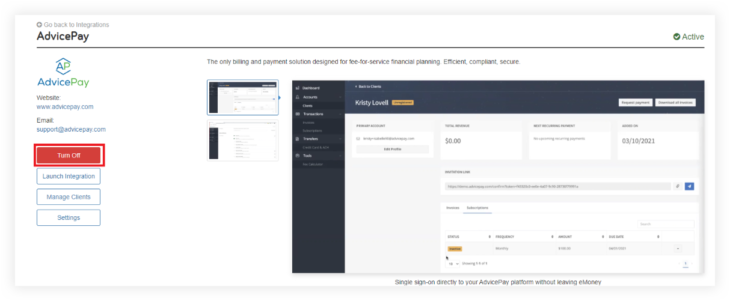

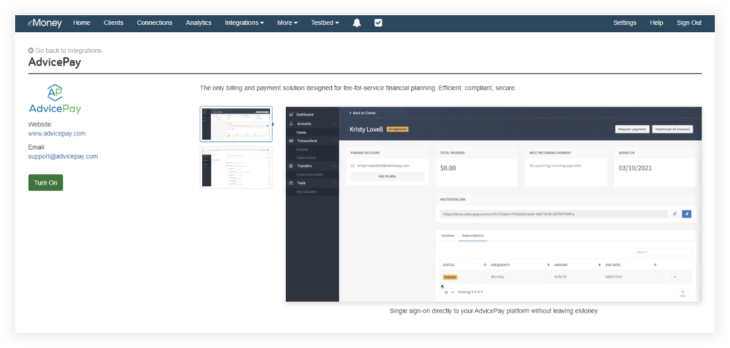

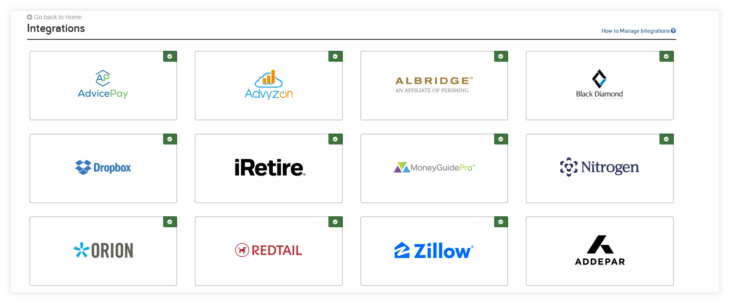

Enhance your workflow and efficiency with eMoney’s first integration with a fee billing solution, AdvicePay.

Features include:

How to Enable the Integration

For more details about the functionalities of this integration, search AdvicePay in your Help menu.

Simply navigate to the Integrations page within the eMoney page and find the new AdvicePay integration tile.

After locating the tile, click Turn On.

Released February 27

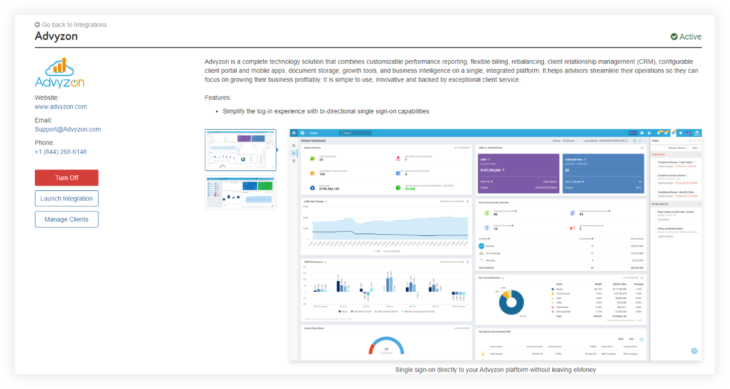

Enhance efficiency with new capabilities of the Advyzon integration.

What’s New?

For more details about the functionalities of this integration, search Advyzon in your Help menu.

Released March 5

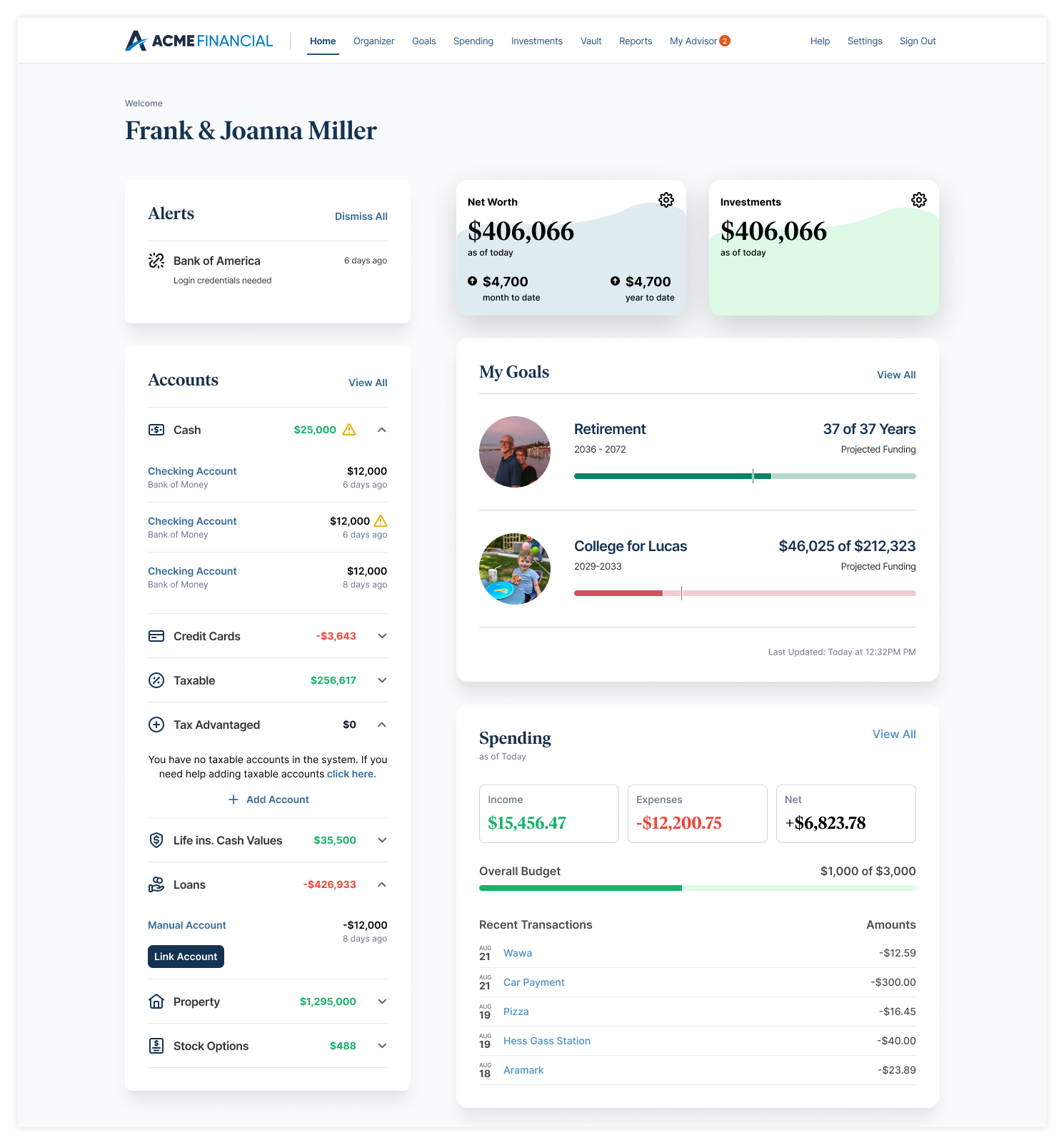

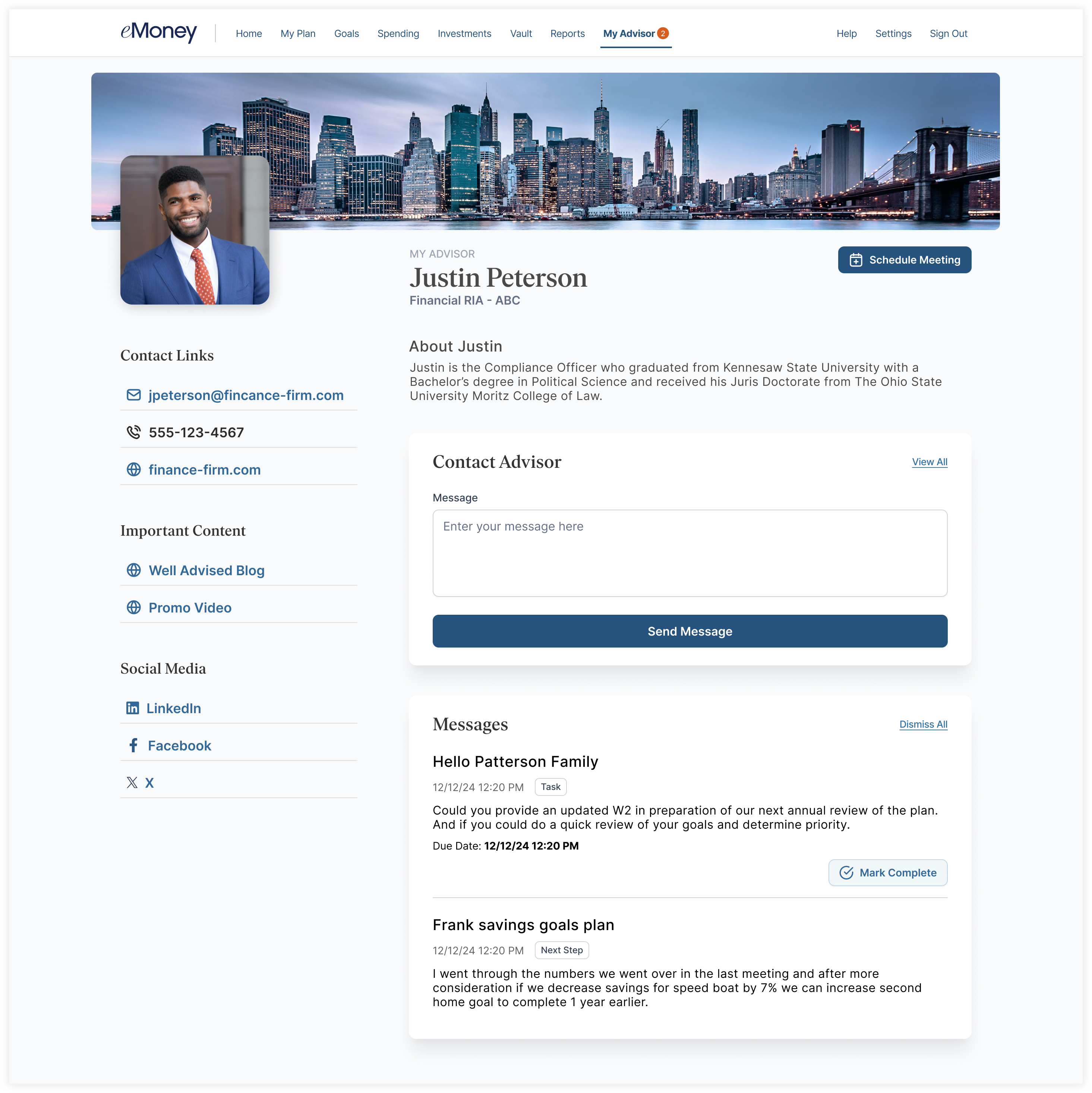

This year, in addition to ongoing engaging, efficient, and intelligent updates throughout the eMoney platform, you can expect a renewed focus on your client experience.

Our data illustrates that clients using the Client Portal:

And those clients are more likely to refer your services to their family and friends!

So, to provide clients with a modern tool that reflects your brand, you can expect marked enhancements to the portal throughout the year, beginning with design improvements to the Client Portal and a new My Advisor page.

What’s Changing?

Steps for Setting up the My Advisor Page

Check out the webinar replay: learn more about these enhancements to the Client Portal. During this session, you’ll learn about how these updates fit into our broader product vision along with some takeaways on preparing your clients for their new experience.

Released January 30

⚐ REQUESTED FEATURE

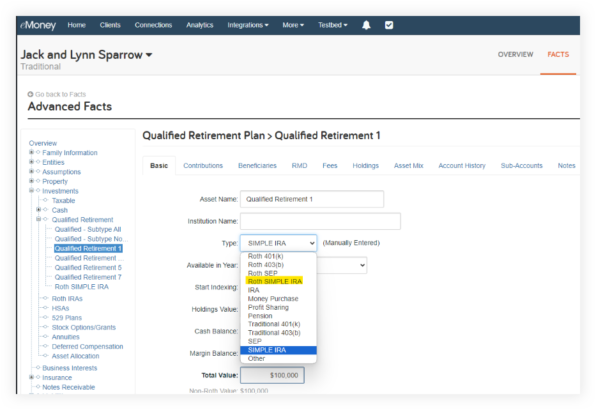

We’re passionate about giving you the tools to build financial plans that can handle the complexity of your clients’ lives. We’re continually listening to your feedback and adding new features.

That’s why we’re excited to announce the support for SIMPLE IRAs and Roth SIMPLE IRAs many of you have requested.

How to Access SIMPLE IRA:

SIMPLE IRA and Roth SIMPLE IRA are categorized as new subtypes within the qualified retirement account section. These account types are readily available for selection within the Base Fact Finder, Advanced Fact Finder, Advanced Planning, and Client Site Organizer functionalities.

Released January 30

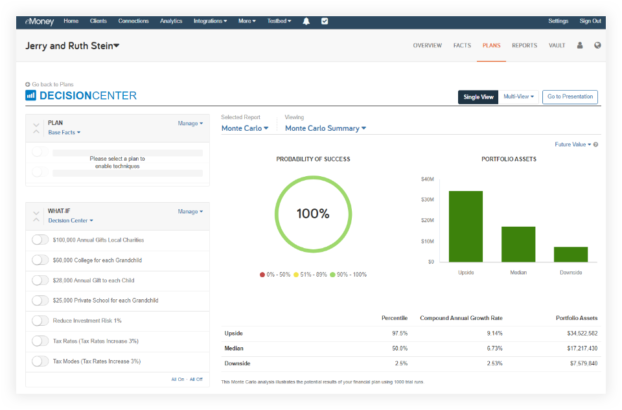

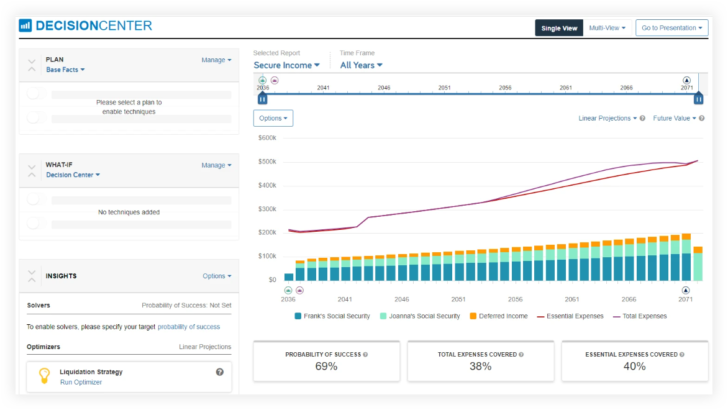

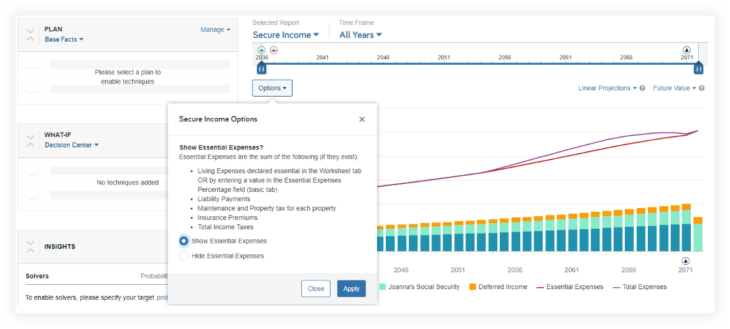

An essential component of our roadmap is creating a more flexible, comprehensive Decision Center where you can access all your essential plan details and reports in one place. Last year, you gained access to many top reports within the Decision Center experience, and this month, that endeavor continues by adding the Secure Income report, and the Life Insurance Summary report.

Sixty-one percent of Americans are more afraid of running out of money than they are of dying.1 With the Secure Income report, available now directly from within Decision Center you can show your clients how income sources like Social Security, annuities, and other deferred income solutions provide peace of mind in retirement.

How Can I View the Report?

Navigate to the Retirement Planning report family within Decision Center and select Secure Income from the Viewing menu.

Key Features of the Secure Income Report:

The Secure Income report is also conveniently accessible within the Multi-View feature in Decision Center, allowing for a broader perspective and enhanced usability.

Experience the power of the Secure Income report in Decision Center today!

1. Allianz Life Study, “Americans Facing a New Retirement Reality”, February and March 2023, n=1,000.

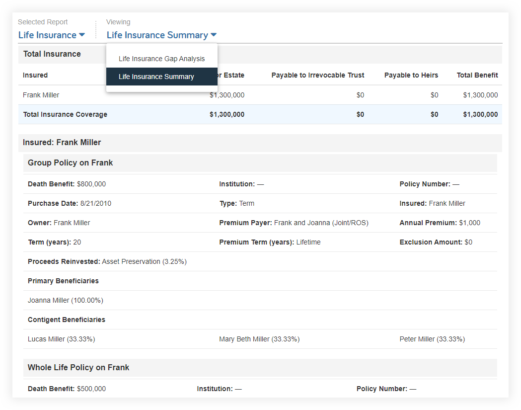

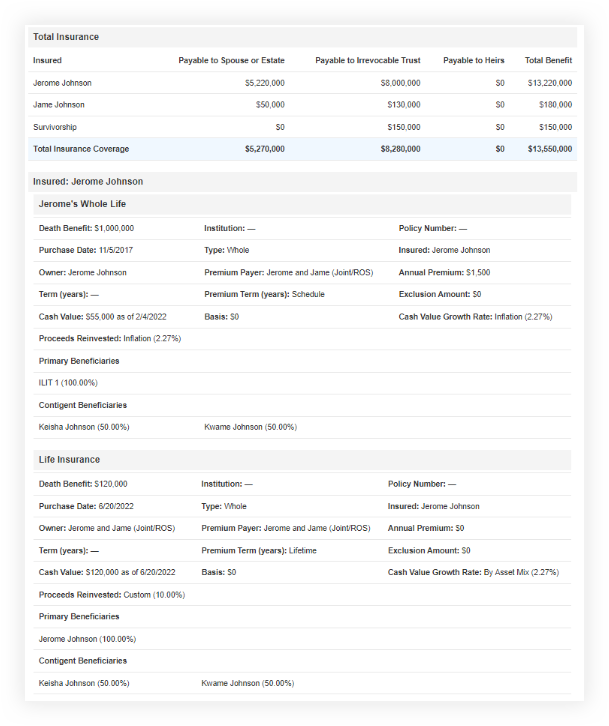

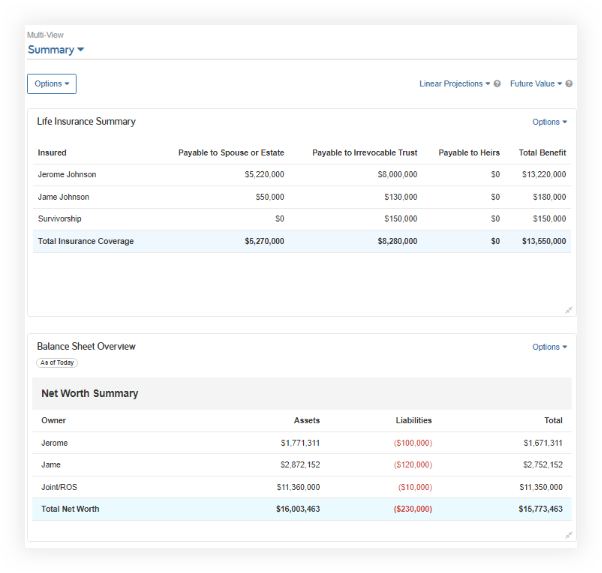

Confidently navigate all your clients’ unique needs and offer a comprehensive grasp of their existing insurance policies with the Life Insurance Summary report now available in Decision Center.

How Can I View the Report Within Decision Center?

Navigate to the Life Insurance report family and select Life Insurance Summary from the Viewing menu.

Key Features:

Experience the enhanced capabilities of the Life Insurance Summary report today!

Updated January 23

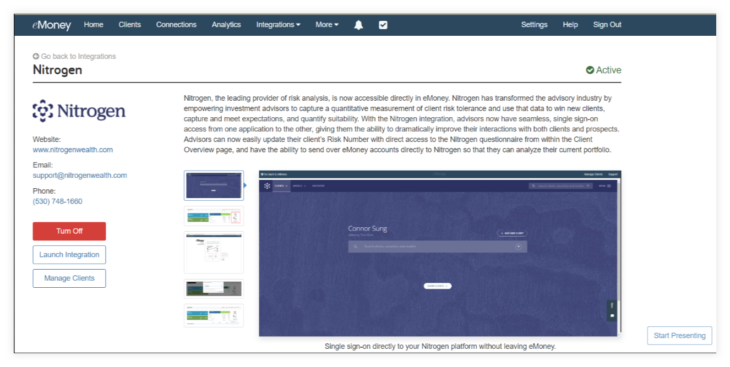

Riskalize is now Nitrogen! While the functionality of the integration remains unchanged, you will notice a new logo to reflect these changes.

Updated 2024

To support accurate planning calculations, federal tax-related values and contribution limits have been updated to their 2024 values.

Released February 14

Please note that the Build Wealth drop-down option found in the Expenses section of Advanced Facts will be removed on February 6 and replaced as Other Expense on February 14. Following this update, any of your clients with an expense value other than 0 for Build Wealth will remain intact but will be simply recategorized as Other Expense type. This will not alter any results.

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.