In Q2 of 2021, our releases focus on creating a streamlined and cohesive user experience. We released the first of our modernized presentation reports, a printable version of the new Longevity Risk report, an enhanced Goals experience on the Client Site, a new View Connections Details option to the Client Site accounts page, and more.

Released April 27, 2021

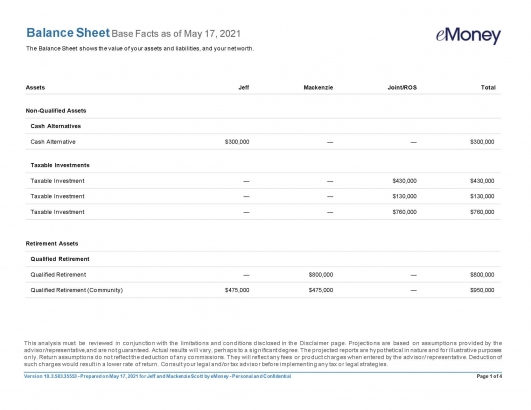

As part of our commitment to modernizing the existing reports and presentations within eMoney, we’ve released the first set of uplifted Reports. This uplift focuses on creating a consistent aesthetic across both the online and printed versions. To achieve this goal we’re standardizing landscape orientation across the updated reports, enabling the addition of your branding to all presentation reports, and updating the tables and charts with new colors and formatting.

This first phase of this initial uplift focuses on the following pages and report families:

It’s important to note that this is the first step in the process. We’ll continue to update reports throughout the course of this year starting with our most widely used reports. During this transitional period, you may experience some co-mingling of reports using legacy and modernized aesthetics.

Note: Presentations currently saved to the Vault will not be updated with the new look and feel.

Released May 18, 2021

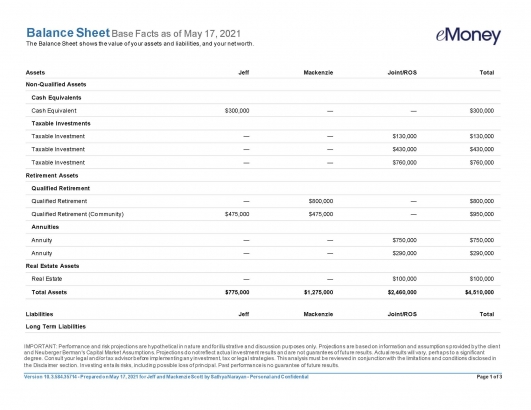

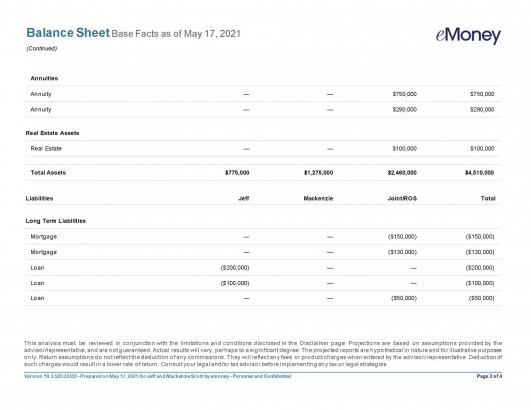

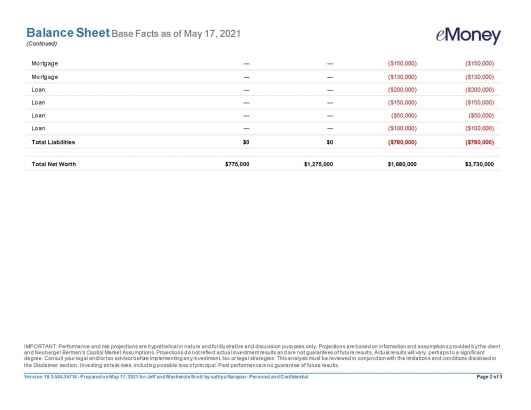

Last month, we released our first set of modernized reports using the report guidelines from the latest Decision Center and Foundational Planning Reports. Our goal with this version is to provide a modern and consistent aesthetic across all online and printed reports. Following the release, we received a wealth of feedback from our users. Feedback like this helps ensure we deliver the most effective, modernized reports in the future.

Effective May 18, you will see the results of diligent work completed to address crucial feedback on the length of the new Reports by:

In addition, liabilities are now clearly defined with red font color. These changes address the most immediate feedback we received and are live in the eMoney application today.

However, we are planning additional updates as we continue to work through your responses. Areas of focus include returning the client’s name from the bottom to the top of the report for additional visibility, streamlining the ability to edit in Microsoft Word, and more.

As always, our goal is to ensure we provide a superior experience for you and your clients as we modernize these reports—so please continue to add your feedback to the Request a Feature page. We’re listening.

Released April 27, 2021

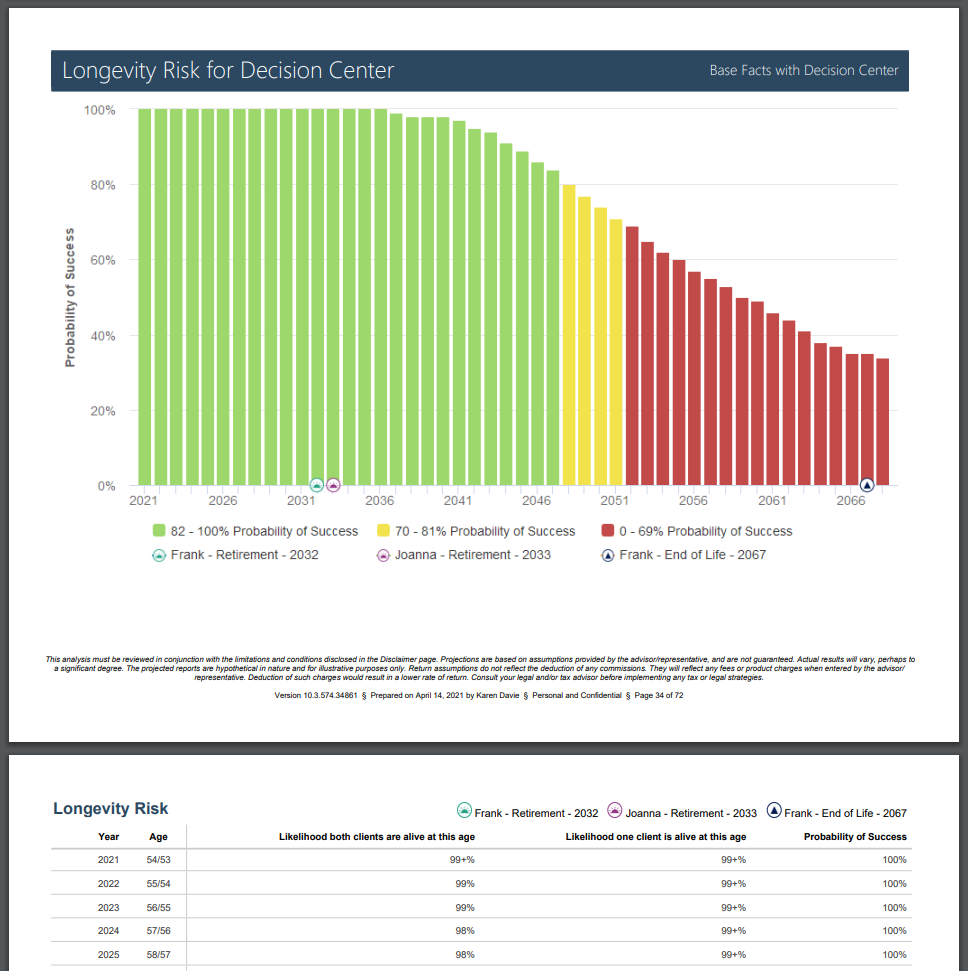

Last month, we released the new Longevity Risk analysis report in Decision Center along with a new planning metric—Confidence Age. This month we’re expanding this enhancement by adding a printable version of the Longevity Risk report to the Decision Center Presentation.

Learn more about Longevity Risk and Confidence Age in this 15-minute on-demand webinar.

Released May 18, 2021

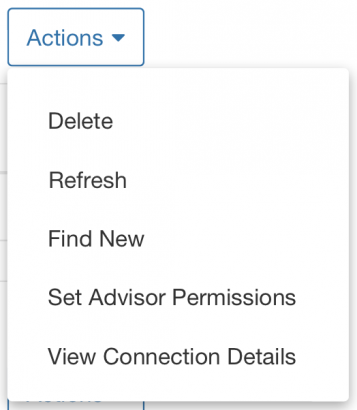

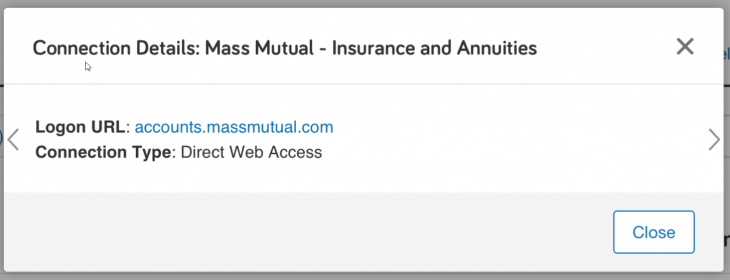

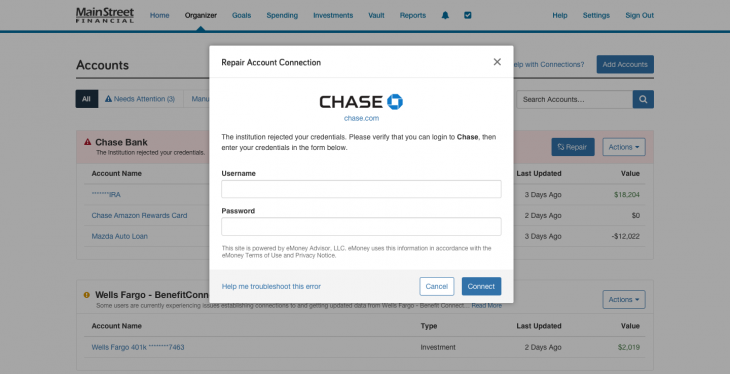

Based on your feedback, we’ve added a View Connection Details option to the Actions menu. Now when troubleshooting an issue you can easily show clients how to view the logon URL for their connection, the connection type, and connection name.

Just go to the Organizer > Accounts page and click the Actions drop-down menu on the desired connection.

Then, click View Connection Details and a modal window will appear that displays the relevant information for their connection.

Stay tuned for even more connections experience enhancements later this year.

Released April 27, 2021

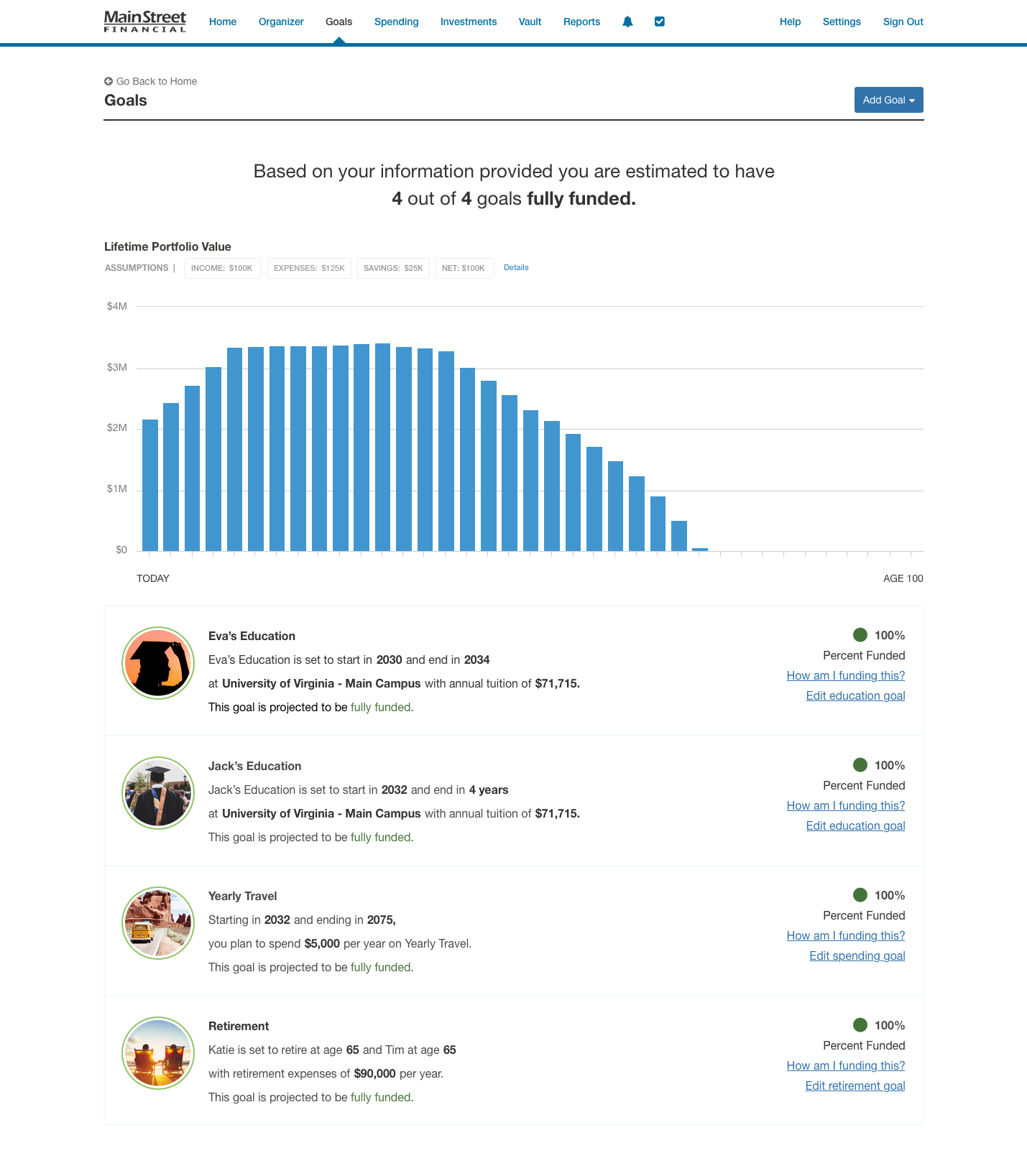

We redesigned the Goals Page on the Client Site to provide a more personalized and streamlined experience for your clients. This enhancement enables your clients to view all their goals details simply and efficiently on a single page.

It also provides consistency between the financial plan visuals and charts that they are already accustomed to seeing throughout other areas of your financial planning experience.

Released April 6, 2021

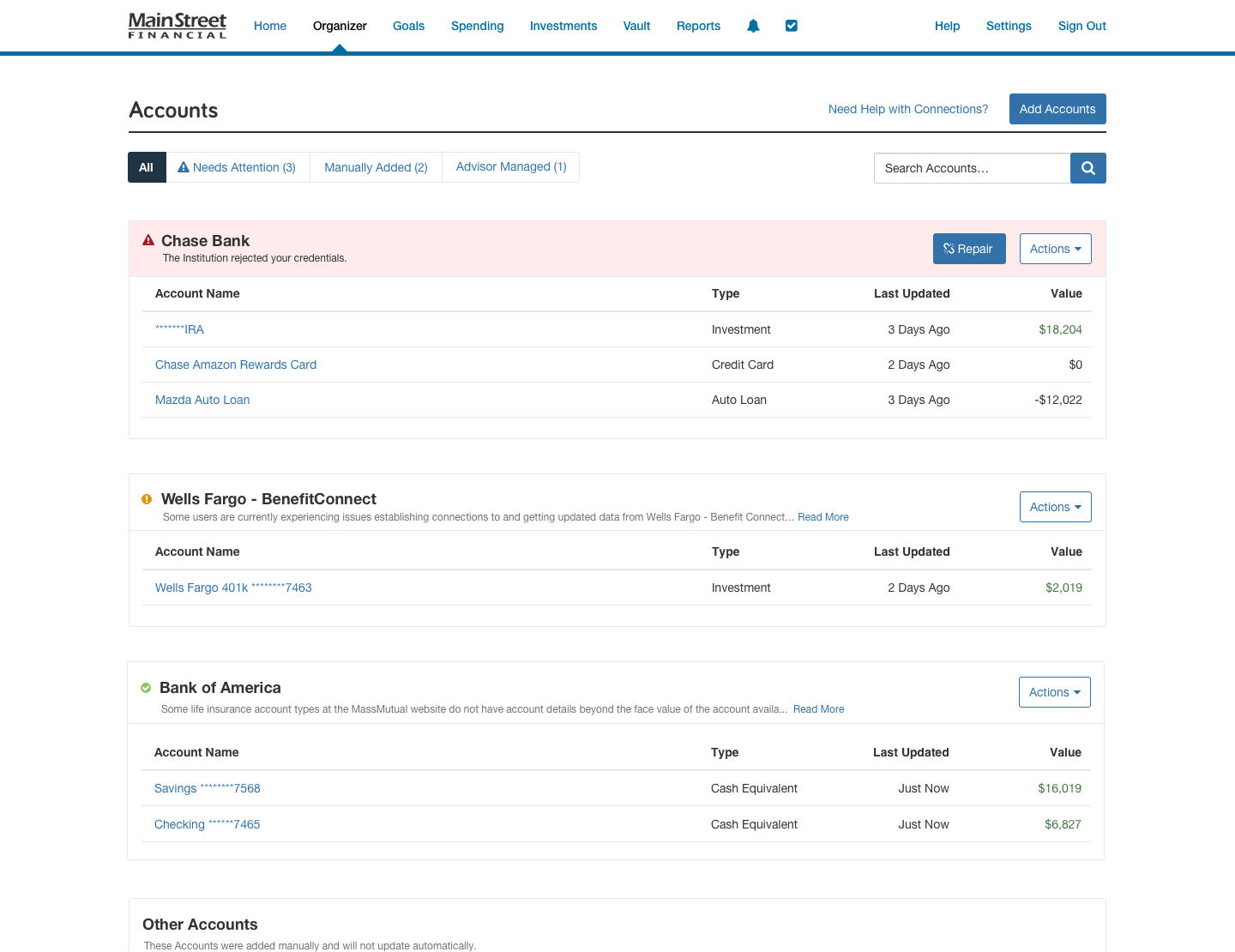

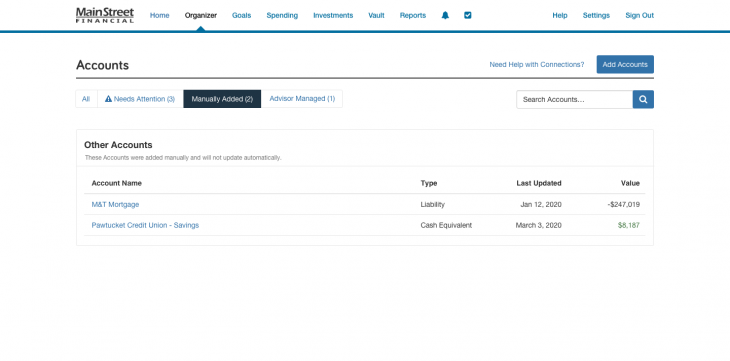

To help you gain a clear picture of the health and status of your connections, earlier this month we simplified the Client Site account view to easily identify connections that may need attention.

Share this guide to help communicate this change to your clients.

New color-coded institution statuses will help your clients easily identify connections that they can repair, such as by updating credentials (in red), versus errors that are outside their control, such as institution errors (in yellow).

Using the new account filters, you and your clients can easily identify connections with errors that are actionable. Clients will even have more insight into manual and advisor-managed accounts.

Filter by:

It’s easier than ever for clients to identify and troubleshoot connections with user fixable errors—such as updating credentials, access codes, and security questions.

As opposed to institutional outages and technical issues where there is nothing for them to correct and where we will work with the institution to resolve.

These updates are designed to streamline your clients’ connections experience and reduce their need for your support.

Released April 27, 2021

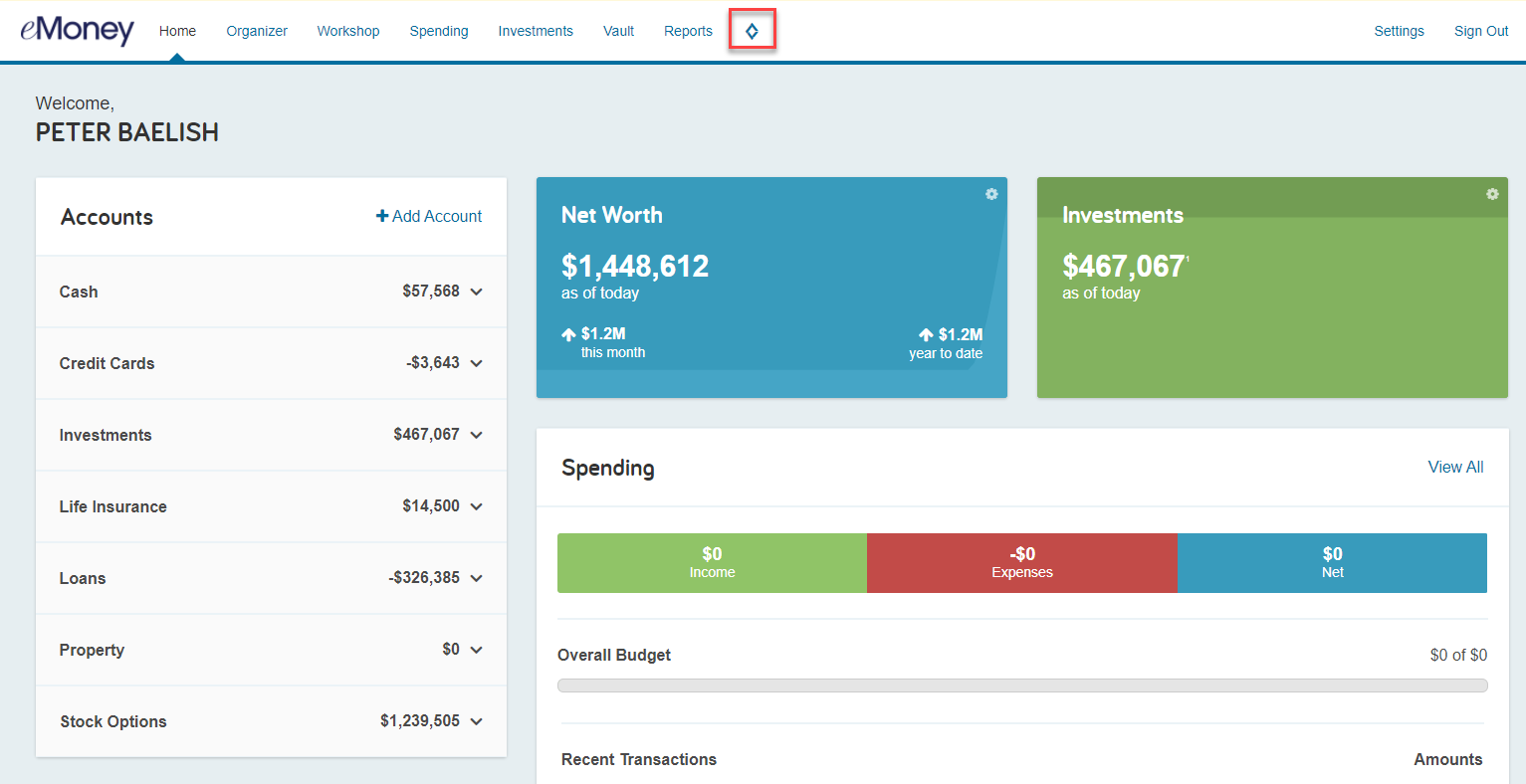

In efforts to provide a more centralized experience for Client Site users, we’re adding the ability for clients to access Black Diamond through single sign-on directly from their Client Site.

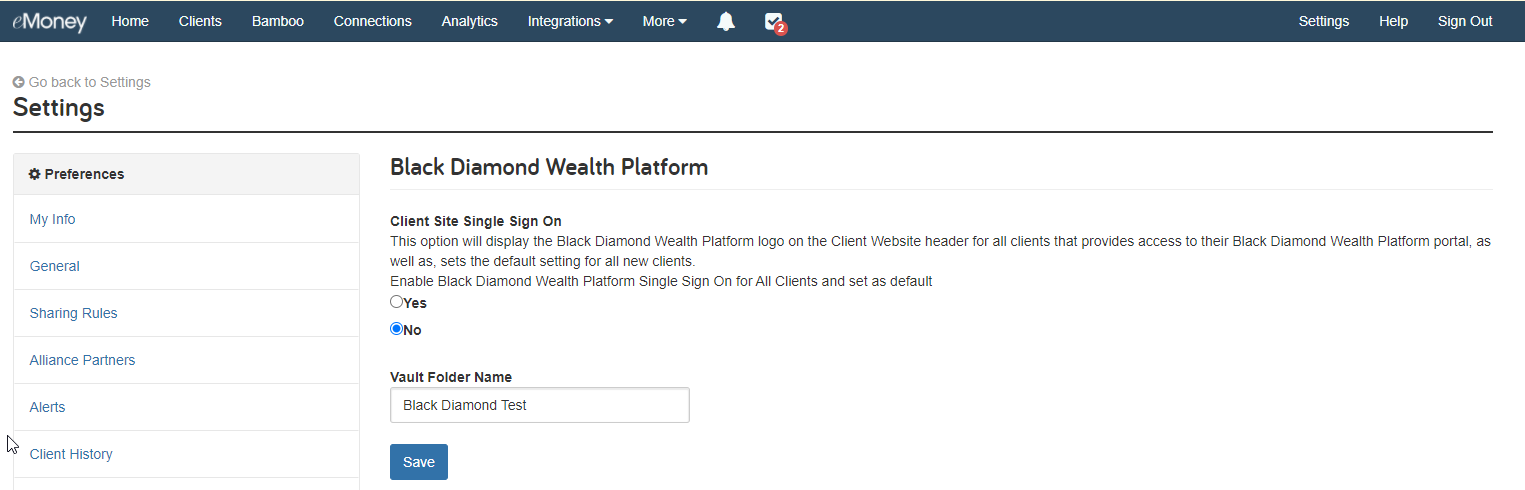

With the Black Diamond integration enabled, go to Settings on your navigation bar and scroll down to Black Diamond under the Integrations menu. Here you will find the option to enable Client Site Single Sign-on.

To enable the integration for all Black Diamond clients, toggle this setting to Yes and click Save.

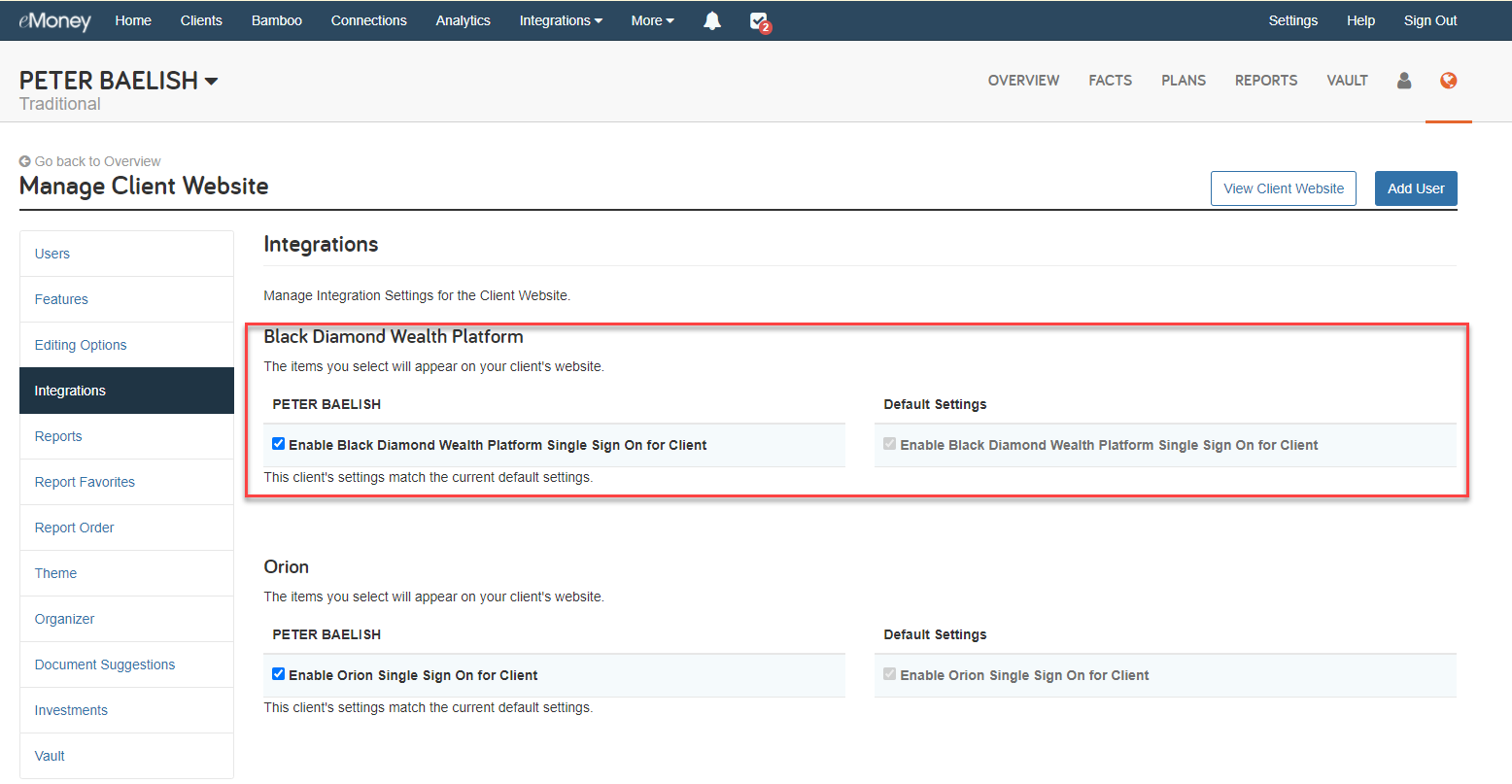

If you’d prefer to only enable this feature for some clients you can also open the Client Overview and go to Manage Client Website – Integrations. Here you can enable the Black Diamond Wealth Platform Single Sign-on functionality on an individual basis.

Once enabled the client can access Black Diamond in a new window by clicking the icon on their Client Site navigation bar. They’ll be prompted to enter their credentials the first time they access Black Diamond.

Black Diamond is also adding the ability to single sign-on from their platform to eMoney. So once enabled, they can have streamlined access to either platform from wherever they are.

Note: Advisors and Support users viewing the Client Site through impersonation will be unable to access the Black Diamond integration through single sign-on. This functionality is limited to the client login. Clients require their own credentials to access Black Diamond through this integration.

Released May 25, 2021

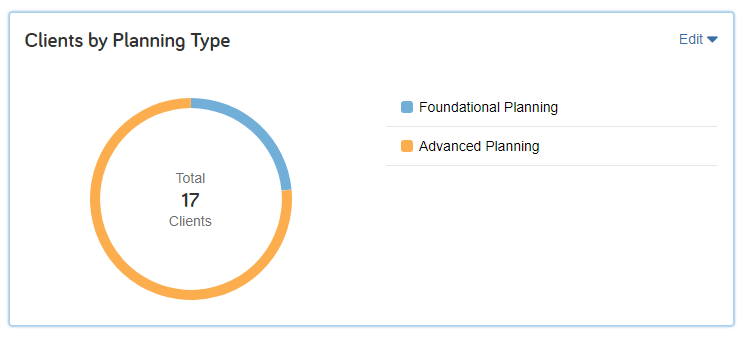

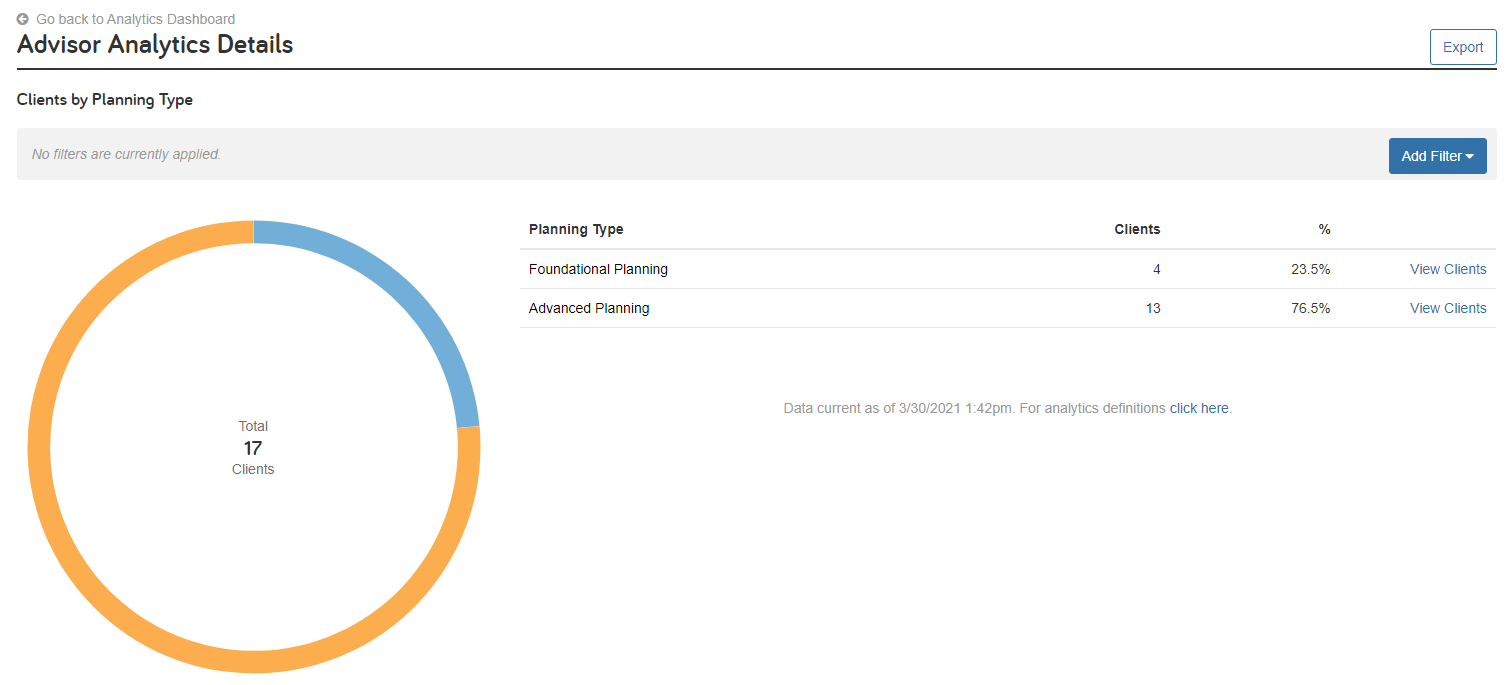

Available in Advisor and Office Analytics, the new Clients by Planning Type chart will provide a clear and concise way to view the total number of clients using Foundational and Advanced Planning.

Users can expand the chart to gain insights into the percentage of clients using each planning type.

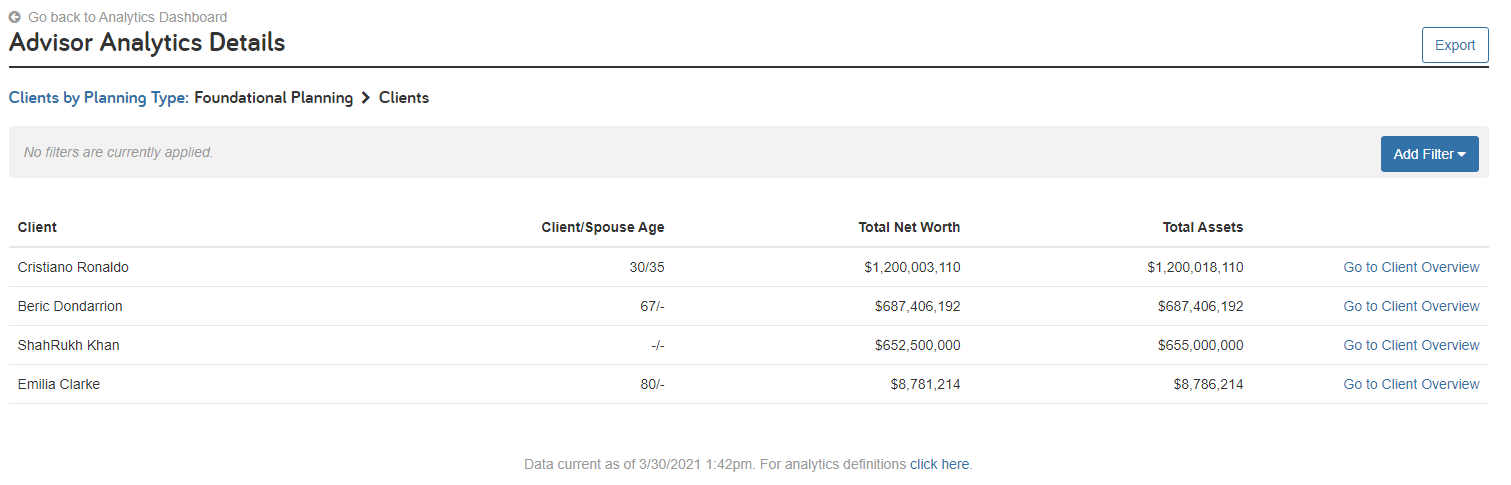

Or click View Clients to see a more detailed breakdown that includes the Client Name, Age, Net Worth, and Total Assets.

This new chart is available by default as part of Advisor Analytics in our eMoney Plus, Pro, and Premier packages.

In addition, to the new Clients by Planning Type chart, we’ve released six new filters to Advisor and Office Analytics.

Finally, a new Planning Type field has been added to the Client Export Template.

Released April 19, 2021

Building on last month’s enhancements to the eMoney Help resources, we’re adding even more suggested Help resources for integrations and Reports.

New Integration Help content will include suggestions for:

Suggested Help content will also be provided for the following Reports:

Released April 23, 2021

In an ongoing effort to enhance security controls and protect you and your investor data, eMoney is making adjustments to its risk-based authentication engine over the next few months. These updates may lead to a slight increase in 2-factor authentication challenges when logging into eMoney.

Released May 24, 2021

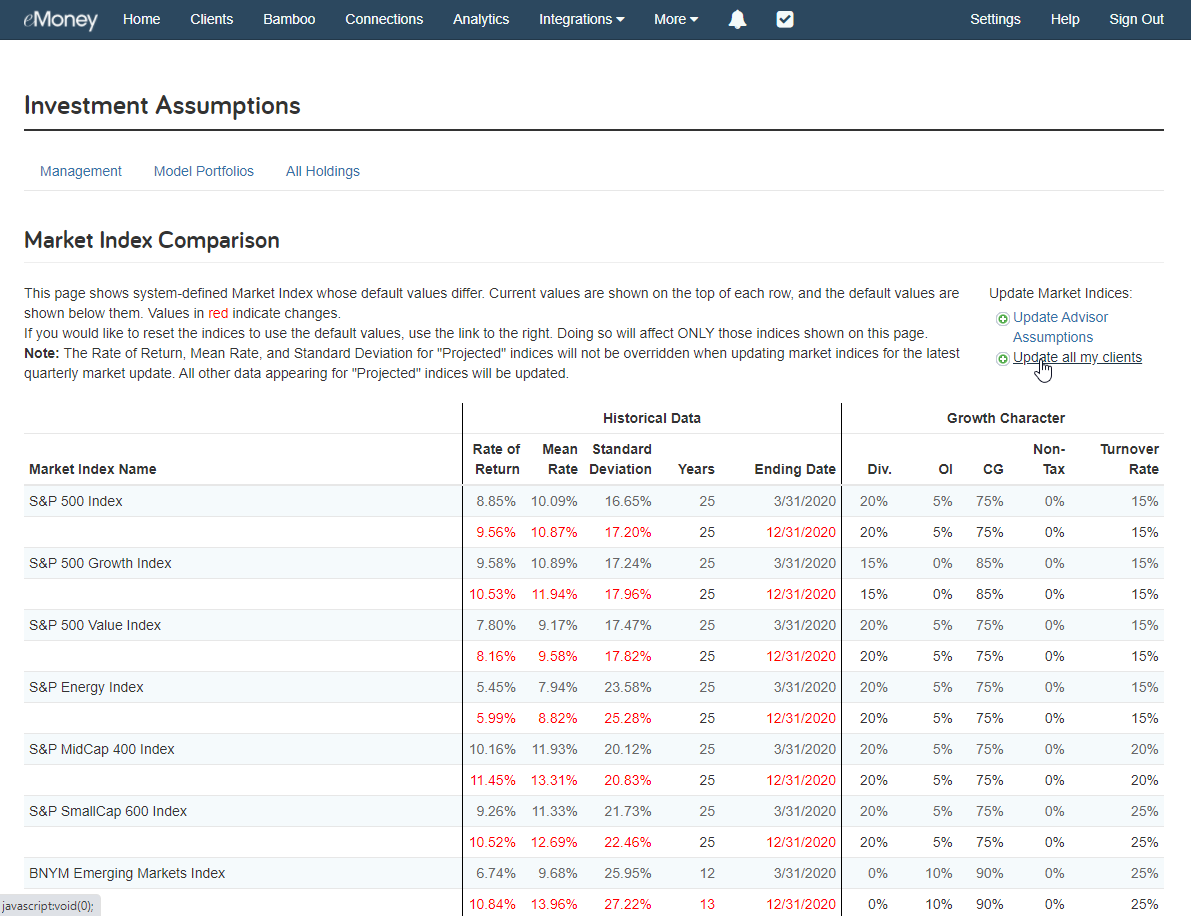

The market index data in your eMoney application has been updated with the latest historical data, as of March 31, 2021.Action is required to update your Investment Assumptions with this data.

Your capital market assumptions are the core of eMoney’s powerful simulation. They are the foundation of all your clients’ financial plans. That’s why eMoney makes new historical data available quarterly, so you can keep these building blocks up-to-date.

We recommend reviewing existing plans and the changes to your capital market assumptions prior to updating your indices.

Use the Compare / Update Market Indices How-to under Help or follow the steps below to update your capital market assumptions:

To update the market indices across your advisor assumptions:

To update the market indices for a single client:

For more information on your market indices, asset classes, and model portfolios in eMoney, check out Understanding Your Investment Assumptions on the eMoney Blog.

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.