Learn more about the latest eMoney updates, including the new Maximum Retirement Spend solver, enhanced solver editing, bulk download for the Vault, and more.

For more information on these updates, sign up for the latest product update webinar.

Released June 21, 2022

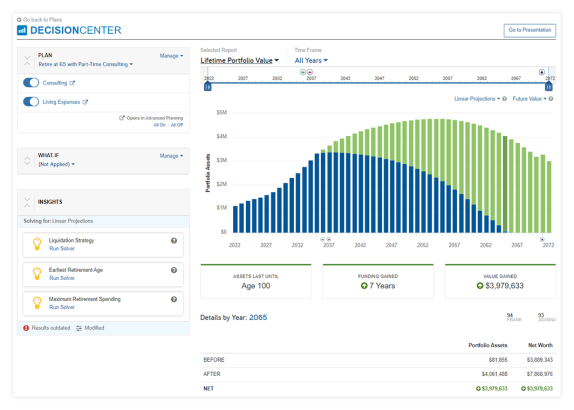

The new interactive Max Retirement Spend solver allows you to quickly show your clients how much they can spend annually in retirement while protecting their legacy.

Open Decision Center and select your desired Plan and Techniques. Then go to the new Insights area accessible below What-If in Decision Center.

Here you’ll find the new Maximum Retirement Spend solver.

Click Run Solver and it will quickly identify the maximum amount your client can spend during retirement while still meeting their expenses and Leave to Heirs goals.

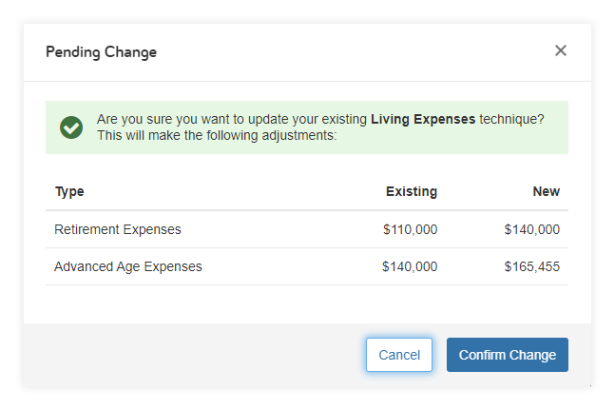

You can then save the results by clicking Save to Plan (or Base Facts). Saving will either create a new technique or when updating the client’s Facts or a similar technique, display a confirmation message indicating the existing and new values prompting you to confirm the change.

It’s important to note that if you update the current scenario by changing the Plan or modifying a Technique, the solver will display Recalculate to show its calculations have not been run against the current dataset.

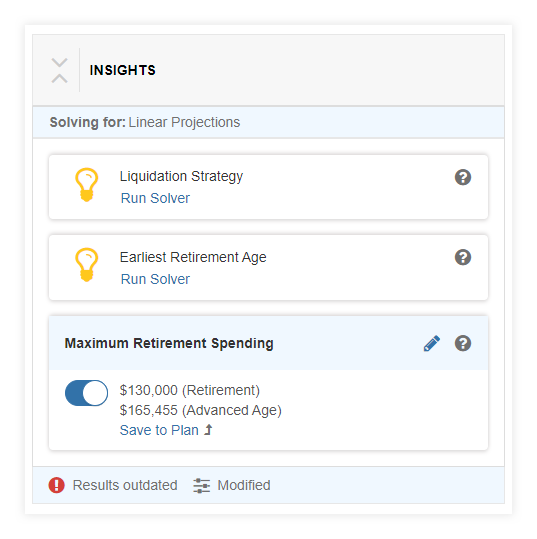

In addition to the new solver, we’ve enhanced your editing capabilities to make it easier to explore the interplay between multiple solvers and adjust the results to meet the unique needs of your clients.

Each solver can now be edited inline, by clicking the pencil icon, removing the need to open the solver to make adjustments, and allowing you to edit multiple solvers at one time.

Note: The new layout also includes icons that show you when the solver results are outdated and need to be recalculated or have been modified.

Explore this new feature by comparing different options between earliest retirement age and maximum retirement spend and see how they work towards a realistic solution for your client.

Stay tuned for even more Decision Center solver updates coming later this summer!

Released June 21, 2022

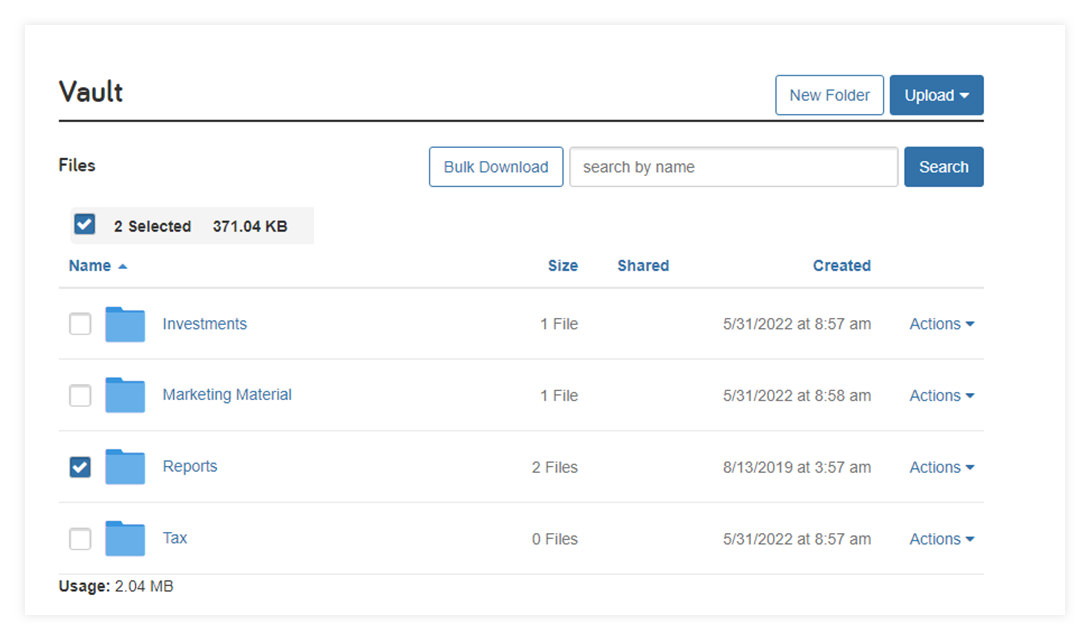

One of the most popular user requests is being implemented this month. Once released, you and your clients can download multiple vault documents in one bulk action.

Open the Vault and choose the folder or files you wish to download using the checkboxes located to the left of the file or folder name.

Once selected click the Bulk Download button to initiate the download.

The selected folder or files will be downloaded in a zip folder. This functionality will also be available in the client vault.

Note: Bulk downloads cannot exceed 50MB or 100 files.

Coming June 28, 2022

By request, the Brinker Capital single sign-on integration will be discontinued on June 28, 2022. It’s important to note that this change has no impact on the Brinker Capital connection.

We apologize for any inconvenience this may cause. Once discontinued, the integration will no longer be available within eMoney.

Coming in Q3 2022

Due to a change in the partner supplying our historical data, we’ll be replacing some of our existing market indices when we update our indices with Q2 2022 data next quarter.

The new indices have been carefully selected to replicate market performance similar to the index they’re replacing. Users should not expect significant changes in essential historical data (e.g., rate of return, mean rate, standard deviation).

Check out the table below to learn more about which market indices are being replaced, and click the links to learn more about each replacement index:

| Existing Indices | Replacement Indices |

|---|---|

| Ibbotson Corp HY Bond | Bloomberg U.S. Corporate High Yield USD |

| Ibbotson IT Gov Bond | Bloomberg U.S. Government: Intermediate USD |

| Ibbotson LT Corp Bond | Bloomberg U.S. Long Credit USD |

| Ibbotson LT Gov Bond | Bloomberg U.S. Treasury: Long USD |

| Ibbotson LT Muni bond | Bloomberg Municipal Bond: High Yield USD |

| Ibbotson Small Co Stock | MSCI US SMALL CAP 1750 |

However, in Q2 2022, we continued to see market volatility and lower than average expected returns—so while we don’t expect a significant impact from the transition—you may see an anticipated drop in returns based on market conditions. We recommend comparing the existing and updated data before updating your capital market assumptions.

Once these market index updates are made, eMoney users will see the following in-app message when clicking the Compare/Update Indices button, encouraging them to compare the existing and updated data before updating their capital market assumptions:

Due to a change in the partner supplying our historical data, we replaced some of our existing market indices with new ones carefully selected to replicate similar market performance.

While you should not expect significant changes in essential historical data (e.g., rate of return, mean rate, standard deviation), you may see an anticipated drop in returns based on market conditions. We recommend comparing the existing and updated data before updating your capital market assumptions.

Note: If your office uses custom market assumption data this update does not apply to you.

Released June 1, 2022

Our State Income Tax rules have been updated with the latest information to provide more accurate projections. This includes updates such as changes to state income tax brackets, exemption values, deduction values, and more.

Released June 6, 2022

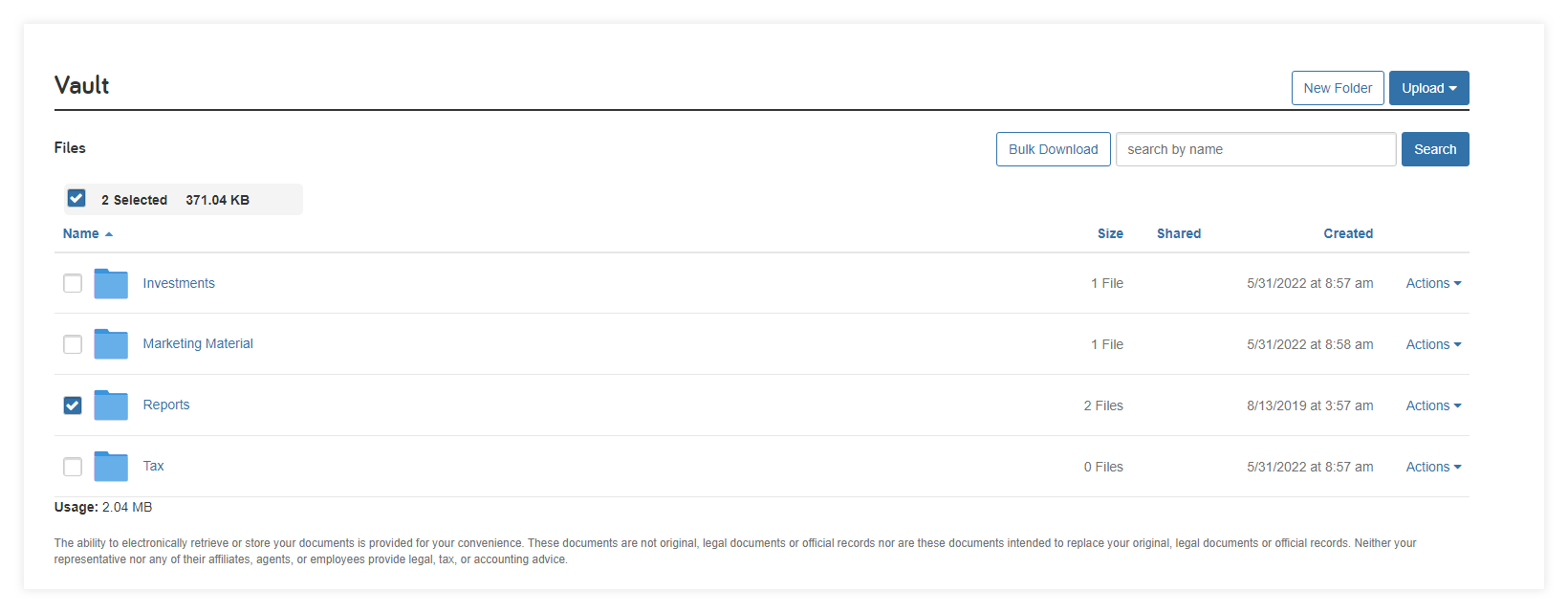

Now it’s easier to find the accounts you need by enhancing the way you view, search, and filter connections on your Connections Dashboard.

Connections on your dashboard are now consolidated into a single search and filterable table. This new view increases page performance while giving you more visibility into all your connections. In addition, the new search and filter functionality saves you time getting to the connections you need.

Released May 31, 2022

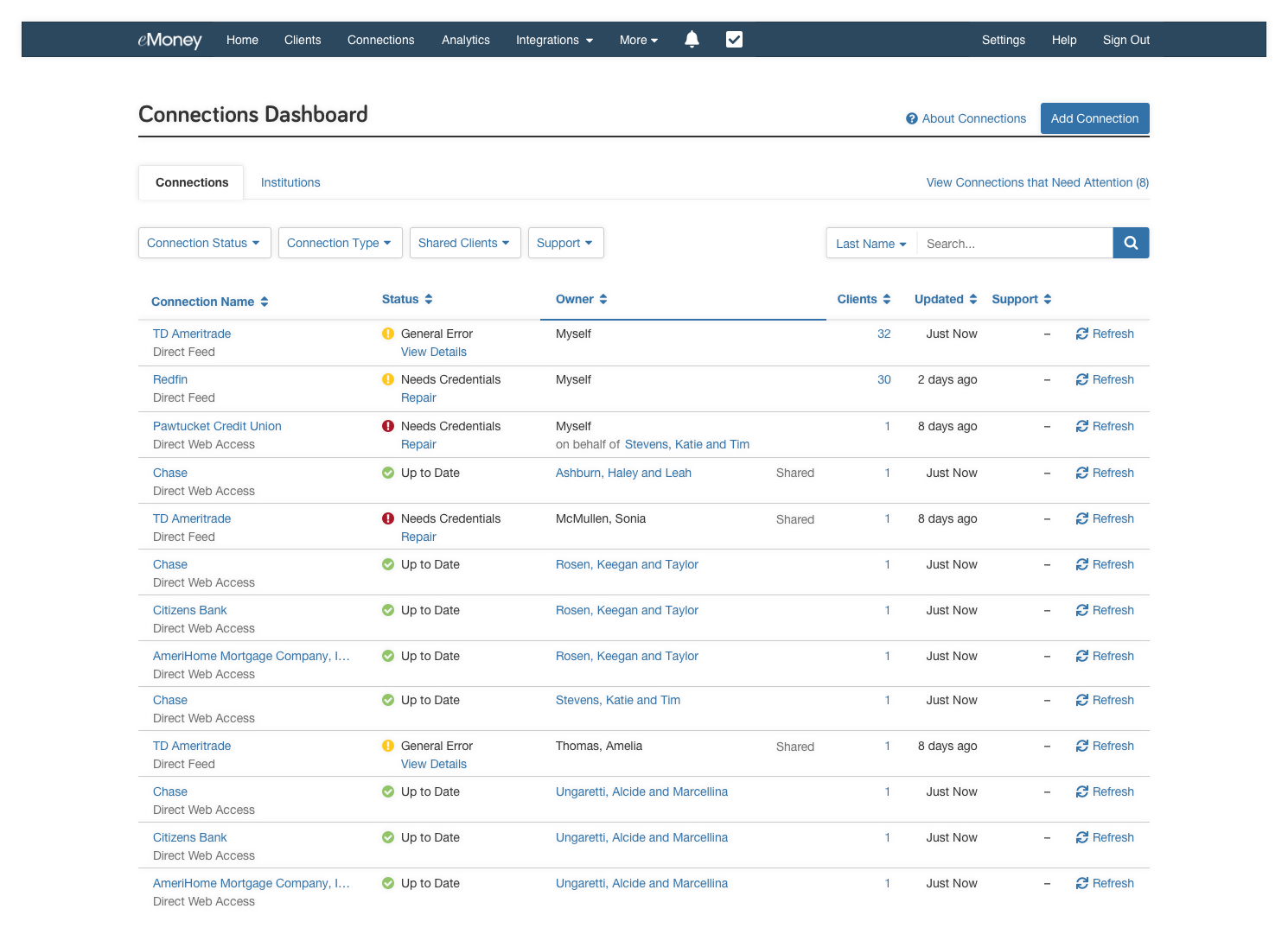

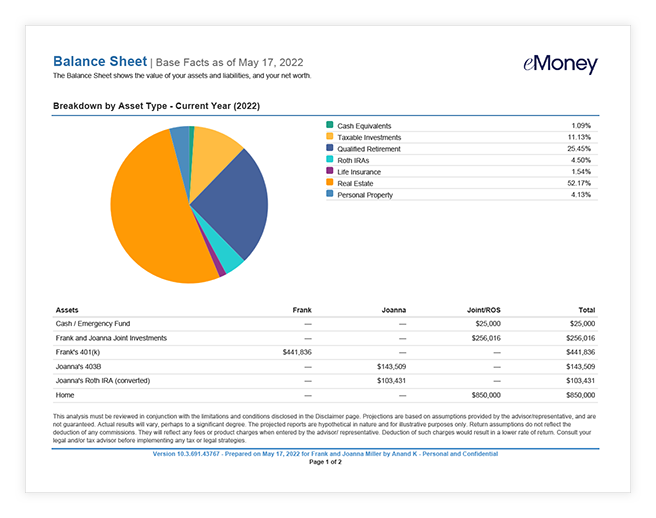

To create a more consistent report experience, the chart element of all Balance Sheet and Detailed Balance Sheet reports will be found at the top of the page in all versions as of May 31. This new layout matches the updated look and feel of these reports in the Decision Center and creates a more visually compelling experience.

Released June 6, 2022

The market index data in your eMoney application will be updated with the latest historical data as of March 31, 2021, on June 3.

To update your data on June 3, log in with your Producer account and search Compare / Update Market Indices under Help for step-by-step instructions.

Note: If your account uses custom capital market assumptions, this update does not apply to you.

Released April 26, 2022

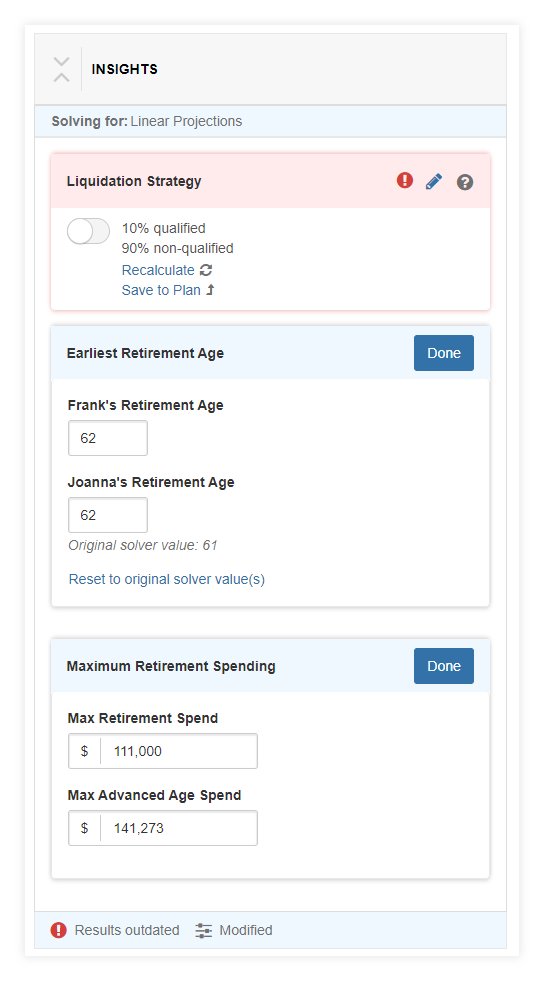

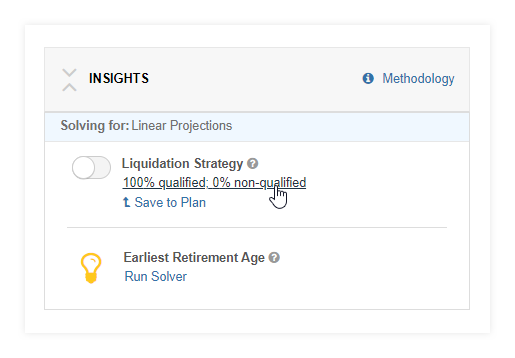

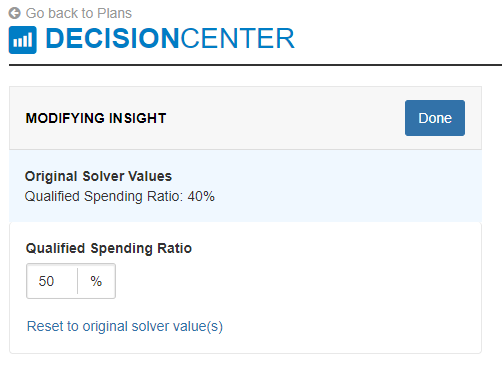

The new Decision Center Insights make it easier to identify ways to potentially improve plan results without requiring manual guess-and-check adjustments or leaving the Decision Center to make those changes. We’re making them even more flexible by allowing you to realign the output to suit your clients’ needs.

As part of our roadmap to deepen and streamline their capabilities, you can now make modifications to solver values for Earliest Retirement Ages or the Liquidation Strategy ratio for qualified / non-qualified assets.

Modifying a solver value is like making inline edits to basic techniques. When you run a solver, the resulting values are displayed as a link under the solver name, as highlighted below:

When you click the values link, the entire left panel is replaced with the Modifying Insight box that allows you to make and save your changes.

Once you modify a solver value and click Done, a Modified label will appear next to the solver title in the Insights section.

While you can toggle a solver result on and off just like a technique and preview the impact in Decision Center, you may find that the resulting value needs to be adjusted to align with your preferences. This ability to modify solver results will become even more essential as more solvers are added to Decision Center.

Released April 26, 2022

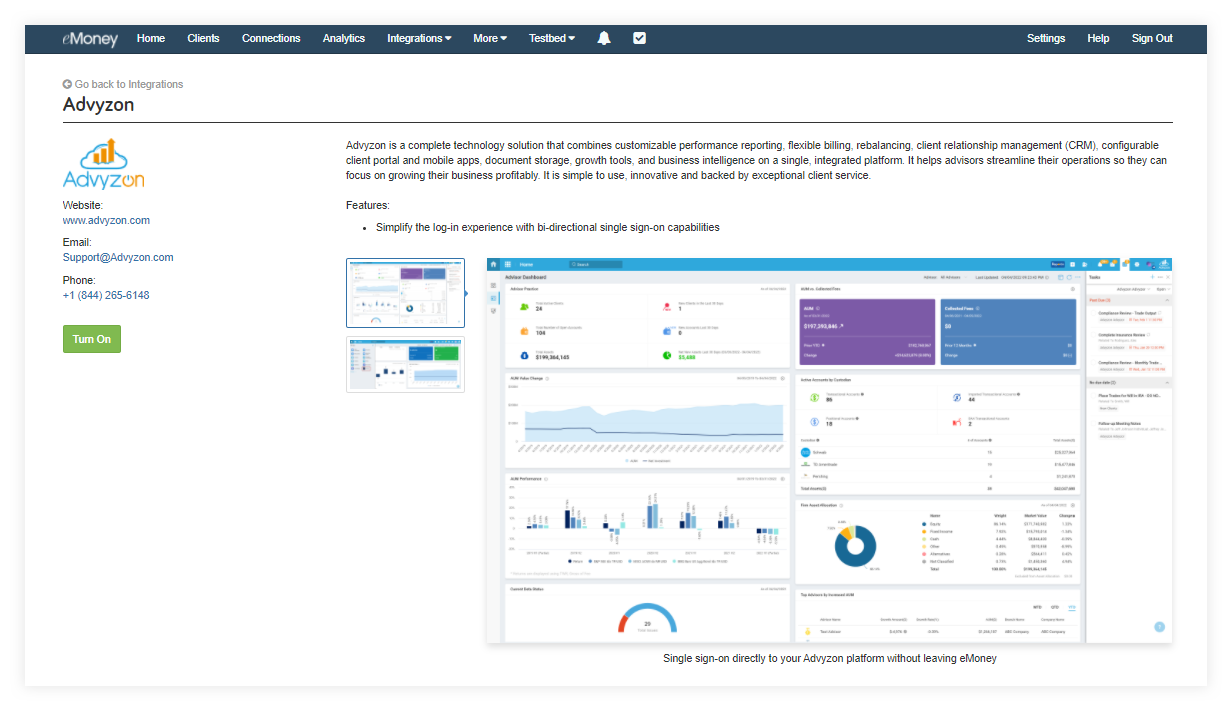

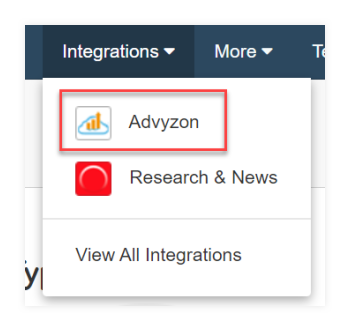

Advyzon helps advisors streamline their operations so they can focus on growing their business profitably—and now all eMoney advisor site users can seamlessly move between platforms with bi-directional single sign-on to Advyzon’s dashboard directly from eMoney.

Advyzon is a complete technology solution that combines customizable performance reporting, flexible billing, rebalancing, client relationship management, configurable client portal and mobile apps, document storage, growth tools, and business intelligence on a single, integrated platform.

Click Integrations on your navigation bar and select View All Integrations. Then click into the Advyzon integration tile to access the integration support page.

On the support page, click the green Turn On button, enter your username and password, and click Connect to enable the integration.

Once enabled you can single sign-on at any time from the Support page or using the Integrations drop-down menu.

Released April 19, 2022

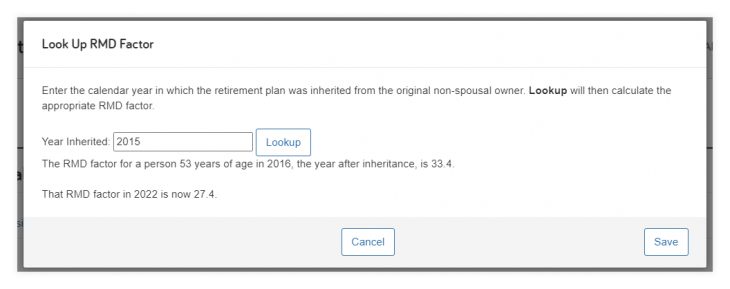

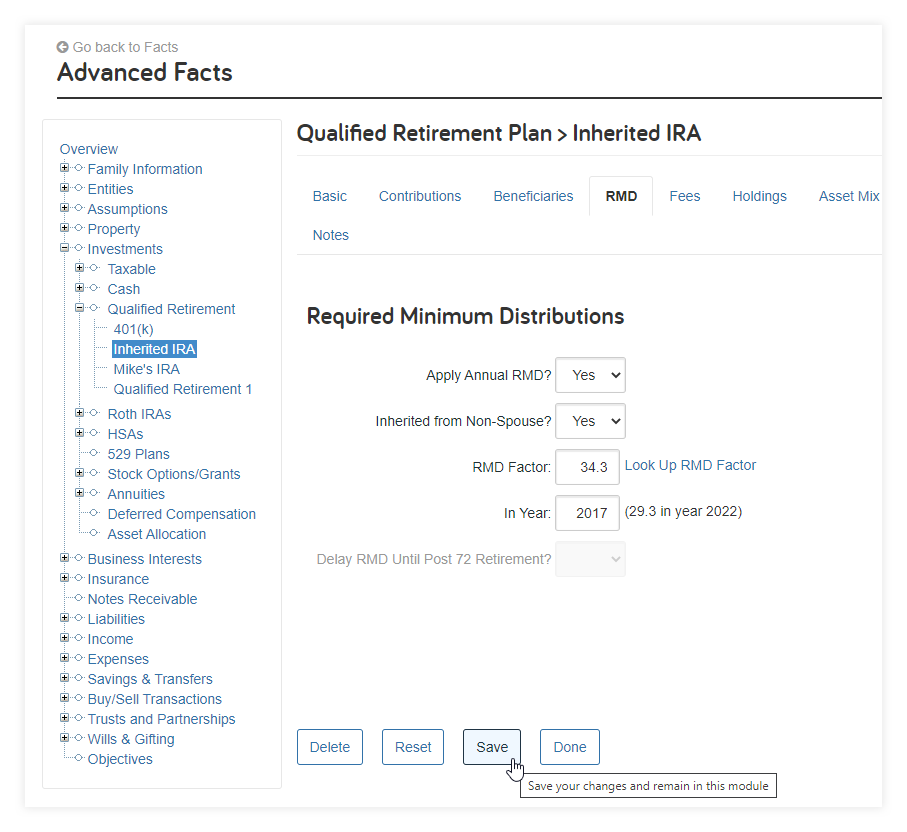

For IRAs inherited from a non-spouse beneficiary before 2020, the IRS released a new RMD schedule, slightly lowering RMDs for each age. Our life expectancy tables, utilized by our RMD lookup tool, have been updated to align with the change.

While this change will apply automatically for newly entered pre-2020 non-spousal inherited IRAs, you must take action to use the updated table for your existing accounts.

To update existing accounts, open them in Advanced Facts, go to the RMD tab, then click Look Up RMD Factor. A modal will appear where you can calculate and apply the new RMD Factor to the accounts field.

Once the RMD Factor has been updated remember to Save your changes.

Note: If this change is not applied to existing clients, their RMDs will be larger than reality.

Released April 26, 2022

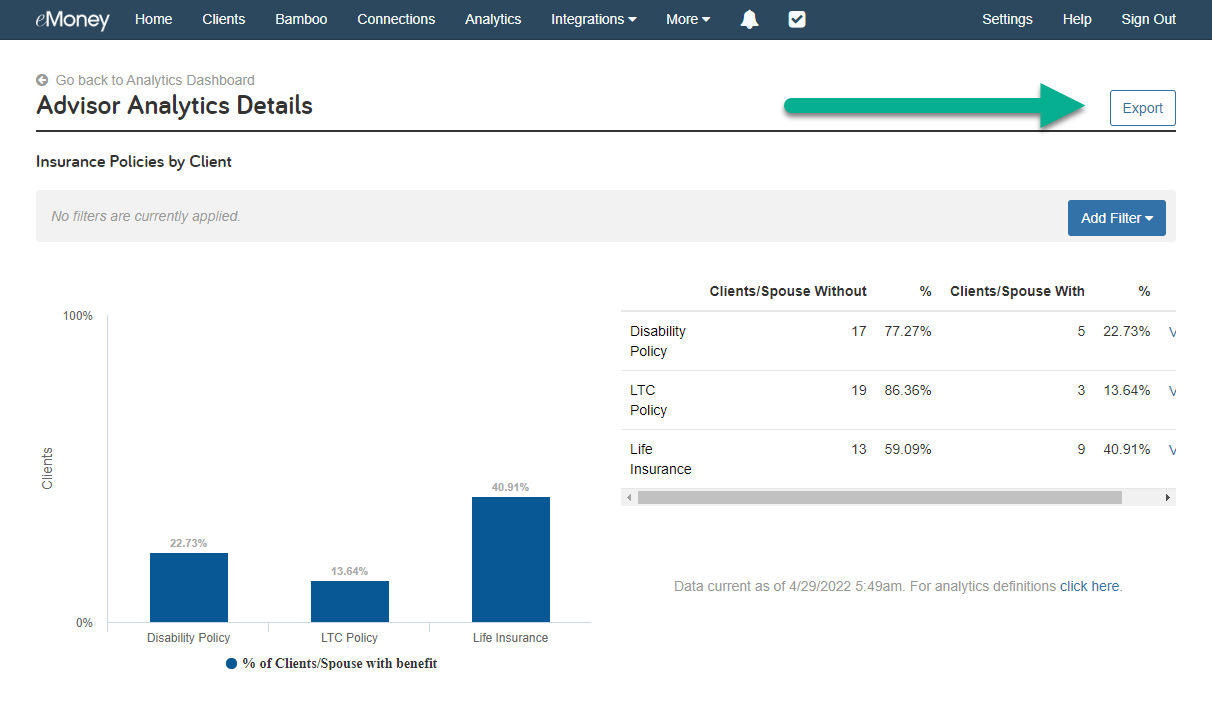

We added additional fields from the Policy Details tab to the Insurance Policy export template so that Analytics users have access to even more data! Click here to download a sample data export (.csv) with the new fields.

Click Analytics on your navigation bar to open your Advisor Analytics dashboard. Then drill down into a chart, like Insurance Policies by Client, and click the top right Export button.

Released May 3, 2022

For more consistent terminology, we’ve replaced the term Scenarios with Plans in key platform areas. Previously, within our tool, we used the words scenario and plan interchangeably.

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.