In the first half of 2024, we’ve focused on enhancing your planning and client experience to be more effective, efficient, and engaging. Join Joe Pearson, Product Marketing Manager, as he highlights some of the most exciting releases so far this year and provides a preview of the upcoming features you’ll see in eMoney in the months ahead. Watch the video below to learn more!

Coming Soon

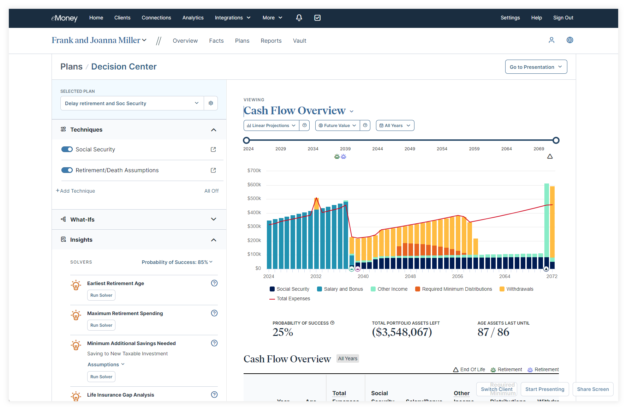

Improve your planning experience with a more modern, streamlined Decision Center interface. This update will mark a significant step forward in our vision to provide a flexible workspace where you can access all your planning details and reports in one convenient location.

What’s updating?

The overall visual experience is evolving to prepare for future updates coming in 2024 and beyond. These updates follow significant Decision Center advancements, including customizable Multi-View dashboards, an expanded report library, and various solver enhancements.

Key updates will include:

Soon, you’ll enjoy a modern aesthetic with a refreshed look and feel, including:

Additional Enhancements:

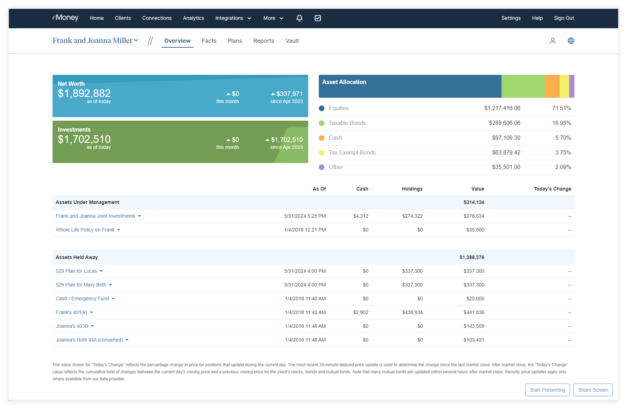

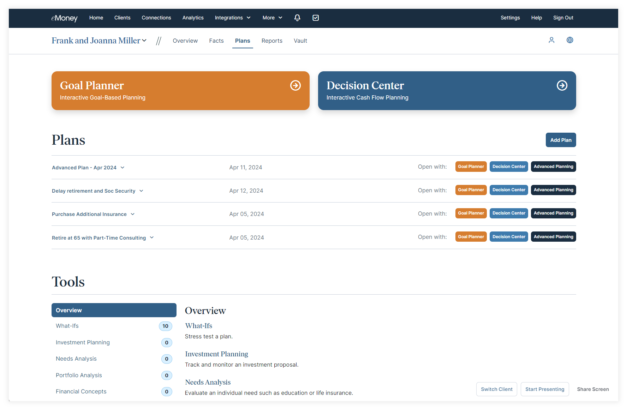

We’re excited to announce the first phase of UX enhancements to our advisor experience! Your navigation bars, Plans page, page headers, and Decision Center now feature a new, modern aesthetic. This improved look and feel is just the beginning of a more intuitive and visually appealing experience. Stay tuned for more updates!

Coming Soon

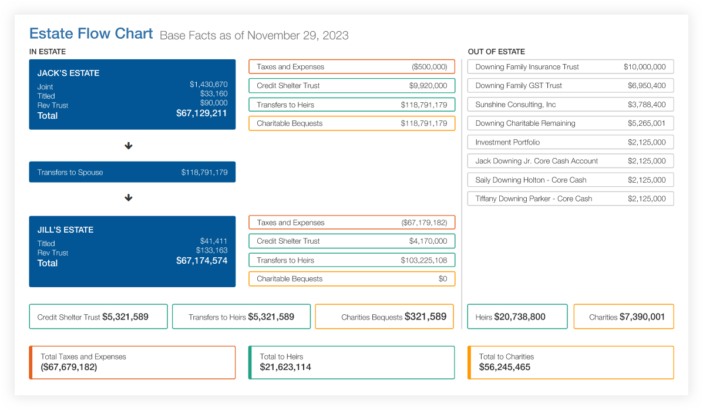

Soon, your Estate Flow Chart and Detailed Estate Flow Chart reports will be updated with improved aesthetics and readability—consistent with our other enhanced reports.

These enhancements are part of our ongoing commitment to modernizing existing reports and presentations within eMoney to provide a clean, updated experience.

Where will these updates be visible?

These enhancements will be visible in the online and printed presentations within Plans and Reports.

Released May 30

Ensure your financial plans reflect the most accurate and current information with the latest 2024 tax updates. State estate, inheritance, and income tax assumptions are now refreshed.

These updates apply specifically to those utilizing the By State Rules tax settings, ensuring accuracy and compliance for their tax calculations.

Dive into the latest updates and navigate regulatory landscapes with confidence.

⚐ REQUESTED FEATURE

Released May 21

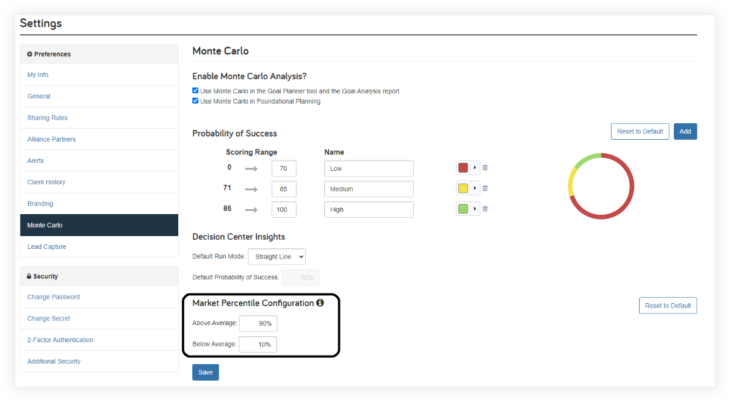

Create a more consistent experience among the reports that display Monte Carlo upside and downside outputs including Monte Carlo Summary, Asset Spread, Progress, and other reports listed below.

How Does It Work?

What Reports Are Impacted?

Released April 23

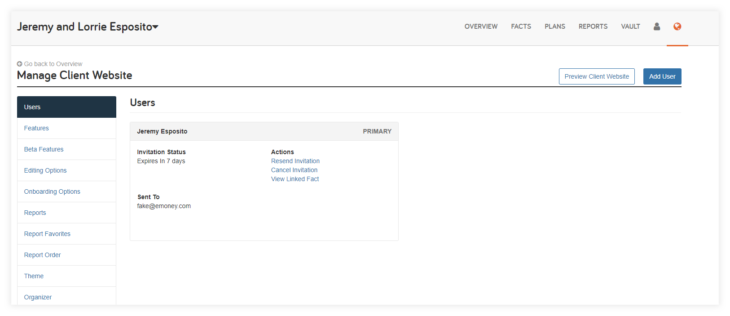

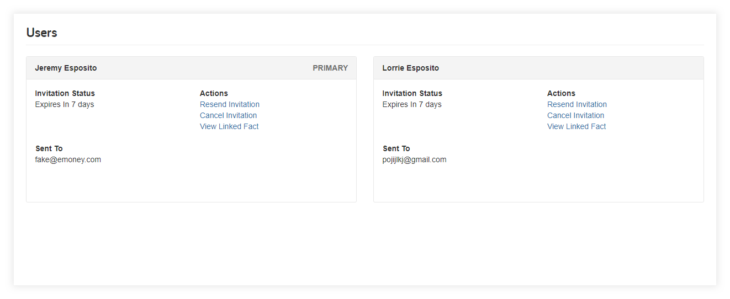

Enable seamless synchronization between client portal users and client facts, ensuring clarity on primary and additional users for each financial plan.

How Does It Work?

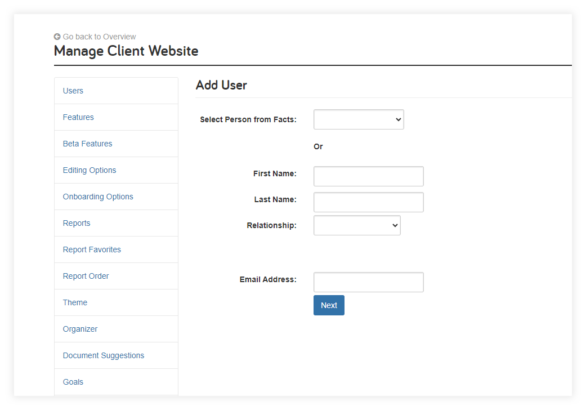

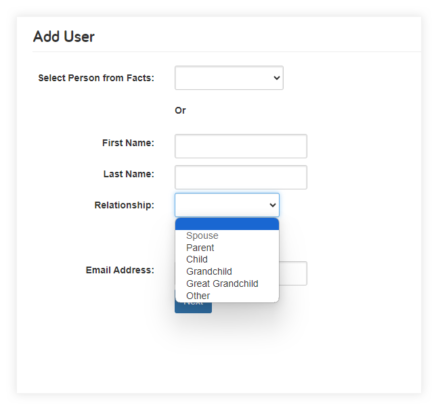

After inviting a primary user, additional users are designated as Secondary Website Users and can be added by clicking the Add User button.

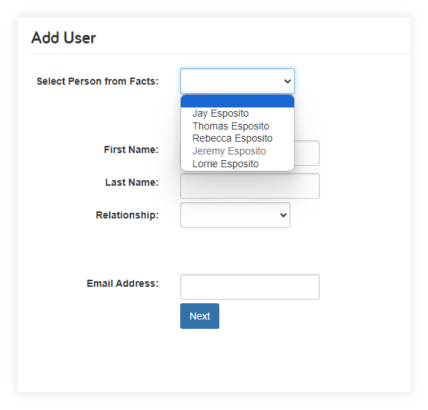

You can now seamlessly select existing individuals from the Facts section or add new users.

By choosing from the dropdown, you can quickly associate users with existing facts, streamlining setup and ensuring accurate synchronization between the client website and facts data.

You can easily add secondary users who are not yet in the Facts by selecting the corresponding option in the Add User flow.

Once the invitation is sent, the new user is instantly synced with their corresponding fact, simplifying management on the Manage Client Website page.

Please note: Existing clients won’t be automatically linked to a fact. You will initiate this change yourself, while new clients moving forward will follow this new process.

Updated April 2024

In the 2024 T3 Advisor Software Survey, eMoney maintained its position as the top aggregation tool provider for the fourth consecutive year. We remain committed to delivering exceptional service, stability, and security.

Establishing and maintaining connections is critical to creating a seamless financial planning experience for you and your clients.

Recent Additions:

Since the start of the year, we’ve integrated 147 new sources, responding directly to top requested connections, including:

You can continue to expect the most streamlined aggregation experience to fuel your financial planning process.

To learn more about the connections available, check out the Help menu resource: Your Guide to Data Aggregation.

Released April 23

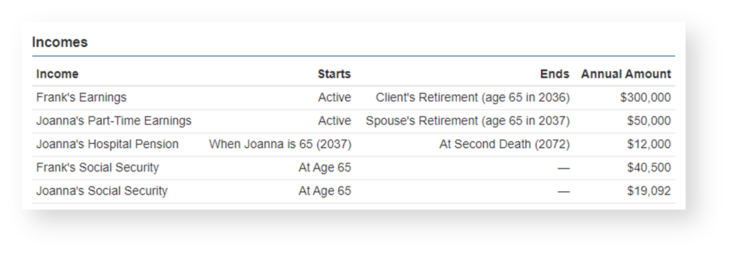

To simplify the review of reports with your clients, we’ve reordered all income streams chronologically by the income start date.

This change is represented on all reports displaying income data:

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.