This month’s updates center around the theme of creating a more cohesive, collaborative experience for advisors and clients. From the launch of Presentation View in Decision Center, connecting directly to My Plan for your clients’ experience, to new reports that align client-facing insights with your workflows, each enhancement is designed to drive clarity, consistency, and confidence.

Released June 17

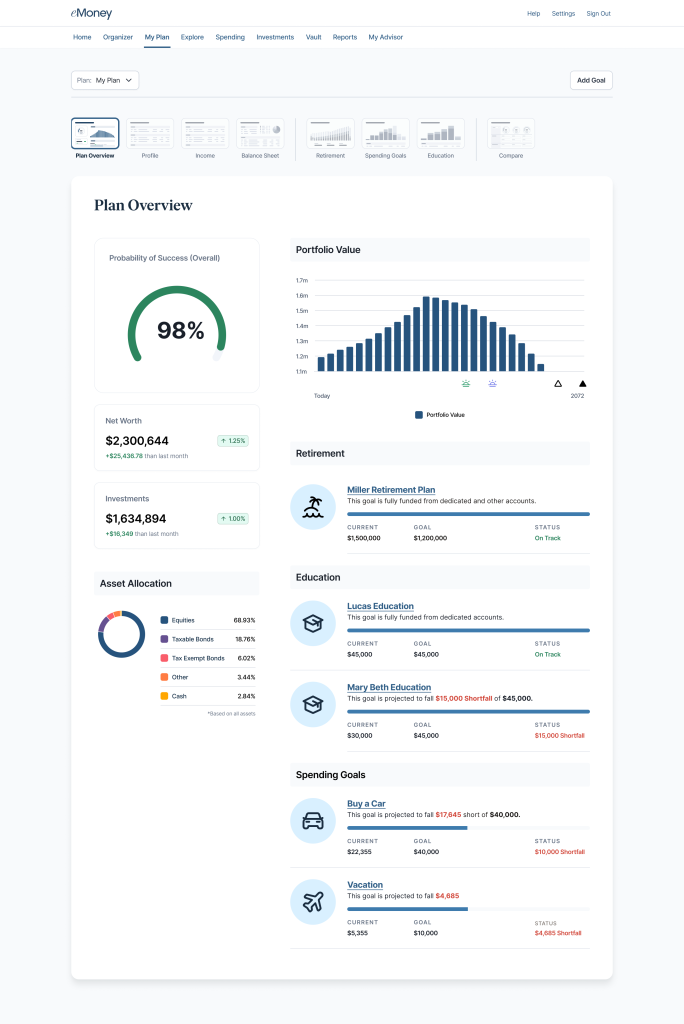

eMoney is setting the standard for seamless, collaborative financial planning. By going beyond static PDFs and printouts, we provide a modern, unified journey that fosters collaboration, streamlines your workflow, and ensures your clients’ experience remains consistent, whether you’re presenting in person or they’re reviewing their plan from home.

Presentation View keeps conversations focused, reduces confusion, and enables scalable personalization through reusable templates tailored to client goals.

What’s New:

With Presentation View, it’s easier than ever to keep clients engaged, informed, and confident in their financial future.

Coming July 2025

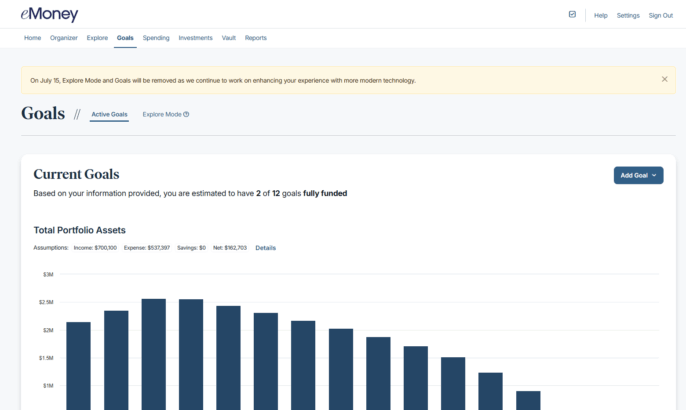

Our product strategy focuses on continuously investing in the Client Portal to benefit advisors and their clients. We’re enhancing capabilities, building new features, and removing outdated technology to deliver modern, efficient tools that improve client engagement and help grow your business.

What’s Changing

We look forward to continuing to be your partners in achieving strong client engagement. We believe in the value of the client experience and are committed to the continuous improvement of your Client Portal, including the June release of Presentation View*.

If you’re interested in enhancing your client’s experience, learn more about the Premium Client Portal here.

*Please note, feature availability and launch dates may differ based on custom configurations..

Released June 17

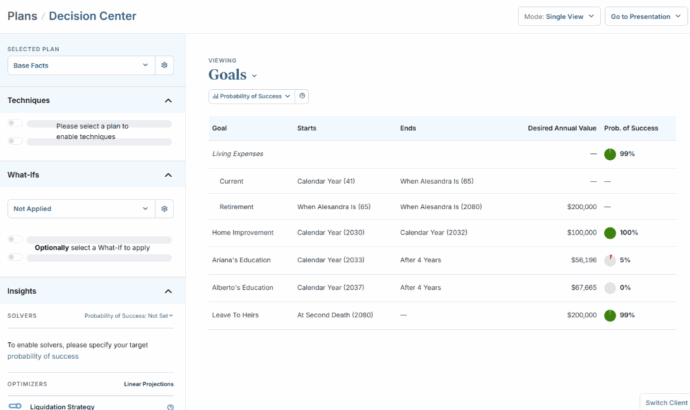

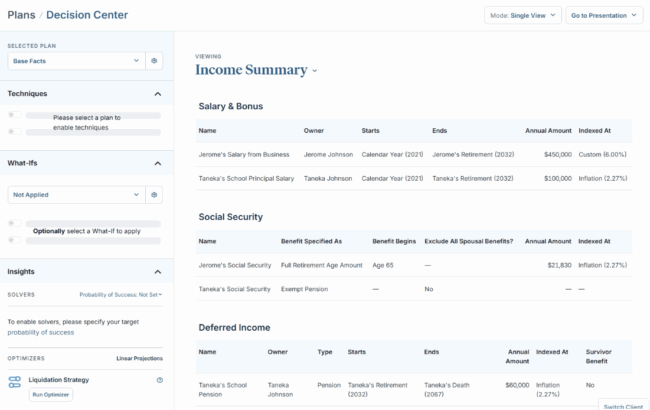

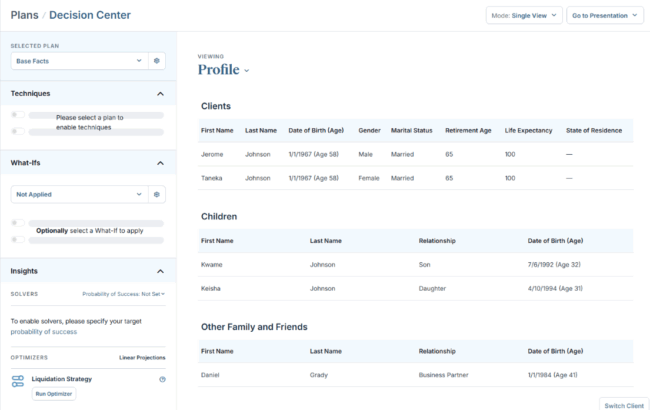

Support clearer planning conversations without switching between different workspaces with three new reports now available in Decision Center. You can now access Profile, Income and Goals reports within Presentation View, just as they’re represented to your clients via My Plan released last year in the Client Portal, bringing together essential plan data.

New Decision Center Reports

The Profile Report, Income Summary Report, and Goals Report—first introduced on the My Plan page —are now fully integrated into Decision Center. That means you can incorporate them into your presentation templates and share them directly to the Client Portal for a seamless, unified planning experience.

How These Reports Enhance Data Transparency

Accessing these reports in Decision Center streamlines your ability to plan collaboratively by enabling you to validate data without leaving the tool and navigating to Facts.

With these new reports, you can keep clients engaged and informed throughout the planning process, whether you’re meeting in person or connecting virtually.

Coming Soon

As part of our ongoing effort to enhance account aggregation in the Client Portal, your clients will soon experience a more intuitive and organized view of their linked accounts.

What’s Improving:

Because of the above experience enhancements, clients no longer need to filter retired connections.

We look forward to continuing this effort to enhance your clients’ experience with improved onboarding and ongoing usability. We recommend mentioning these enhancements to your clients in an upcoming meeting so they feel supported.

Released May 20

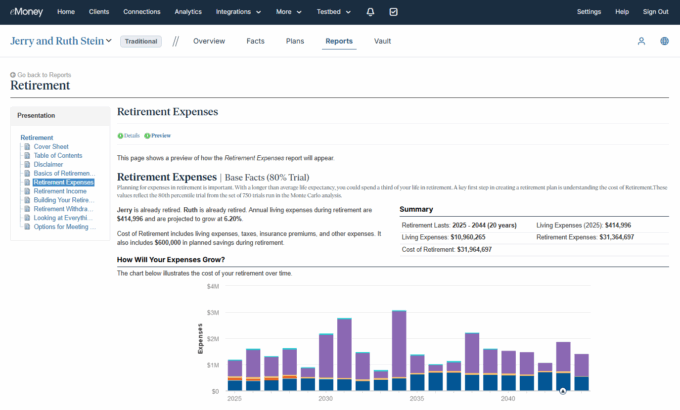

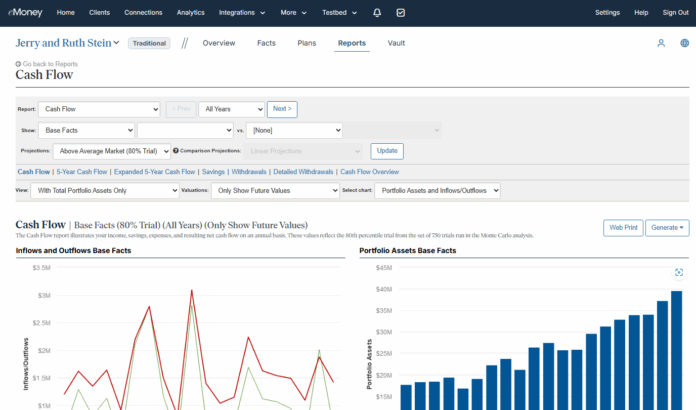

To make your presentations more consistent across experiences, now you can apply a single Monte Carlo trial percentage to your printable reports and presentations. This feature has been available in Decision Center, and now you can use the same logic in your print presentations.

This update is part of our ongoing effort to provide a smoother, more consistent experience for you and your clients.

Released May 29

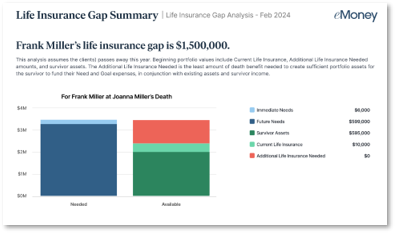

Soon, deliver clearer, more flexible life insurance evaluations—online and in print.

The print version of the Life Insurance Needs Analysis will include dollar values in the chart legend, making it easier to interpret results when reviewing or sharing printed analyses for both spouses, ensuring consistency and clarity across formats.

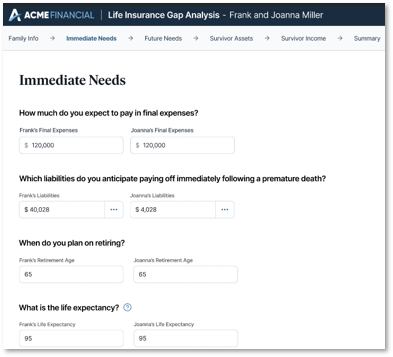

The Life Insurance Needs Analysis now also includes retirement age and life expectancy inputs—bringing it in line with the Retirement module, increasing clarity without affecting existing analysis results.

Ensure your financial plans reflect the most accurate and current information with the latest 2025 tax updates. State estate, inheritance, and income tax assumptions are now refreshed.

These updates apply specifically to those utilizing the By State Rules tax settings, ensuring accuracy and compliance for tax calculations.

Dive into the latest updates and navigate regulatory landscapes with confidence.

Released April 22

Deliver personalized solutions in minutes with the new version of our most-used classic Needs Analysis topic—Life Insurance Gap Analysis.

Personalized, Actionable Results

At the end of the workflow, you’ll see a clear summary of the client’s coverage shortfall, along with options for addressing it—making it easy to determine the next steps and present impactful solutions.

Explore the New Needs Analysis

Enhance your topical planning experience with Needs Analysis featuring:

Start using Needs Analysis with prospects and new clients today to spark interest in financial planning conversations!

A Look Back at Q1 2025

As the leader of aggregation tools in the market, we are committed to helping you unlock opportunities to grow your business by providing you a holistic view of your clients’ data to enhance personalized financial planning. We kicked off 2025 with a continued focus on delivering stable, secure, and seamless data aggregation experiences—helping you stay connected so you can focus on what matters most: your clients.

Recent Additions:

In Q1, we added 95 new sources, including top-requested institutions like:

We also upgraded 30 existing connections to improve performance and reliability, including:

Recent Product Updates:

In February, our top-notch customer service team made it even easier and more efficient to get help, so you can get back to what you do best, we introduced the Connections Support Assistant—an automated response tool built to help reduce the time needed to resolve connection interruptions. It’s now a step in the existing Report a Problem workflow. Read the full release notes ›

In 2024, we aggregated over 40 million accounts—90% via API or bulk file—and introduced key updates to make data aggregation smarter and more seamless. From easier connection discovery and client transfers to 300+ new high-value connections and a new standalone offering, we’ve laid the groundwork for even more innovation ahead.

Due to the Stop Student Debt Relief Scams Act (STOP Act), financial data for federal student loans can no longer be accessed by third parties. To comply with this regulation, eMoney will discontinue access to federal student loan financial data effective Friday, April 18, 2025.

All data previously aggregated or manually added to the system will remain, but it will no longer be updated automatically. You and your clients can continue to manually input the details of federal student loan accounts to ensure data from these sources is included in your clients’ full financial picture.

Note: This change only impacts federal student loan providers—private student loans are not affected.

We remain committed to delivering compliant, secure, and reliable data aggregation experiences that help you stay connected to what matters most.

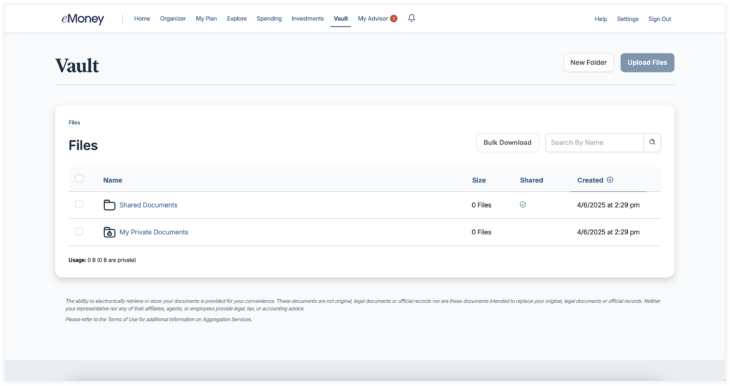

Released April 22

The Schwab integration unlocks faster, more efficient document sharing by enabling seamless access to Schwab statements directly within the Client Vault. This enhancement streamlines your workflow by eliminating the need for manual downloads and uploads to share these documents in eMoney.

Enhancements:

Now that the Schwab Vault feature is accessible, please take a moment to enable the Schwab integration and link your clients if you haven’t yet by following the steps below.

How It Works:

Now that the feature is live, linked clients can see a notification banner prompting them to log in to Schwab and enable document sharing. Informing your clients about this coming enhancement is a great way to instill continued confidence that you have their best interests in mind!

Get ready to simplify your workflow and deliver an even better client experience with the enhanced Schwab integration and Vault features.

Released April 22

As we work hard to improve the experience of Client Portal users, a few remaining pages have been visually enhanced to align with last year’s modernization of the Portal’s design. These enhancements are purely aesthetic with no functional changes.

Newly Updated Client Portal Pages:

Feel confident in engaging your clients with a consistent, modern digital experience that fosters trust and helps your business grow.

Released April 10

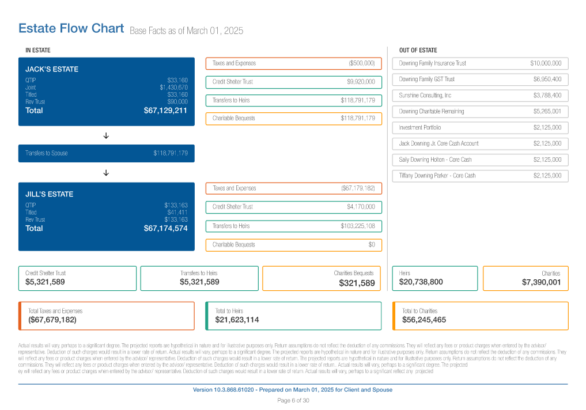

Estate Flow Chart and Detailed Estate Flow Chart reports are updated with improved aesthetics and readability—consistent with our other enhanced reports.

These enhancements are part of our ongoing commitment to modernizing existing reports and presentations within eMoney to provide a clean, updated experience.

Where are these updates visible?

These enhancements are visible in the online and printed presentations within Plans and Reports.