Learn more about the latest eMoney updates, including the new Multi-View in Decision Center, Life Insurance Gap Analysis Report, the new launch of the Knowledge Base Podcast, new Advanced Help Resources, and a sneak peek at what is coming soon!

For more information on these updates, sign up for the latest product update webinar.

Released September 26

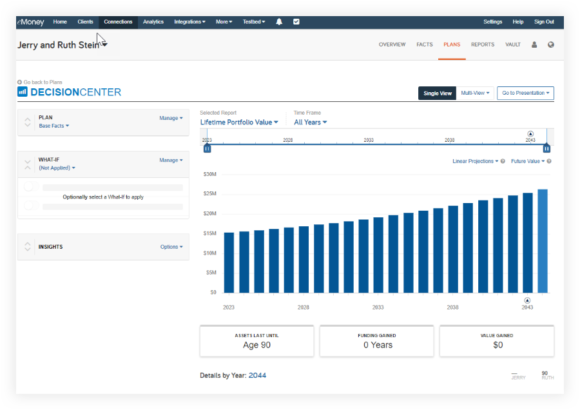

Welcome to Multi-View. A new way to create personalized dashboards and visualize the impact of plan changes across multiple reports simultaneously. Now, you can streamline your process, while providing clients with a highly customizable and engaging experience using personalized dashboards that reflect your planning conversations.

With Multi-View, you can add, edit, resize, reorder, and save templates of your favorite reports on consolidated dashboards, removing the need to switch between screens.

So, whether you’re providing a high-level plan summary or creating a custom dashboard to highlight the benefits of Roth conversions, Multi-View helps you move more efficiently through your planning process so you can focus on what matters—conversations with clients.

How Does It Work?

Check out this demo of the new Multi-View feature in Decision Center by eMoney Financial Planning Consultant, Michelle Riiska, ChFC or keep reading below to learn more.

Multi-View empowers you with the flexibility to create custom collections of reports, providing a responsive and interactive platform for making informed decisions. Now, easily add and manage reports in these collections to enhance planning and analysis capabilities.

Navigating to Multi-View

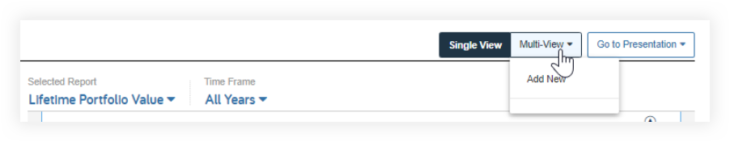

Multi-View can be found on a new page in Decision Center. The standard Decision Center page will appear as Single View. To change your view, simply click Multi-View.

When you first use Multi-View, the only option is Add New. Click the Add New selection to create a new Multi-View.

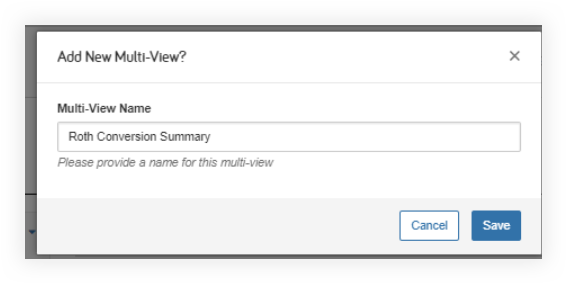

Steps to Create a New Multi-View

1. First, enter a name for your Multi-View as shown below, then click Save.

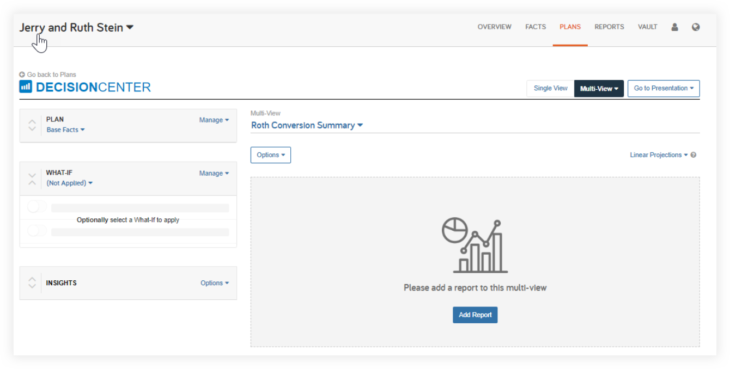

2. After saving, you will be prompted with a menu of available reports to select from. Select your report, and click Add.

3. The report you selected will appear in Multi-View. Clicking the + Add Report option at the bottom of your view allows you to add additional reports to this Multi-View.

We are excited for you to begin to use Multi-View and would like to share that this is only the first iteration of the feature. We are looking forward to rolling out several exciting enhancements that are currently in progress.

As with all our new features and functionalities, we encourage you to provide us with suggestions, as your feedback is critical to ensuring we continue to evolve our product to meet your business goals! To leave us feedback, click Request a Feature in the footer of the site!

Released September 26

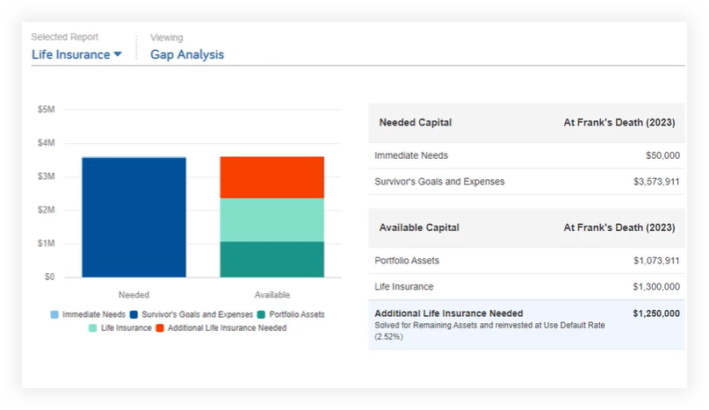

Show your clients how they can protect their loved ones and secure their financial well-being in case of unforeseen circumstances with the Life Insurance Gap Analysis report now available in Decision Center.

How Can I View the Report Within Decision Center?

Simply select Life Insurance from the Selected Report category. Gap Analysis will be shown by default.

Printable version of this report coming soon.

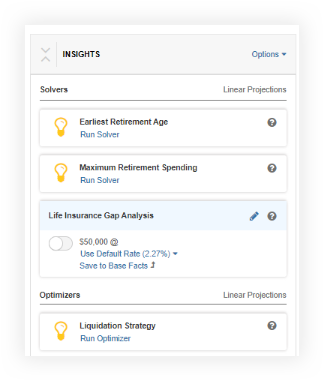

How Do I Run the Solver?

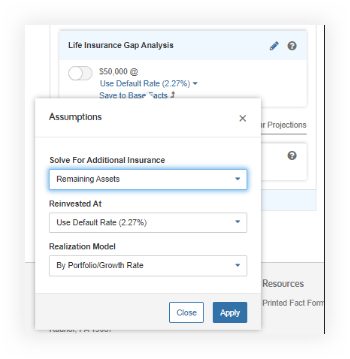

On the left side of Decision Center, select your premature death what-if (client or spouse), then inside the Insights area where the Life Insurance Gap Analysis lives, answer a couple key assumptions such as the assumed growth rate of the additional insurance, and then click on Run Solver. As with other solvers, you can choose straight line or Monte Carlo methodology.

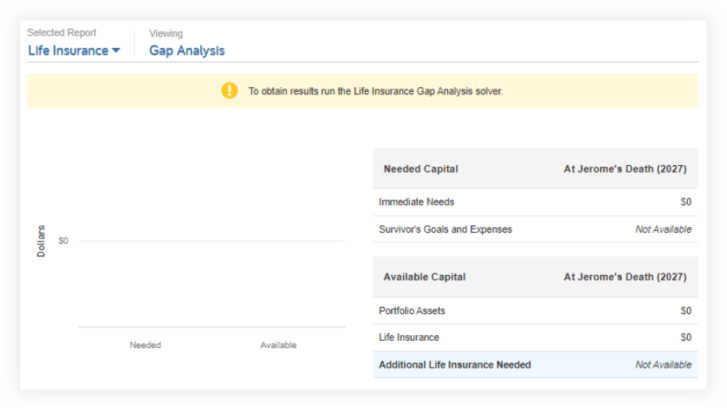

Please note, when first opening the Life Insurance Gap Analysis report in Decision Center, the data needed to populate the report is not available until the Life Insurance Gap Analysis solver is run.

Empower your client relationships and enhance your life insurance strategies by leveraging this report within Decision Center starting today!

Launched September 26

Introducing a NEW channel to take you deeper into important areas of eMoney: the Knowledge Base Podcast! This new podcast, accessible only to eMoney users, empowers you to hear directly from the product experts themselves via dynamic and lively conversations.

Where can I access the podcast?

Accessible via the Help Menu, this feature provides convenient, on-the-go learning opportunities, enriching your understanding of the eMoney platform. Simply search for the term, “podcast” or find the section in the All Help tab with links to each episode and a general link to the podcast site!

When will new episodes be released?

New episodes will be released on the second and fourth Tuesday of every month.

Updated September 2023

⚐ REQUESTED FEATURE

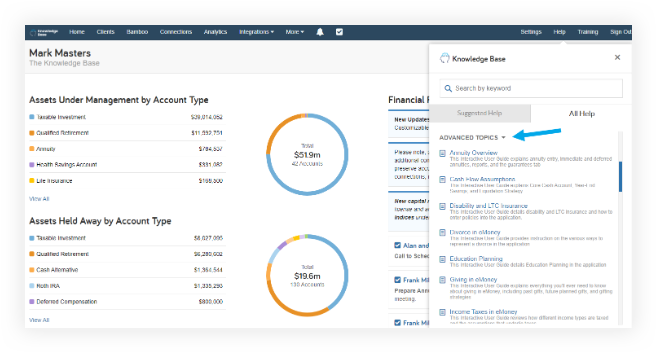

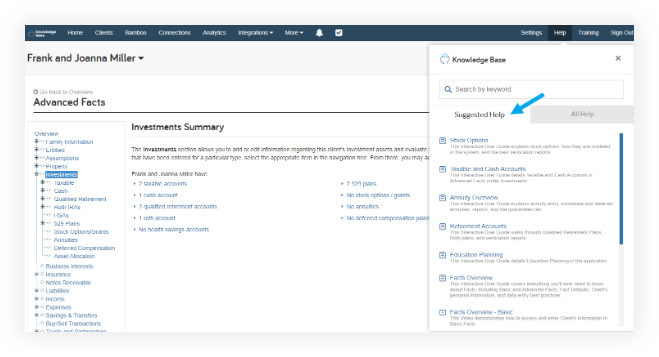

Access support quickly on advanced topics throughout eMoney with new detailed user guides found in the Help menu! You can expect revamped and updated advanced topics, including fresh material on subjects such as annuities, insurance, trusts and partnerships, and more. These valuable resources have been carefully selected based on user requests, and we’ve made it easier than ever to access them.

How to Access New Advanced Help Resources

Simply navigate to the Help menu, select All Help, and find the dedicated Advanced Topics section. You can also type the term or keyword you’re looking for into the search bar.

Additionally, you can click Help from wherever you are across the platform. These new resources will populate within Suggested Help based on their relevance to the page you are on.

Workflow Automation: Solvers in Decision Center

The eMoney product roadmap is focused on expanding and deepening planning capabilities, offering more streamlined and intuitive workflows, and supporting collaborative planning conversations. As part of the eMoney strategy to evolve Decision Center into the one true hub for all planning conversations, solvers save advisors time while identifying ways to improve plan results. Advisors can be more responsive to client inquiries and offer options interactively and seamlessly—all within Decision Center. eMoney users can expect even more solvers in Decision Center in 2023.

“This is a tremendous honor that reinforces our commitment to supporting advisors with both the technology and unique insights to meet clients’ evolving expectations,” said Susan McKenna, CEO of eMoney.

Coming Soon

Workflow Automation: Solvers in Decision Center

We’re enhancing the presentation-building experience, so all your reports are available in the Facts, Goal Planner, Decision Center, and Reports presentations. This update will make it easier than ever to build the deliverables you want quickly and efficiently—no matter where you are in eMoney.

Stay tuned for the launch of this simplified, presentation experience coming soon!

Released August 29

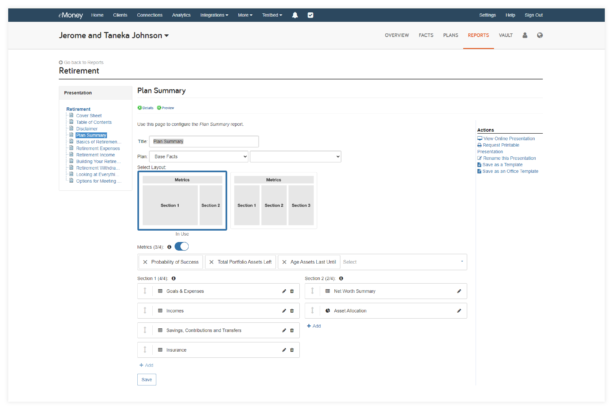

Ditch the one-size-fits-all approach and create personalized Plan Summary reports tailored to your clients’ needs that reflect your planning conversations. Now you can customize the Plan Summary report with all of the metrics, visuals, and notes that are meaningful to your clients.

How Does It Work?

While viewing the Plan Summary Report, you’ll now find a Customize button. Clicking Customize allows you to tailor the report according to the specific requirements of the client. From there, you can:

Once you’ve created your ideal summary, save it as a template for future use. If you choose to save as a template, it will save universally to all your owned clients.

Pro tip: When using the Plan Summary report in a printable presentation, you can use it twice—once to represent the base case and again to represent the plan.

Where Can I Go to Customize This Report?

Customization of the Plan Summary report can be done on the Reports tab, and in the Presentation building experience.

Is This Available on the Client Portal?

Yes! If you enable the Plan Summary report under Manage Client Website > Reports > Plan Summary, your clients can view it on their Client Portal Reports page.

Pro-tip: Make the Plan Summary report the only favorite in your client’s settings, so it shows up by default when the client loads the Report page on their Client Portal.

Provide all your clients with a personal, powerful, and consolidated view of their financial plans with the Plan Summary report today!

Coming September 6

Prepare for the much-awaited migration from TD Ameritrade to Schwab, scheduled for September. Below, you’ll find essential details about this conversion:

Still looking for more information on this update? Please check out the TD Ameritrade to Schwab Migration blog post.

New Changes Coming Soon

We are aware of the latest IRS guidance on mandatory Roth catch-up contributions for high-earning employees and are promptly making the necessary adjustments in eMoney to ensure alignment. For further details, please refer to the SECURE 2.0 Act of 2022 Overview and eMoney Updates blog post.

Updated August 29

As part of our transition to a new investment data provider, eMoney has enhanced its ability to filter out capital gains distributions in the Income By Security report, so it reports only income distributions. You may notice a decrease in reported income for some mutual funds as a result of this.

Released August 29

⚐ REQUESTED FEATURE

Enable your clients to make more informed decisions concerning their spending goals with an expanded range of 13 new spending categories. These new categories improve categorization accuracy along with budgeting precision and expense tracking.

Now, your clients can categorize their spending with a more extensive array of spending categories available on the Client Portal, seamlessly accessible when connecting an account through aggregation. This ensures a greater sense of financial well-being and fosters a sense of confidence in managing personal finances.

These categories include:

Please note: Previous transaction data will not be recategorized.

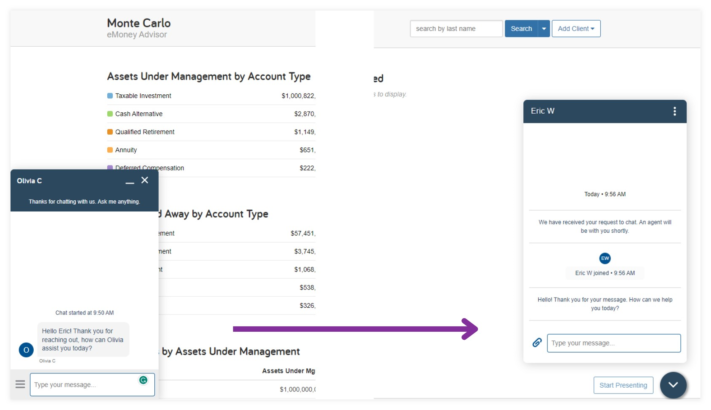

Released August 21

To elevate the chat experience, subtle behind-the-scenes enhancements have been implemented. One notable impact of these enhancements is the chat feature has been repositioned from the left side of the screen to the right, as well as, now having the ability to attach images and files to a chat conversation.

Released August 29

To streamline your access to training, Go to Courses has been removed from the Help menu and is exclusively available now via the Training link in your primary navigation bar.

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.