Explore the latest updates in eMoney, featuring My Plan in the Client Portal, heightened security at sign in, recently added integrations, and more.

Interested in learning more about what’s coming on the roadmap?

Join Leaders from the Product team at the virtual eMoney Summit taking place October 21-23 to learn how our platform is becoming the single solution for your financial planning process and how we continue to lead the way in fintech, helping you and your clients plan better together.

LEARN MORE

Updated September 24

Transform the way your clients view and interact with their financial plans. My Plan, a new tab within the Client Portal, is coming soon! Watch the short video below to learn more.

Key Features:

To enable My Plan (read only mode):

Navigate to Client Overview:

To enable a client’s ability to change their base facts, create and edit goals, etc.:

How to choose a Metric of Success the client can view:

To customize how your clients view plan progress on the My Plan page watch this short tutorial.

Please note if you have the My Plan tab enabled, Goals and Workshops will be disabled.

Updated September 24

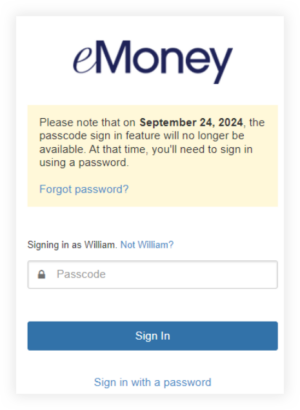

To maintain high security and align with industry standards, the passcode sign in feature will no longer be available after September 24. Currently, the passcode feature enables advisors and their clients to log in to eMoney via mobile devices with a passcode instead of a username and password.

What to Expect

In preparation for this change, you may have noticed a warning message within the passcode login screen informing you of the coming removal of the passcode sign in feature.

Updated September

In the 2024 T3 Advisor Software Survey, eMoney maintained its position as the top aggregation tool provider for the fourth consecutive year. We remain committed to delivering exceptional service, stability, and security.

Establishing and maintaining connections is critical to creating a seamless financial planning experience for you and your clients.

Recent Additions:

Since the start of the year, we’ve integrated 268 new sources, responding directly to top requested connections, including:

You can continue to expect the most streamlined aggregation experience to fuel your financial planning process.

To learn more about the connections available, check out the Help menu resource: Your Guide to Data Aggregation.

Coming Soon

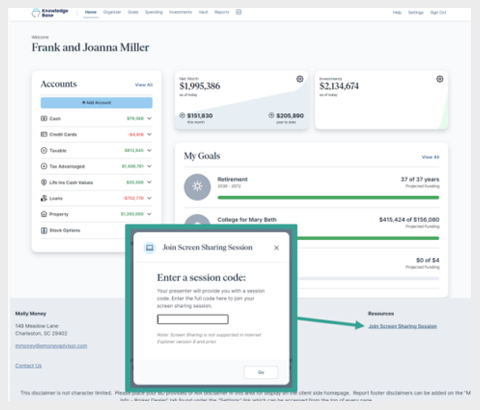

To adapt to updated industry standards and due to low usage, the Screen Share function will be discontinued this November.

Our research has shown that financial advisors prefer using well-known screen-sharing technologies due to their popularity, ease of use, and robust security features. This preference has resulted in low usage of the Screen Share feature. To allow our team to focus on the capabilities that are most impactful to you, this function will be discontinued in November.

After November 6, Screen Share will no longer be available, however, Present Mode, which protects clients’ information by locking in a single client’s facts, will remain accessible.

Released August 27

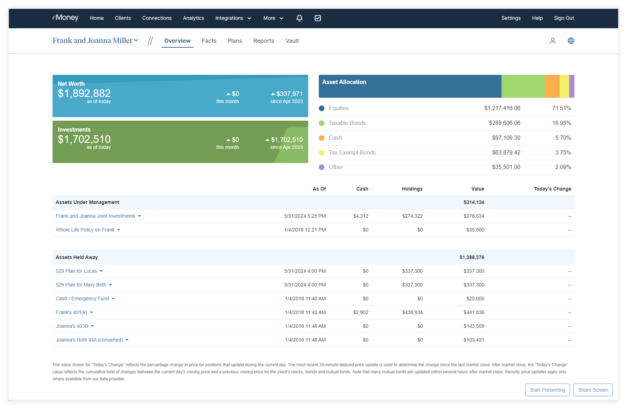

Make client conversations more compelling and elevate your financial planning services with our latest integration with Flourish. Now clients can easily take action on their plan by opening a Flourish Cash account.

How It Works:

Flourish Cash is an invitation-only cash account designed exclusively for clients of independent RIAs, offering rates up to 10 times the national savings account average while covered by FDIC insurance through its Program Banks. Inviting your clients is easy:

Key Benefits:

Elevate your financial advisory services with these powerful new tools and continue to provide exceptional value to your clients.

Released August 27

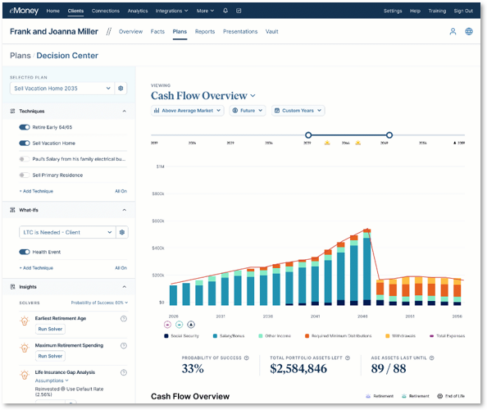

Show your clients the benefits of maximizing the yield on their cash accounts and identify new opportunities with two updates. Read on for more about the Reallocate Low-Yielding Cash optimizer in Decision Center and the new Cash Management Opportunities analytics chart.

The new optimizer is called Reallocate Low-Yielding Cash.

How Does the Optimizer Work?

When activated, it simulates reallocating the funds by applying a new growth rate to your client’s cash accounts. You can edit this percentage by selecting Edit, adjusting the yield, and then re-toggling the optimizer.

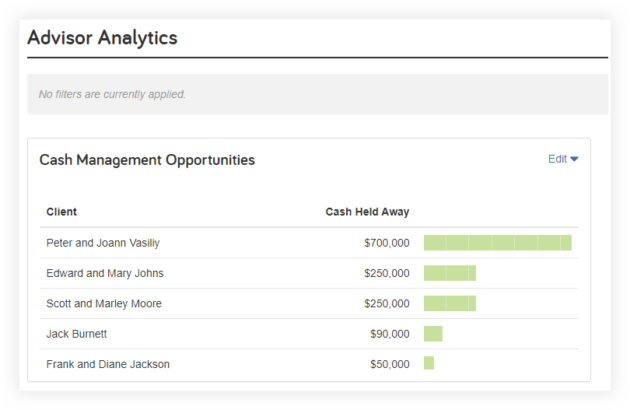

We’ve also introduced a new chart within Advisor Analytics called Cash Management Opportunities. The chart displays all clients with held-away cash accounts.

These enhancements are designed to provide greater insights and flexibility in managing client cash accounts, ensuring you have the tools needed to effectively optimize financial strategies.

⚐ REQUESTED FEATURE

Released August 27

Enhance your financial planning with streamlined Year 1 Required Minimum Distributions (RMDs) handling, providing you with greater control and precision over your current year RMD settings.

What’s New?

New fields have been added to the RMD tab, such as:

Explore these improvements to enhance your financial planning experience and ensure accurate RMD calculations.

Released August 27

Sample clients are invaluable resources for familiarizing yourself with the functionality of eMoney as well as showcasing the value of your recommendations to clients and prospects.

Periodic updates are essential to ensure their use cases and scenarios align with the diverse scenarios encountered in financial planning. Soon you’ll notice updates to your sample clients to ensure they represent relevant, up-to-date examples with scenarios ranging from retirement and education expenses to estate planning.

Explore some adjustments made to existing clients by watching this short video on the changes.

Important Updates

Biographical Information:

Financial Changes:

Account Updates:

Scenarios and What-ifs:

See all sample client updates.

It’s important to note that any existing sample clients currently in use will not automatically reflect these new changes.

Released July 30

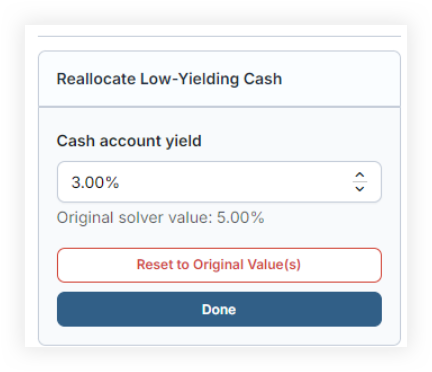

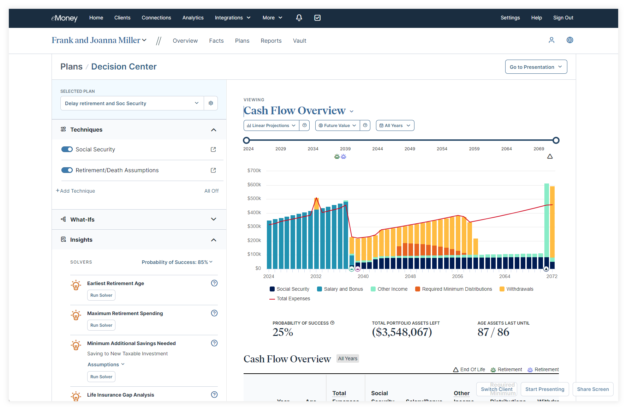

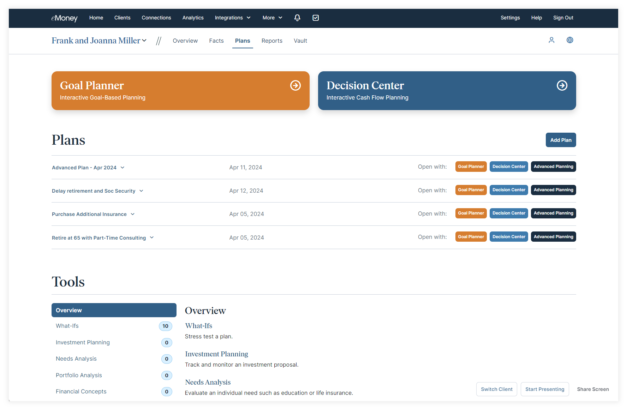

Improve your planning experience with a more modern, streamlined Decision Center interface. This update will mark a significant step forward in our vision to provide a flexible workspace where you can access all your planning details and reports in one convenient location.

What’s updating?

The overall visual experience is evolving to prepare for future updates coming in 2024 and beyond. These updates follow significant Decision Center advancements, including customizable Multi-View dashboards, an expanded report library, and various solver enhancements.

Key updates include:

Enjoy a modern aesthetic with a refreshed look and feel, including:

Additional Enhancements:

We’re excited to announce the first phase of UX enhancements to our advisor experience! Your navigation bars, Plans page, page headers, and Decision Center now feature a new, modern aesthetic. This improved look and feel is just the beginning of a more intuitive and visually appealing experience.

Released July 30

Enhance your annuity planning in eMoney with added support for Indexed and RILA annuity fact types and the new Credit Strategy tab. Now you can better communicate the benefits of products that use these strategies and open up conversations on how annuities could fit into your clients’ larger investment strategy.

Key Features Include:

To learn more about Enhancing Your Annuity Planning, sign up for the Annuities webinar on Thursday, August 1, at 2:00 p.m. ET.

Updated August 12

To enhance security, we’re updating email systems, which means messages sent to or from corporate eMoney email accounts may be relayed through new IP addresses.

While we don’t expect any disruption, if you’ve previously whitelisted our email relay IP addresses, please forward this notice to your IT team to add the new IP addresses by August 12.

| Existing Email Relay IP Addresses | New Email Relay IP Addresses |

| 204.13.244.33 204.13.244.34 162.254.232.33 | 66.159.240.34 66.159.238.7 204.13.244.33 204.13.244.34 162.254.232.33 |

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.