for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreWhat’s your client’s current tax allocation? How could it change over time based on your advice? With Roth accounts becoming more common than ever, helping your clients attain a healthy tax diversification with their investments can be invaluable to their financial plan.

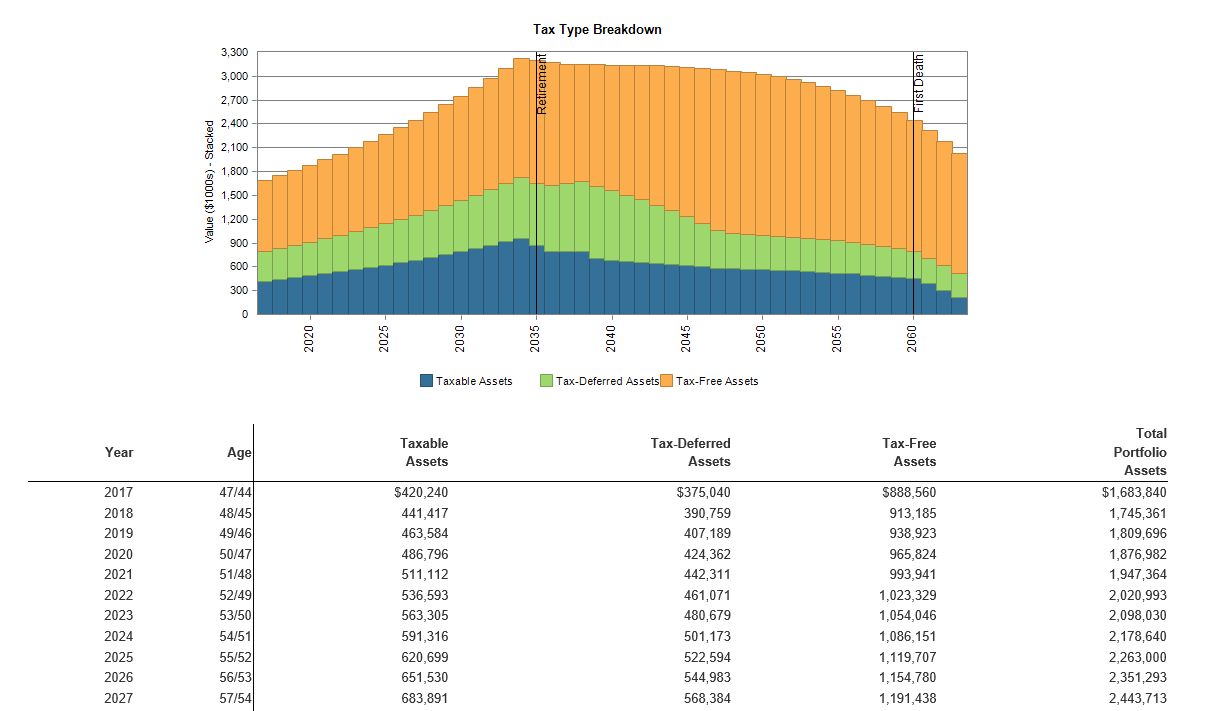

With the new Tax Type Breakdown report, you can divide your client’s assets by the type of taxation. Now you can see a report segmenting your client’s assets into three categories: taxable assets, tax-deferred assets, and tax-free assets.

See the Tax Type sub report under the Assets Report Family.

Example of Tax Type Breakdown Report