for expert insights on the most pressing topics financial professionals are facing today.

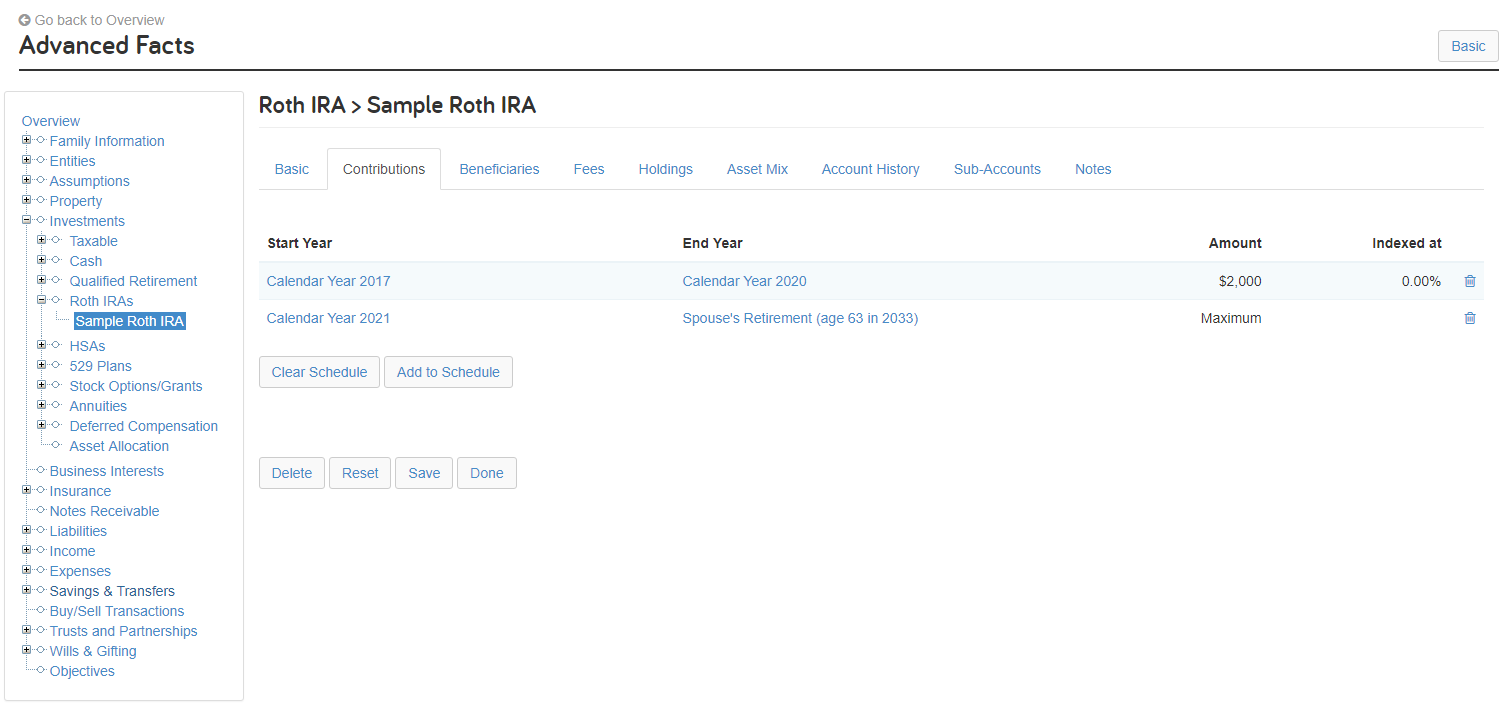

Learn MoreTo ensure that the planning process when working with Roth IRA accounts is as efficient as possible we’ve added the Contribution tab to Roth IRA accounts.

This update will eliminate the need to model Roth contributions via Transfer Flows. Additionally, all Roth contributions will adhere to the IRS maximum contribution limits. These changes will be most visible in your Fact Finder, the Client Organizer, Advanced Planning Techniques and all Reports that display contributions.

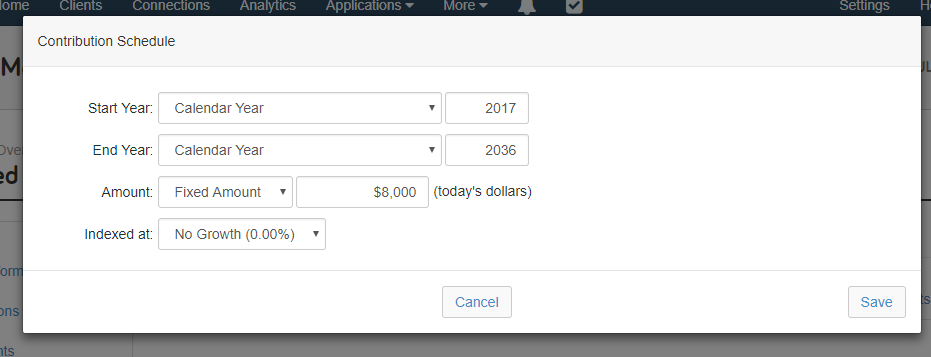

Adding Roth IRA Contributions is easy!

With the Contribution Schedule, you can easily simulate future contributions and changes in contributions over time — all in one place — providing your clients with an even more accurate understanding of their financial futures.

To minimize extra work to the advisor, we’ve automatically removed transfers to Roth IRAs and replaced them with an equivalent, fixed amount contribution using the new contribution tab. However, for technical reasons, we are unable to automatically update all transfers. So, you may find that some clients have this update and others do not.

For those clients where the transfer has not been converted to a contribution, the transfer will continue to work as intended. You can leave it alone, or manually remove the transfer and add a contribution in its place using the workflow we describe above.

Going forward, we strongly encourage that contributions are added using this new feature.

Stay tuned for more about Traditional IRA account Contributions coming March 2018!