for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreCheck out below for a brief overview of our Elite 8 Reports for more information on how to include eMoney’s reports in a client deliverable.

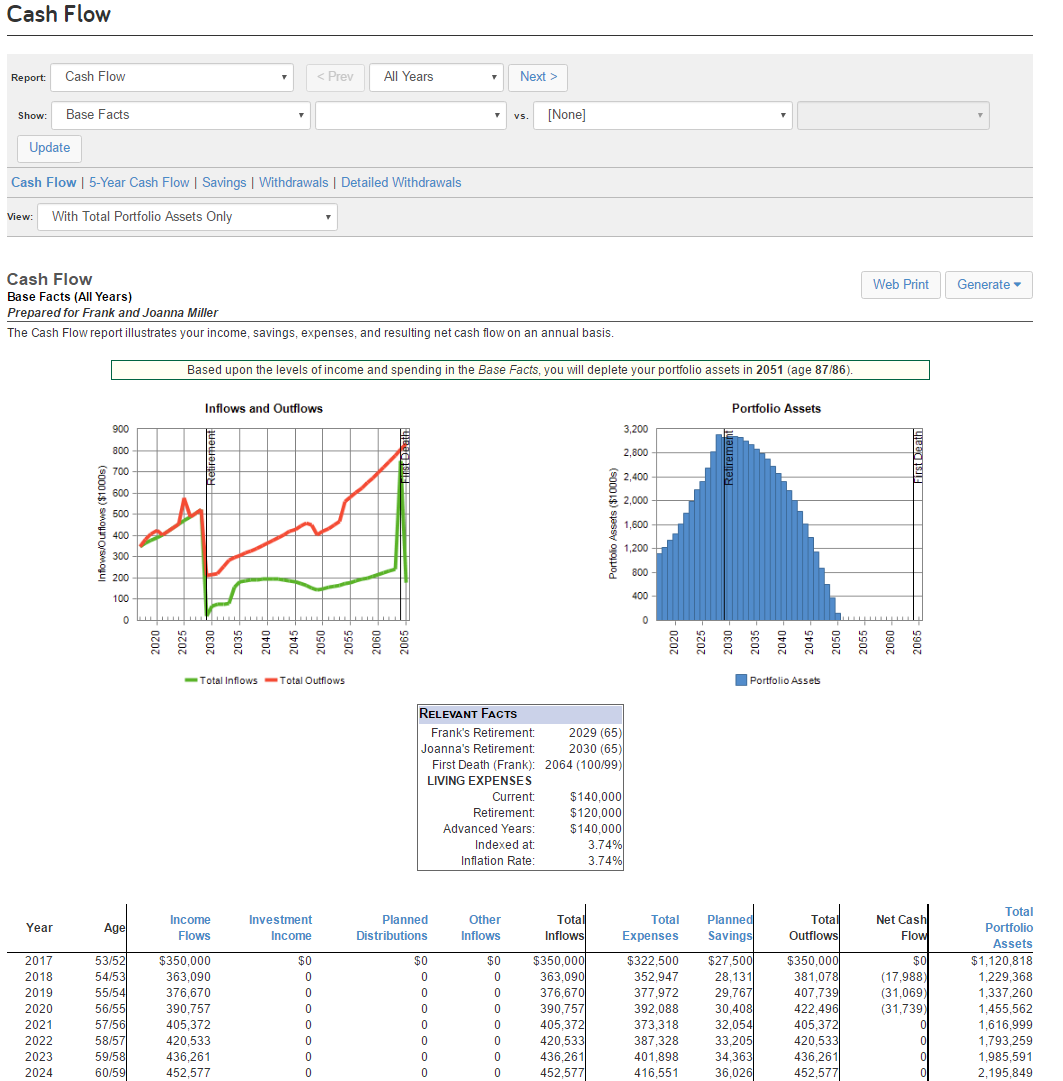

If you had to choose one report to show your client, Cash Flow would be that report. Cash flow planning is one of the easiest ways to see and explain to your clients their financial status over their lifetime. The report is integrative meaning you can drill into columns to see what each is comprised of.

Also, utilize the cash flows sub-reports like the withdrawals report which will explain what accounts will be liquidated from if the client’s expenses exceed their income. The Cash Flow report is the backbone of a financial plan.

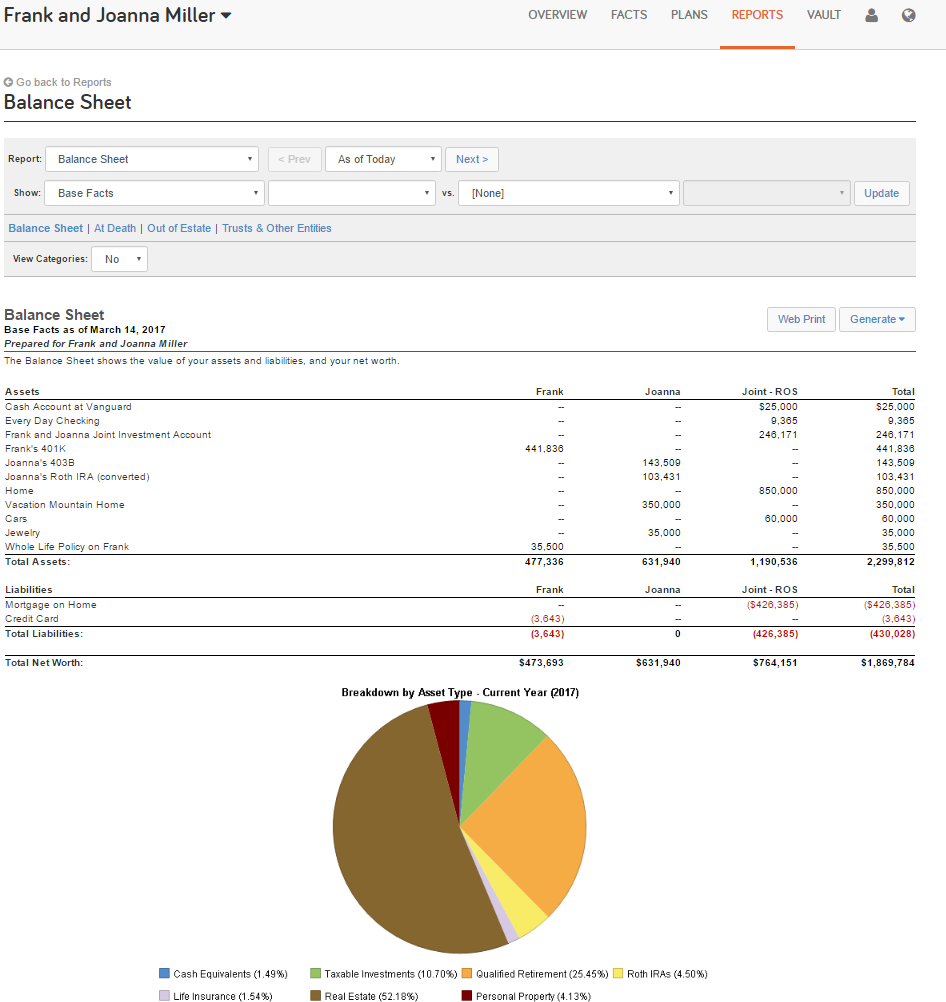

To get a snapshot of your client’s assets and liabilities take a look at the Balance Sheet report. We can see a breakdown of the client’s net worth year by year. One best practice is to frequently send this report to the vault to timestamp the client’s assets and liabilities for later reference.

The Asset Allocation report provides both a high-level and detailed view of how your clients are invested. Are they heavily weighted in stocks or bonds? Does their allocation accurately reflect their risk allocation? Utilize the asset allocation report to analysis allocation and give investment recommendations.

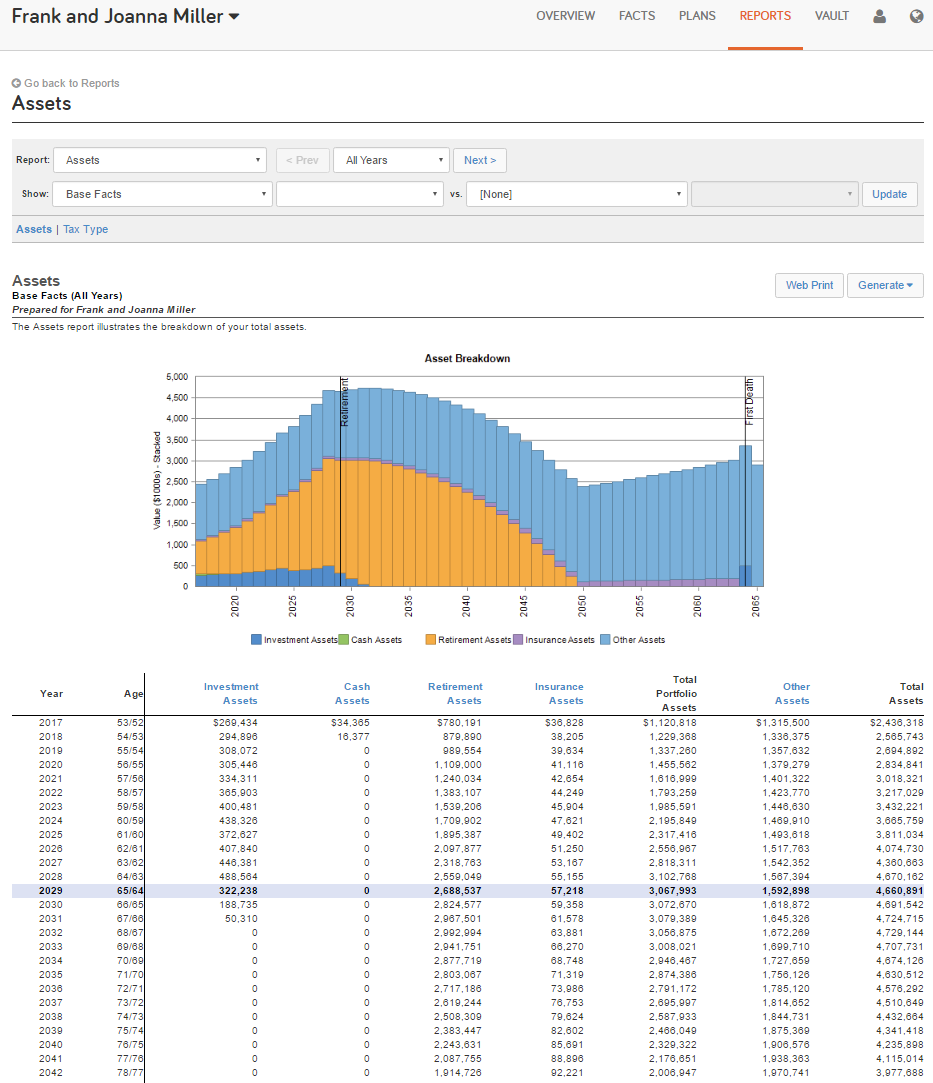

The Assets report can have a huge impact on clients showing them how their investments and other portfolio assets will grow over time. The Assets report provides a bird’s eye view of all of your asset’s growth over time your financial plan. It will also show what assets will run dry if there are any withdrawals from them.

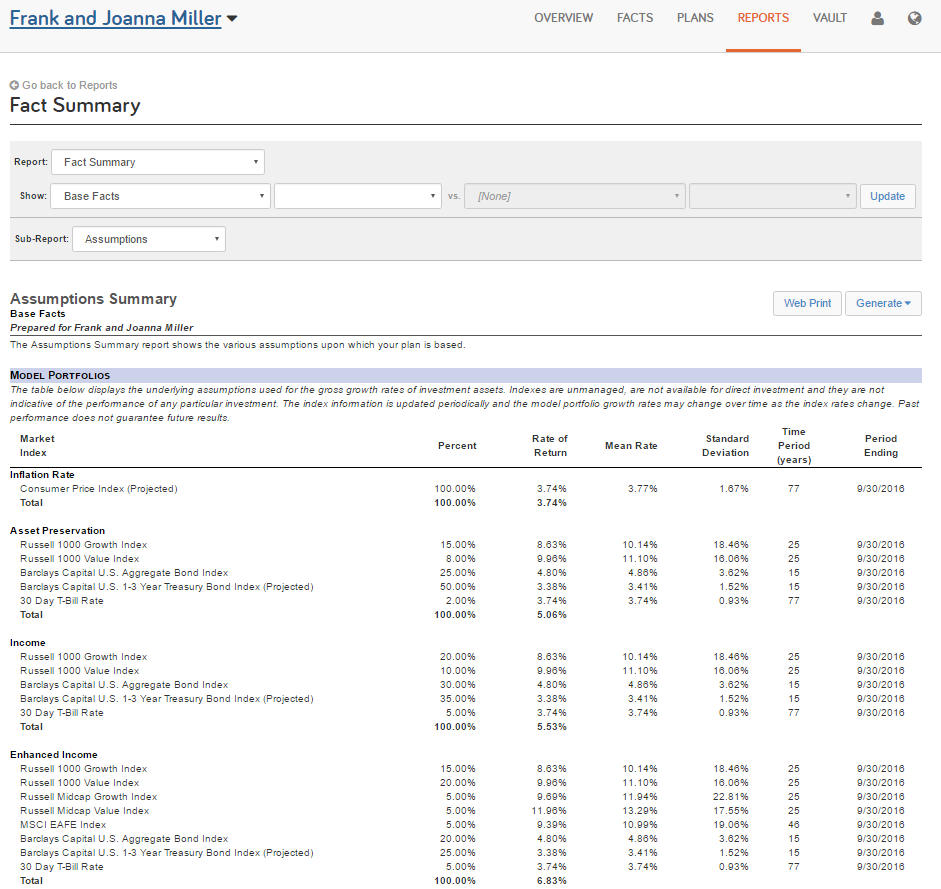

It is always beneficial to explain all of your assumptions you are making for your client when presenting a financial plan. The Fact Summary report will aggregate all your plan assumptions. It is always a good idea to save a copy of the current facts and assumptions to the vault semi-annually to time stamp your fact inputs.

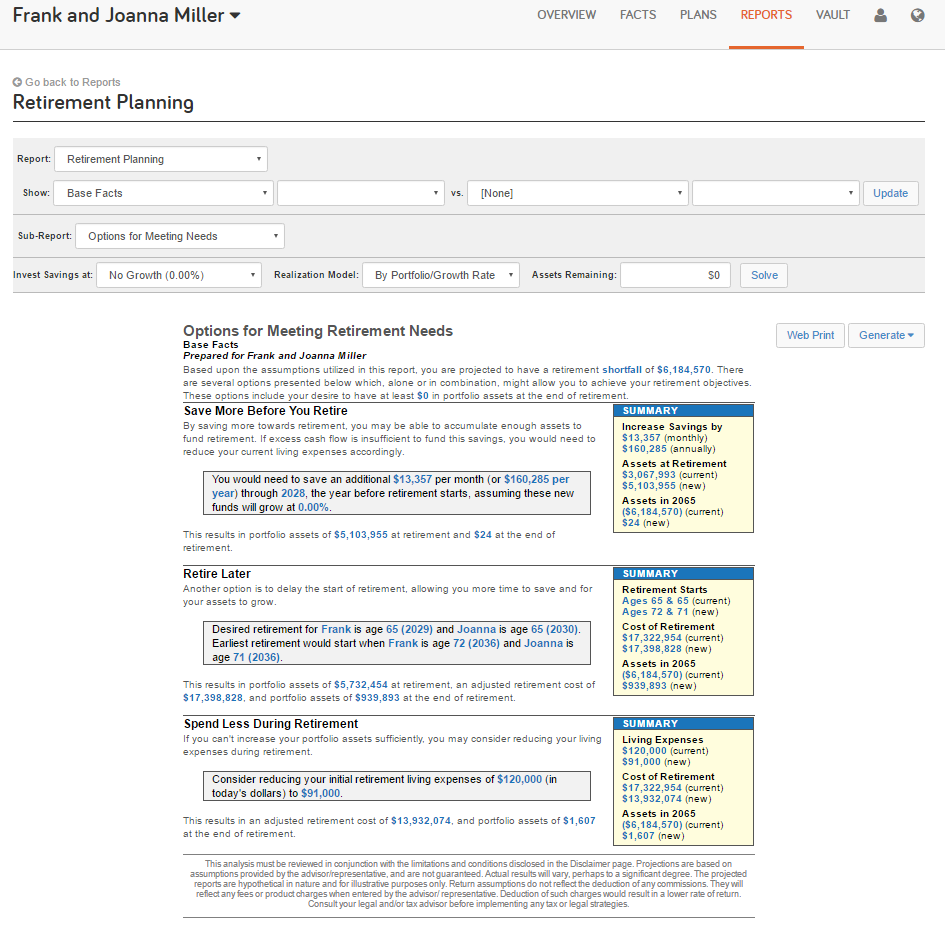

Some clients want all the facts you can provide. While other just want the answer to one question.. can I retire successfully? The Retirement Planning reports answer provides all the answers to your client’s retirement questions. The Options for Meeting Needs sub report is a great starting point when working on a retirement plan in the retirement planning report which calculates different options, your clients can take make your retirement goals.

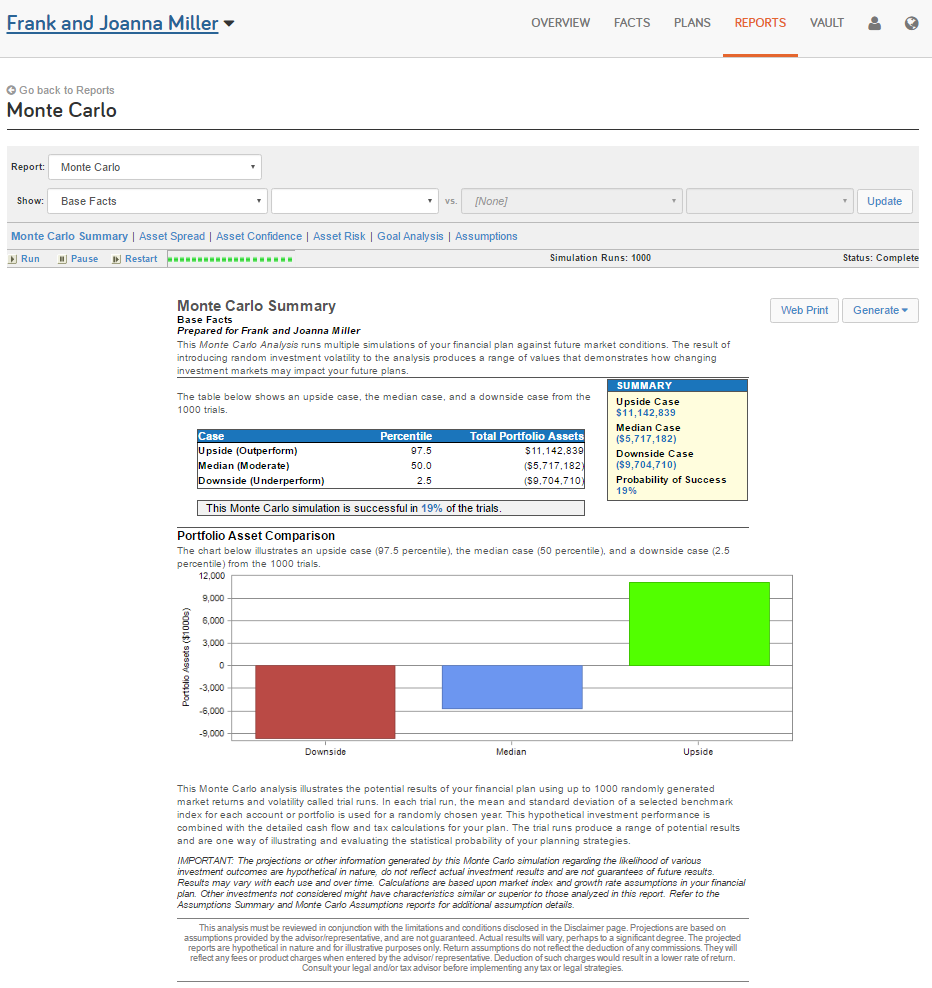

Cash Flow Reports projects straight lined growth and life doesn’t always go according to plan. To account for volatility in your financial plan, utilize the Monte Carlo Report. This runs 1000 random scenarios to stress test your plan’s success to give a more realistic view on how successful your plan really is.

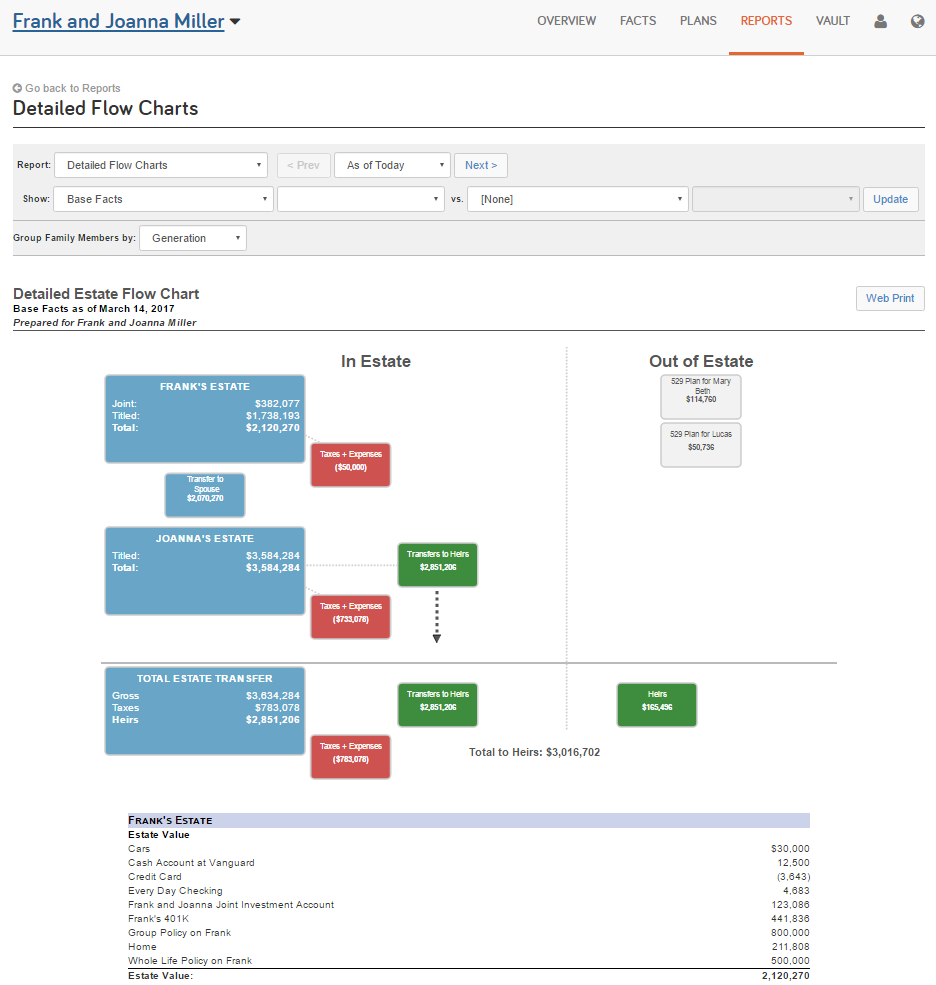

If both the client and spouse were to pass today, where will their assets go? What assets will be considered in and/or out of their estate when calculating the estate tax? The detailed flow charge aims to visually display the movement of assets to their defined beneficiaries after the deaths of the client and spouse. We can also see the impact of any taxes and expenses at death paid at death.