for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreWhen it comes time to take the plunge into retirement it can be a scary thing. Uncertainty on where the money to fund your expenses is the first unknown that you should tackle. Luckily, eMoney’s Income Summary Tool is custom built to illustrate just retirement income.

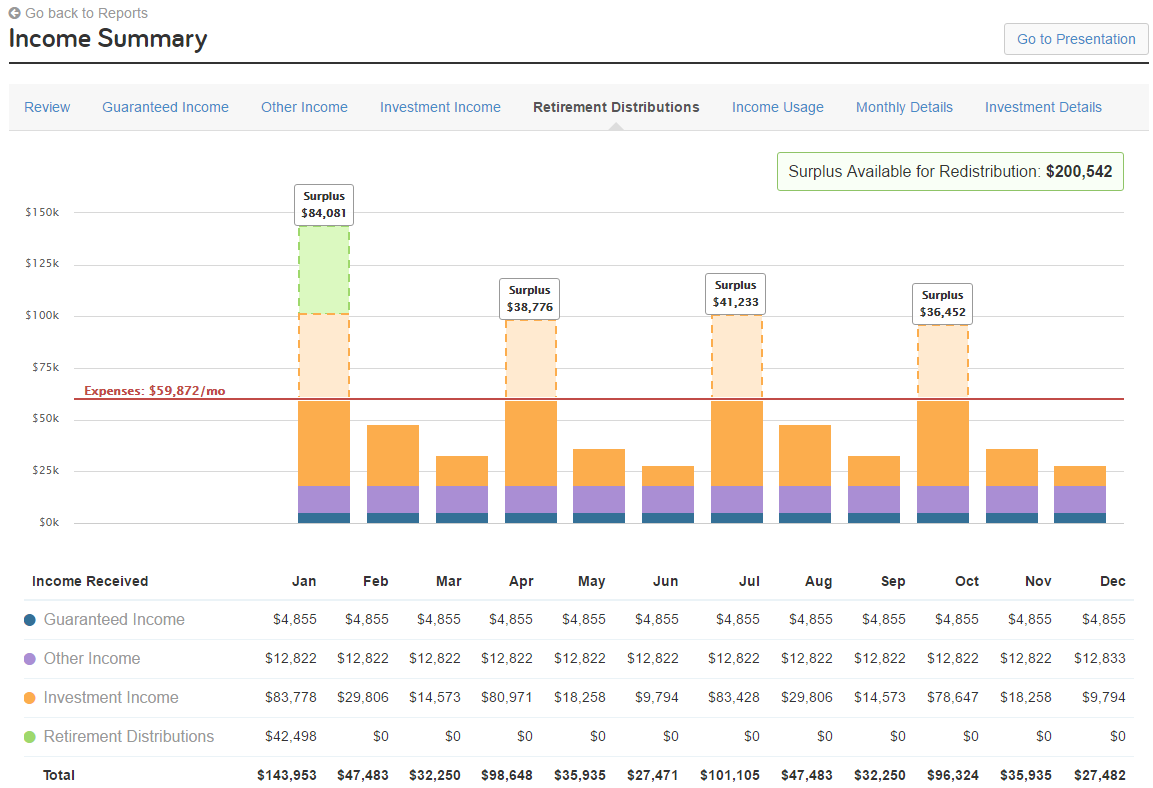

The Income Summary is a storytelling tool that helps you give your clients a clear, month to month picture of how they will meet expense needs. Navigate across the tabs to layer in different income sources. It starts by showing guaranteed income, the shows other income, investment income driven by holdings, and RMDs.

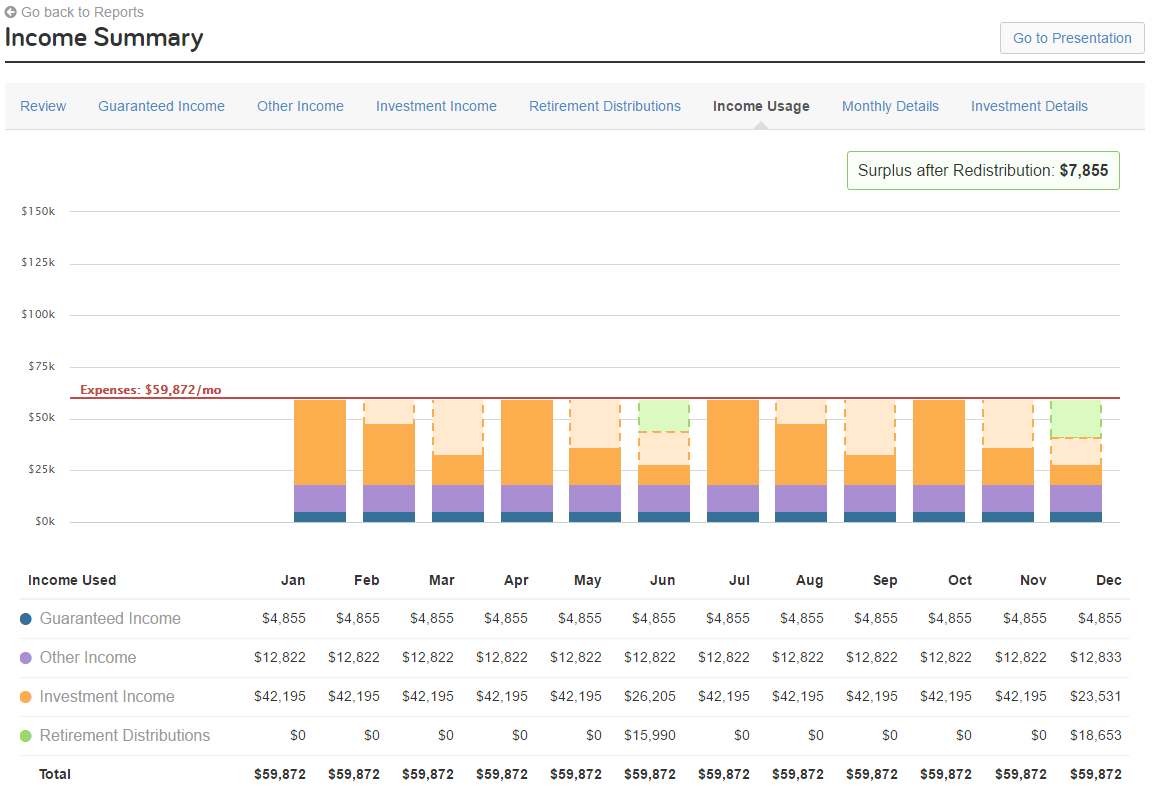

Finally, select the “Income Usage” tab to illustrate a redistribution from overly funded months to underfunded months.

By clicking “Go to Presentation,” you can upload the final product into the clients’ vault. They will appreciate the ability to be able to quickly reference which months are most beneficial to take an RMD, for example, as well as other investment related information.

After your clients review of the Income Summary Tool, they will be confident with their cash flow and will be ready to focus on other things, like how they will spend their golden years!