Discover this year’s most impactful releases and take moment to watch an on-demand webinar hosted by eMoney’s Senior Financial Planning Product & Development Consultant, John Costello, along with eMoney’s Planning Product Marketing Manager, Joe Pearson, for a recap of the year’s product releases and how these updates align with our product vision: 2022: Where We’ve Been | 2023: Where We’re Going

Released December 6, 2022

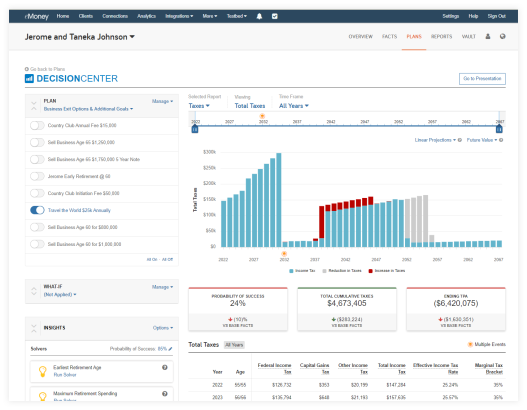

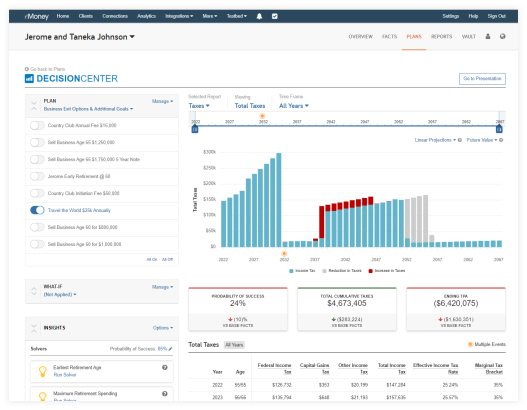

The Decision Center has tax planning! With the new Total Taxes report, you can show your clients the long-term impact of your recommendations on their total cumulative taxes in a way that is engaging, interactive, and a natural part of their planning conversation.

With Total Taxes, you can visually demonstrate to your clients how tax, charitable gifting, and portfolio strategies impact not only their plan’s Probability of Success and Ending Total Portfolio Assets but the Total Cumulative Taxes over the lifetime of the plan.

The new Decision Center report category Taxes and Total Taxes report continues our future vision for a streamlined, intuitive, and comprehensive work environment within the Decision Center.

This update is just the first in a series of tax reports coming to the Decision Center. So stay tuned for a new tax bracket chart early next year.

The Total Taxes chart will show you and your client the impact of tax-efficient strategies in real time by providing visibility into how different plan changes can impact their long-term cumulative taxes. Show your client how significant life events, such as selling a business or a vacation home, will affect their lifetime taxes.

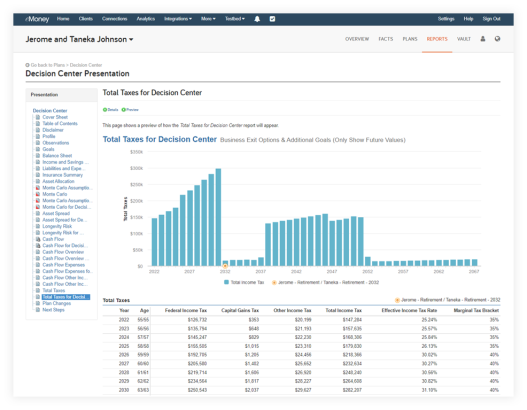

While in Decision Center, you can also select Go To Presentation to view the Total Taxes Report.

You will now notice a new Selected Report category for taxes in Decision Center. The Taxes category will launch with the Total Taxes report. To access the new Total Tax report in Decision Center, select Taxes under the Selected Report drop-down menu.

To access a step-by-step how to on this new update, go to the Help menu, type in Decision Center Total Taxes Report.

Released December 6, 2022

Foundational Planning had two incredible updates this month, learn more about each one below.

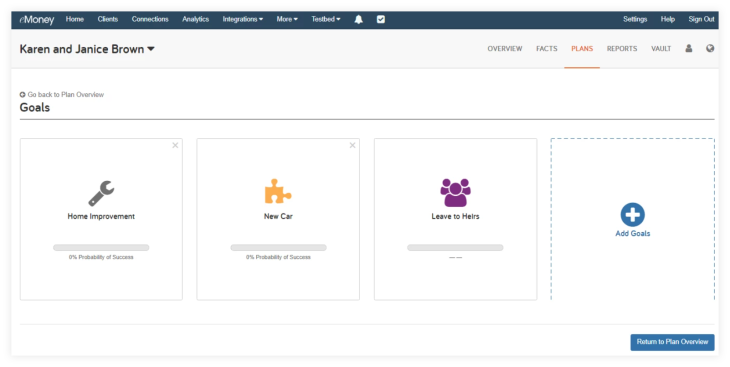

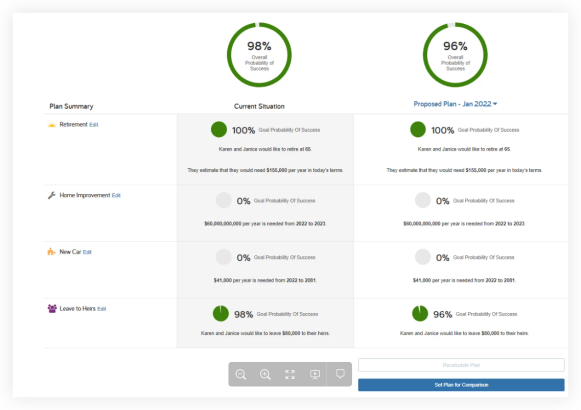

Foundational Planning users have a new way to initiate legacy planning conversations with clients. The new Leave to Heirs goal is integrated into the planning experience and shows clients how likely they are to achieve their legacy goals.

Available under Additional Goals, Leave to Heirs is a default goal that cannot be removed. However, it will not appear in any reports or presentations until data is entered.

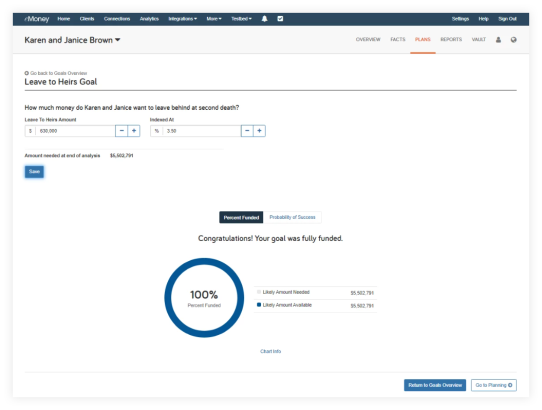

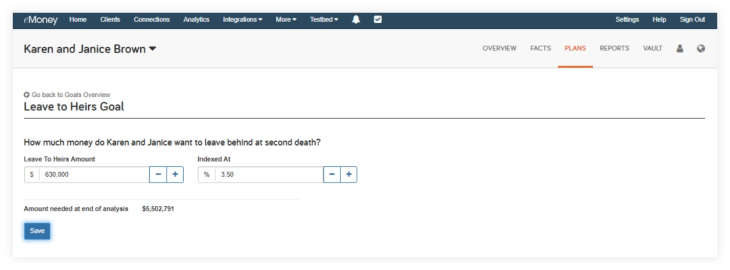

To provide greater transparency into the amount needed at the end of the analysis, it provides immediate feedback when you apply an Indexed at rate to the Leave to Heirs Amount.

Once the goal is selected, you can enter a dollar amount that the client wishes to leave to their heirs. You can also select an index rate from the drop-down menu and have the amount increase over time at the rate you and the client choose. The Amount needed at the end of analysis will be the combination of the Leave to Heirs Amount and Indexed at rate.

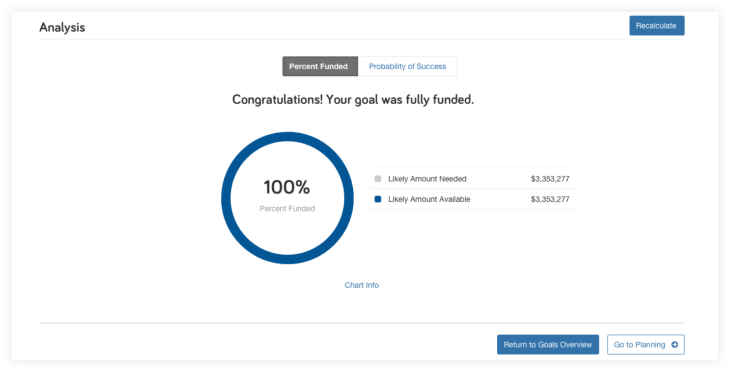

The Analysis chart will show the percentage of the goal being funded, as well as the probability of success. How the goal is funded will come from the information input within the facts.

Log in and check out the new Leave to Heirs goal today!

To better represent the action taking place within Foundational Planning when selecting a plan to use for comparison to the base facts and reports, we’re renaming the button text from Set Plan to Active to Set Plan for Comparison.

This update makes no changes to functionality and is intended only to provide consistency between the Foundational Planning tool and reports.

Released November 1, 2022

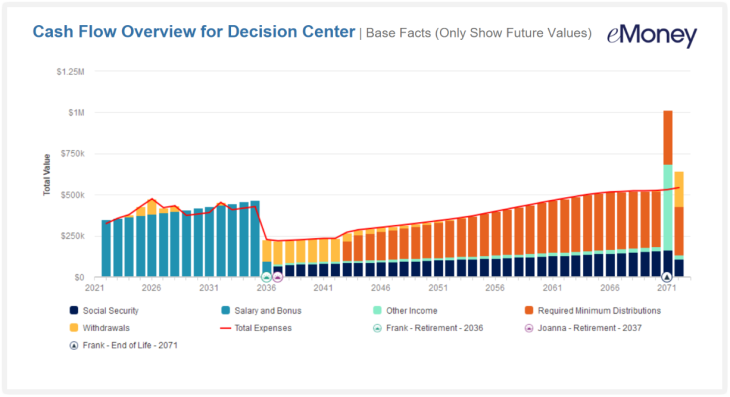

The Cash Flow and Monte Carlo report families are the most recent reports to receive an uplift in their aesthetics and readability—in line with our other enhanced reports. Enhancements include updates to report titles, text, tables, charts, orientation and more that improve the report experience while ensuring accessibility and compliance.

Please note: the 5 Year Cash Flow report has not been updated yet, but will be included in our ongoing uplift project in the near future.

Some reports will have additional options or receive a more significant visual shift to create a consistent experience across tools. Click here to preview a sample of the new printable Cash Flow and Monte Carlo reports, or keep reading below for more information on what’s changed.

In addition to side-by-side, you’ll now have the option to stack report comparison tables when viewing two different plans in your cash flow reports. Use this new option to improve readability or column-heavy reports and prevent information from being cut off the page.

The Monte Carlo Summary report will receive a more significant uplift that aligns with how Monte Carlo and the probability of success are visualized throughout the eMoney planning tools.

Your other Monte Carlo reports have received comprehensive color and chart changes to improve readability.

The Monte Carlo Statistics table will be updated to include portfolio asset totals for every year, not just the last. The columns will follow the same as the rows configured for the Monte Carlo chart.

These enhancements will be visible in the online and printed presentations under Reports.

Keep an eye out for an in-app message when these enhancements go live!

Released October 25, 2022

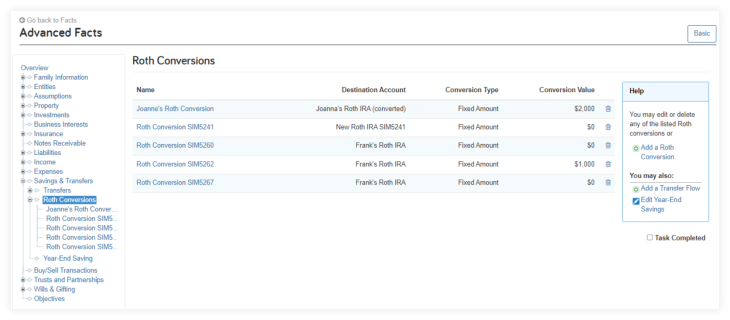

This release simplifies the process of entering a Roth conversion into eMoney, making it easier to show the tax diversification benefits Roth accounts give to clients.

Now you can stop building complicated transfer flows between traditional and Roth accounts and model them directly in Roth Conversions, available under Savings & Transfers in Advanced Facts.

While existing transfers created to model a Roth conversion will continue to work, new Roth conversions will be much easier to perform. Additionally, the new Facts will support future releases with more Roth options that will not be available via transfers.

Note: If you use the new Roth Conversions facts to replace already-created Transfer Flows, remember to delete the existing transfers.

This is just the first in a series of releases planned for the coming months that will add to your ability to demonstrate Roth and other tax strategies in engaging and interactive ways. In the future, you’ll get access to new charts like Total Taxes and Tax Brackets in the Decision Center, where you can better demonstrate the impact Roth conversions and other tax strategies have on your clients’ plans.

In addition to the tax charts, next year, your Roth facts will be updated with additional options to set the conversion up to a target tax bracket.

Roth conversions are located under the Savings & Transfers menu. Here you can add new conversions or delete previous conversions.

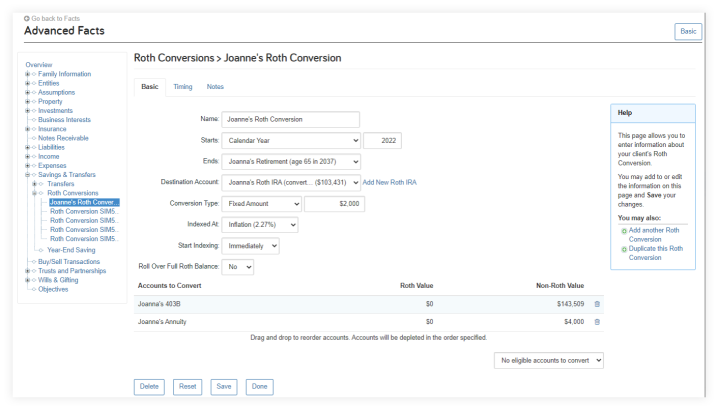

The Basic button is where you will enter the data to create the Roth conversion. First, name the conversion, enter a start date and an end date, and then follow the next steps:

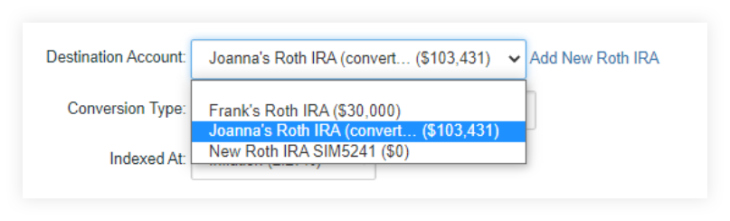

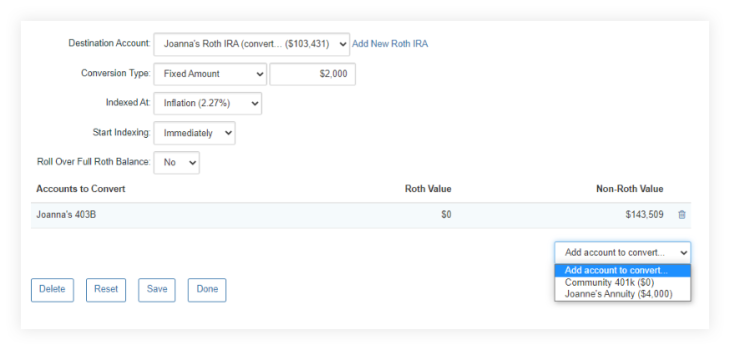

The Destination Account field will list the available Roth IRA accounts. If needed, you can create a Roth IRA by using the ‘Add New Roth IRA’ link beside the Destination Account field.

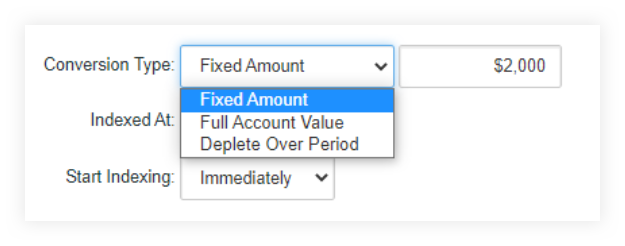

The Conversion Type field has three options:

The Accounts to Convert section of the Roth Conversion form allows you to add available qualified retirement accounts and qualified annuities as source accounts. The Accounts to Convert must be associated with the same owner of the selected Destination Account.

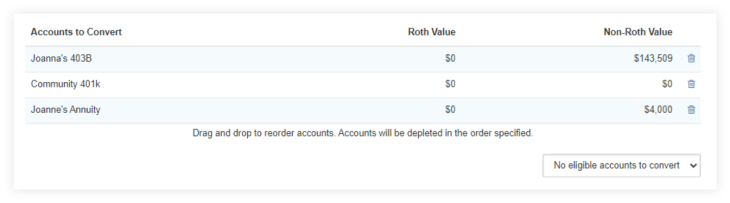

When all the desired accounts to convert have been selected, they will be listed in the Accounts to Convert section of the form displaying the Roth and non-Roth values for each. You can drag and drop these accounts to change the order. The top account will be the primary source of funds to be converted first across all the accounts provided.

Accounts that have been selected can also be removed from the list by using the trash can icon for each account. If no more accounts are available to be converted, the ‘Add accounts to convert’ menu will state ‘No eligible accounts to convert.’

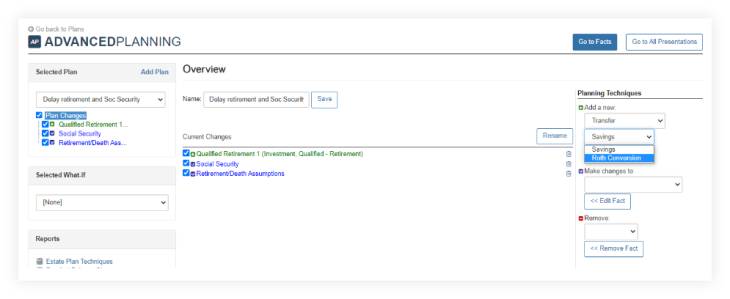

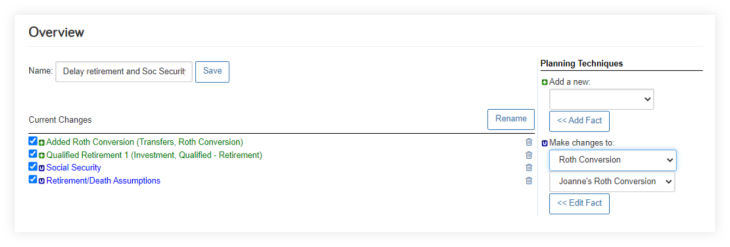

To add a new Roth conversion, select Roth Conversion in the Add a new: menu under Transfers > Roth Conversion. Adding a new Roth Conversion to a plan is the same form as used in Fact Finder.

To modify or update a Roth conversion in a plan, select Roth Conversion under the Make changes to field. Select the desired Roth conversion from the list provided. Click the << Edit Fact button.

To delete a Roth conversion from a plan, select Transfer under the Remove heading. Select the Roth conversion to delete from the list provided. Click the << Remove Fact button and then Done on the read-only form page displayed.

Keep an eye out for the new tax charts and additional Roth options in the coming months!

Released October 25, 2022

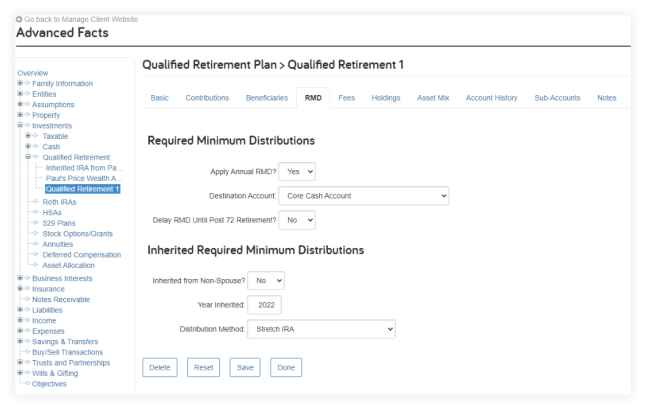

To ensure the most accurate simulation calculations based on the latest tax laws, we’re updating how qualified accounts are distributed after being inherited by a non-spouse. With these enhancements, you can expect new distribution options based on when the beneficiary inherited the account.

This feature facilitates how qualified accounts are distributed after being inherited by a non-spouse. For IRA accounts inherited from a non-spouse, you select the appropriate distribution method based on the date and age of the original owner at the time of inheritance. For all RMD-eligible accounts, you can now select a specific destination account for the RMDs upon withdrawal.

This field is optional and best used for cases where RMDs are reinvested and are not needed for cash flow purposes. If RMDs are needed for cash flow, you can still have the RMD withdrawals go into the core cash account and be included in the cash flow.

Updating the system this way ensures that simulation calculations reflect the most up-to-date tax laws at a federal and state level where and when relevant so the financial plans advisors run are as accurate as possible.

Released September 27, 2022

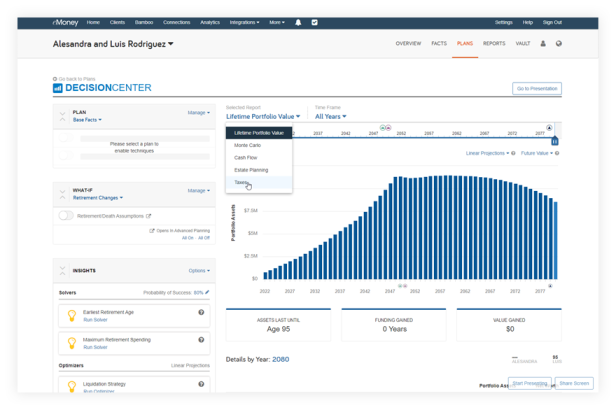

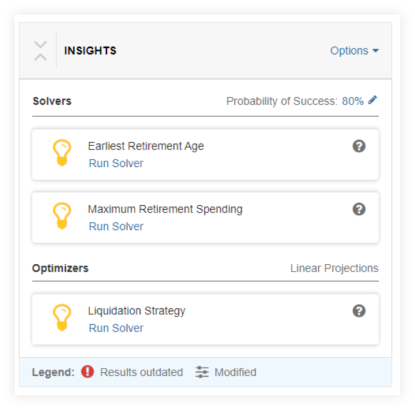

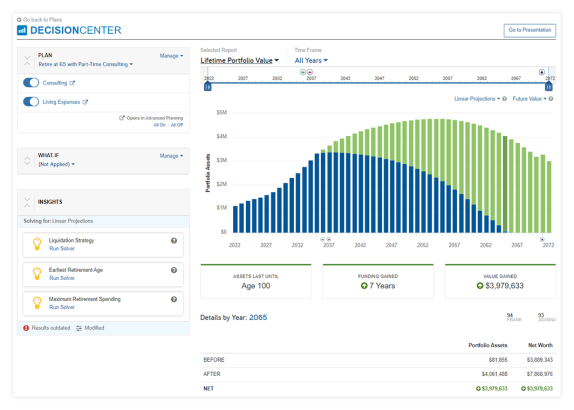

This month, we’re releasing a highly requested enhancement to the Insight section within Decision Center. With Monte Carlo calculations now available for solvers, you can easily set your client’s desired probability of success and see how to achieve the results the client, or advisor, are seeking—without having to guess, or make multiple adjustments.

Following this release, the first time you visit Decision Center, we’ll prompt you to set your target probability of success within the Options menu. Then you can run the solver for the desired probability of success, apply it to the client’s plan, and even Save to Base Facts to implement the recommendation on their plan.

Note: While Monte Carlo will be the default option, you can switch back to straight-line calculations at any time using the Options menu. Users can save a default probability of success so you do not need to enter it every time within Decision Center.

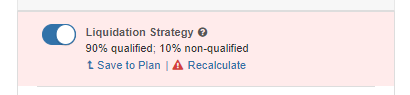

Finally, you’ll also notice that the existing options have been split into Solvers and a new Optimizers category. The Liquidation Strategy solver is designed to maximize the amount of wealth left at the end of a plan, rather than provide large scale solutions for plans not currently on target. For this reason this solver is unavailable for Monte Carlo since the results provided by the solver are unlikely large enough changes to produce significant shifts in Probability of Success.

Stay tuned for more updates to Decision Center in the coming months.

Released August 9, 2022

Early next month, a variety of your reports and presentations will be updated to include new features, improved aesthetics, and enhanced readability—in line with our other enhanced reports. Your Goal Planner, Decision Center, and Facts presentations, as well as Net Worth and Investment Report families, are included in this round of enhancements.

These changes address user feedback about report aesthetics, readability, and consistency—both across planning tools, print, and online versions.

Click here to preview a sample of the new Decision Center presentation and the Net Worth and Investments reports.

New Report Features include:

Where will these updates be visible?

These enhancements will be visible in both the online and printed presentations for the interactive planning tools under Plans and under Reports for the Net Worth and Investment report families.

Keep an eye out for an in-app message under Plans and Presentations when these enhancements go live!

Released June 21, 2022

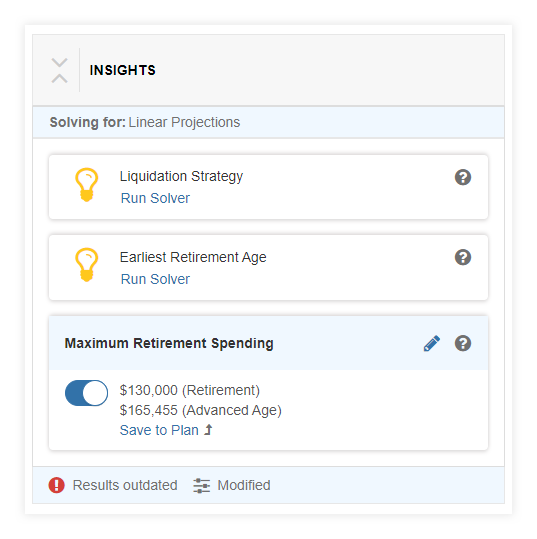

The new interactive Max Retirement Spend solver allows you to quickly show your clients how much they can spend annually in retirement while protecting their legacy.

Open Decision Center and select your desired Plan and Techniques. Then go to the new Insights area accessible below What-If in Decision Center.

Here you’ll find the new Maximum Retirement Spend solver.

Click Run Solver and it will quickly identify the maximum amount your client can spend during retirement while still meeting their expenses and Leave to Heirs goals.

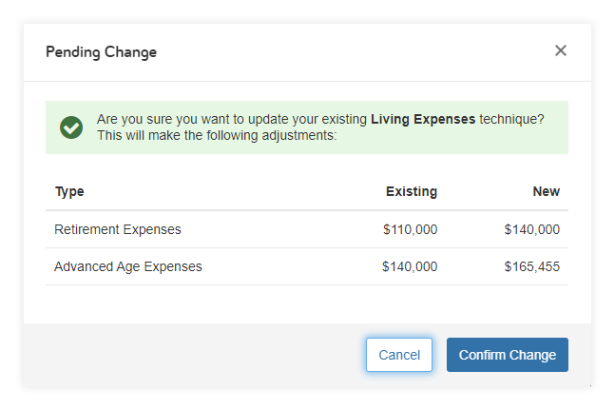

You can then save the results by clicking Save to Plan (or Base Facts). Saving will either create a new technique or when updating the client’s Facts or a similar technique, display a confirmation message indicating the existing and new values prompting you to confirm the change.

It’s important to note that if you update the current scenario by changing the Plan or modifying a Technique, the solver will display Recalculate to show its calculations have not been run against the current dataset.

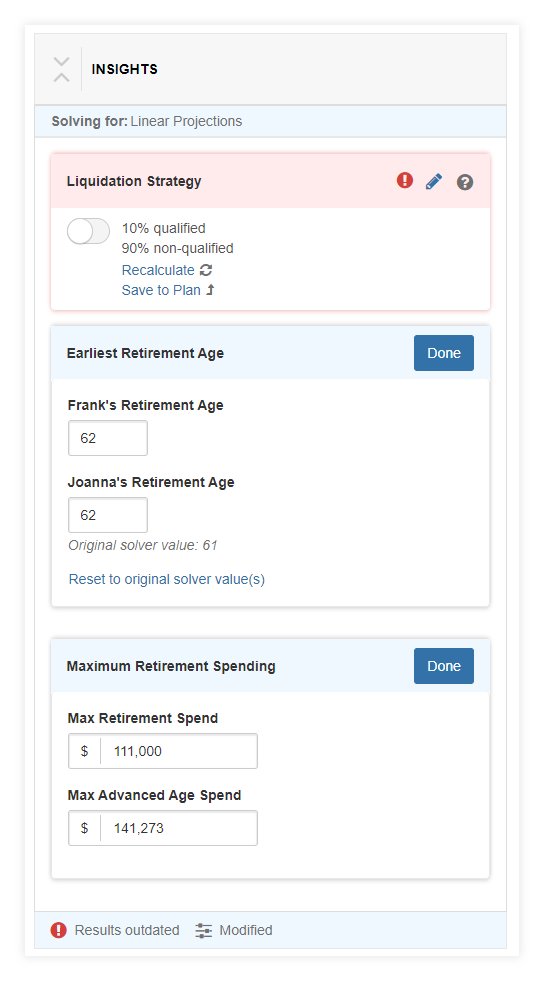

In addition to the new solver, we’ve enhanced your editing capabilities to make it easier to explore the interplay between multiple solvers and adjust the results to meet the unique needs of your clients.

Each solver can now be edited inline, by clicking the pencil icon, removing the need to open the solver to make adjustments, and allowing you to edit multiple solvers at one time.

Note: The new layout also includes icons that show you when the solver results are outdated and need to be recalculated or have been modified.

Explore this new feature by comparing different options between earliest retirement age and maximum retirement spend and see how they work towards a realistic solution for your client.

Stay tuned for even more Decision Center solver updates coming later this summer!

Released June 1, 2022

Our State Income Tax rules have been updated with the latest information to provide more accurate projections. This includes updates such as changes to state income tax brackets, exemption values, deduction values, and more.

Released May 31, 2022

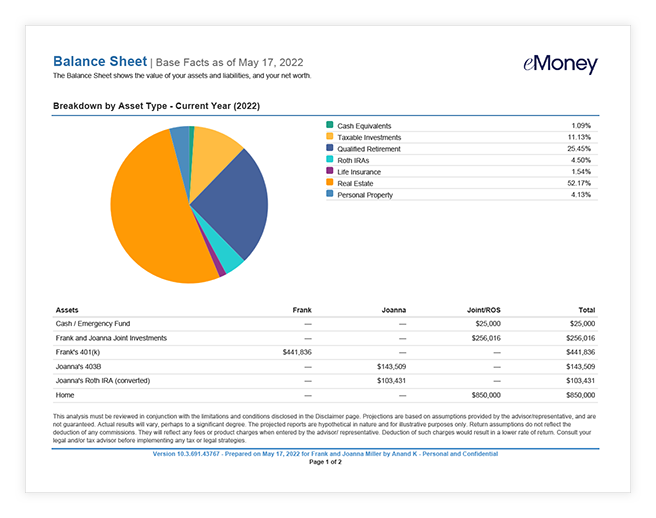

To create a more consistent report experience, the chart element of all Balance Sheet and Detailed Balance Sheet reports will be found at the top of the page in all versions as of May 31. This new layout matches the updated look and feel of these reports in the Decision Center and creates a more visually compelling experience.

Released May 3, 2022

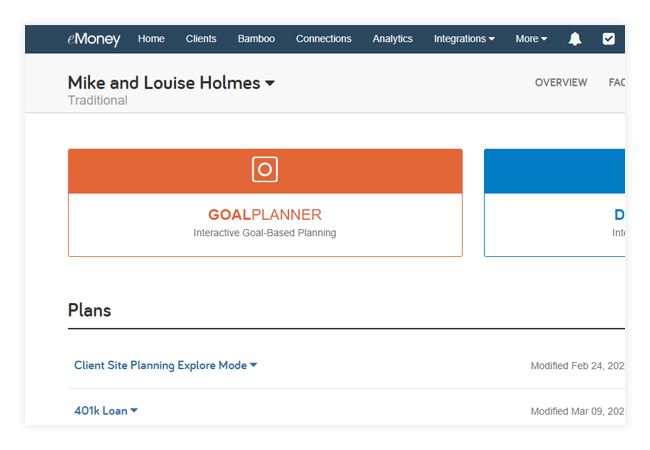

For more consistent terminology, we’ve replaced the term Scenarios with Plans in key platform areas. Previously, within our tool, we used the words scenario and plan interchangeably.

Released April 26, 2022

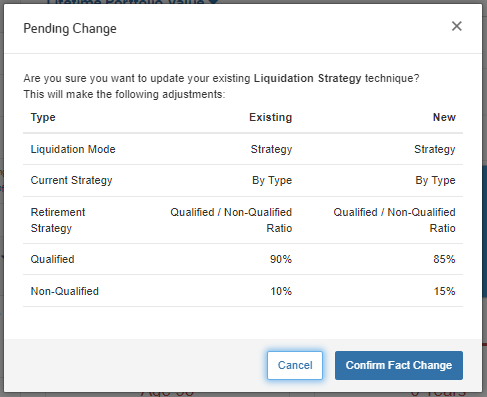

The new Decision Center Insights make it easier to identify ways to potentially improve plan results without requiring manual guess-and-check adjustments or leaving the Decision Center to make those changes. We’re making them even more flexible by allowing you to realign the output to suit your clients’ needs.

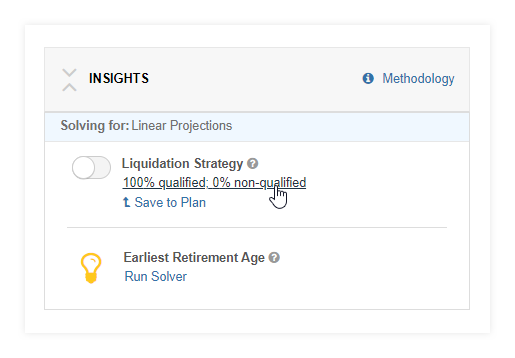

As part of our roadmap to deepen and streamline their capabilities, you can now make modifications to solver values for Earliest Retirement Ages or the Liquidation Strategy ratio for qualified / non-qualified assets.

Modifying a solver value is like making inline edits to basic techniques. When you run a solver, the resulting values are displayed as a link under the solver name, as highlighted below:

When you click the values link, the entire left panel is replaced with the Modifying Insight box that allows you to make and save your changes.

Once you modify a solver value and click Done, a Modified label will appear next to the solver title in the Insights section.

While you can toggle a solver result on and off just like a technique and preview the impact in Decision Center, you may find that the resulting value needs to be adjusted to align with your preferences. This ability to modify solver results will become even more essential as more solvers are added to Decision Center.

Released April 19, 2022

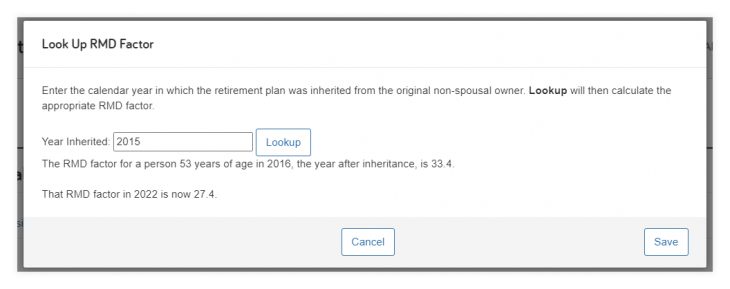

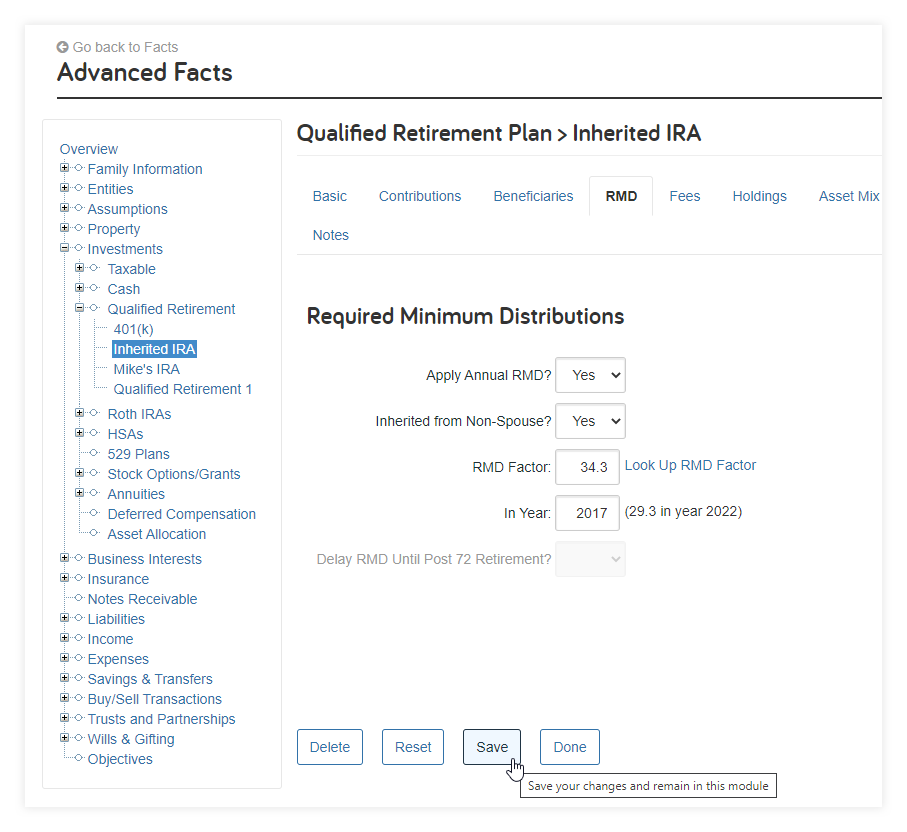

For IRAs inherited from a non-spouse beneficiary before 2020, the IRS released a new RMD schedule, slightly lowering RMDs for each age. Our life expectancy tables, utilized by our RMD lookup tool, have been updated to align with the change.

While this change will apply automatically for newly entered pre-2020 non-spousal inherited IRAs, you must take action to use the updated table for your existing accounts.

To update existing accounts, open them in Advanced Facts, go to the RMD tab, then click Look Up RMD Factor. A modal will appear where you can calculate and apply the new RMD Factor to the accounts field.

Once the RMD Factor has been updated remember to Save your changes.

Note: If this change is not applied to existing clients, their RMDs will be larger than reality.

Released March 23, 2022

For advisors, not using custom capital market assumptions, search Compare / Update Market Indices under Help for step-by-step instructions on how to update your capital market assumptions with the latest data.

Note: If you use custom capital market assumptions, this update does not apply to you.

Your capital market assumptions are the core of eMoney’s powerful simulation. They are the foundation of all of your client’s financial plans. That’s why eMoney makes new historical data available quarterly, so you can keep these building blocks up-to-date.

We recommend reviewing existing plans and the changes to your capital market assumptions prior to updating your indices.

Use the Compare / Update Market Indices How-to under Help or follow the steps below to update your capital market assumptions:

To update the market indices across your advisor assumptions:

To update the market indices for a single client:

Released February 15, 2022

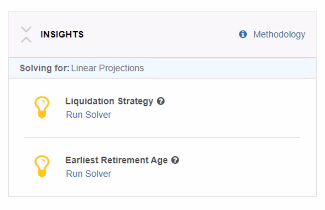

We created a more intuitive and streamlined planning experience by adding solvers to a new Insights section of Decision Center. These solvers help to automatically maximize plan success by running simulations and implementing changes to achieve your desired plan results.

This release includes two new solvers for Liquidation Strategy and Retirement Age.

Note: You can learn more about how each solver works by clicking Methodology within Insights or by clicking the tooltip next to each solver.

Open Decision Center and select your desired Plan and Techniques. Then go to the new Insights area accessible below What-Ifs in Decision Center. Here you’ll find two new solvers for Liquidation Strategy and Retirement Age.

Click Run Solver and it will begin the calculations. Once the calculations are complete, toggle the solver on to see the impact on the Plan.

You can then save the results by clicking Save to Plan (or Base Facts). Saving will either create a new technique or, when updating the client’s Facts or a similar technique, display a confirmation message indicating the existing and new values prompting you to confirm the change.

It’s important to note that if you update the current scenario by changing the Plan or modifying a Technique, the solver will display Recalculate to show its calculations have not been run against the current dataset.

Stay tuned for even more Decision Center updates coming this year as our planning product roadmap continues to focus on expanding and deepening planning capabilities, offering more streamlined and intuitive workflows, and supporting collaborative planning conversations.

Released January 3, 2022

We’ve updated all of our Federal tax, contribution limit, and social security settings with the latest values for 2022 and beyond. These updates include marginal taxes rates and brackets, deductions, phaseouts, tax credits, exemptions, exclusions, and more..

Released December 6, 2022

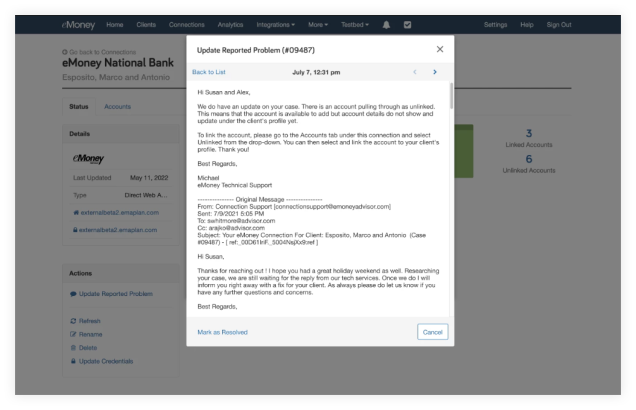

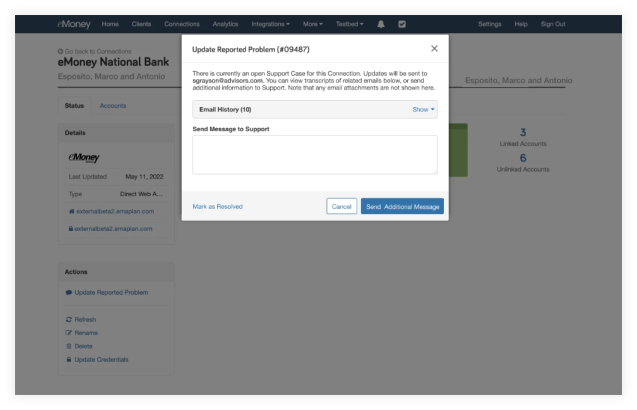

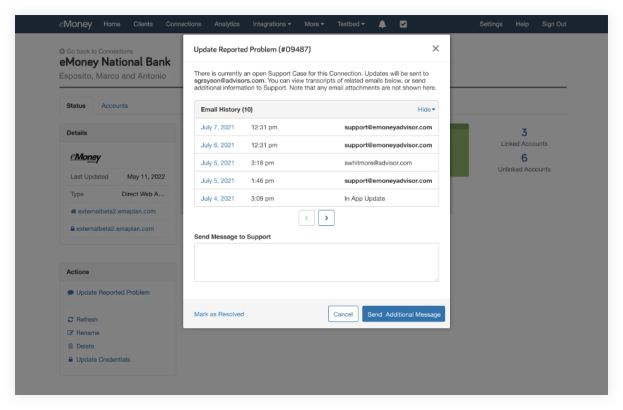

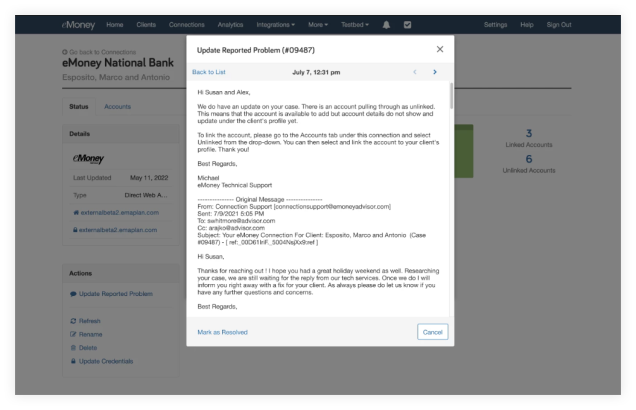

The new Conversation History feature within the Report a Problem workflow provides better insight and visibility. All individuals involved in helping clients resolve issues can now see a full conversation history, including the date and time of all outgoing and incoming messages related to a connections-related issue.

This is especially useful for instances when multiple people are involved in the resolution of a connection issue.

When a connection is selected, to the left you will see the Actions box. Click on Update Reported Problem to send a message to the support team. Above that, you can see your Email History where you can click Show to view all previous communications.

The emails are presented in chronological order, with five per page and the most recent email at top of the list.

When you select a specific email, the text includes the full history of the email.

If the issue is resolved, you can click Mark as Resolved, to close out the case or click Cancel to go back to the connection.

Released November 1, 2022

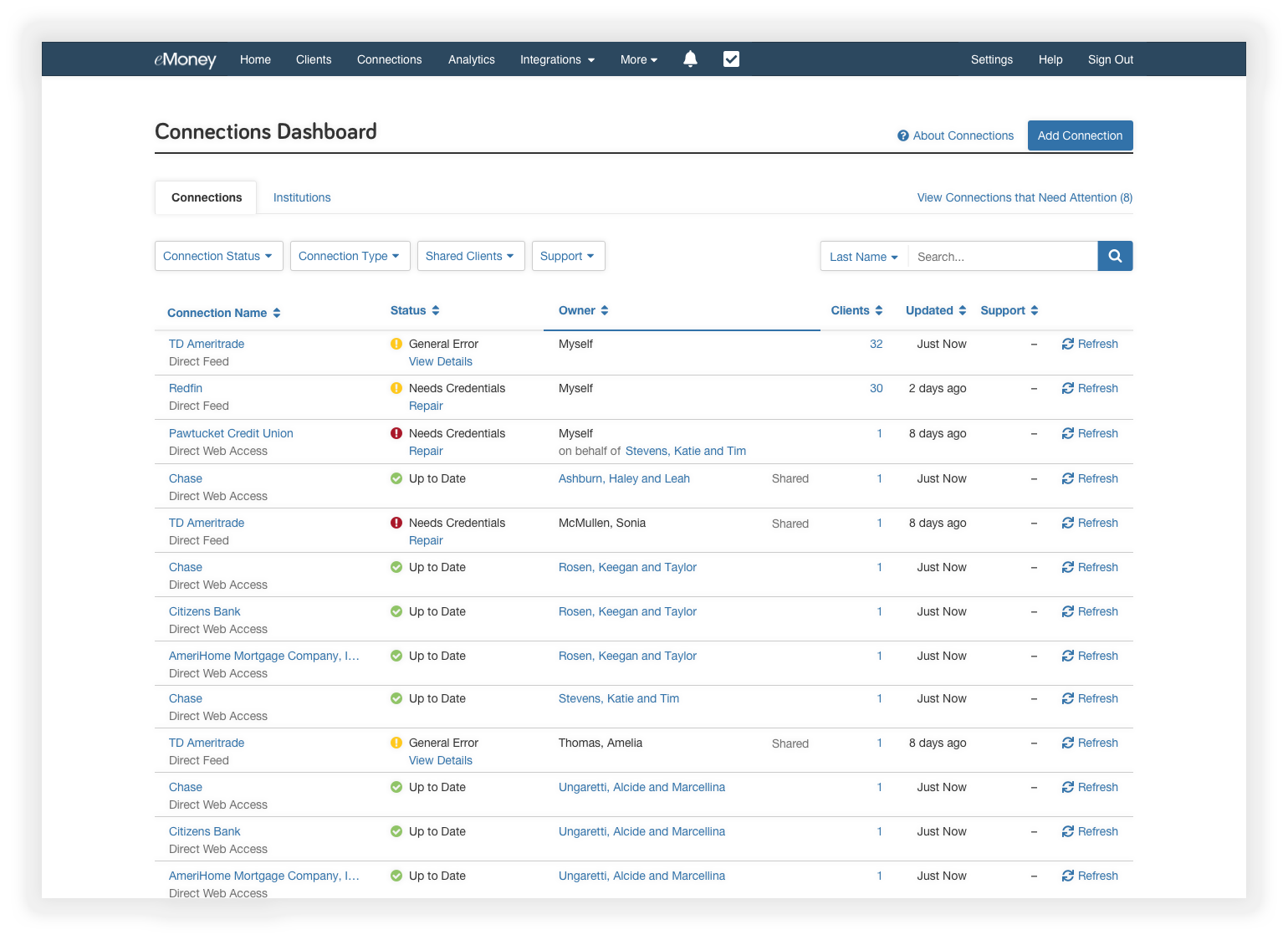

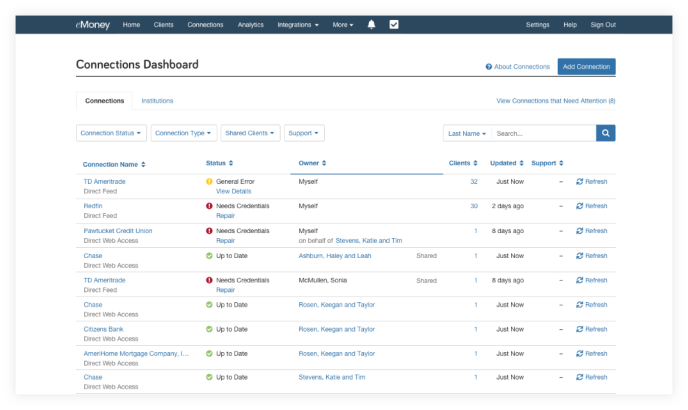

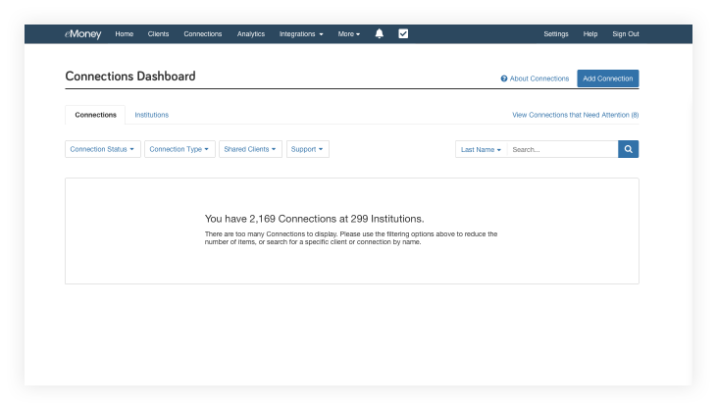

Connections on your dashboard are getting more enhancements! The dashboard is now consolidated into a single search and filterable table, providing more visibility into all your connections while also saving you time.

In addition to a new data display experience, expect to see deeper filtering capabilities. See below for more detail.

The two notable Connection Dashboard improvements include:

Enhanced Filtering:

Released August 30, 2022

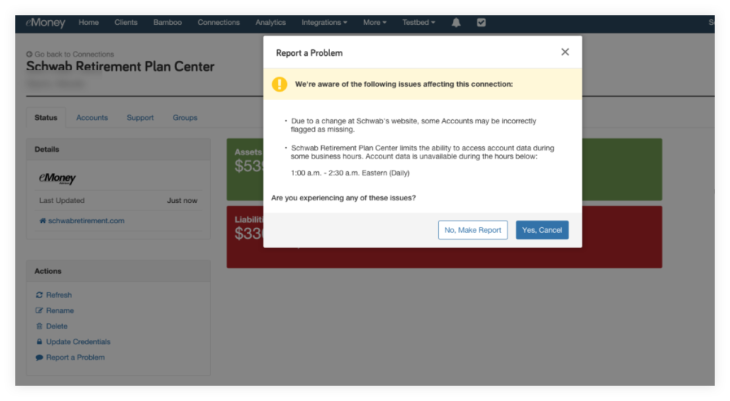

Provide much-needed context to your clients while reducing the number of issues you report by gaining insight into known connection issues. Now, additional context will be included when maintenance events, outages, or specific issues related to the connection are known and are actively being addressed.

With this additional visibility, you’ll be better informed to communicate with your clients and keep them in the know with the latest connection updates.

When you Report a Problem, the modal will present a list of known incidents. If this is a temporary issue (such as a maintenance event), or a known issue the Support team is actively working on, you can cancel your request and update your client.

If your issue is not represented, continue with your Report a Problem submission.

Released August 30, 2022

These two client site enhancements focus on streamlining how clients create and maintain connections.

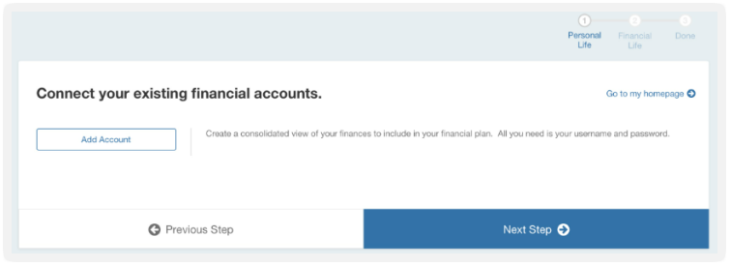

Soon, onboarding your clients will get easier. Clients going through the Onboarding wizard will be prompted to connect their accounts as part of the workflow. This update ensures all essential information is collected as part of the Client Site onboarding process.

Not sure what the Onboarding wizard is? Learn more about how to enable it here

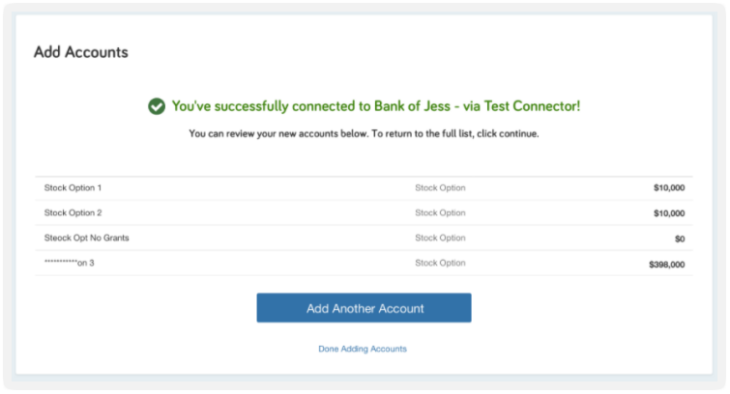

Once this feature goes live, the client will be presented with the option to “Connect your existing financial accounts” as a step in the onboarding process.

In line with the existing process, they’ll be prompted to Add Accounts and have the option to connect or manually add accounts. Once they’ve added all desired accounts, they can click Done Adding Accounts to continue with the Onboarding wizard workflow.

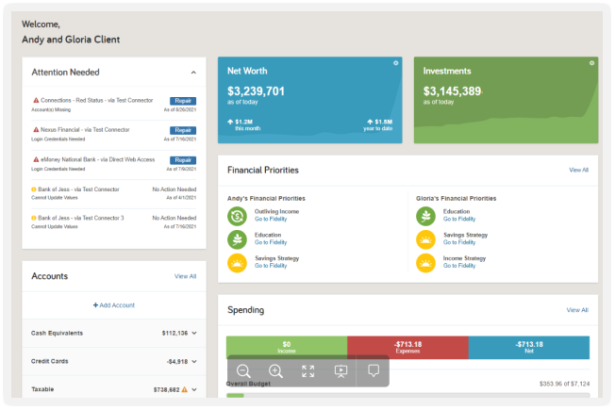

To improve visibility into broken connections and simplify the process of fixing them, next month we’ll begin adding account issues to the home.

This update is based on feedback from Client Site users who want a simpler way of staying up to date and taking action to fix their Accounts. Clients will simply click the Repair button in the new Attention Needed tile.

Stay tuned for these updates soon!

Released August 30, 2022

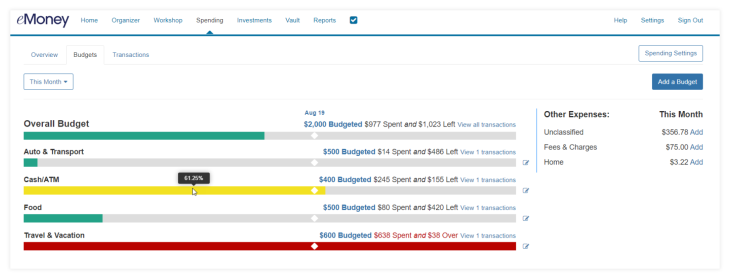

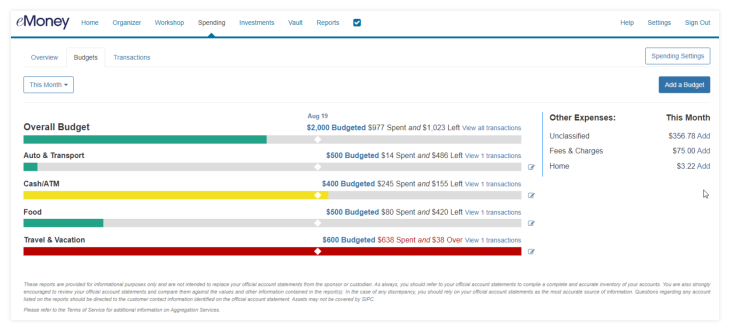

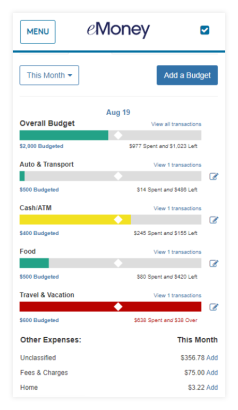

The Spending and Budgeting tool on the Client Site has received quality of life updates to improve your client’s experience. Building on the layout and mobile experience of the Budgets page, all values and links are now found on the same line for each budget, including minor quality of life updates.

Under Spending and Budgets, the client can now see what percentage makes up the whole budget when they hover their mouse over one of their budgets.

The date has also been added, above Overall Budget, to show the client where they are within the month.

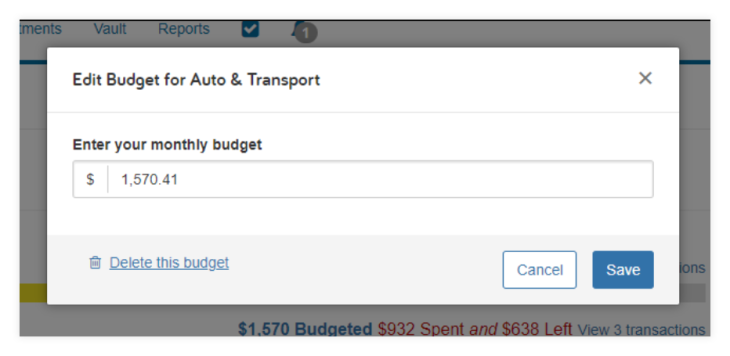

The client will now have the option to delete or edit a budget within the same pop-up screen.

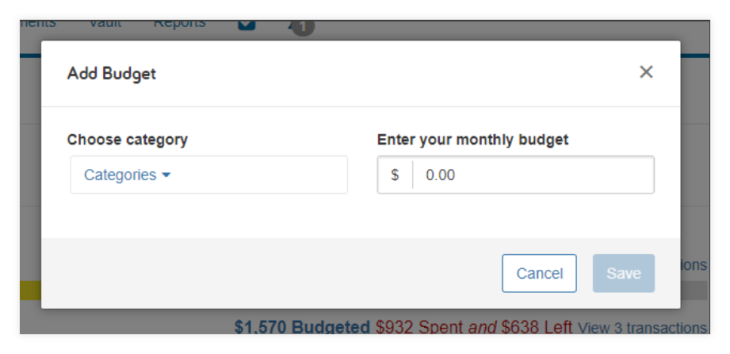

The client will also be able to add budgets more easily from the Budgets tab.

Budgets 2.0 brings a more mobile/tablet friendly experience on the Overview, Transactions, and Budgets pages.

Released March 29, 2022

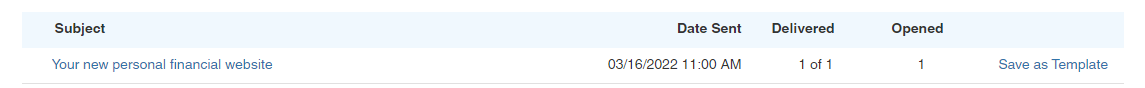

Based on your feedback, we’re adding the ability to save emails you create and send as templates. This feature will help you save time when preparing essential communications for your business.

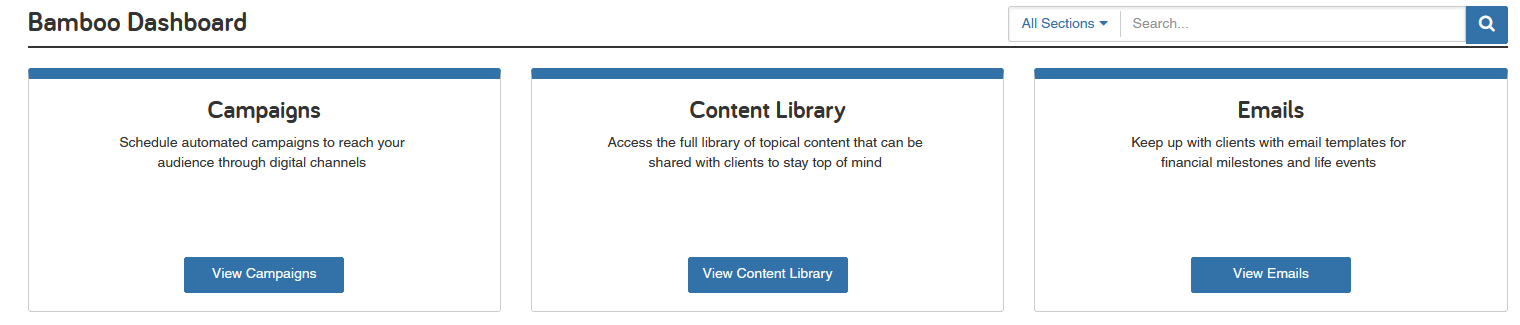

Log in to the Bamboo Dashboard and click View Emails to open the Emails tile. Now select the Sent category to view the emails you’ve sent to your clients and prospects. Here you’ll see a new Save as Template option to the right of your sent emails.

Click Save as Template and confirm your selection, and a new template will become available in the My Templates folder.

Select Use Template under the Action menu to the right of each template to create a new mail with the pre-populated subject, body, and eMoney content.

Note: Custom attachments are not saved to email templates.

Now you can add the recipients and send the email and send.

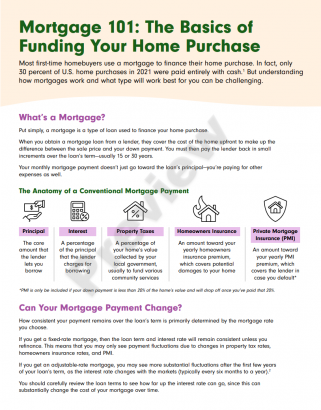

Working with first-time homebuyers? Provide essential advice to clients entering the market with new campaigns and articles in Bamboo.

Keep reading below for a summary of what’s new and updated this month.

Mortgage 101: The Basics of How to Buy a Home

Share this article to break down the different home financing options for first-time homebuyers.

Take These 5 Financial Steps Before Buying a House

Provide your clients with an overview of how they need to prepare financially for buying a home.

5 Modifications to Make to Your Finances After Buying a Home

Share this high-level overview of what aspects of your client’s financial plan need to be revisited after buying a home.

6 Wise Ways to Use Your Tax Refund

Show clients financially responsible ways to use their tax refund, such as paying down debt, contributing to an IRA, or building an emergency fund.

Financial Advice for First-Time Homebuyers

Help first-time homebuyers understand how purchasing a home fits into their greater financial picture and how advisors can help them better understand the actual cost of owning a home.

Financial Advice for Home Sellers

Guide potential home sellers by walking through the primary factors they should consider when deciding if it’s the right time to sell and what they can do to get the best price for their home.

Finally, we’re updating the videos below to be more diverse and inclusive.

Not a Bamboo subscriber? Click here to learn more about our marketing automation platform.

Released February 15, 2022

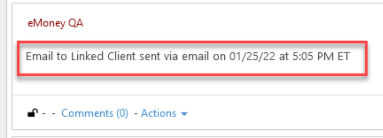

Building on the Bamboo | Redtail integration launched last year, we’re streamlining email documentation by automatically creating a Redtail Note when a Campaign or Email is sent to a client from Bamboo.

A Redtail Note will be created for all contacts within a Redtail Group regardless of whether they are linked to an eMoney Client. For Redtail contacts linked to eMoney clients, a note will be added within the eMoney’s Notes and Tasks.

The notes will show that an email was sent and will include the subject line, date, and time sent (in Eastern time).

Released January 25, 2022

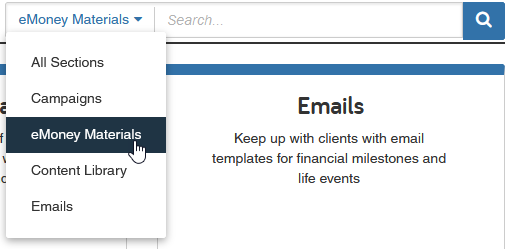

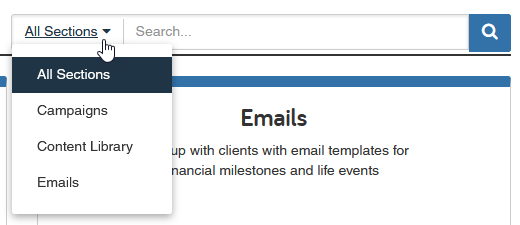

To streamline the content management experience, we are moving eMoney Materials into the Content Library section on January 25. Once consolidated, all video, email, and PDF content available within Bamboo can be accessed in one location.

Two new Content Library categories will be created to accommodate this change—eMoney Client Site and Digital Planning.

You can find all content from the previous Client Site Best Practices and Client Site Onboarding area of eMoney Materials under the new eMoney Client Site category and all the materials from Showcasing Your Value under the new Digital Planning category.

What do the new Content Library categories represent?

In coordination with the content relocation, we’ll update the Bamboo Dashboard to remove the eMoney Materials. All links to eMoney Materials within the platform have been removed or replaced with links that take you directly to the Content Library.

Not a Bamboo subscriber? Learn more about the marketing platform here.

Released November 21, 2022

We know questions come up, and when they do, you want help that’s quick and efficient. Starting November 21, when you contact Client Support, you will notice a different experience within our phone system. Our goal is to make it easy for you to do business with us by getting you to our world-class support representatives as quickly as possible.

New Speech-enabled System The eMoney Customer Support phone line is converting to a speech-enabled system that will allow you to simply speak into the phone to tell us what you’re calling about. With just a few simple words, new machine learning and natural language recognition software will guide you to the right representative. No more spending minutes pressing several options and getting lost in a sea of menu options.

Automatic Verification

The system will also automatically verify the phone number you’re calling from and quickly route you to a representative if we have a phone number match on file. This means when the system recognizes and verifies the number, the representative will jump right into troubleshooting your problem, as opposed to spending a few moments to verify your account.

Self-service Password Reset

The final enhancement is a self-service element allowing automatically verified clients to unlock their accounts or reset their passwords 24 hours a day, seven days a week, without having to interact with a representative.

Released November 14, 2022

We recently transited Allianz connections to API. Our API connections are a more secure and reliable way to aggregate data. This update and transition allows you to bring over your clients’ data in a more secure manner while reducing the number of connection issues in the future.

Your clients will need to re-establish the Allianz connection by re-entering their login credentials to allow their accounts to go back to an ‘up-to-date’ status. The clients will also see an in-app institution note at the top of the screen as a reminder to update the connection.

Learn more about our API Connections here. In addition, here is more information on all Client Connection Resources.

Released October 4, 2022

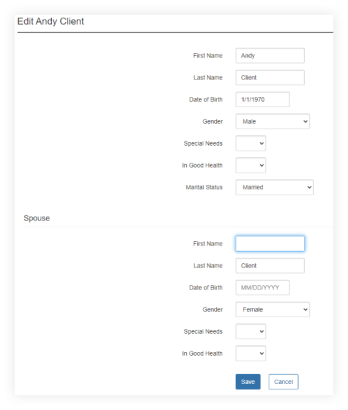

To ensure we’re as inclusive and diverse as our client base, the Last Name and Gender fields for clients’ spouses will no longer be prefilled as they are today.

From the Client Site, the client will click the Organizer tab. Once there, they’ll click Edit the Client > Basic Information.

Currently, this is where you’ll notice the Last Name and Gender fields have been pre-filled in by default in the Spouse section.

Following this release, these fields will be left blank for the client to fill out.

Released August 19, 2022

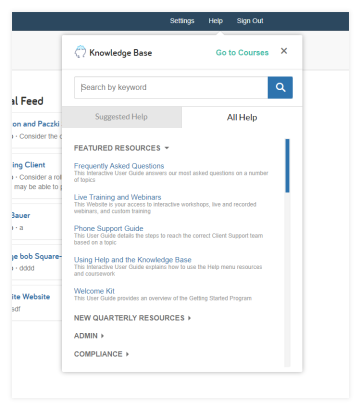

As you know, there are plenty of valuable in-app resources only a click or two away. To provide better clarity on what a resource is before you click it from your Help menu, you’ll notice new resource descriptions. See the example screenshot below for reference.

Released July 19, 2022

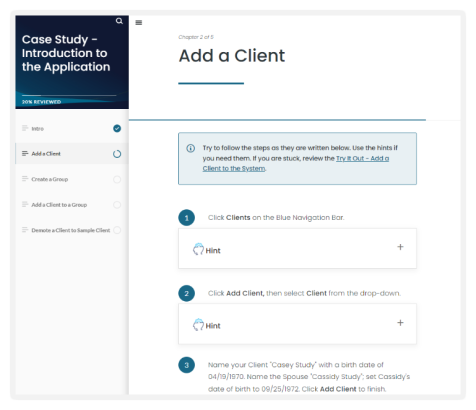

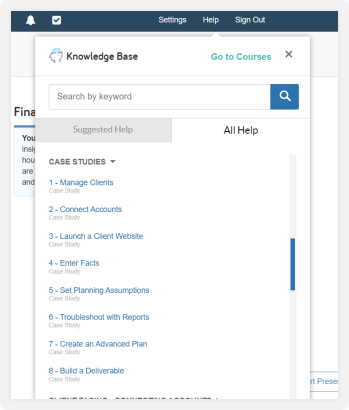

New eMoney Case Studies empower you to walk through a full client lifecycle in eMoney. With this curated series you can walk step-by-step through everything from creating the client in eMoney to building a plan and creating the end deliverable.

The Case Studies will be available through the Help menu in two places: under the Courses menu in a new Case Studies tile, and by searching Case Studies in the Help menu.

Case Studies are available to those with eMoney Pro/ Premier features, and will not appear for users without the Client Site or Advanced Planning.

Released June 21, 2022

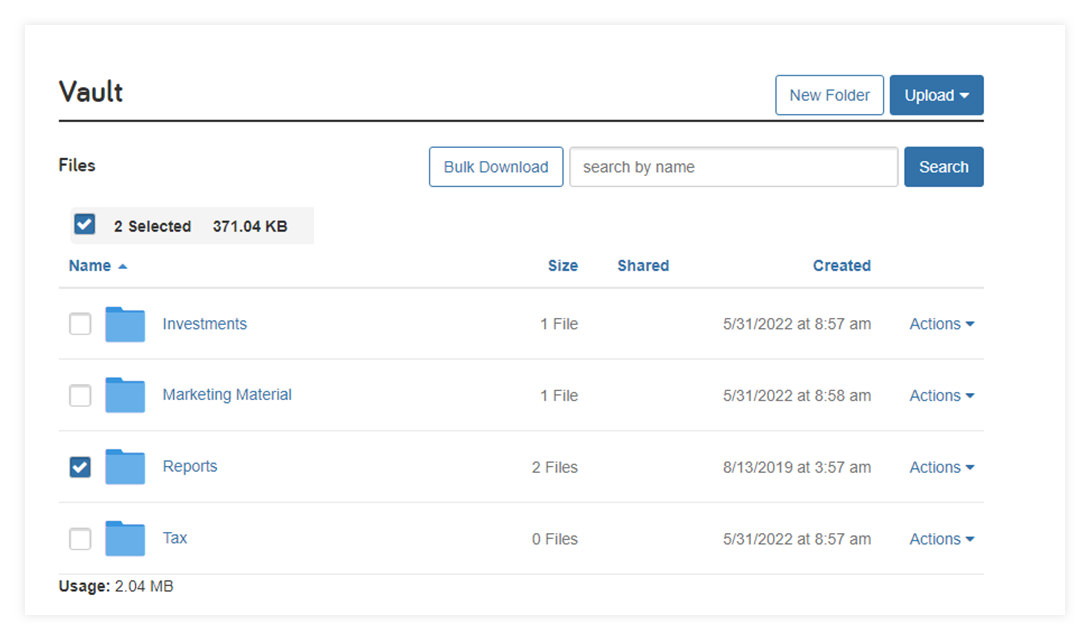

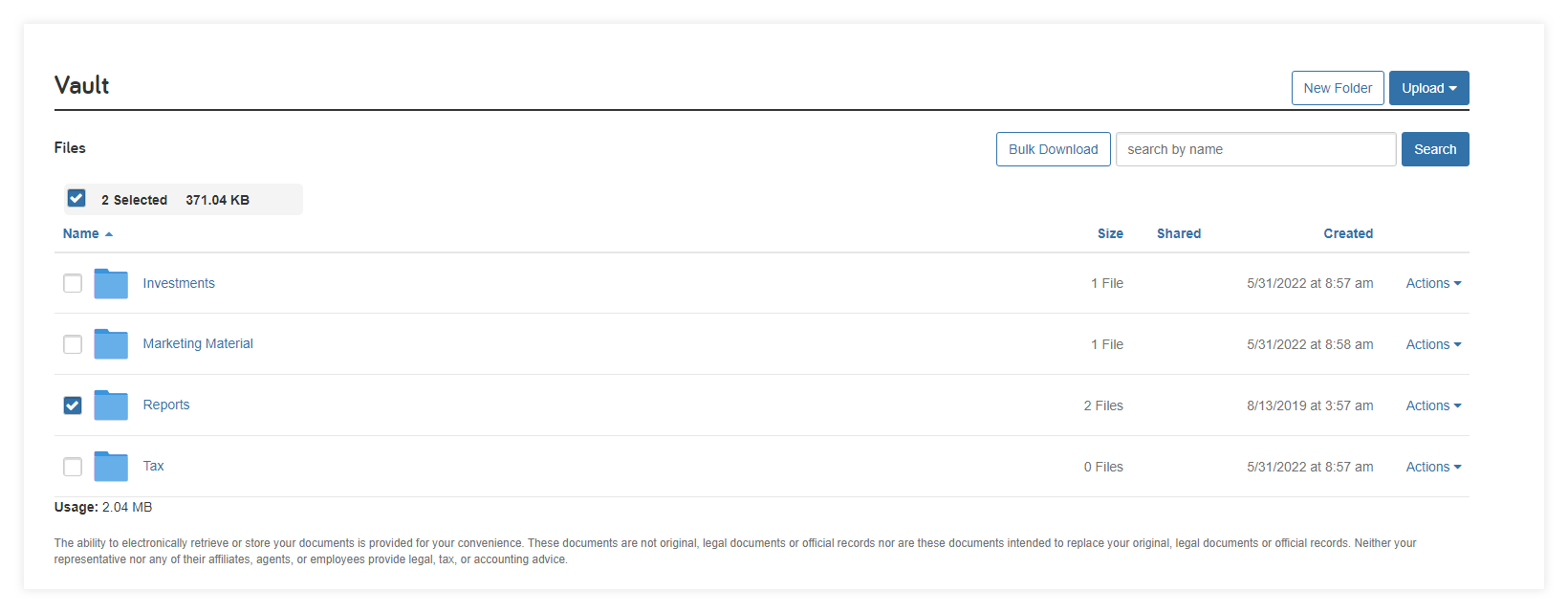

One of the most popular user requests is being implemented this month. Once released, you and your clients can download multiple vault documents in one bulk action.

Open the Vault and choose the folder or files you wish to download using the checkboxes located to the left of the file or folder name.

Once selected click the Bulk Download button to initiate the download.

The selected folder or files will be downloaded in a zip folder. This functionality will also be available in the client vault.

Note: Bulk downloads cannot exceed 50MB or 100 files.

Released June 28, 2022

By request, the Brinker Capital single sign-on integration will be discontinued on June 28, 2022. It’s important to note that this change has no impact on the Brinker Capital connection.

We apologize for any inconvenience this may cause. Once discontinued, the integration will no longer be available within eMoney.

Released April 26, 2022

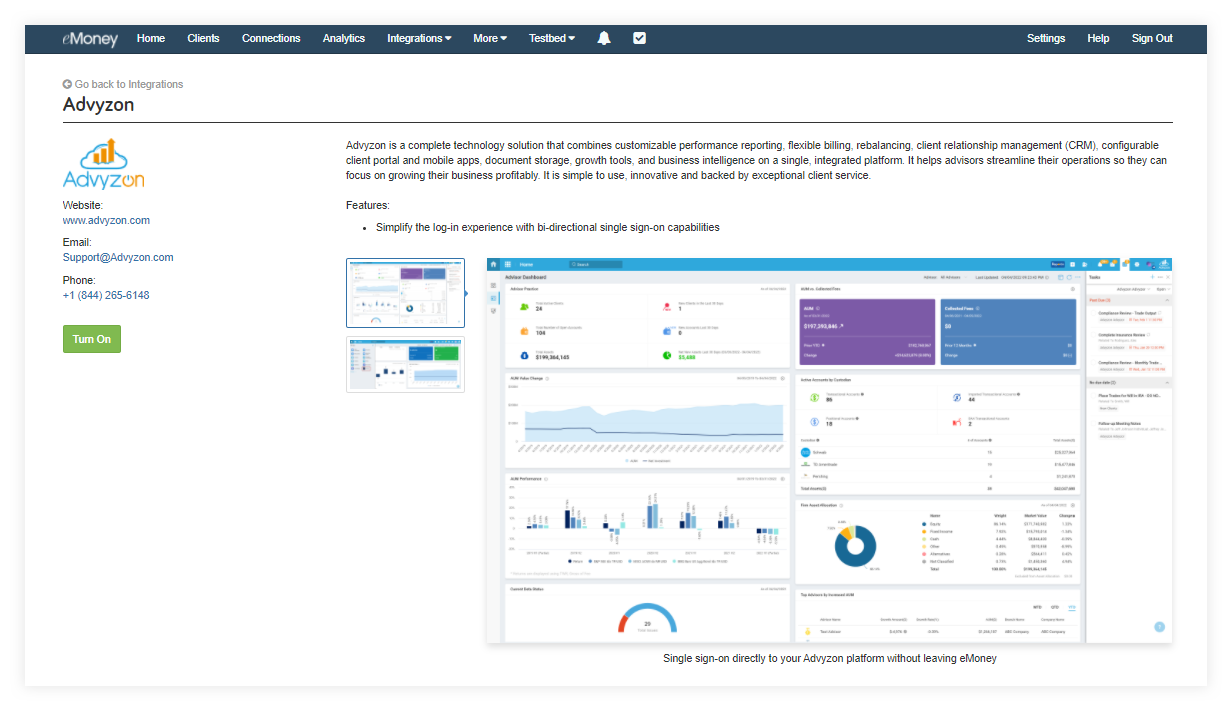

Advyzon helps advisors streamline their operations so they can focus on growing their business profitably—and now all eMoney advisor site users can seamlessly move between platforms with bi-directional single sign-on to Advyzon’s dashboard directly from eMoney.

Advyzon is a complete technology solution that combines customizable performance reporting, flexible billing, rebalancing, client relationship management, configurable client portal and mobile apps, document storage, growth tools, and business intelligence on a single, integrated platform.

Click Integrations on your navigation bar and select View All Integrations. Then click into the Advyzon integration tile to access the integration support page.

On the support page, click the green Turn On button, enter your username and password, and click Connect to enable the integration.

Once enabled you can single sign-on at any time from the Support page or using the Integrations drop-down menu.

Released April 26, 2022

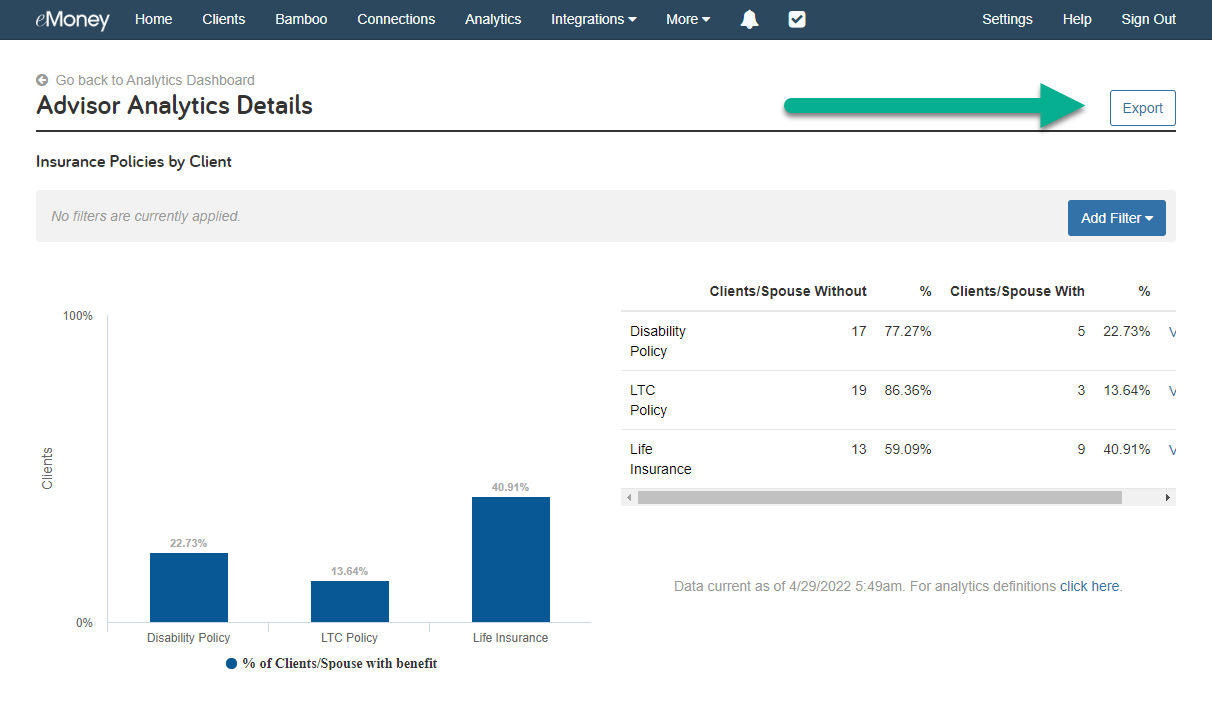

We added additional fields from the Policy Details tab to the Insurance Policy export template so that Analytics users have access to even more data! Click here to download a sample data export (.csv) with the new fields.

Click Analytics on your navigation bar to open your Advisor Analytics dashboard. Then drill down into a chart, like Insurance Policies by Client, and click the top right Export button.

Released March 29, 2022

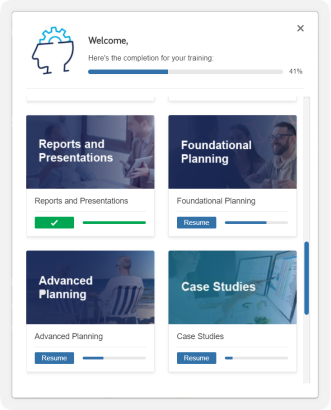

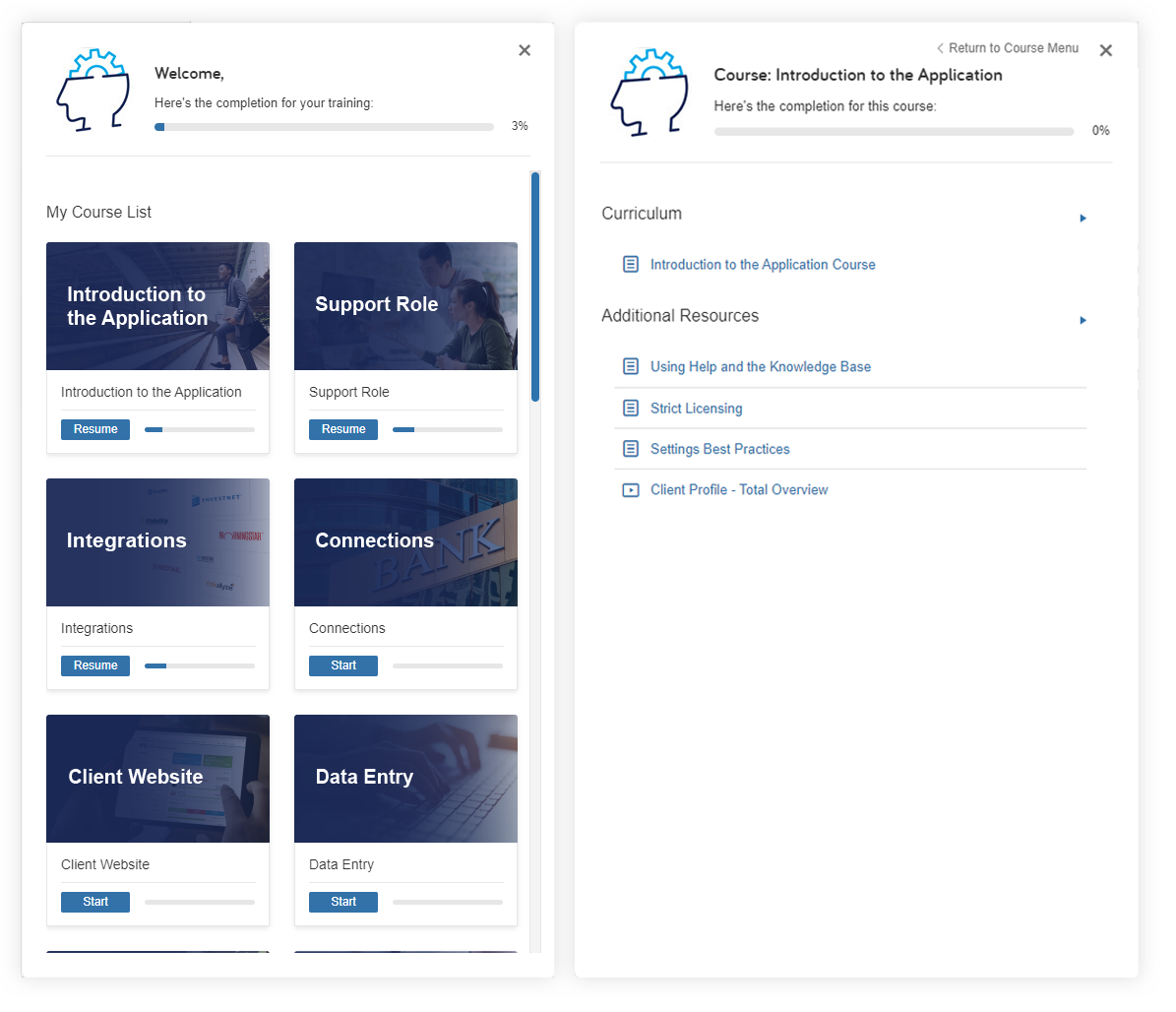

We have officially launched a new series of courses with streamlined and enhanced educational content accessible under Help. These replace the existing courses within the eMoney Knowledge Base.

These courses will cover the same material as the current courses but have been streamlined and are more interactive.

Instead of having courses broken down into individual progress for each video, guide, and how-to, you’ll now have access to a singular interactive course that includes all the requisite content. With this update, you no longer need to open a new tab for each piece of coursework, allowing for seamless navigation.

While the look and feel of the courses are similar to the previous versions, you will notice a slight change to the thumbnail images. As the previous courses have been removed, you’ll also notice that course progress has been reset.

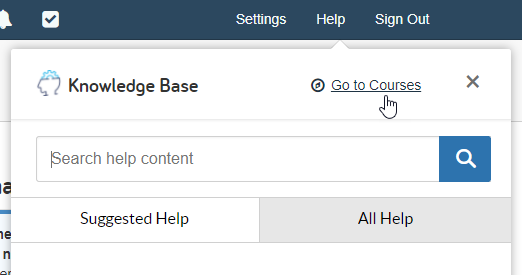

To access courses in eMoney, simply click Help on your advisor navigation bar and select Go to Courses. This will launch the menu modal where you can browse and select from what is available.

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.