for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreIt’s that time of year again, the April 18th deadline to file your taxes for 2016 is right around the corner. How are you going to best prepare your clients’ for the agony and monotony of filing your taxes?

Well, eMoney is here to help! We provide quick and easy ways to enter and categorize your information so that your taxes can be illustrated properly and referred to when the time comes.

Before you even think about viewing any reports, you want to make sure all of your client’s information is entered correctly in the Fact Finder. This allows the system to run a proper calculation of your client’s taxes.

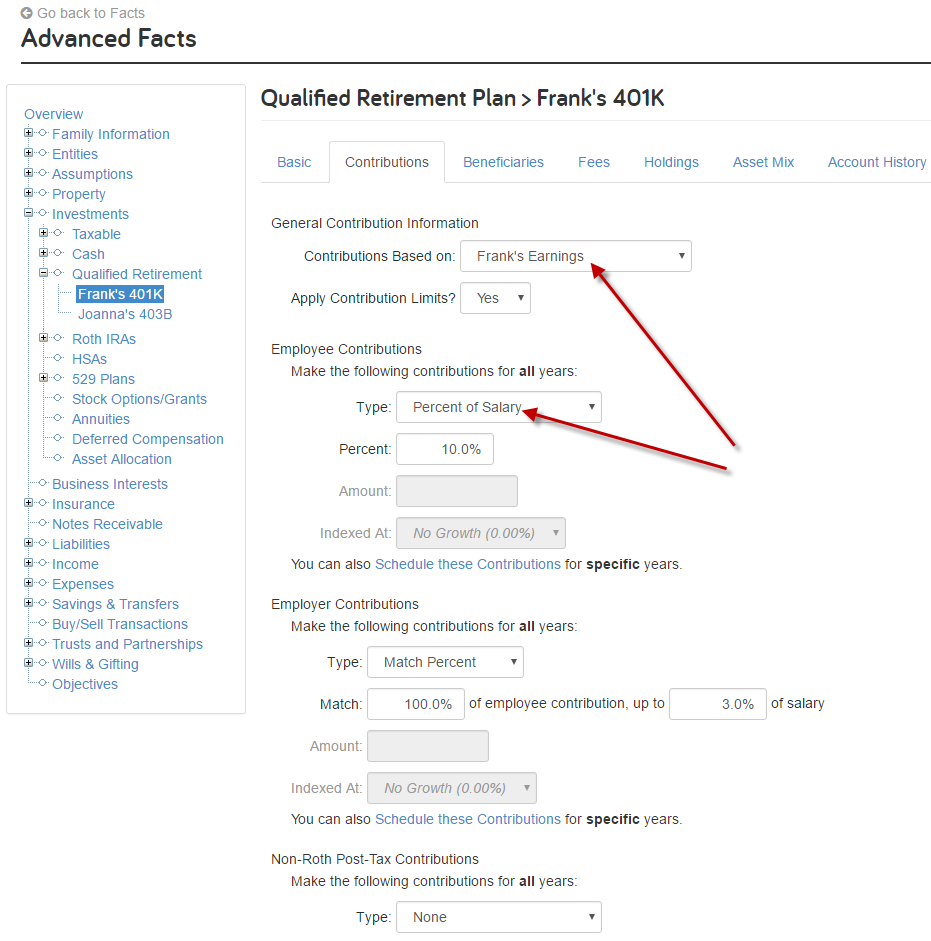

When entering information into the Fact Finder, make sure to utilize the “Contributions” tab when entering certain qualified assets like your 401k, as emX automatically account for the above line deduction.

Define Contribution Amount

Other useful aspects of the Fact Finder is the ability to itemize your expenses using the “Other Expenses” field, where you can input the proper tax treatment or “Deductible Type”, and that expense will be shown appropriately in the 1040 calculation. Another useful place to enter your expenses and categorize them based on the type of expense is the “Worksheet” tab under “Livings Expenses”.

[slideshow_deploy id=’13589′]

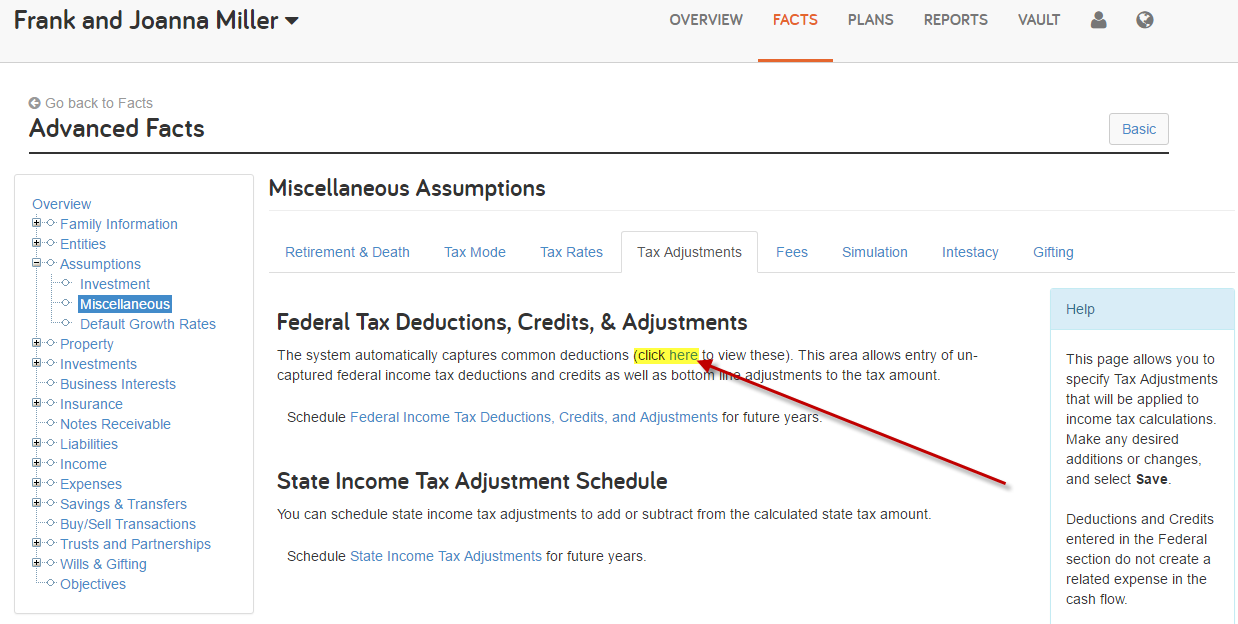

Lastly, eMoney automatically captures numerous deductions that you will not have to account for when entering your facts. If you ever need to double check if a deduction is being applied, take a look at the link for a list of our deductions on the “Tax Adjustments” tab in the “Miscellaneous” assumptions.

Click here to view commonly captured deductions

Assuming you have all of your current facts up to date in the Fact Finder, we can now dive into how that information is displayed on our EMX reports. The best report to look at for a comprehensive view of your client’s taxes is our “Income Tax” report.

The “Income Tax” report allows us to drill down into each component of the taxes, whether we are trying to see the 1040 calculation in more detail by clicking into “Regular Federal Income Tax” or a breakdown of the client’s Social Security, Medicare or State taxes. This report allows the client to see every facet of their tax liability and the numbers that account for those outputs.

[slideshow_deploy id=’13582′]

Making sure to enter your client’s information accurately and utilizing the fields EMX offers will allow the system do the heavy lifting when you want to prepare your clients’ for the upcoming tax season. Be sure to take advantage of all the tools eMoney has available to make your clients’ tax season as stress-free as possible.