Learn more about the latest eMoney updates, including updates to some of our most popular reports and presentations, client site onboarding and connection experience, new case studies that walk through the client lifecycle, and more.

For more information on these updates, sign up for the latest product update webinar.

Released September 27

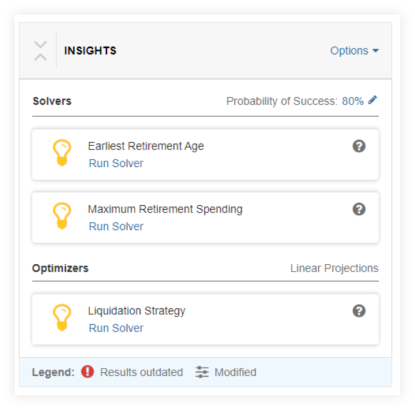

This month, we’re releasing a highly requested enhancement to the Insight section within Decision Center. With Monte Carlo calculations now available for solvers, you can easily set your client’s desired probability of success and see how to achieve the results the client, or advisor, are seeking—without having to guess, or make multiple adjustments.

Following this release, the first time you visit Decision Center, we’ll prompt you to set your target probability of success within the Options menu. Then you can run the solver for the desired probability of success, apply it to the client’s plan, and even Save to Base Facts to implement the recommendation on their plan.

Note: While Monte Carlo will be the default option, you can switch back to straight-line calculations at any time using the Options menu. Users can save a default probability of success so you do not need to enter it every time within Decision Center.

Finally, you’ll also notice that the existing options have been split into Solvers and a new Optimizers category. The Liquidation Strategy solver is designed to maximize the amount of wealth left at the end of a plan, rather than provide large scale solutions for plans not currently on target. For this reason this solver is unavailable for Monte Carlo since the results provided by the solver are unlikely large enough changes to produce significant shifts in Probability of Success.

Stay tuned for more updates to Decision Center in the coming months.

Released October 4

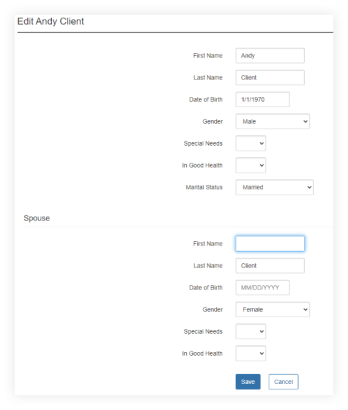

To ensure we’re as inclusive and diverse as our client base, the Last Name and Gender fields for clients’ spouses will no longer be prefilled as they are today.

From the Client Site, the client will click the Organizer tab. Once there, they’ll click Edit the Client > Basic Information.

Currently, this is where you’ll notice the Last Name and Gender fields have been pre-filled in by default in the Spouse section.

Following this release, these fields will be left blank for the client to fill out.

Released August 30

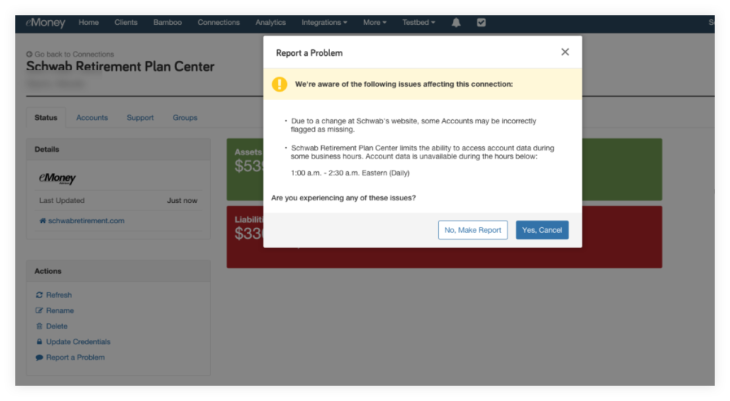

Provide much-needed context to your clients while reducing the number of issues you report by gaining insight into known connection issues. Now, additional context will be included when maintenance events, outages, or specific issues related to the connection are known and are actively being addressed.

With this additional visibility, you’ll be better informed to communicate with your clients and keep them in the know with the latest connection updates.

When you Report a Problem, the modal will present a list of known incidents. If this is a temporary issue (such as a maintenance event), or a known issue the Support team is actively working on, you can cancel your request and update your client.

If your issue is not represented, continue with your Report a Problem submission.

Released August 30

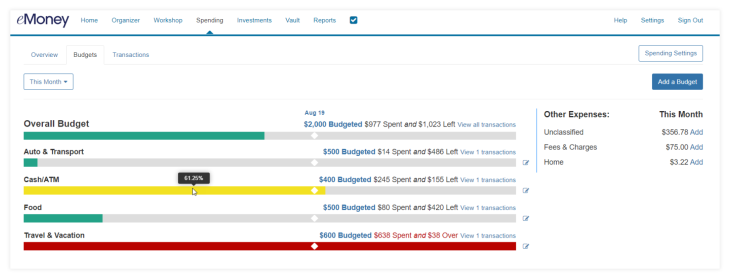

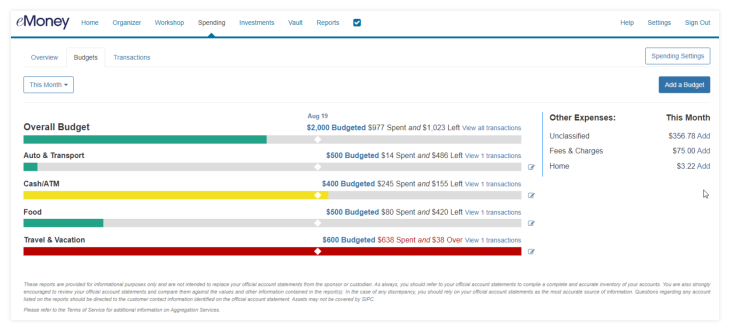

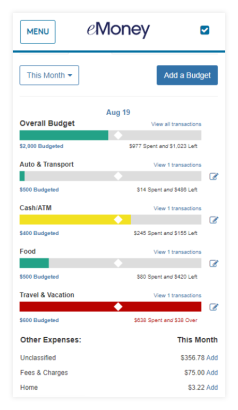

The Spending and Budgeting tool on the Client Site has received quality of life updates to improve your client’s experience. Building on the layout and mobile experience of the Budgets page, all values and links are now found on the same line for each budget, including minor quality of life updates.

Under Spending and Budgets, the client can now see what percentage makes up the whole budget when they hover their mouse over one of their budgets.

The date has also been added, above Overall Budget, to show the client where they are within the month.

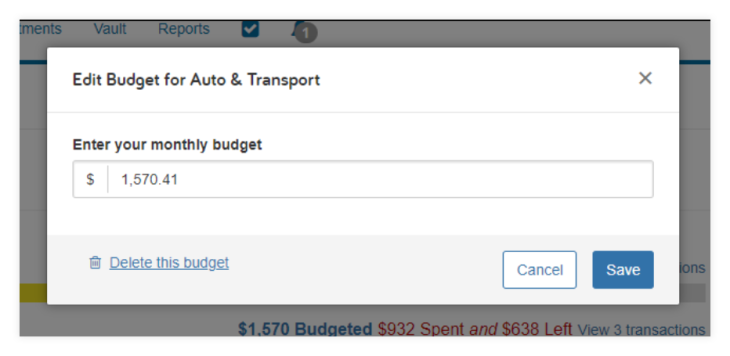

The client will now have the option to delete or edit a budget within the same pop-up screen.

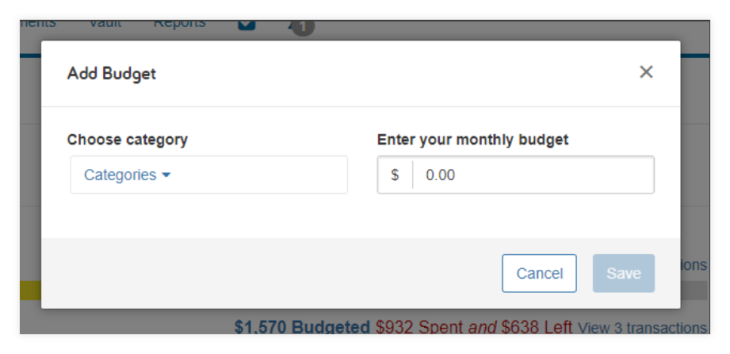

The client will also be able to add budgets more easily from the Budgets tab.

Budgets 2.0 brings a more mobile/tablet friendly experience on the Overview, Transactions, and Budgets pages.

Released August 30

These two client site enhancements focus on streamlining how clients create and maintain connections.

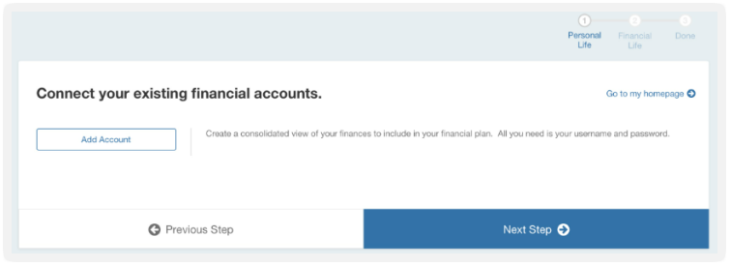

Soon, onboarding your clients will get easier. Clients going through the Onboarding wizard will be prompted to connect their accounts as part of the workflow. This update ensures all essential information is collected as part of the Client Site onboarding process.

Not sure what the Onboarding wizard is? Learn more about how to enable it here

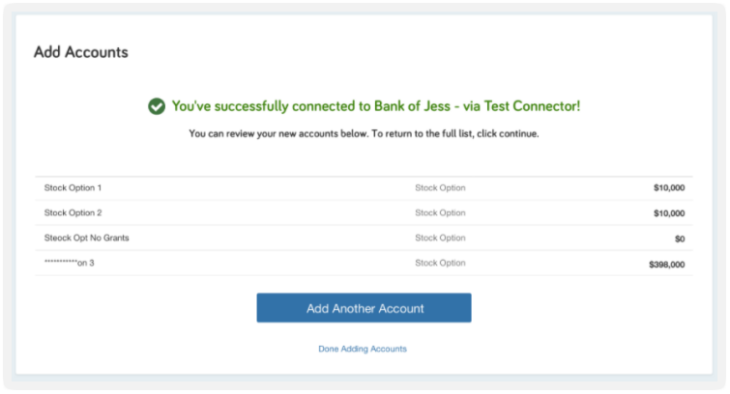

Once this feature goes live, the client will be presented with the option to “Connect your existing financial accounts” as a step in the onboarding process.

In line with the existing process, they’ll be prompted to Add Accounts and have the option to connect or manually add accounts. Once they’ve added all desired accounts, they can click Done Adding Accounts to continue with the Onboarding wizard workflow.

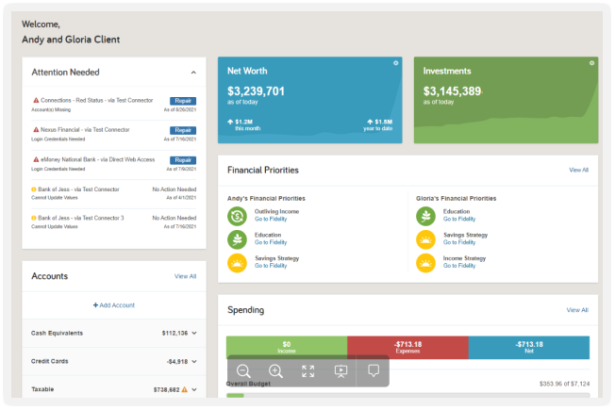

To improve visibility into broken connections and simplify the process of fixing them, next month we’ll begin adding account issues to the home.

This update is based on feedback from Client Site users who want a simpler way of staying up to date and taking action to fix their Accounts. Clients will simply click the Repair button in the new Attention Needed tile.

Stay tuned for these updates soon!

Released August 19

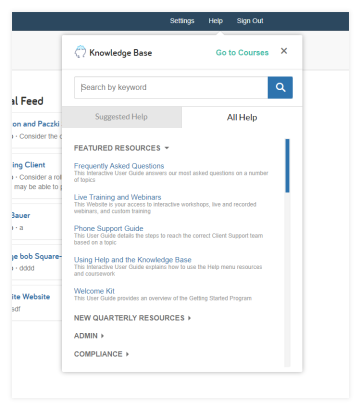

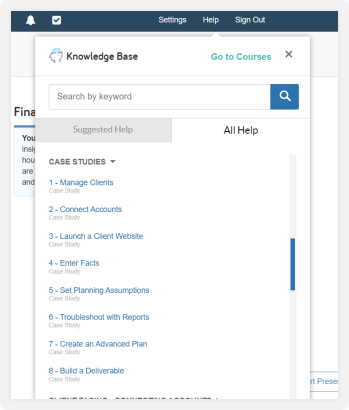

As you know, there are plenty of valuable in-app resources only a click or two away. To provide better clarity on what a resource is before you click it from your Help menu, you’ll notice new resource descriptions. See the example screenshot below for reference.

Released August 9

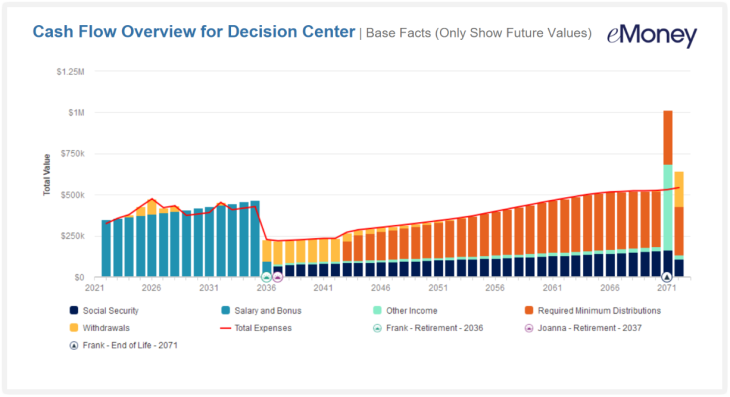

Early next month, a variety of your reports and presentations will be updated to include new features, improved aesthetics, and enhanced readability—in line with our other enhanced reports. Your Goal Planner, Decision Center, and Facts presentations, as well as Net Worth and Investment Report families, are included in this round of enhancements.

These changes address user feedback about report aesthetics, readability, and consistency—both across planning tools, print, and online versions.

Click here to preview a sample of the new Decision Center presentation and the Net Worth and Investments reports.

New Report Features include:

Where will these updates be visible?

These enhancements will be visible in both the online and printed presentations for the interactive planning tools under Plans and under Reports for the Net Worth and Investment report families.

Keep an eye out for an in-app message under Plans and Presentations when these enhancements go live!

Released July 19

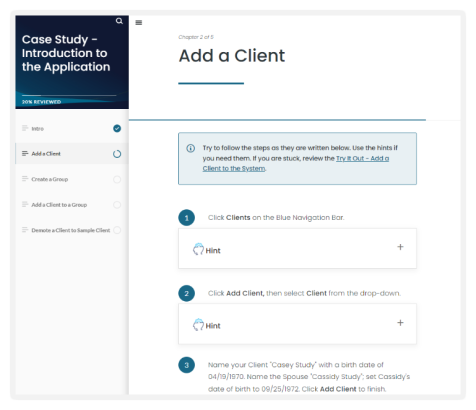

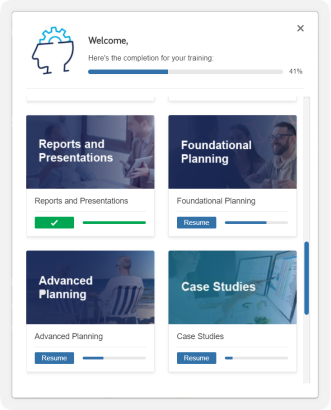

New eMoney Case Studies empower you to walk through a full client lifecycle in eMoney. With this curated series you can walk step-by-step through everything from creating the client in eMoney to building a plan and creating the end deliverable.

The Case Studies will be available through the Help menu in two places: under the Courses menu in a new Case Studies tile, and by searching Case Studies in the Help menu.

Case Studies are available to those with eMoney Pro/ Premier features, and will not appear for users without the Client Site or Advanced Planning.

Coming Soon

Due to a change in the partner supplying our historical data, we’ll be replacing some of our existing market indices when we update our indices with Q2 2022 data next quarter.

The new indices have been carefully selected to replicate market performance similar to the index they’re replacing. Users should not expect significant changes in essential historical data (e.g., rate of return, mean rate, standard deviation).

Check out the table below to learn more about which market indices are being replaced, and click the links to learn more about each replacement index:

| Existing Indices | Replacement Indices |

|---|---|

| Ibbotson Corp HY Bond | Bloomberg U.S. Corporate High Yield USD |

| Ibbotson IT Gov Bond | Bloomberg U.S. Government: Intermediate USD |

| Ibbotson LT Corp Bond | Bloomberg U.S. Long Credit USD |

| Ibbotson LT Gov Bond | Bloomberg U.S. Treasury: Long USD |

| Ibbotson LT Muni bond | Bloomberg Municipal Bond: Long Bond (22+) |

| Ibbotson Small Co Stock | MSCI US SMALL CAP 1750 |

| 30 Day T-Bill Rate | FTSE 1 Month Treasury Bill Index |

However, in Q2 2022, we continued to see market volatility and lower than average expected returns—so while we don’t expect a significant impact from the transition—you may see an anticipated drop in returns based on market conditions. We recommend comparing the existing and updated data before updating your capital market assumptions.

Once these market index updates are made, eMoney users will see the following in-app message when clicking the Compare/Update Indices button, encouraging them to compare the existing and updated data before updating their capital market assumptions:

Due to a change in the partner supplying our historical data, we replaced some of our existing market indices with new ones carefully selected to replicate similar market performance.

While you should not expect significant changes in essential historical data (e.g., rate of return, mean rate, standard deviation), you may see an anticipated drop in returns based on market conditions. We recommend comparing the existing and updated data before updating your capital market assumptions.

Note: If your home office provides its own Capital Market Assumption data then these changes do not apply to you.

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.