for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreA reinvestment technique in eMoney will reinvest an individual account or all accounts from its current asset allocation to a new model portfolio. Today, we’ll look at how to model a reinvestment technique in Advanced Planning and present the results to clients.

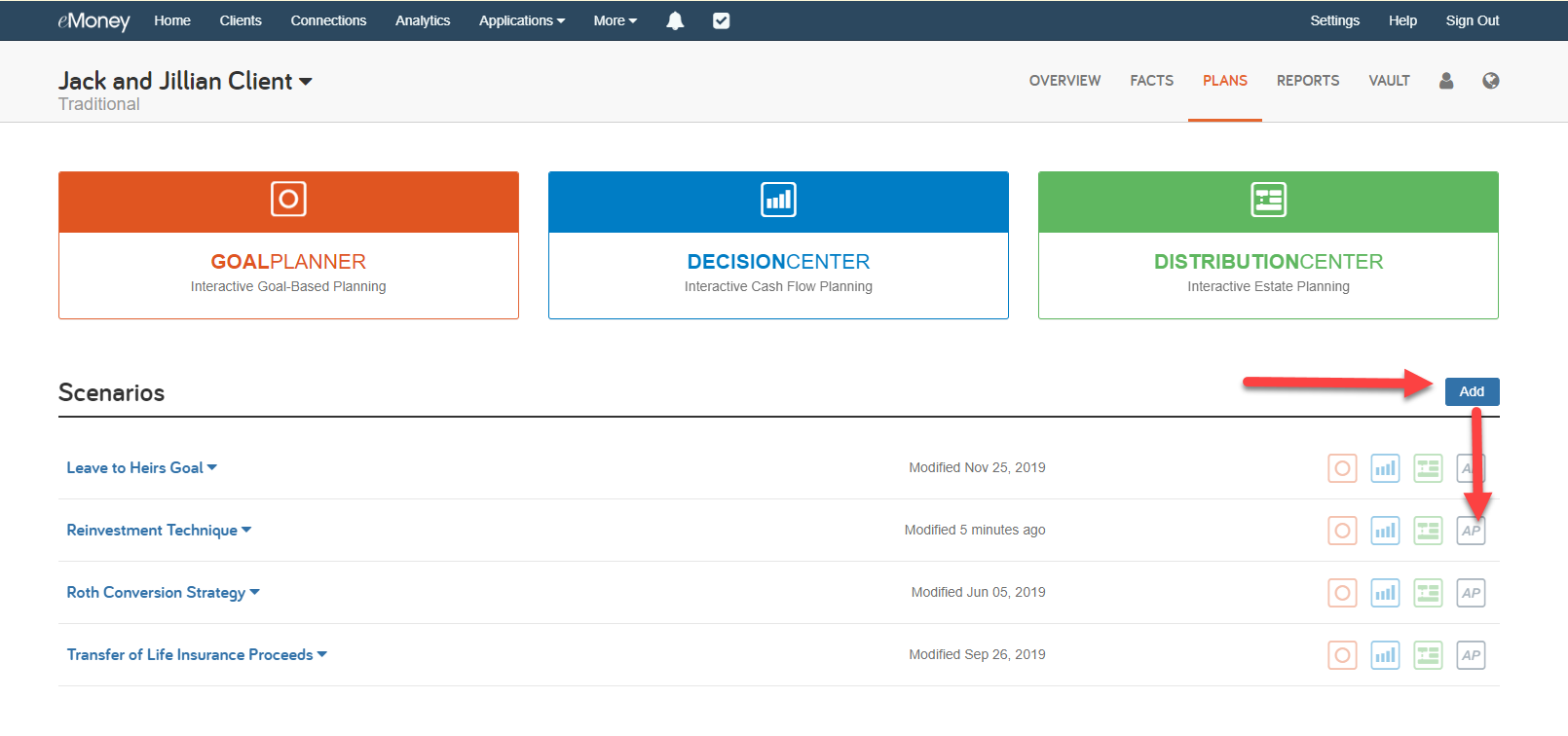

First, you’ll navigate to the Plans section of your client’s overview page. Click Add under scenarios and then click the AP icon to access your advanced planning techniques.

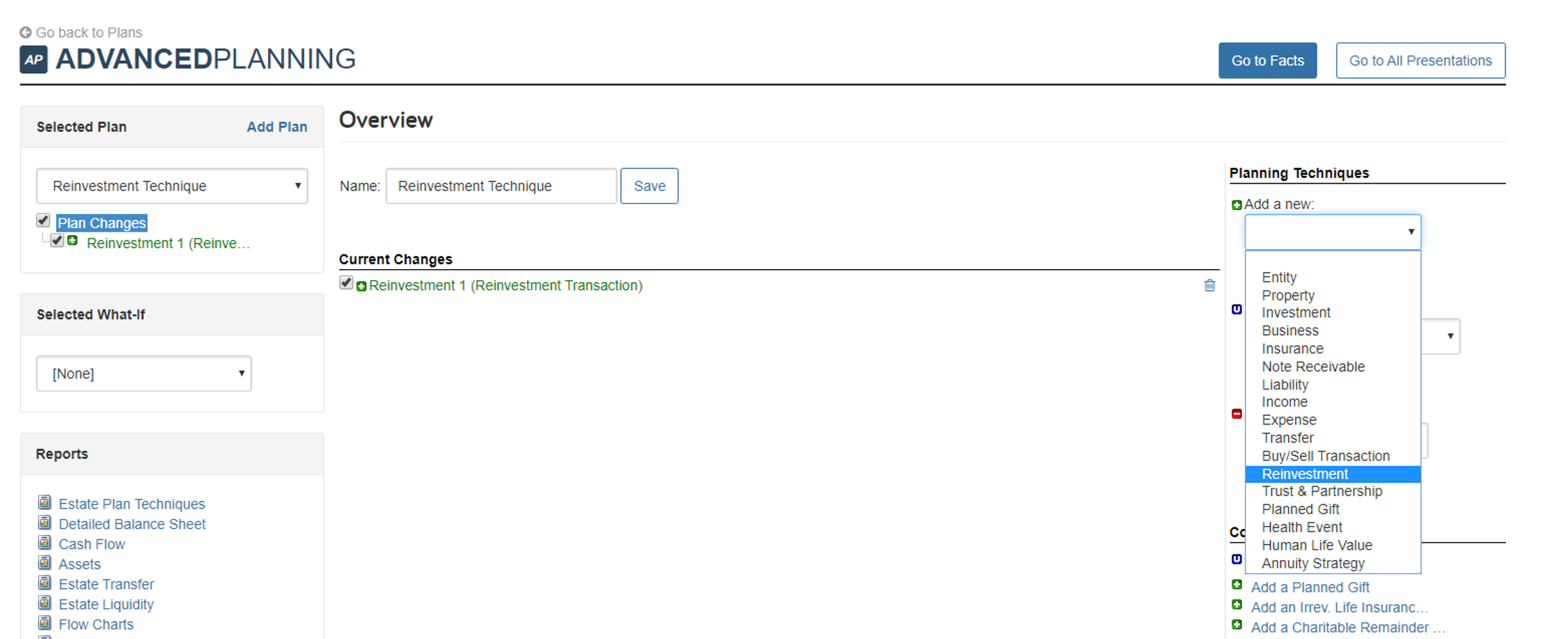

Next, you’ll add the reinvestment technique under Planning Techniques > Add a New > Reinvestment.

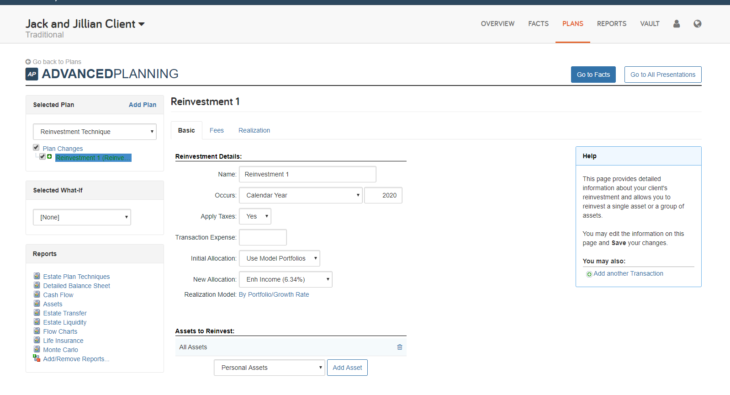

Then, follow the steps below:

For more information, check out our Modeling a Reinvestment Technique user guide.

Now your recommended scenario will be available to apply in reports and the interactive planning tools. Using the reports such as Investments > Asset Allocation and Cash Flow and interactive tools such as Decision Center, you can compare the scenario to the current strategy and also show clients the impact reinvesting can make on their lifetime cash flow and Monte Carlo results.

Do you use Foundational Planning? Learn how to use the Asset Reallocation technique here.

Looking for more training? Check out our interactive user guides, webinars, and more in the Help section of your advisor site.