for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreDid you know that you can determine when cash flow begins?

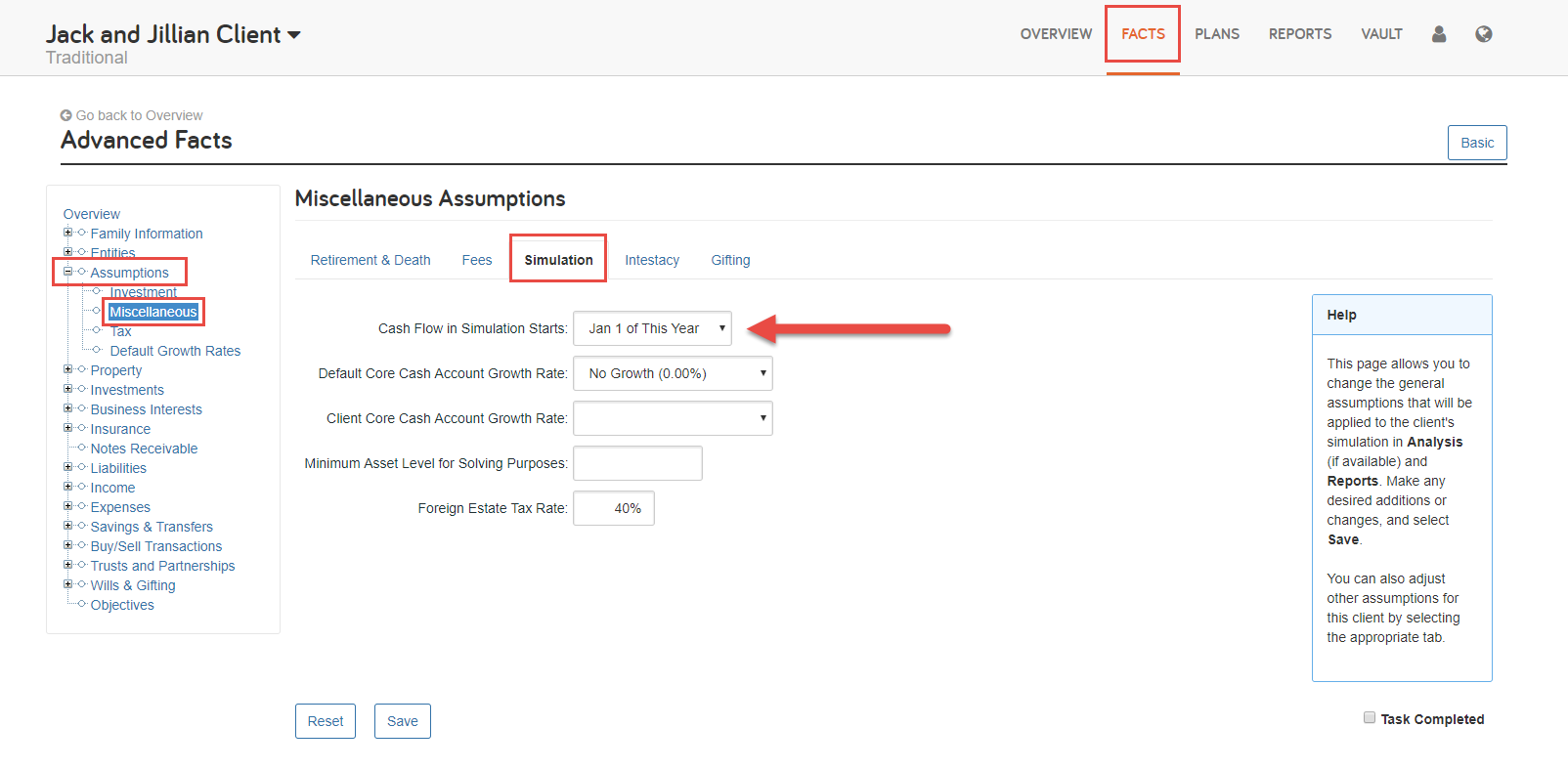

An important but easily overlooked feature, the Simulation settings within Miscellaneous Assumptions, allows you to change the underlying assumptions of your client’s cash flow simulation.

With just a few changes to the settings, you can adjust when the cash flow starts based on the time of year or based on a client’s financial plan.

For example, if you’re in a mid-year review with your client and they want to see their income and expenses from this month instead of the whole year – you can illustrate this!

Let’s look at where you can find the Simulation settings, how to update them, and when you might use each of the setting options.

The first option Cash Flow in Simulation Starts provides you with three options:

January 1 of This Year – Cash flow will begin on January 1st of the current year and you’ll see a full year’s worth of activity. This is the default setting and typically used in the beginning of the year.

January 1 of Next Year – Cash flow will begin on January 1st of the next year and exclude the cash flow remaining for the current year. Often used toward the end of the year, this setting allows you to focus on the future while taking into account events that have occurred in the current year.

This Month – Cash flow will begin in the current month and will prorate flows such as income, expenses, and contributions for the remaining months of the calendar year. You may select this option mid-way or later in the year to see prorated values on the cash flow report. To view a full list of prorated items, click here.

Select the cash flow setting that works best for your needs and then click Save.

Next, the Core Cash Account Growth Rate allows you to define a growth rate for assets held in the Core Cash Account, which is used to hold unassigned liquid assets. When Year End Savings is set to Save 100%, excess cash will be stored in the Core Cash Account. This value is utilized across all individuals and entities.

The Minimum Asset Level for Solving Purposes corresponds to the Assets Remaining field in the Report Center. Changes made to the Assets Remaining field in a specific report will be applied here and across other reports with this field.

Finally, the Foreign Estate Tax Rate is the estate tax rate used for non-resident aliens(selected under Client & Spouse in the Fact Finder). This rate is not used for U.S. citizens or resident aliens.

For more tips on items that are adjusted in Miscellaneous Assumptions, check out Customized Living Expense Periods and Advisor vs. Account Fees.

Have a question? Give us a call at 888-362-8482 or send us an email.