Learn more about the latest eMoney updates, including the new enhanced search precision for client and advisor connections, Cash Flow Insurance Premium Report in Decision Center, and more.

For more information on these updates, sign up for the latest product update webinar.

Released December 11

⚐ REQUESTED FEATURE

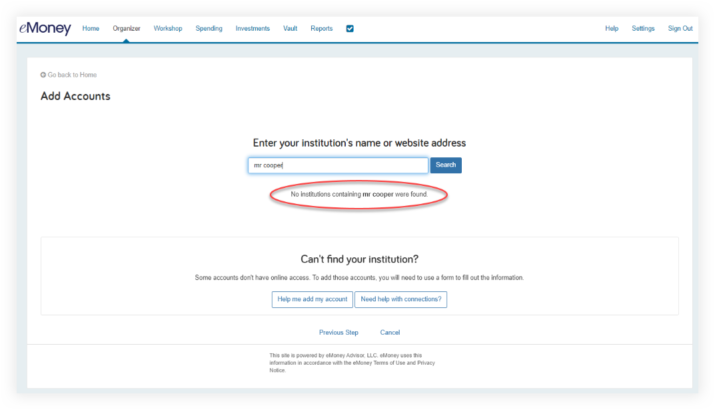

The capacity for your clients to connect with their institutions is foundational to a collaborative planning experience, but it can be challenging for them to find the right ones, requiring you to step in to help. Simplify the client experience with enhanced search in Connections.

How Does It Work?

When advisors and clients face difficulties in finding connections, it leads to increased outreach for assistance.

The upgraded connections search system accessed from Advisor and Client Connections helps you establish client connections more quickly, efficiently, and accurately.

Released December 5

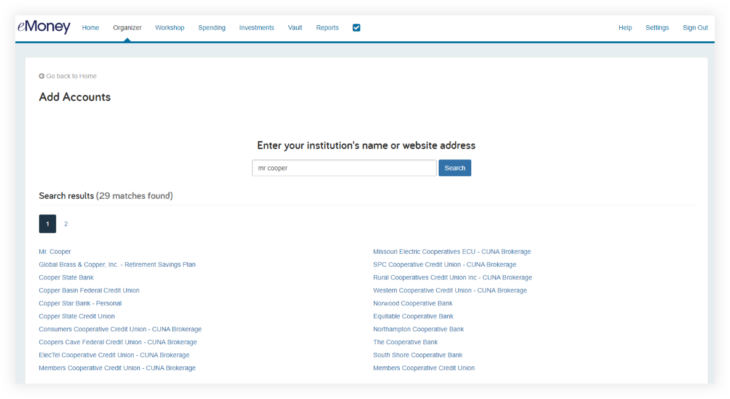

An essential component of our roadmap is creating a more flexible, comprehensive Decision Center where you can access all your essential plan details and reports in one place. Throughout 2023, we’ve brought many top reports into the Decision Center experience, and this month, that endeavor continues by adding the Cash Flow Insurance Premium report to Decision Center.

Now, you can swiftly examine and discuss detailed client-specific information on insurance premiums, enabling comprehensive analysis of annual cash outflows from diverse insurance policies within our most interactive and collaborative workspace.

How Can I View the Report Within Decision Center?

Select Cash Flow from the Selected Report category in Decision Center. Then, choose the Insurance Premiums report from the Viewing category.

With the availability of this report in Decision Center, you can choose to either view it independently or in Multi-View.

Stay tuned for even more enhancements to Decision Center that will save you time, open up new planning conversations, and create a more engaging experience for you and your clients in the first half of 2024!

Released November 14

⚐ REQUESTED FEATURE

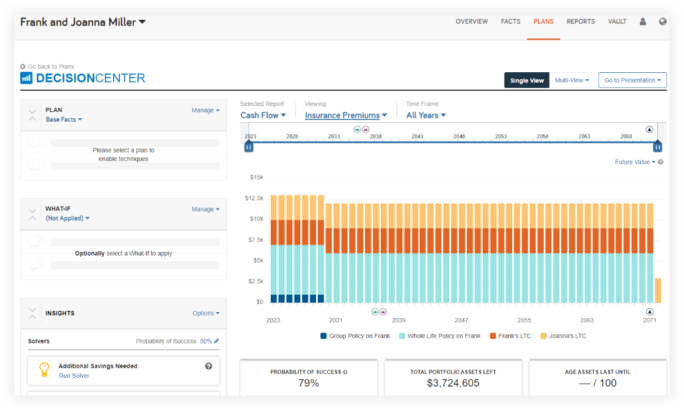

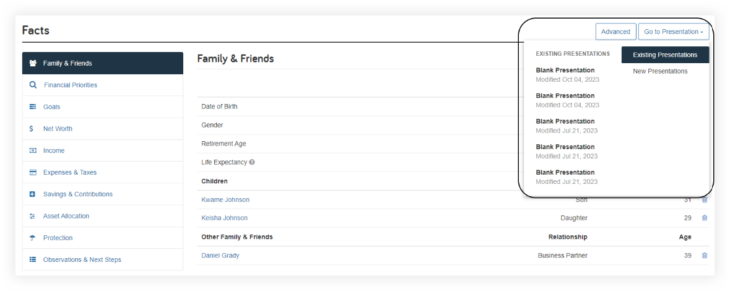

We’re enhancing the presentation-building process—saving you time by making it more intuitive, streamlined, and consistent—while making all reports available in every presentation experience, no matter where you are in eMoney.

How Does It Work?

It starts with seamless access to both new and existing presentations from all planning workspaces.

Once you select a presentation base, you’ll have access to all reports anywhere with a new searchable and centralized report library.

The new report selection experience saves you time by turning what was formerly a one-by-one building process to a streamlined builder where you can search, select, and add multiple reports to add to the presentation at once.

You can even customize your default presentation templates by adding the newly available reports from each planning space.

Stay tuned for this update coming soon to your Facts, Goal Planner, Decision Center, and Reports presentations.

Released October 24

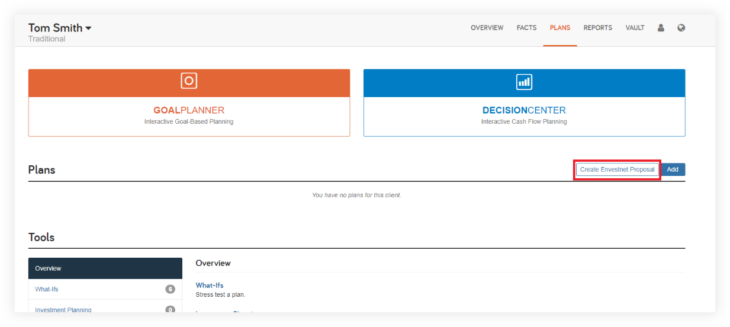

Eliminate unnecessary steps and offer a more streamlined process for managing client proposals in Envestnet. Creating a new Envestnet proposal is now simpler and more efficient to save you time.

Proposal Creation Workflow:

From the Client Overview, click the Plans tab, and then locate Create Envestnet Proposal.

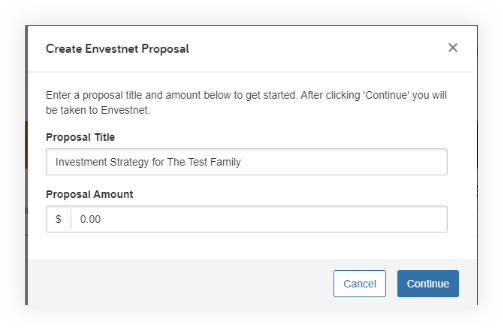

If your client is already connected to Envestnet,a modal will appear that prompts them to enter a proposal title and amount. Although the title is prepopulated it can be edited.

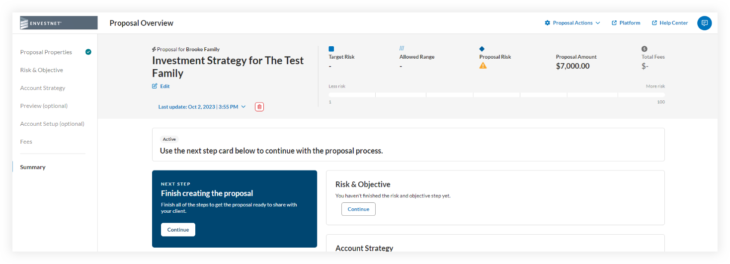

After selecting Continue, the Envestnet proposal will be created and you will single-sign-on into the new proposal via the new tab to Envestnet. When in the newly created proposal you will see that the proposal is associated with the client and the proposal title is populated along with the proposal amount.

Update October 24

Connections are paramount in enabling a successful planning experience and stand out as one of the most utilized features on both the Advisor Dashboard and Client Portal. We are committed to adding new sources to increase eMoney’s breadth of data while considering customer requests. This year, we added more than 300 new connections, moved more than 1.5 million accounts from parser to API and upgraded 7 APIs.

Learn more about our most recent updates below.:

Between the months of July and September of this year, we continued to add the following:

We look forward to continuing to provide you with the best planning experience possible. To learn more about the different types of connections we offer please check out the Help menu resources Your Guide to Data Aggregation.

For more information on new and upcoming releases, best practices, or eMoney news visit the eMoney Client Blog.