for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreWe’re negotiating and developing APIs for over 57 percent of all client connections. With the imminent release of APIs with Capital One, Fidelity, and Fifth Third in the coming months, it’s important that your clients know what to expect as their connections transition.

When your clients’ connection switches to an API, they will need to take some action to complete the transition. But don’t worry, we’re here to help!

Clients may not understand the difference between their existing connections and an API. In this case, our client Guide to Data Aggregation can help you explain the benefits. If your connections haven’t started transitioning to APIs yet, it can still help to let them know that the change is coming. We’ve created a client-facing email template that you can use to start a conversation about APIs with your clients.

If they’re aware of the upcoming change, it will be even easier to help them through the transition when one of their connections switches over.

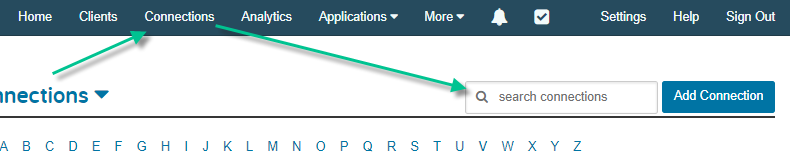

If one of your client’s connections is set to convert to an API-based aggregation model, they will usually need to take some action. We’re proactively communicating with advisors whose clients and connections are being impacted by the transition. Once you’ve been notified, you can identify your affected clients by visiting Connections and searching for the name of the connection being impacted.

Note: We’re excited to release the Capital One and Fidelity APIs soon, Fifth Third is also nearing completion. We’ll continue to send out updates as more APIs approach release.

Once you have identified which clients will be impacted by this transition, they will need to follow the instructions below:

If their credentials are rejected, they may need to go to the institution’s website and update their credentials before re-entering in eMoney. Finally, if they’ve followed the steps above and the connection does not re-connect, open a ticket and tell them not to delete their account!

Need additional help communicating this change? We’ve created another client-facing email template that you can customize to notify your clients of any changes.

Note: Once the transition takes place, your clients should re-establish this connection promptly to prevent any historical account data from being lost.

Thank you for your patience as we go through this transition and please contact us at 888-362-8482 or send us an email if you have any questions!