for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreThe Life Insurance Gap Analysis in Foundational Planning enables you to easily demonstrate if your clients’ current life insurance and other resources provide adequate protection for their families.

Next month, we’re updating two key aspects of the Life Insurance Gap Analysis that will allow you to:

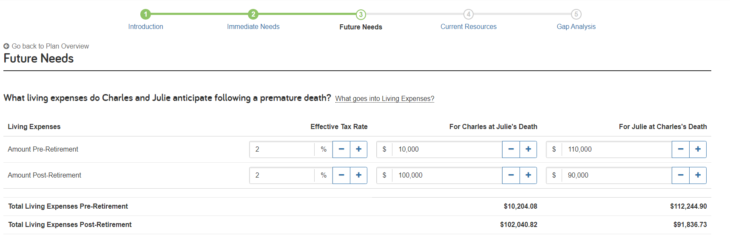

Effective Tax Rate

The Effective Tax Rate will be added in the Future Needs section and survivor expenses will be increased by the Effective Tax Rate in the Cash Flow Summary View providing clients with a more realistic picture of their expected gap.

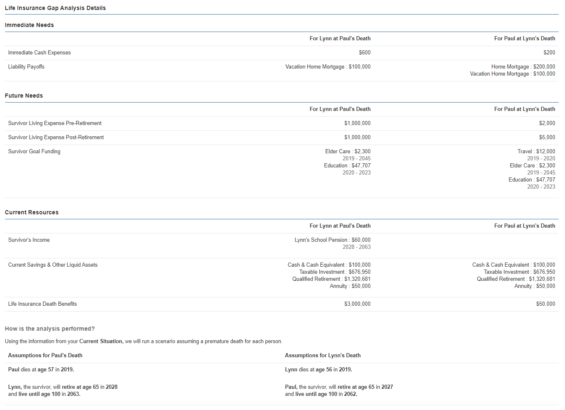

Details and Assumptions Report Section

This new section shows a detailed breakdown of the individual expenses, liabilities, and resources that go into the Additional Life Insurance Required Gap calculation. This includes three sections:

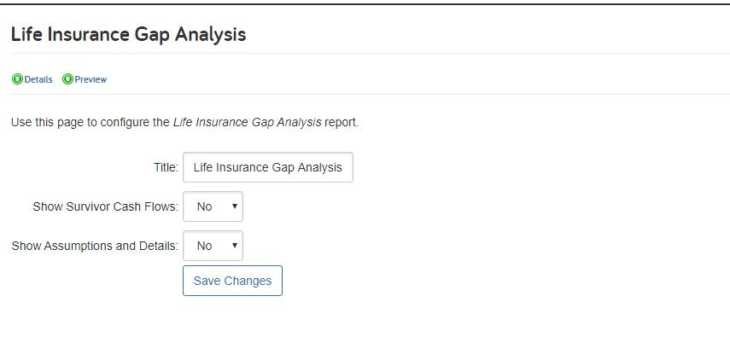

Advisors will also have the ability to choose whether Survivor Cash Flows and Assumptions and Details are included in the report. This setting is controlled within the Details tab of the report.

Questions? Give us a call at 888-362-8482 or send us an email.