for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreThis product release includes functionality that adds flexibility and creates new opportunities to start conversations with your clients regarding the Tax Cuts and Jobs Act.

Check out our eMoney Update video to learn more about this release:

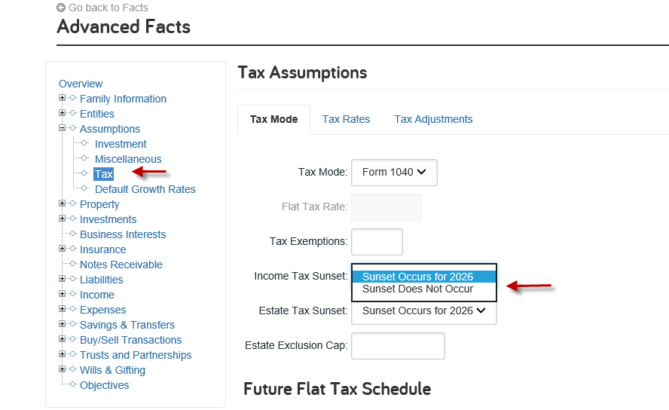

With the Income Tax Sunset setting, you can specify in your Tax Assumptions whether or not the new tax laws will expire on their legislated sunset dates.

This creates the opportunity to meet with your clients to discuss how their financial picture could change if the new tax laws are extended in the future.

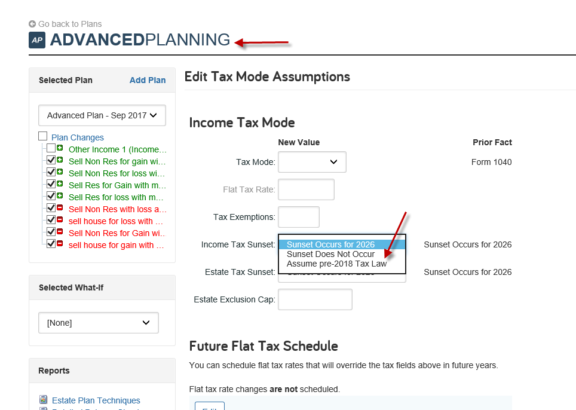

In addition, a new option has been added to the Income Tax Sunset drop-down list that can be used only within Advanced Plans. This new option allows you to use the tax laws prior to the release of the Tax Cuts and Jobs Act.

While eMoney is not a tax preparation software, this new feature can help you create financial plans that answer the client question – does the new tax law help me?

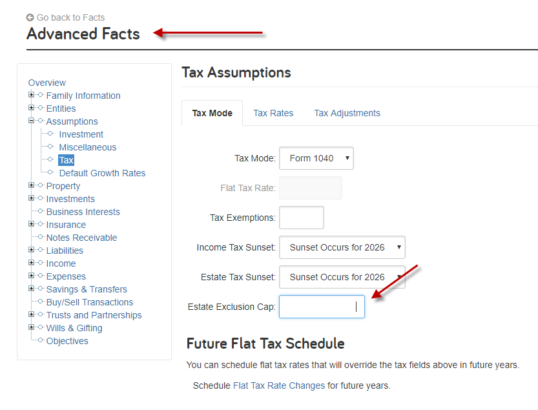

Finally, we’ve added the ability to set a custom limit to the Estate Exclusion Cap. This custom limit will not grow over time and eMoney’s simulation will use the lowest available limit between the custom cap and the actual tax law projections.

By capping the estate exemption amount at a value of your choosing, you have the opportunity to show your clients a new range of estate tax possibilities.

The following tax rules have been moved as they include new tax rules eMoney did not previously handle and additional time is needed to finalize the changes.

The per child tax credit has increased from $1,000 to $2,000, and the credit amount is reduced for AGIs above the threshold. Thresholds also changed from $75,000 to $200,000 for single filers and from $110,000 to $400,000 for joint filers. The sunset date of December 31, 2025, has been applied.

Eligibility for this credits are determined by the birthdate of the child and whether the child is financially dependent.

A 20 percent deduction of qualified business income (QBI) has been added. The deduction is limited when QBI is generated by a professional services business. In this case, the deduction is phased out for owners above a certain adjusted gross income (AGI), namely $157,500 for single filers and $315,000 for joint. The sunset date of December 31, 2025 has been applied.

Update: Support for IDGTs and GRTs was added on April 24.

Questions about the latest release? Call us at 888-362-8482 or send us an email.