for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreWhen working on an estate plan for a client there are a few key questions that they’re likely going to ask you: Are my assets going to go to who they’re supposed to? How much am I going to leave behind? Am I subject to any estate taxes?

Here at eMoney, we have a key set of estate planning reports that are going to allow you to tell a story to your client to address these concerns and more.

The first report we’ll take a look at is the Detailed Estate Calculations report. This report is the quintessential problem-solving report when it comes to estate planning. Much in the way that the Cash Flow report is used for evaluating a retirement plan, the Detailed Estate Calculations report is going to provide you, as the advisor, all the information you need to verify your plan before presenting it to your client.

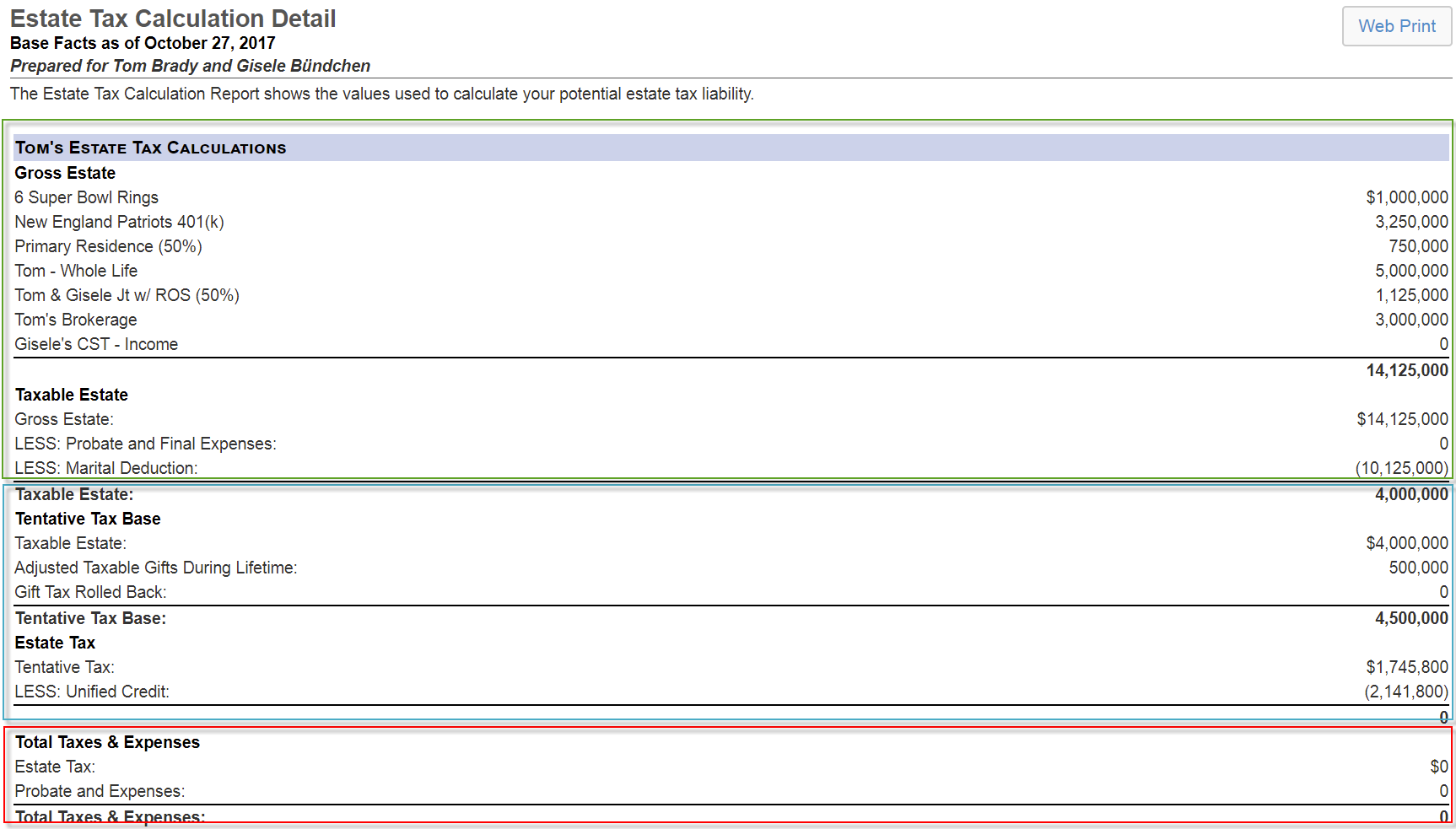

There are two main sub-reports of this report that you should be aware of. The first one we’ll take a look it is called the Estate Tax Calculation report. This report is going to illustrate the system’s calculation of estate taxes at both the client and the spouse’s passing:

Looking at the above example we can see the estate tax calculation for Tom’s Estate as of today. The area highlighted in green illustrates what assets are being included in his gross estate, how much the estate is paying in probate and final expenses, as well as how much is being passed on to Gisele through the unlimited marital deduction.

The following area, highlighted in blue represents his taxable estate, including any taxable gifts that had been made prior to the simulation. After rolling those gifts back in, we calculate the tentative tax that would be due on his estate and subtract the unified credit.

Finally, we see the total taxes and expenses incurred upon his passing represented by the area highlighted in red.

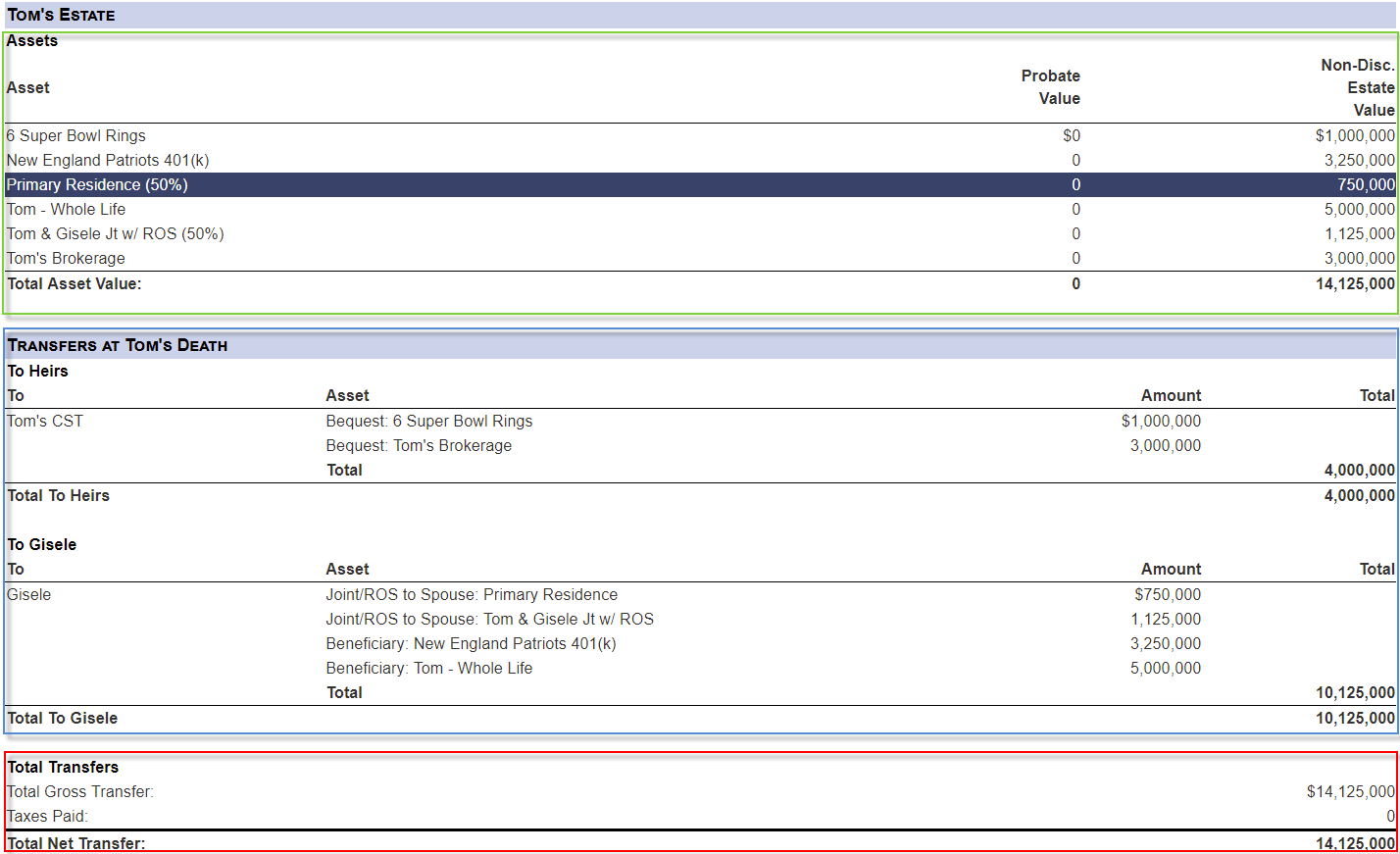

The second sub-report we’ll take a look at today is called the Estate Valuation & Transfers report. This report is going to illustrate to whom assets are passing at both the client and the spouse’s passing:

Looking at the above example, we can see how assets would be passed upon Tom’s passing. The area highlighted in green illustrates the assets of his estate. The area highlighted in blue shows what each heir in the system will receive. Finally, the area highlighted in red will show what the total transfer will be.

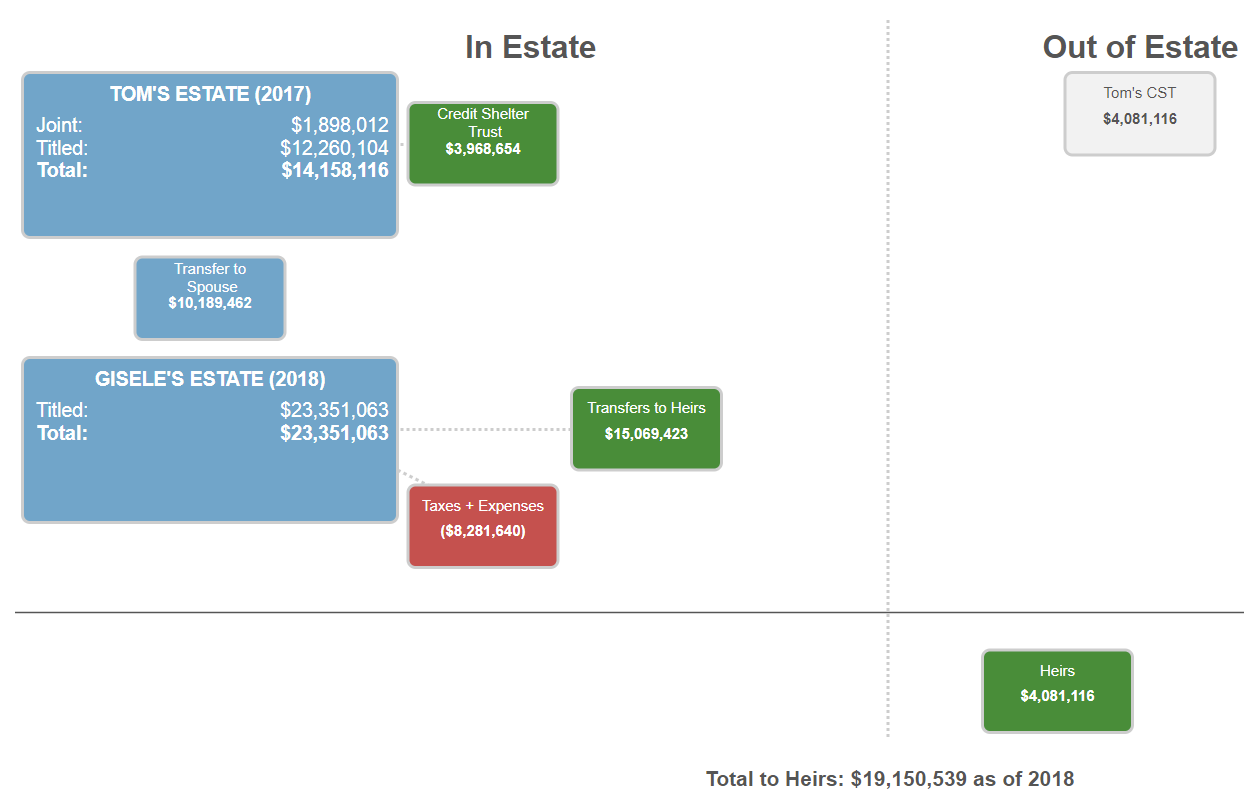

The next report we will take a look at will be the Flow Charts report. Once you have verified that the data input for the client’s plan is solid, the Flow Chart will allow you to cleanly present the plan to your client.

Using the above example, we can see the information covered by the previous two reports but laid out in such a manner that is easier to explain to clients. Starting from the top we will see how much Tom is passing along upon his death, followed by how much Gisele will be passing along when she dies the following years.

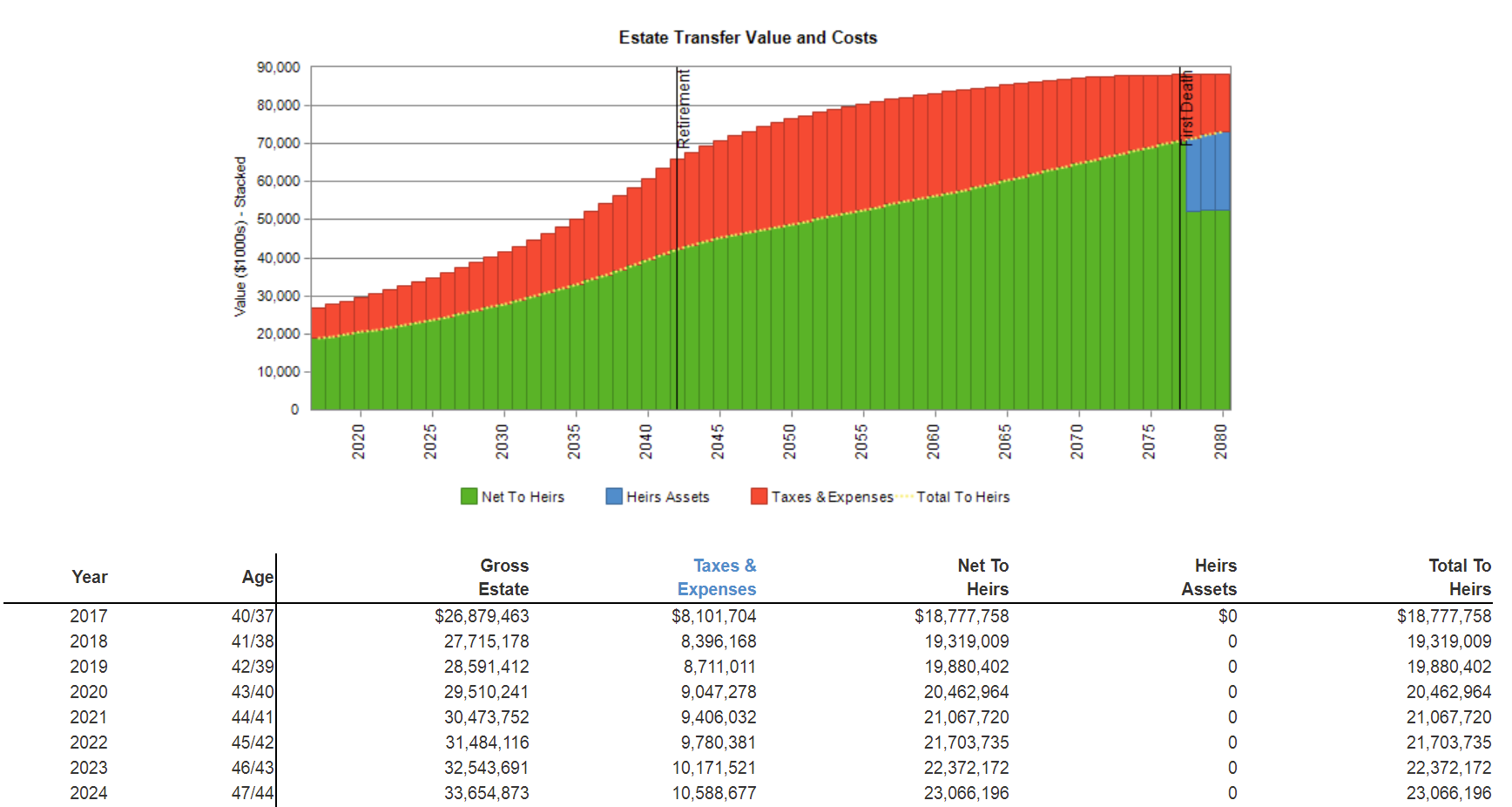

The final report we will be looking at today is the Estate Transfer report. While the above reports can be run to show an estate plan in any year you desire, it can be quite cumbersome to show multiple years to clients without bloating your presentation. This is where the Estate Transfer report comes into play, as it will give you a high-level overview of what would happen to your clients’ assets in any given year in the simulation:

Unlike the previous reports we looked at, the Estate Transfer report will show you what happens to the estate no matter what year the clients pass away. This is a great report to follow-up to your Flow Chart to show the clients how their estate plan may change over time.

– John Costello, Financial Planning Analyst