for expert insights on the most pressing topics financial professionals are facing today.

Learn More

How do you bridge the gap between your services and expertise and the experience consumers want? This conference was designed to help you bring planning to more people. Over the course of three days, we will share proprietary research and the resulting insights to help identify the opportunity for you to better connect and engage with the millions of households looking for the service, knowledge, and experience you are positioned to deliver.

Susan McKenna, the new eMoney CEO kicked off our ninth annual eMoney Summit with excitement and enthusiasm! She shared insights about Bridging the Gap—between your services and expertise and the experience consumers want. With a focus on bringing more plans to more people, we shared new research and actionable insights to help financial professionals identify new opportunities.

Drum roll, please…

eMoney now serves more than 100,000 Financial Professionals! All 100,000 of you share the same goal—to help people talk about money—and we are so grateful for your loyalty and trust throughout the years.

In honor of our 100,000 user milestone, eMoney will be making a donation to an organization selected by our Summit attendees! Attendees have until Tuesday, October 18, at 11:59 p.m. ET to vote for a charity of their choice (an email will be sent to attendees Tuesday morning with a reminder link to vote).

If you are a current Summit attendee and looking for a refresher, or you weren’t able to attend this year, keep reading for a full recap!

Matt Schulte, Head of Finacial Planning at eMoney shared highlights of the support beyond the platform that eMoney provides to advisors. He leaned into the theme with a bridge analogy: “Like a bridge, in order to shift with the industry, you balance the force of tension and compression, the pull and the push, to achieve the strength and stability necessary to move confidently into the future.” He outlines the five forces pushing the industry towards change: Increased regulation, the need to provide the holistic planning that clients prefer, the wealth transfer, the shifting needs of an aging client base and the use of financial psychology in the planning process.

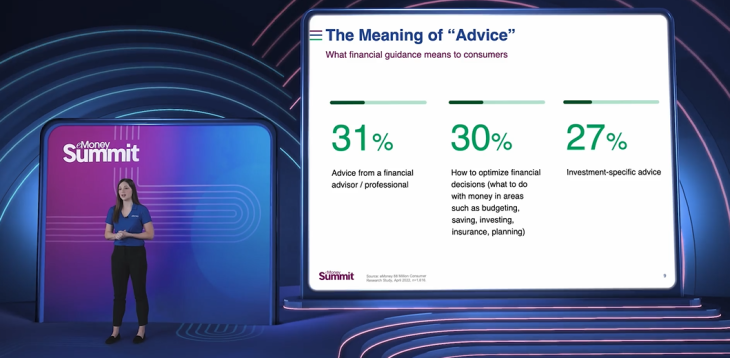

Matt then introduced Dr. Emily Koochel, to share the research and insights gained through proprietary research conducted from April to August of this year. Emily highlighted where advisors and consumers stand on several topics such as defining and understanding preferences, financial guidance and resources.

We learned 88 million households are seeking financial advice that contains some degree of a human element. Many of these consumers are looking to optimize their financial decisions and have investment guidance. So why is it that people are hesitant to work with someone? We found lack of confidence to be a major consideration, in fact only 39% of consumers were confident enough to achieve their financial goals and 49% use negative words to describe their situation. Additionally, consumers are seeking peace of mind and confidence and the enablement to make meaningful changes to their financial lives.

Emily ended with the reminder that technology not only offers the opportunity to scale your services and enable your client, but it can also act as guide to help navigate important client conversations.

Tom Sullivan, head of Product at eMoney, kicked off the Product Roadmap and Vision presentation by sharing how we work to bridge the gap to create efficiency so you can scale your practice while maintaining your high level of service as an advisor. Tom shared eMoney’s four core value-drivers: –

We also heard from other leaders on the product team, including Ricky Illigash, Director of Product Management, to add more detail about how eMoney is innovating within the four pillars of the product:

Ricky also shared our planning roadmap and how we continue to focus many of our future enhancements on the Decision Center, our widely used interactive cash flow-based planning experience.

Chad Porche, VP of Product Innovation, joined the stage to share updates on update on Incentive, eMoney’s financial wellness solution application currently available to retirement advisors. Chad dives into all the benefits the app offers to help clients and advisors work together to view their full financial picture.

Questions were flying at Monday’s live Product Experience Q&As, where eMoney’s Head of Product, Tom Sullivan, and Director of Product Management, Ricky Illigasch, fielded your most pressing questions about our current offerings alongside with members of eMoney’s Product, Training, and Financial Services teams.

Monday afternoon was dedicated to eMoney breakout sessions that fall into the category of Optimizing Your Process. Attendees chose from six different sessions including Enhancing Engagement Through the Client Portal, Creating a Complete Financial Picture, Understanding and Maintaining Connections, and more. Attendees had the ability to earn up to 3 CE credits if all six sessions were attended. See a short teaser from one of our highest attended sessions below:

Tricia Haskins, Head of Integration Solutions at Fidelity Institutional, posed the age old question, “what technology should I be using?” in her session, The Digital Empowerment. Historically, the wealth management industry has been slow to embrace technology. Tricia shared that firms prioritizing their technology pre-pandemic grew at a faster rate than those who were forced to invest in technology to survive Covid-19. Tricia went on to share the Digital Empowerment framework that firms can use to technologically adapt to the need of their clients.

It is safe to say day two of the Summit was jam-packed and filled with lots of exciting content, including our keynote speakers, breakout sessions, and panel discussions.

Day two kicked off with the CFP Board Code of Ethics and Standard of Conduct presentation, for CFP Board-approved ethics CE credits.

Carla Harris, Managing Director and Senior Client Advisor at Morgan Stanley and 2013 President Barack Obama appointee, shares her success equation made from eight intentional “pearls” that successful leaders should implement to inspire and motivate their teams to achieve innovation:

Carla illustrates each of these eight areas with personal stories from her career, while also addressing how this equation applies to the workforce today made up of Millennial and Gen Z professionals. This generation of professionals are much more interested in the “why” behind their contributions in the workplace and are the least comfortable with failure than other generations historically. Carla asserts, “failure has no place in your leadership equation” and drives home the importance of getting your teams comfortable with failing and thoughtfully encourage risk-taking.

eMoney Sr. Financial Planning Consultant, Dr. Emily Koochel kicked off this panel discussion about conflict resolution in financial planning. She introduced her panelists, Dr. Megan McCoy, assistant professor and program director for the master’s program at Kansas State University, and Dr. Meghaan Lurtz, a professor of practice at Kansas State University, who teaches for the advanced financial planning certificate program and leads lectures about financial psychology at Columbia University.

Dr. McCoy and Dr. Lurtz started the breakout session by discussing how arguments around money can be the hardest a couple experiences because it speaks to our deepest fears, hopes, and dreams, and typically people talk about money without addressing it head-on due to it being a taboo topic in today’s culture, unlike other cultures in countries such as China and Italy. For example, in Chinese culture, personal worth is measured more by quality, moral, and ethical values, rather than economic value, which is the norm here in America.

Dr. Lurtz explains the different money personalities, such as spenders and savers, and how each person differs in what they believe when it comes to money, and how that shapes what we do and how we spend. Dr. McCoy and Dr. Lurtz shared tips for working with and guiding clients through these difficult conversations while considering the different money personalities.

Ultimately, Dr. Koochel, Dr. Lurtz, and Dr. McCoy agree that we need to reapproach conflict as not good nor bad, but rather question the underlying cause to better address the reason so both parties can enter into a productive conversation. We wrapped this session up with Dr. Lurtz posing as a financial advisor for her clients, Dr. Koochel and Dr. McCoy. Dr. Lurtz, applied the 4 steps of non-violent communication to lead the “couple” through a heated conversation about their contrasting views regarding their familial financial priorities. This role play really drove their message home and provided a real-life template for financial advisors to copy in their business.

Connor Sung, Director of Practice Management at eMoney, kicked off his panel by introducing:

Together they discussed this year’s Summit theme: Bridging the Gap. They began the discussion by reminding attendees of the impactful statistic shared at the start of the Summit: 88 million households are interested in receiving financial advice through a hybrid experience. Together, they explored the gap between clients wanting to feel more in control of their financial journey while also wanting to work with a financial professional. The panel discussion focused on gaps in the industry and how best to bridge them to adapt to the changing market and evolving client expectations.

Featured breakout sessions from Fidelity Institutional and Allianz included:

Tuesday afternoon featured several timeslots breakout sessions about Presenting to Clients and Beyond Planning. Session topics included: Uncovering and Addressing Potential Vulnerabilities, Outsourcing Planning: Serve More Clients with eMoney Collaborate, Total Client Engagement, and more.

Economic futurist and the former first Chief Market Intelligence Officer for the U.S. Government, Andrew Busch kicked off his session by asking, “Does the world seem to be spinning a little faster these days?” His presentation provided an economic overview, covering government policies, elections, and trends. He also covered where we are, where we’ve been, and where we’re going—to frame up things financial professionals should be aware of and discussing them with clients.

And that’s a wrap for the eMoney summit! We hope that you enjoyed and absorbed all the information we offered this year. But not to worry, the Summit experience will live on beyond today via the recaps below, and soon you’ll receive all the recordings and associated resources from the summit sessions.

On day one, Susan McKenna announced that eMoney now serves more than 100,000 Financial Professionals!

In honor of our 100,000 user milestone, we announced that eMoney will be making a donation to an organization selected by our Summit attendees.

You voted and the results are in. We are happy to announce the chosen charity is Junior Achievement!

Thank you to everyone who helped us celebrate this incredible milestone and assisted us in picking such an important charity!

We closed out the Summit with Live Q&A in Product Experience, and continued with a packed day of breakout sessions about Presenting to Clients and Beyond Planning.

Attendees had a final opportunity to ask questions and engage directly with eMoney leadership on topics around the eMoney planning products, training opportunities, or financial planning services.

Wednesday morning was dedicated to closing out our Presenting to Clients and Beyond Planning breakout sessions, giving attendees a final opportunity to join any sessions they missed the previous day. Attendees had the opportunity to earn up to 1. 5 CE credits.

The rest of the day was dedicated to our breakout sessions about building plans. Attendees had the option to pick from 10 different sessions such as Building and Delivering Estate Plans, Leveraging Planning Solvers to Build Scenarios, Illustrating Equity Compensation, and much more.

If you attended the Summit, we hope you enjoyed it as much as we did! If you could not attend, we hope these daily recaps provided some value and a healthy amount of FOMO and that we’ll see you next year!

We’ll be reaching out to our 10 lucky social media posters who will receive a $50 Visa gift cards as well as the winner of the Apple Watch! And don’t forget, throughout the month of October, Summit attendees can take advantage of 15% off any planning product. You can redeem the offer by purchasing your first planning package, upgrading your existing package, or adding another member of your firm to your eMoney subscription. See terms of promotion.

TERMS OF PROMOTION: eMoney 2022 Summit (“Summit”) registrants can receive 15% off of one new, annual subscription of eMoney Plus, Pro or Premier – including 15% off the upgrade price from Plus to Pro or Premier, or from Pro to Premier, or, alternatively, registrants can receive 15% off the price of one support subscription under their contract, for a new subscriber who did not attend Summit (the “Discount”). The Discount is only available for a subscription purchased by Summit registrants, including a support subscription purchased by registrants, and cannot be combined with other promotional offers, including without limitation, Planning+Bamboo bundle pricing. The Discount only applies to the first year of the new subscription. After the first year, the Discount expires and the contract price will increase to eMoney’s then current price at the time of renewal. The Discount only applies to a subscription purchase made during the dates of October 1 through October 31, 2022. The Discount applies solely to an individual or firm purchase made under eMoney’s standard retail pricing and is not available for purchases made as part of larger home office or pursuant to institutional pricing. Limit one Discount per Summit registrant. Registrants cancelling their Summit registration will automatically forfeit the Discount. eMoney reserves the right to change or discontinue the Discount at its sole discretion, with or without notice.