for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreDuring the 2023 eMoney Summit, financial professionals convened over a span of three dynamic days to delve into the theme: Beyond the Plan. In this post, we will recap essential insights and highlight our favorite moments from popular sessions.

Susan McKenna, eMoney’s CEO, kicked off the tenth eMoney Summit with enthusiasm and gratitude. She introduced this year’s Summit theme, Beyond the Plan, emphasizing that financial professionals go above and beyond a mere financial plan to create trust, comfort, and confidence for their clients.

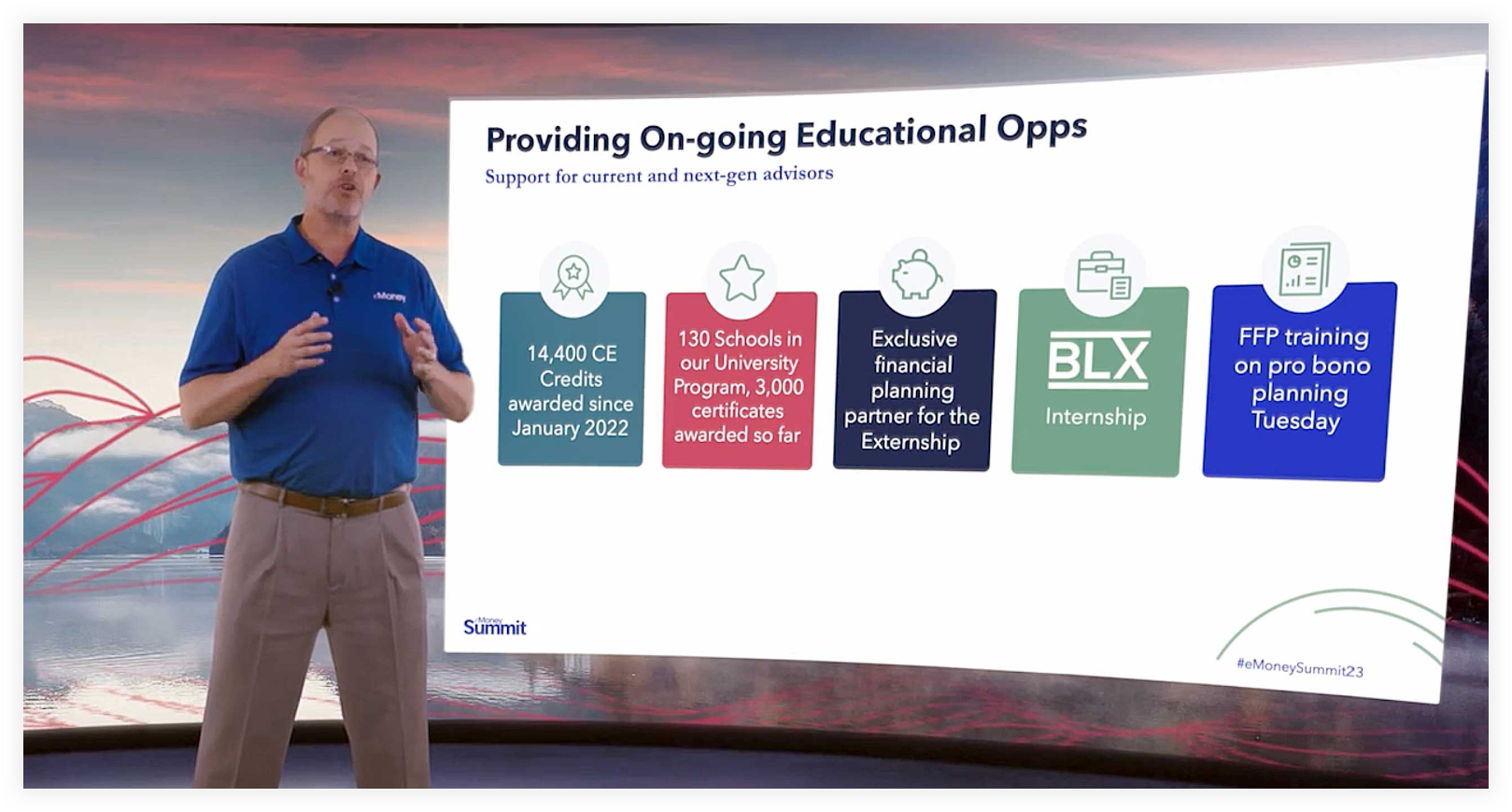

Matt Schulte, Head of Financial Planning, celebrated the industry’s evolution and the importance of technology, which has shifted from optional to indispensable. eMoney’s commitment to advancing the profession includes collaborating with industry organizations on compliance and research projects, and ensuring advisors stay at the forefront of innovation.

Matt highlighted the importance of:

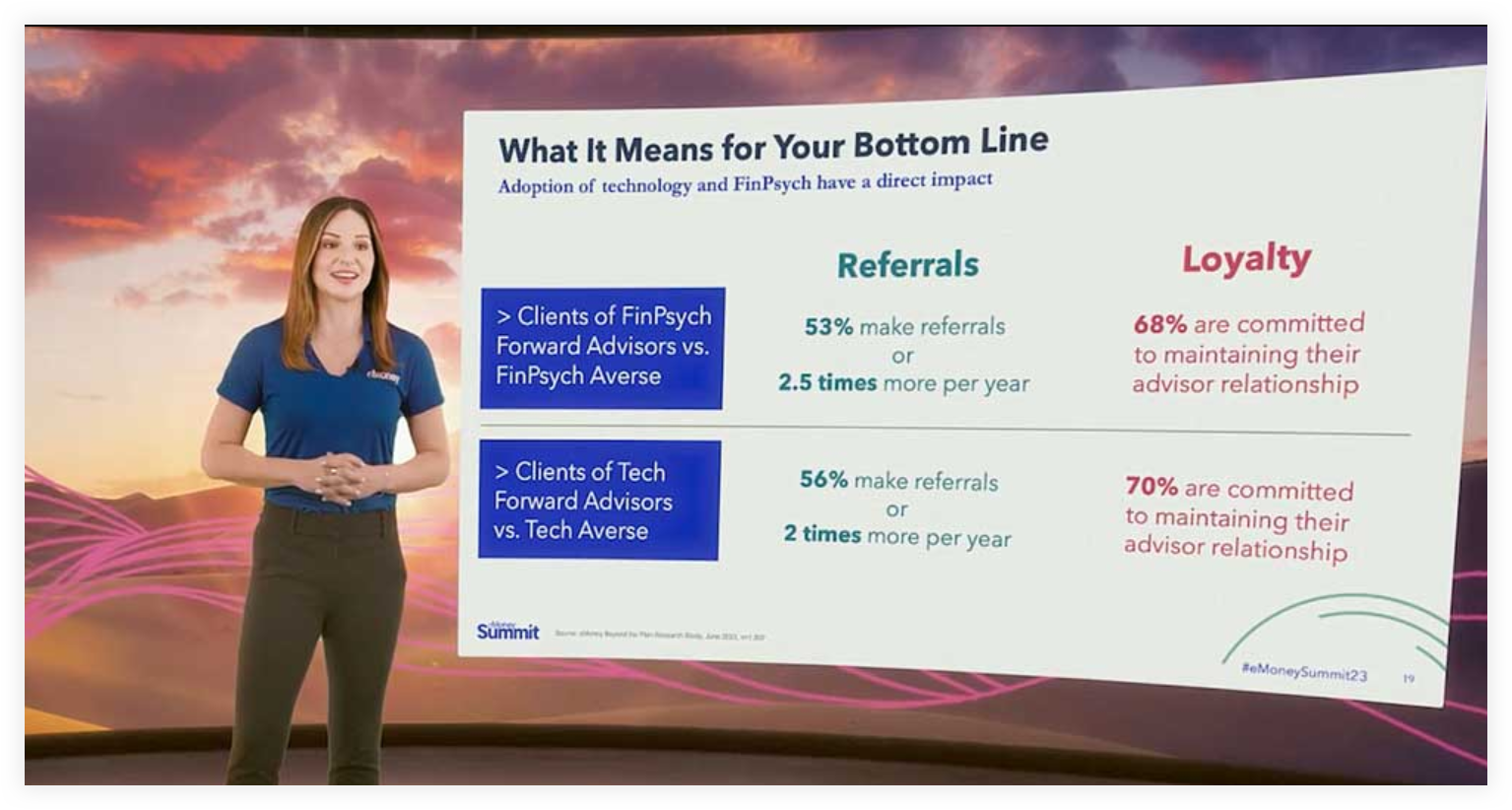

Emily Koochel, Manager of Financial Wellness Programs, delved into research findings aimed at propelling advisors Beyond the Plan. The research, which builds on eMoney’s Evolution of Advice study, examined the crucial role of personalization in financial planning. Key highlights included:

The research findings emphasized that while financial planning skills and credentials are essential, what truly sets advisors apart is the quality of the client experience, achieved through personalized communication, motivation, and a deep understanding of clients as individuals. In an evolving landscape, clients increasingly expect a seamless blend of financial expertise and advanced technology.

In this highly-anticipated presentation, Tom Sullivan, Head of Product, and his leadership team shared the product roadmap, which is fueled by feedback from users like you. Key takeaways can be summarized into three core themes:

Overall, eMoney is dedicated to creating world-class experiences that drive better planning outcomes for advisors and their clients.

The Live Q & A Product Experience covered several important topics:

In addition to these key insights, the session covered various other topics. If you missed the presentation, don’t worry – it will be available on-demand after the summit.

Madeline McAleer, Senior Financial Planning Services Consultant, focused on leveraging eMoney’s annuity workflows to demonstrate options for clients to reduce market-related retirement concerns by incorporating guaranteed income solutions.

Brandon Heid, Senior Financial Planning Practice Management Consultant, delved into how eMoney’s personal financial planning solutions drove growth through enhanced office efficiency. By leveraging integrations, account aggregation, and sophisticated planning tools, eMoney streamlines processes, allowing financial professionals to concentrate on client engagement. Attendees discovered how the scalable platform empowered users to optimize workflows, track and manage client portfolios, and deliver personalized experiences.

Sponsored breakouts featured sessions hosted by Allianz, Fidelity, and Nationwide.

These breakout sessions provided attendees with diverse perspectives and practical knowledge to enhance their financial planning practices.

In this session, Zac Gates, Training Specialist, focused on maximizing efficiency in delivering estate plan recommendations to clients.

Tarnisha Bruce, Vice President of Relationship Management at eMoney, was joined by panelists, Dr. Miranda Reiter, Ph.D., CFP® Diversity, Equity, & Inclusion, and Luis F. Rosa, CFP ®, EA, Founder & Financial Planner at Build a Better Financial Future LLC and Co-Founder of the BLX Internship Program.

Together, the group explored vital strategies for enhancing the industry’s inclusivity and adapting to changing generational, cultural, and societal norms. The discussion shed light on the importance of understanding diverse cultural values and expanding communication approaches to serve all clients effectively. Top advisors shared insights into the straightforward yet impactful changes that can be made to lead and plan with inclusion, ultimately propelling the financial industry forward. This engaging session offered valuable insights for professionals seeking to navigate the evolving landscape of financial planning.

Sallie Krawcheck, a prominent figure in the financial industry, reflected on her extensive career. She underscored the significance of the financial industry in helping individuals build wealth and offered insights on how to help women see finances as a source of strength.

Krawcheck distilled five key lessons from her career, addressing the subprime crisis, leadership decisions, and the significance of kindness in the corporate world. She concluded by reaffirming the greatness of the financial industry in empowering families, strengthening the economy, and contributing to a better society.

After an exhilarating first day packed with insights and networking, Day 2 did not disappoint and delivered a captivating lineup of sessions and discussions.

In his captivating keynote address, Morgan Housel, author of The Psychology of Money, explored the complexities of managing money and why it remains challenging for so many individuals. Housel noted that managing money is not solely about understanding finance; it’s a study of how people behave with money. Housel explored how understanding human behavior can lead to more productive financial management, encouraging individuals to align their financial decisions with personal happiness and much more.

Tuesday’s sponsored breakouts featured sessions hosted by Nationwide, Fidelity Charitable, and MaxMyInterest.

Brett Tharp, Advisory Training Specialist, shared how to effectively leverage eMoney to enhance clients’ financial security by mitigating risks across different life stages. The session emphasized paying attention to the various risk management inputs and assumptions within eMoney, showcasing the potential for quick wins and product sales through Needs Analysis.

Connor Sung, CFP®, Director of Practice Management, and Emily Koochel, PhD, AFC®, CFT-I™, BFA™, Head of Financial Wellness Programs at eMoney, led a panel discussion that delved into the strategies and insights needed to go beyond traditional financial planning methods. The session focused on the critical element of trust, which underpins clients’ demand for personalized advice and solutions. The discussion emphasized how trust can be secured through a combination of behavioral approaches, tailored plans, and advanced technology, resulting in long-lasting, meaningful client relationships that drive success. Panel members shared their expertise, offering valuable guidance on building and maintaining the foundational trust required for thriving in the financial planning industry.

Panelists included:

For this year’s virtual Summit, we brought real-time interaction to the forefront with live roundtable discussions. These roundtables provided a unique opportunity for live interaction, allowing participants who pre-registered to dig deeper into specific topics of interest and connect with their peers.

Participants had the opportunity to engage in discussions such as:

These live roundtable discussions were a valuable and interactive addition to this year’s Summit, providing participants with the opportunity to learn, share, and connect in real time. We were delighted to see so many of you there!

Michelle Riiska, Financial Planning Services Consultant, provided a comprehensive view of how eMoney can be used to demonstrate the value of modeling tax-conscious decisions for clients. The session highlighted new functionalities like Roth conversions and updated reporting capabilities.

As we bid farewell to an incredible two days of learning and networking, Day 3 marked the grand finale of the 2023 eMoney Summit. This final day was filled with a series of captivating sessions and discussions that left attendees inspired and enlightened.

Jennifer Rock, Training Specialist, explained how the eMoney Client Portal can assist them in working effectively with their clients. The session covered best practices for rolling out, managing, and supporting this valuable tool, emphasizing its role in securely exchanging important information and empowering clients to drive their financial conversations.

Carla Youngs, Senior Training Specialist, demonstrated to attendees about showcasing their value, refining the client experience, and harnessing technology for a white-glove service.

Building on the discussion in Part 1, Connor Sung, Director of Practice Management, along with Emily Koochel, Head of Financial Wellness Programs, and panel participants delved into the strategies and insights necessary to go beyond traditional financial planning approaches. The discussion emphasized that securing trust through behavioral consistency, customized plans, and advanced technology paves the way for enduring and profound client relationships that drive success.

Brandon Tucker, Director, Financial Planning Services, explored how using Analytics and Office Analytics to identify client and prospect needs, enhance the client experience, and adopt a holistic approach to financial planning.

Michael Kitces joined us live to discuss the challenges and solutions surrounding the financial planning process. The session emphasized that while financial planning is valuable, it can be time-consuming, particularly for growing advisory firms managing a substantial client base. Key topics included the impact of advanced education and designations, the development of repeatable financial planning processes using an annual service calendar, the influence of client variability on firm efficiency, and the benefits of refining advice processes for specific target clientele.

We extend our heartfelt gratitude to all of you for making this year’s virtual Summit a resounding success. Your participation and engagement have been truly inspiring.

We look forward to welcoming you all again, and together, we’ll continue to explore, learn, and innovate.

Until then, stay connected, stay inspired, and we can’t wait to see you next year!