for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreWith Advanced Planning, you can simulate any real world financial scenario and model the implications of that simulation over the course of a client’s entire lifetime.

Have a client who wants to see how buying a boat will affect their retirement? Or want to help them understand why you’ve recommended that intentionally defective grantor trust? Advanced Planning in eMoney can handle everything from the simplest planning scenario to the most complex.

So when you have a tool with this level of versatility, where do you start? Follow our guide to getting started and you’ll be well on your way.

Start by reviewing your Miscellaneous Assumptions. These include both personal assumptions about the client, and other variables such as taxes, simulation years, intestacy and fees.

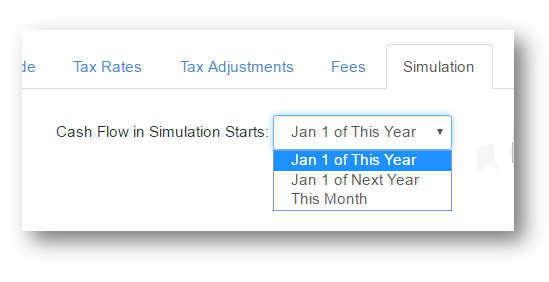

Next, determine how you are modeling your cash flow. eMoney’s Simulation Assumptions allow you to model your simulation based on January 1 of the current year, next year, or pro-rate your simulation based on this month. To save time editing these assumptions for all new clients, you can edit the default settings under Settings -> Fact Defaults on your navigation bar.

Pro tip: When using January 1 of this year, clients who have connected personal accounts, take note of income and expense events that have already occurred to prevent double counting. Alternatively, be sure that you’re aware of what items are pro-rated when using the monthly simulation.

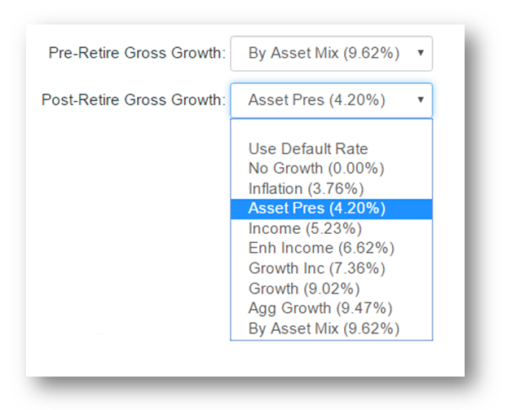

From here, quickly review your individual facts—and remember to pay close attention to the Pre-Retire and Post-Retire growth rates.

Are you using Model Portfolios, Asset Mix, or Custom Growth Rates? Each has unique pros and cons:

Custom Growth rates allow you to set a specific, linear growth for an account, but remove the standard deviation that creates variability in Monte Carlo. Due to their effect on Monte Carlo, custom growth rates should be used only as a last resort.

By Asset Mix looks at the actual holdings data for an account and uses that information to construct the growth rate based on the underlying index data of the real world holdings. A common best practice is using By Asset Mix pre-retirement and switching to a Model Portfolio post-retirement to simulate moving to a more conservative asset distribution.

Model Portfolios allow the advisor to retain the most control over an account’s growth rate while still allowing for Monte Carlo to simulate variations in the growth rate.

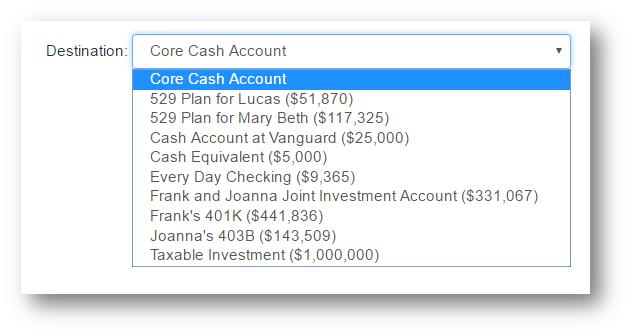

Next, look at your income flows. For most scenarios, the best practice is to direct all income to the Core Cash Account, and use the Core Cash Account to distribute any income to planned savings. This prevents your Liquidation Strategy from activating due to the appearance of negative cash flow which can cause additional taxable events.

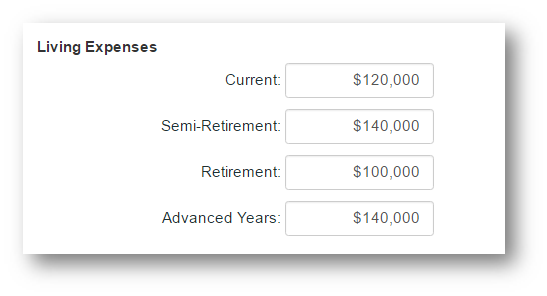

Finally, be sure to complete your Basic Living Expenses when not using the Living Expense Worksheet. The Living Expenses in the Event of fields allow for your what-if scenarios to function properly when simulating pre-mature death.

Pro tip: If you need more variation in living expenses over your client’s lifetime, remember that Semi-Retirement and Advanced Age fields in your Miscellaneous Assumptions give you two additional time periods from which you can queue living expense changes.

Once you’ve double checked your Facts, it’s time to check for issues such as large spikes in income, expenses, and taxes within the Cash Flow report. The Cash Flow report allows you to track these issues to their source whether it’s a large expense coming due, stock option vesting, etc.

See below for an example of an issue within the Cash Flow Report.

Once you’re confident in your base case, you’re ready to begin constructing your first Advanced Planning Scenario.

It’s best to begin your scenario with clear goals in mind.

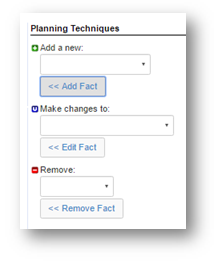

There are three primary Planning Techniques that simulate changes to your base case scenario within the Advanced Planning Tool. With these techniques, you can add a new technique, make changes to a technique, or remove.

Adding a new technique can be as straightforward as creating a new account, property, or income stream. It can also be as complex as adding a reinvestment technique to show a change in asset allocation for one or multiple accounts, or a Buy/Sell transaction to model the sale of a business over a 10-year period.

Making changes to technique is generally used to adjust growth rates of existing accounts or modify income streams. However, it can create incredibly nuanced scenarios when used to adjust your overarching assumptions. By making changes to your assumptions, you can adjust retirement and death ages, modify inflation rates, taxes, and much more.

Removing a technique is as direct as it sounds – this immediately erases investments, liabilities, and insurance policies from the planning scenario. Caution should be used when removing a technique when a Buy/Sell technique may be applicable in its place to properly simulate the tax repercussion or consequences of the simulation.

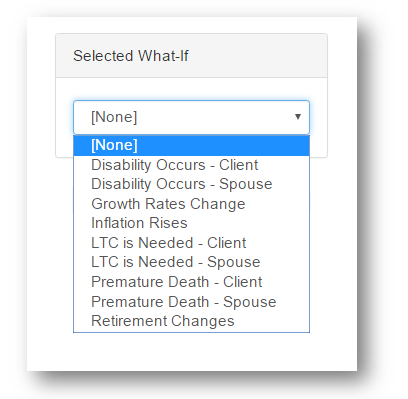

Once you have a strong handle on the Planning Techniques, it’s time to start stress testing and building variations of your scenario to account for all possibilities and market conditions. Unlike Advanced Planning techniques, What-If’s are designed to simulate something out of your client’s direct control.

The Default What-If scenarios account for common life-altering events such as Disability, Long Term Care, Premature Death, Inflation and more. But don’t be afraid to create your own unique What-If based on your client’s real world scenario.

The key to a successful advanced plan is taking your client’s dreams and fears into account and building a plan that accounts for both.

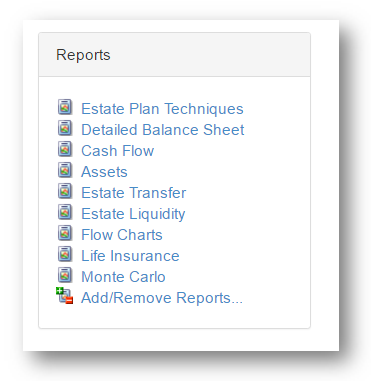

These What-If scenarios can be used to stress test your plan using the Reports already available in the Advanced Planning Module. You can even customize the list of easily available reports.

After you’ve planned, built, and stress tested your scenario in the Advanced Planning module, it’s time to present it to your clients with your Interactive Planning tools and Presentations.

Stay tuned for more best practices with eMoney!