for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreCapital Market Assumptions power the cashflow simulation at the core of all of your client’s financial plans. So it’s important to understand each of the building blocks that go into constructing eMoney’s Investment Assumptions.

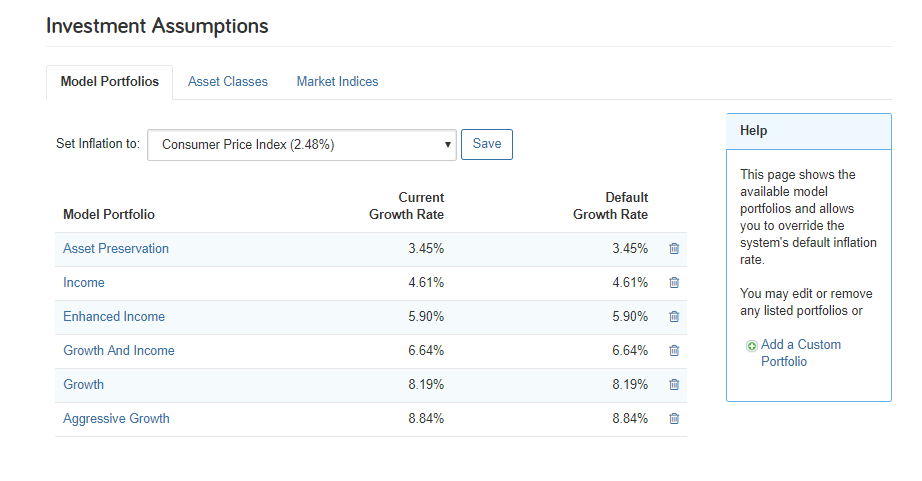

Let’s take a look at eMoney’s Investment Assumptions starting with the Model Portfolios tab.

Market Indices are the foundation of the eMoney Cash Flow Simulation. You need Market Indices to build your Asset Classes, you need Asset Classes to create your Model Portfolios, and you need Model Portfolios to accurately define the growth rate of well—everything.

The Market Indices tab allows you to modify the rate of return or standard deviation for a system-defined index, create a custom index, and update the market index data when new quarterly data is published.

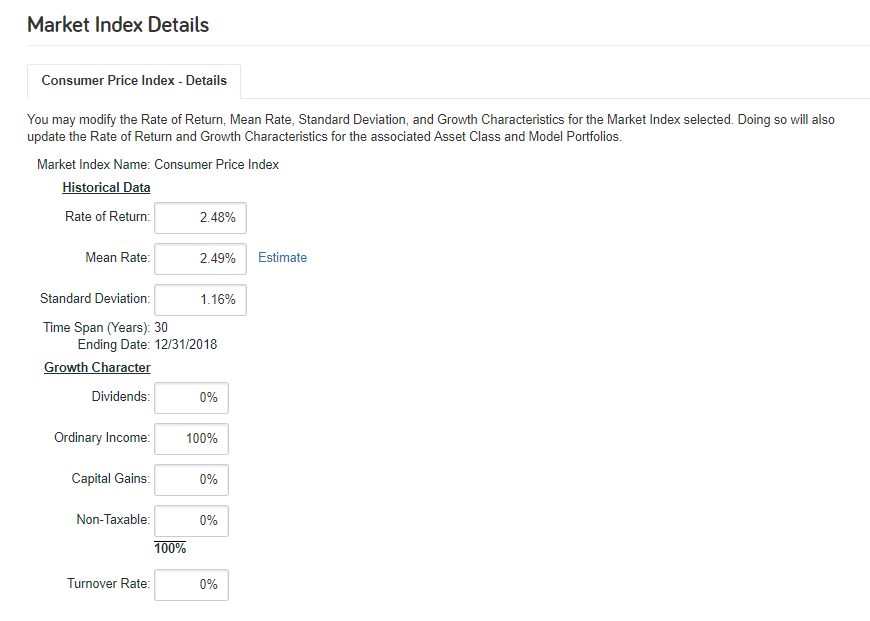

Every Market Index is composed of Historical Data and Growth Character. These factors determine how the index interacts within the eMoney Cashflow Simulation.

Historical Data has three core components that control the index’s performance and two that describe the span of time upon which it is based:

Pro tip: While you can add your own custom indices, they will not be correlated with other index data in Monte Carlo simulations and Efficient Frontier analysis. However, modifying the Rate of Return, Mean Rate, and Standard Deviation for a system-defined market index will maintain correlation with other index data.

Growth Character is composed of five characteristics that describe how gross growth is treated for tax purposes:

Pro tip: Growth Character is especially important because it determines the Realization Model for accounts using Model Portfolios that include Asset Classes made up of the Market Indices. Turnover specifically has two functions. It simulates the percentage of the account being sold and reinvested each year, which generates capital gains and revises the basis of the account. Meanwhile, it also applies the capital gains portion of the annual growth generating taxable, short-term capital gains.

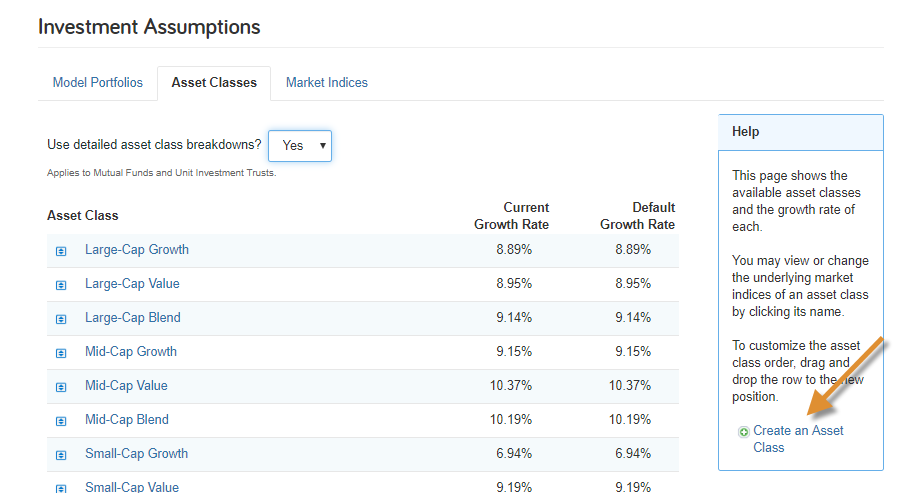

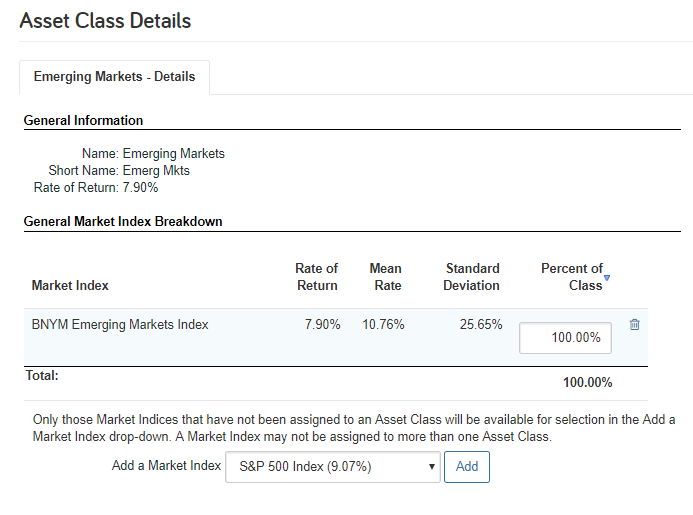

Asset Classes comprise one or more Market Indices and are used to represent groupings of investments with similar growth characteristics. Here you can create new custom Asset Classes, edit existing ones by adding or removing market indices, or re-order the list by dragging and dropping.

Editing Asset Classes is as simple as adding additional Market Indices and defining the Percent of Class that each index defines.

Model Portfolios allows you to adjust Inflation, modify existing portfolios, add custom ones, or remove them entirely.

Pro tip: Inflation is typically set to the Consumer Price Index (CPI) by default. The CPI is shielded from bear market scenarios to avoid fluctuations in living expenses but is not shielded from variance and volatility when running Monte Carlo.

While our default Model Portfolios cover a wide range of planning options, we recommend customizing them to your business to streamline the process of entering client data and onboarding. You can even create your own Custom Portfolios to utilize your firm’s specific model portfolios and recommendation portfolios.

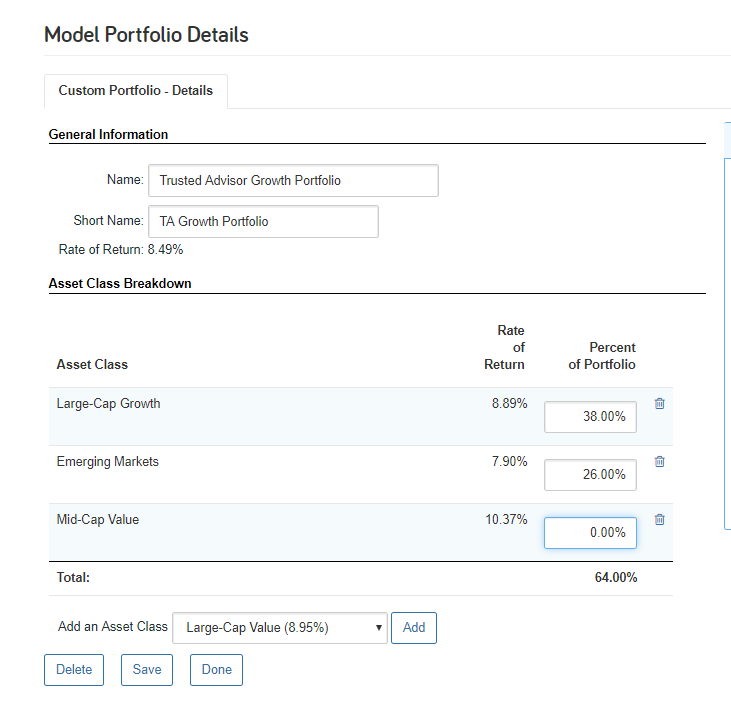

Since we’ve already gone through Market Indices and Asset Classes, creating a custom Model Portfolio should be as simple as clicking Add a Custom Portfolio, adding the Name and Short Name, and selecting and your Asset Classes from the drop-down list. Once you’ve added all the Asset Classes, assign the appropriate Percent of Portfolio and click Save.

By customizing your Market Indices, Asset Classes, and Model Portfolios to your business, you can be sure that the foundation of your client’s cash-flow simulation and their experience is unique to your business.

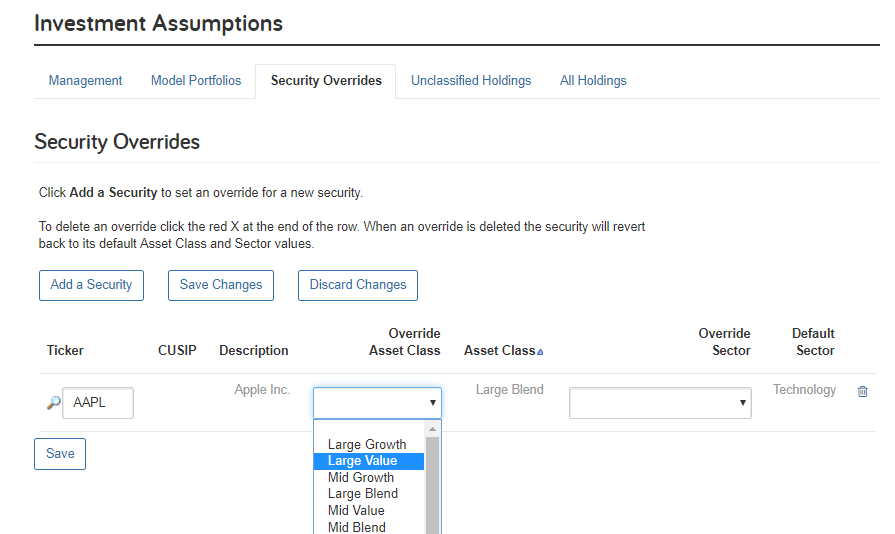

Security Overrides let you make manual changes to how Tickers and CUSIPs are interpreted by eMoney by overriding default settings for Asset Class and Sector.

Once a security has its Asset Class or Sector overridden, the override is stored for that Ticker or CUSIP. This means that any clients with holdings that include that security, and using Advisor (not Client specific) Investment Assumptions, will take the Asset Class and Sector values from the override.

Pro tip: We recommend using the All Holdings page to see how many clients have holdings using a specific Ticker or CUSIP before applying any Security Overrides

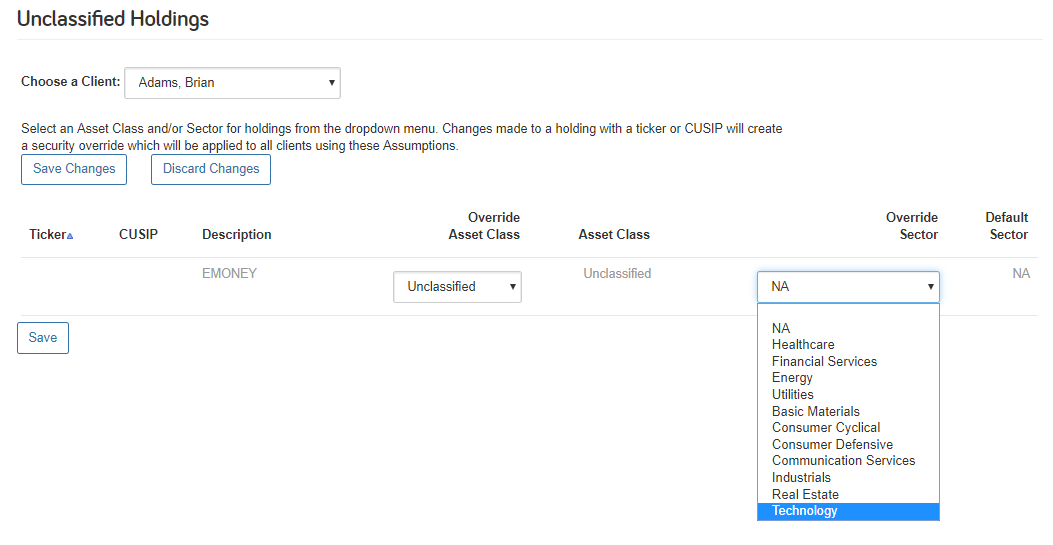

The Unclassified Holdings page allows you to select a client and view any unclassified holdings included in their assets. You can then elect to Make Changes and override their Asset Class and Sector. If a Ticker or CUSIP is defined, changes will create a security override which will be applied to all clients using these Assumptions.

While Unclassified Holdings work well for individual clients, we recommend using the All Holdings page to ensure you have insight into all clients who may be impacted by applying a Security Override.

The All Holdings view, available for advisors and delegated support users, allows you to easily identify all your clients with holdings under a specific Ticker or CUSIP and, if necessary, update the holding’s underlying Asset Class or Sector. It makes the process of parsing your client’s holdings data simple by giving you the ability to:

This means that you can instantly see how many clients have holdings that include a Security and who they are. You can even select to view All Unclassified Holdings at once to quickly identify and correct missing Asset Class and Sector data.

Have more questions about your Investment Assumptions? Check out the resources available in The Knowledge Base under Help within your eMoney application.