for expert insights on the most pressing topics financial professionals are facing today.

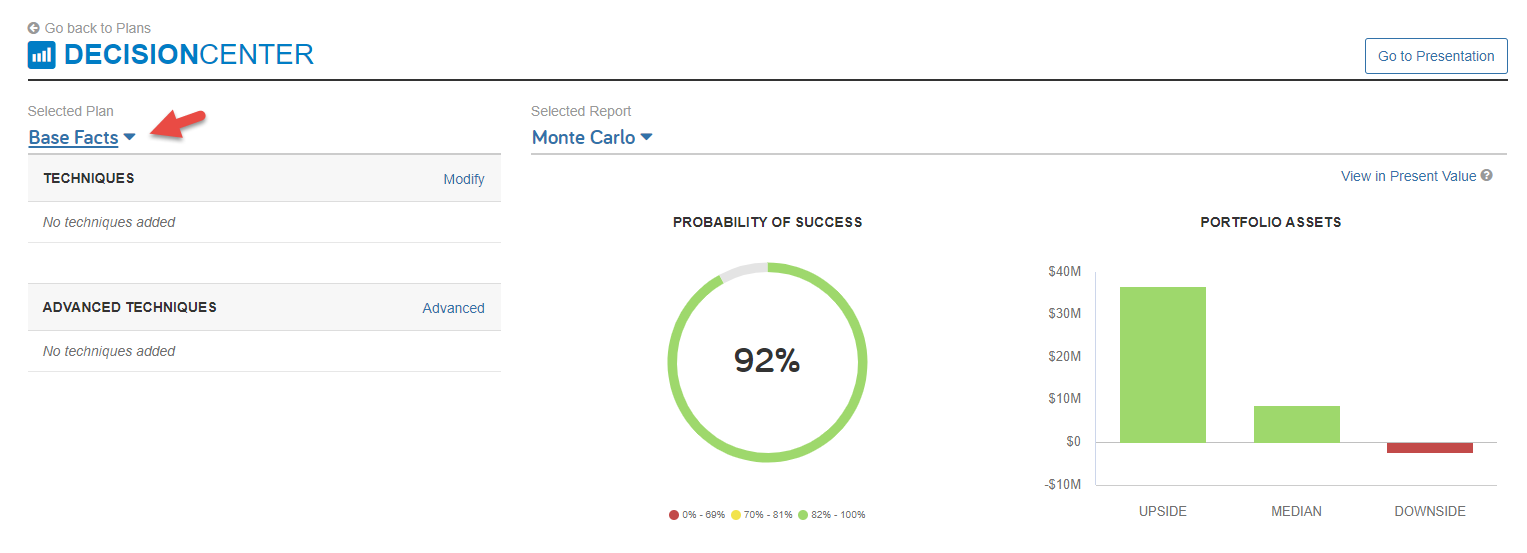

Learn MoreWith Monte Carlo, you can show a client their plan’s probability of success. However, eMoney assumes with every Monte Carlo trial both the client and spouse will pass at their life expectancy age entered in the Retirement and Death assumptions.

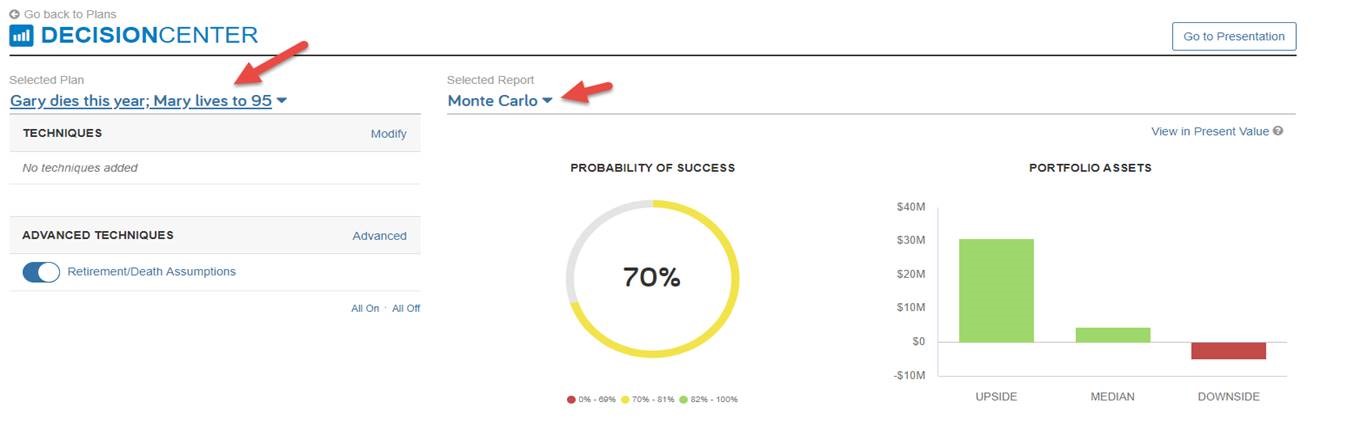

Let’s look at how you can demonstrate the financial and planning effects of a wide range of longevity scenarios, including a client passing away prematurely and the spouse living to life expectancy.

To model premature death in Monte Carlo reports:

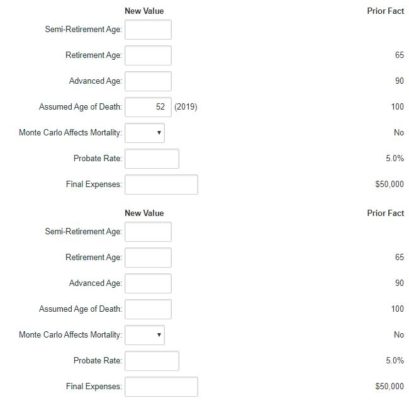

Do you currently use Monte Carlo Affects Mortality setting to assess longevity risk in eMoney? Due to low usage and lack of transparent results, we are discontinuing this option under the Miscellaneous Assumptions in the Advanced Facts on November 20.

The lack of transparent results made it difficult for advisors to determine the assessed longevity and adequately convey the results to clients. We plan to build a more innovative way to present this information in the future.

Questions? Give us a call at 888-362-8482 or send us an email.