for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreDuring the holiday season, giving gifts to loved ones is always top of mind. In eMoney, gifting is often used in estate planning for high net worth individuals looking to pass along their wealth to the next generation or their favorite charities.

Today, we’ll look at how to model past taxable gifts, planned gifts, and charitable gifts in eMoney and the best reports to check your work and present it to clients.

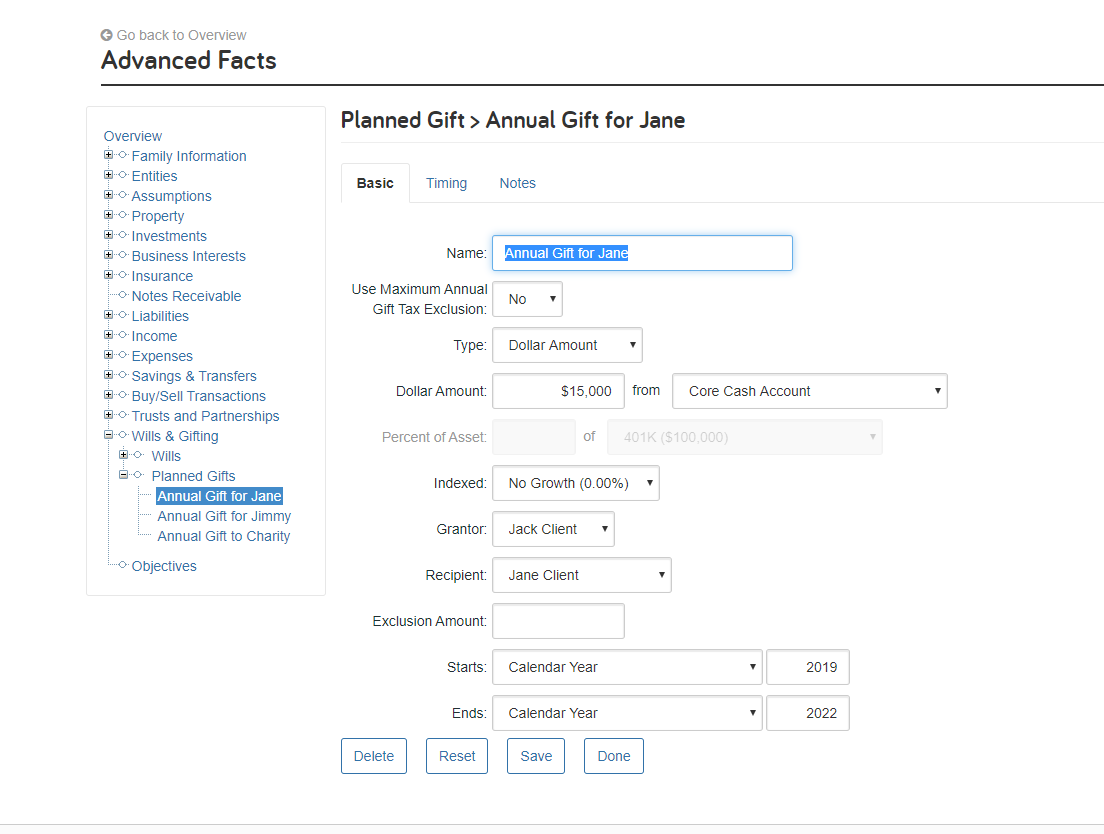

Before adding gifts, it’s important to note that the IRS limits the amount you can gift tax-free. In 2019, the annual exclusion is $15,000 per recipient per year. Any gifts exceeding the annual exclusion amount will be added back into a client’s estate for estate tax purposes.

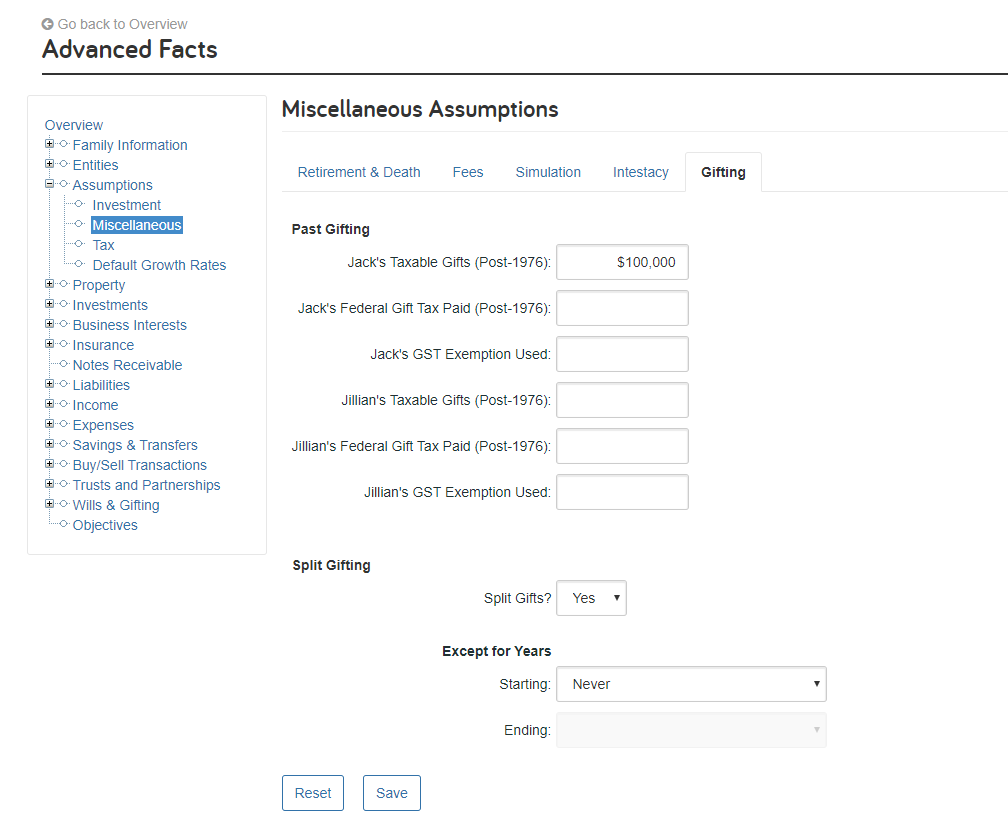

First, let’s review how to add taxable gifts the client has made in the past. This step is important for calculating estate taxes.

To model a past taxable gift:

You’ll also notice the option to split gifts in this section. The system defaults to Yes, gifts will be split for tax purposes to allow for easy use of both spouse’s annual gift exclusion.

Next, you can enter gifts made in the current year and any gifts planned for future years as Planned Gifts.

To model a planned gift:

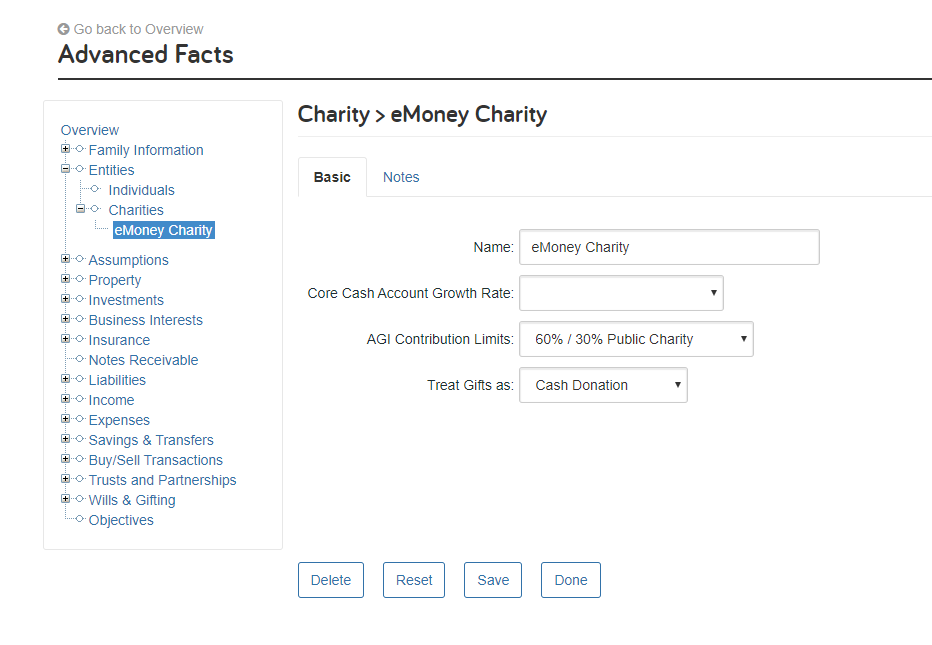

Your client may also want to gift to charity. There are no limits or gift tax consequences for charitable gifts. Clients will also receive an income tax deduction. Adding a charitable gift in eMoney is similar to a planned gift, but with one additional step. First, you’ll need to enter the charity.

To model a charitable gift:

Finally, we’ll look at a few of the best reports for showing your clients’ annual and lifetime gifts.

For more information on how to model gifts in eMoney, check out our Planned Gift User Guide.

Questions? Give us a call at 888-362-8482 or send us an email.