for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreThe SECURE Act (Setting Every Community Up for Retirement Enhancement) was passed and signed into law on December 20, 2019. This new law aims to strengthen retirement security across the country, giving advisors a unique opportunity to engage with their clients on a major piece of legislation.

Watch the webinar below to hear from Steven Taylor, CFP®, Advisory Live Training Specialist and Ryan Coburn, CFP®, Senior Live Training Specialist as they discuss the SECURE ACT and eMoney.

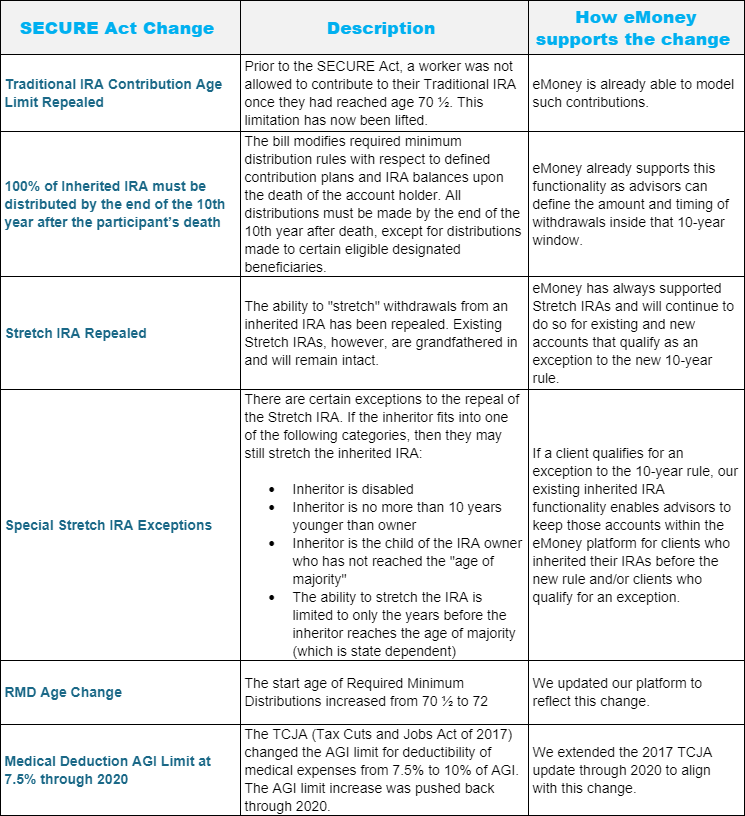

The SECURE Act is complex and touches many aspects of retirement. There are a number of ways the new bill could impact the way advisors interact with both their financial planning software and their current clients, including:

eMoney has always believed in the value of financial planning, and now, the argument for using planning as the basis of a fruitful relationship with clients is stronger than ever.

Due to the current level of sophistication of our platform and our existing comprehensive approach to financial planning, we are already well-positioned to accommodate the changes occurring with the SECURE Act, including:

Introducing your clients to these changes, as well as the new possibilities for retirement savings demonstrates that you have their best interests at heart and are helping them achieve their goals.

Plus, having another opportunity during the year to meet your clients and find out what’s on their minds may uncover other opportunities as well.

Show your clients how the SECURE Act may affect their savings and demonstrate the value of your advisory services.

A summary of the major provisions of the bill can be found at Congress.gov: https://www.congress.gov/bill/116th-congress/house-bill/1994.

The full text of the bill with a clickable table of contents can be found at Congress.gov: https://www.congress.gov/bill/116th-congress/house-bill/1994/text .