for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreThis month, we’re hosting virtual training, weekly webinars, and more. Join our experts for online training sessions to help you master the eMoney platform and integrate it effectively into your business in October!

Our Training team offers various levels of live and on-demand training on the eMoney application designed to take your competency to the next level. Click the links below to jump to the appropriate training series for you.

The Core Concepts series is a part of our Getting Started program which covers the basics of the platform for users who are new to the platform or looking for a refresh. What was previously a series of six, one-hour live webinars has been converted to a new micro-learning format. Learn more about the new micro-learning format for the Core Concepts Series here.

Ready to get started? To view all the available sessions and sign up click here!

Intermediate series webinars are hosted daily at 11:00 a.m. ET and are designed for mid-level users to expand their knowledge of the eMoney platform. Session topics will range from a deep dive into investment assumptions to best practices for inputting personal property, and much more. View all sessions here.

Join us as we review the optimum workflow for maximum efficiency within the eMoney platform.

October 2nd, 11th at 11:00 a.m. ET

Discover the importance of accurate assumptions and how they affect cash flow simulations and your client’s financial plans.

October 3rd, 14th at 11:00 a.m. ET

Get ready to explore your client’s portfolio assets. The session outlines best practices for accurately entering all Investment types, from cash accounts to stock options, into the eMoney platform.

October 4th, 15th at 11:00 a.m. ET

Explore eMoney best practices for inputting personal property and real estate, as well as various insurance policies.

October 7th, 16th at 11:00 a.m. ET

Join us for an in-depth look at all cash flow-related Facts within eMoney. Review our advanced cash flow simulation, then dive deep into all income, expense, and transfer workflows.

October 8th, 17th at 11:00 a.m. ET

Understand how to effectively use our most popular planning reports and even discover some lesser-known reports. This session outlines how to use reports to their full potential and present customized presentations to your clients.

October 9th, 18th at 11:00 a.m. ET

Learn how to effectively use the eMoney platform to serve a variety of different client types. This session explores best practices for low, moderate, and high net worth households.

October 1st, 10th at 11:00 a.m. ET

For the month of October, Advanced Series sessions are hosted as on-demand recordings and are for more advanced users. These sessions provide a deeper look at modeling more sophisticated planning concepts using eMoney.

Take your cash flow and retirement planning skills to the next level with helpful tips to elevate your eMoney knowledge.

Get ready to explore various tax planning strategies and implementation tactics to help clients plan for the future.

Uncover planning strategies, techniques, and reports while learning more about life, long term care, and disability insurance in eMoney.

Learn how to build the foundation you need with eMoney’s estate planning capabilities which allow you to create and present simple and complex estate plans for your clients.

Our Impactful Extras Series is for users of any level. In Impactful Extras, we discuss a broad range of features included in eMoney and their far-reaching impact. View all previously recorded webinars here.

Beginning November, you will access Product Update webinar registration by clicking Training from within the eMoney application!

Visit our Continuing Education Page to view our upcoming live online opportunities for CFP®s to earn continuing education credits from programs accepted by the CFP Board or check out our thought leadership blog, Heart of Advice, for more insights and best practices.

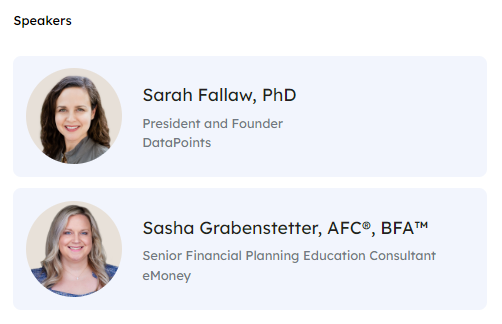

A client’s psychological risk tolerance is complex and includes characteristics like volatility composure, confidence, and risk personality. This session will help you understand the characteristics that drive investment decision-making. You’ll learn how these factors can not only help identify a client’s risk tolerance but can also help identify areas to coach and guide clients. You’ll leave this session with a better understanding of how to measure psychological risk tolerance, how to use risk tolerance questionnaire (RTQ) results to predict how clients might react to market downturns, and a way to personalize the client experience based on a client’s unique investor personality.

Thursday, October 3 from 2:00 p.m. – 3:00 p.m. ET

Join our eMoney Training team and your peers for these interactive, online workshops. Register using the links below or visit our Live Training Page to view the upcoming schedule, daily agendas, and more.

Learn the essentials for getting started with the eMoney platform, delivering a differentiated client experience, and developing a financial plan—quickly and efficiently. Earn 4 CE Credits.

Learn the fundamentals for creating comprehensive financial plans and incorporating interactive planning tools into your financial planning process. Earn up to 8 CE Credits.

These CFP® instructor-led sessions help you learn how to enter detailed information into all facets of the Advanced Fact Finder, create planning techniques, and build scenarios to use in reports and interactive tools. Earn up to 8 CE Credits.

Questions about these training events or looking for more resources? Email training@emoneyadvisor.com