for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreWith the eMoney Client Portal, you can offer your clients spending and budgeting tools to build monthly spending budgets while also tracking their spending habits on connected transactional accounts. But because clients can make their spending transactions private, it’s sometimes tricky for the advisor to help troubleshoot issues in this area of the platform.

We have a few resources that can help you set your clients on the right path including a helpful client-facing user guide.

Here are some other common questions we hear…

Pro tip: Are you a Bamboo subscriber? If so, you have access to a wealth of additional resources that showcase the value of the Client Portal.

Share the Save More, Spend Less PDF with your clients, covering the basics of setting up and maintaining a budget in the Client Portal. You can find it by navigating to: Bamboo > eMoney Materials > Save More, Spend Less.

With these resources, you can become more familiar with the capabilities within the Client Portal and be prepared to answer your clients’ spending and budgeting questions.

Clients can control who has access to their spending information in Settings on the Privacy tab. The Spending Permissions area allows them to grants None, Limited, or Full access.

When the Create an Auto-Budget link is selected:

* This feature does not currently take into account the possibility of having less than 6 months of transaction data. Thus, the averages will be wrong if you have less than 6 months worth of data.

Connected account transactions depend on the type of connection and the financial institution. Not all connections pull transactions—some only allow the past 30-90 days, while others allow access to a few years of past transactions. Although a connection may not populate past transactions, it will import and keep new transactions moving forward.

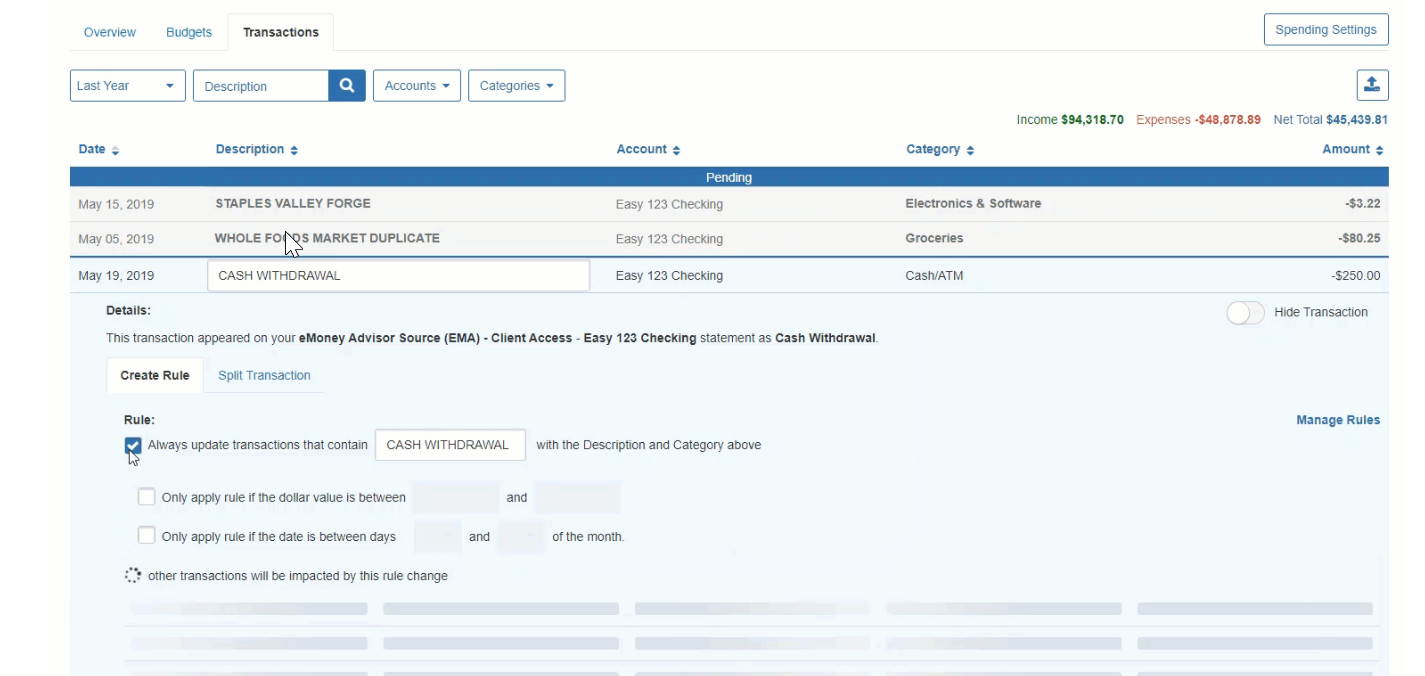

Yes, by setting a Rule. First, click the blue category name to select a new category, then check the box under Rule to always update transactions that contain […] with the description and category above.

You can set more specific guidelines on the Rule that will only apply if the dollar value is between a certain amount or if the date is between certain days of the month.

Yes, in the open transaction, click the switch next to Hide Transaction. This transaction will no longer count against your budget.

Spending Settings allow you to quickly select and exclude accounts from being included in your budgets.

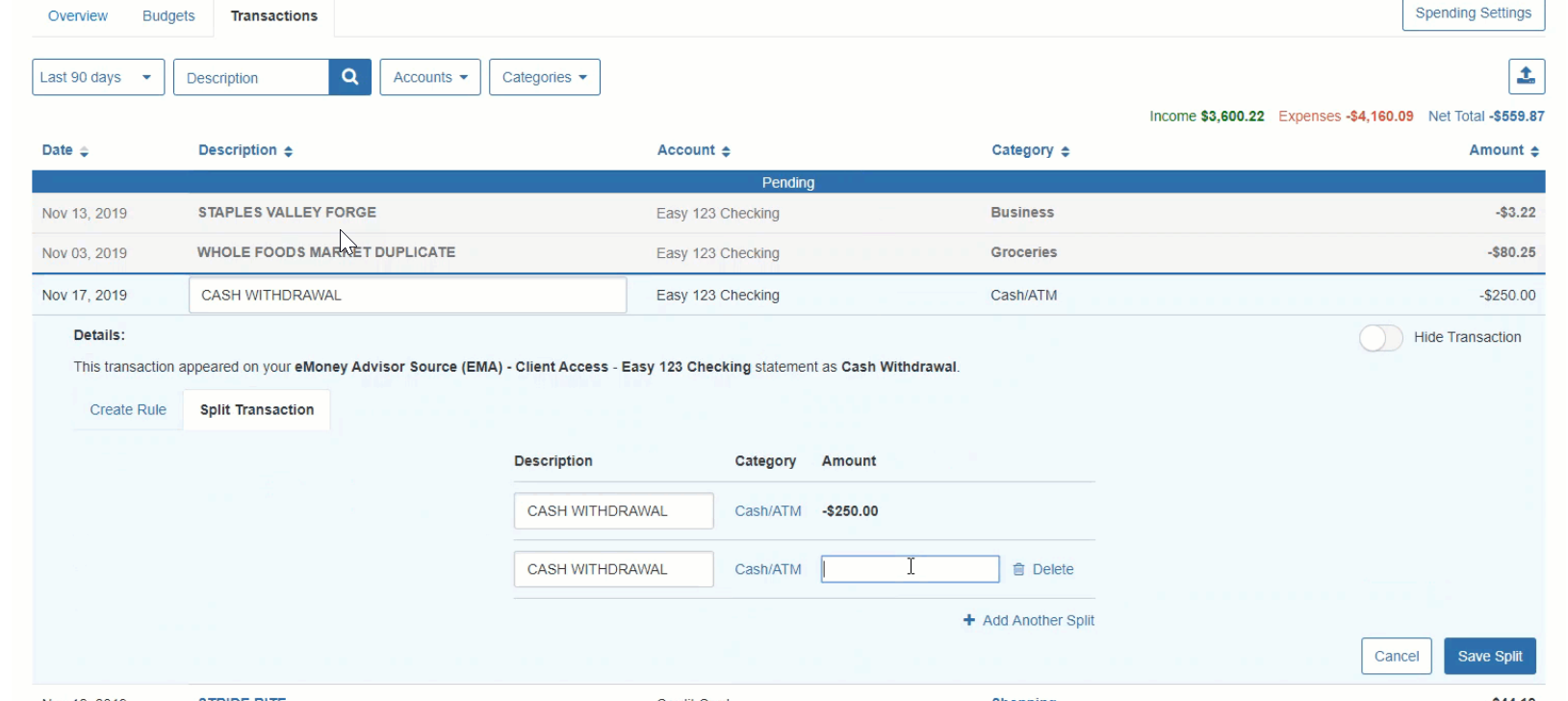

Yes, in the open transaction, click the Split Transaction tab and select Add Another Split. Then, adjust the dollar amount and change the description and category if needed. Lastly, click save.

Spending Transactions are activities related to your personal accounts, such as bank deposits and withdrawals, credit and debit card purchases, and checks cashed.

Investment Transactions represent activity on your investment and retirement accounts, such as contributions, distributions, dividend payments, reinvestment transactions, and buy/sell transactions.

For more information, access the Spending and Budgeting Overview in the Help section of your advisor site.

Looking for access to client-facing resources that can help you talk to your clients about Spending and Budgeting in the Client Portal? Learn more about Bamboo.