for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreFees commonly need to be factored in to a financial plan. In eMoney, you can enter fees in two ways— advisor fees and account fees. But which option will work best for you?

Let’s look at how to input an advisor fee schedule, apply advisor and account fees, and where these fees appear on reports.

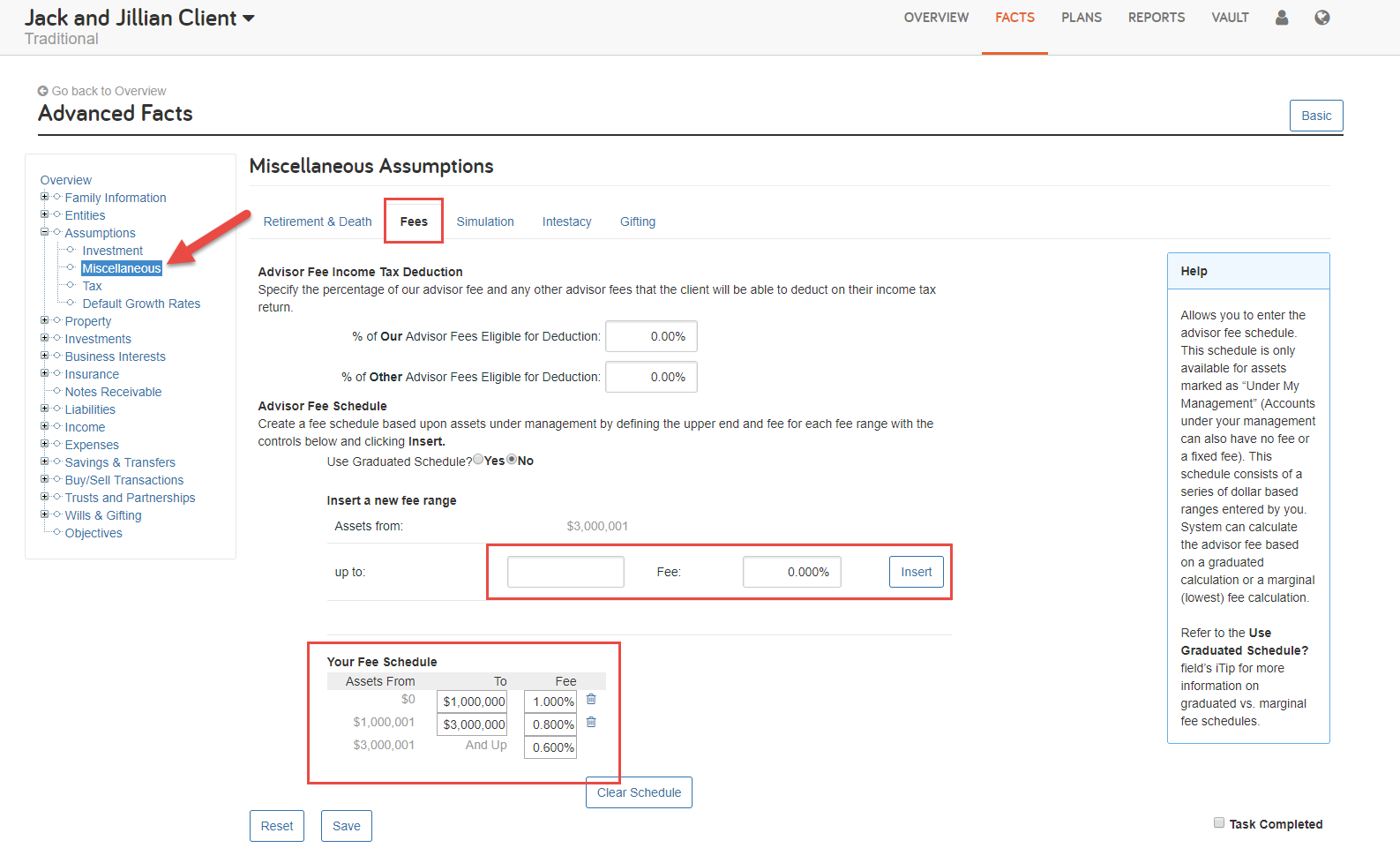

You can add a default fee schedule in your global settings to apply to all future clients or you can add a fee schedule for individual clients in their advanced facts. The fee schedule will only apply to assets under your management and advisor fees show as an expense on the Cash Flow report.

1. Global Fee Settings:

Note: The default global fee settings only apply to new clients. Existing client fees are not updated. For existing clients, you need to use the Client Fee settings.

2. Client Fee Settings:

3. Entering a Fee Schedule

It’s important to note that you can select if advisor fees are eligible for deduction on the client’s income tax return. You will not have this option for account fees.

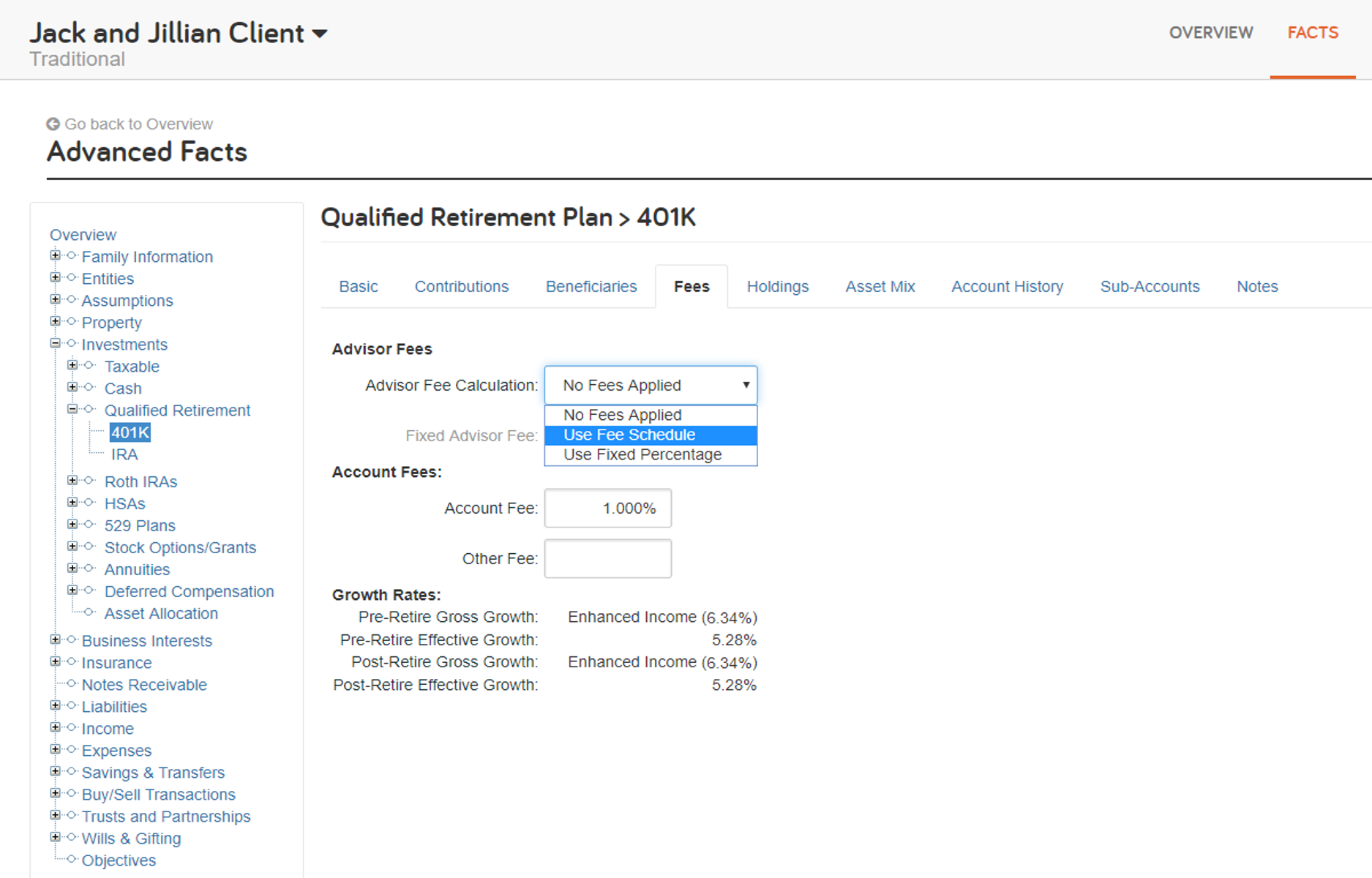

Advisor fees require you to select the accounts subject to fees individually, since they are not automatically applied to all assets under management.

To apply advisor fees:

You’ll repeat the steps above for any asset subject to an advisor fee.

Advisor fees appear as an expense in the Cash Flow report. To view, navigate to Cash Flow > Total Expenses > Other Expense Flows > Additional Expenses. The report displays the total cost of advisor fees.

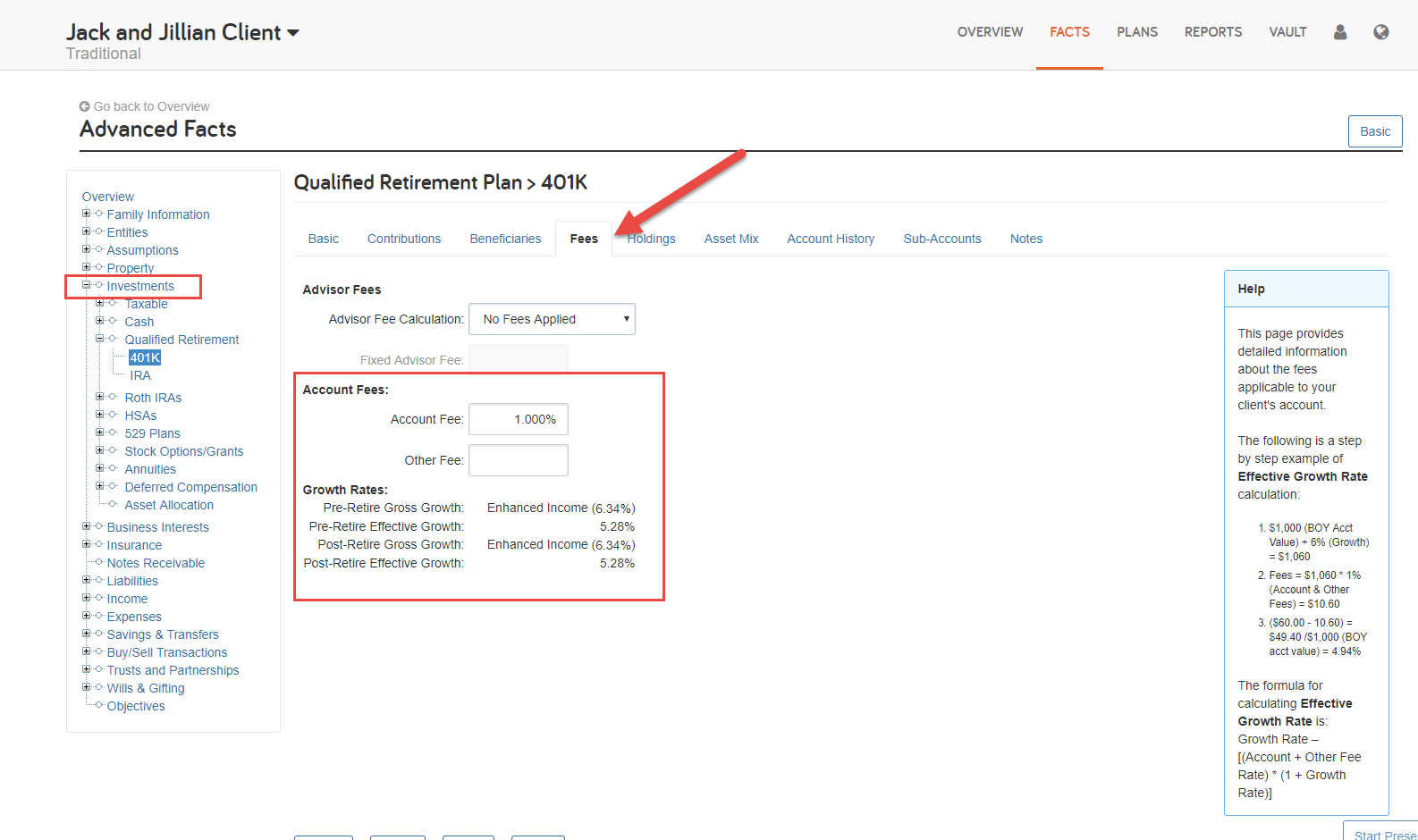

You’ll enter fees on a client level and by account within Investments. Account fees decrease the growth in the portfolio.

To apply an account fee:

Account fees show as a reduction of growth, not as an expense. Both gross growth and effective growth rates are visible on the Fees tab.

Pro tip: Effective Growth Rate is: Growth Rate – [(Account + Other Fee Rate)] * (1 + Growth Rate)]

Unlike advisor fees, account fees are not visible on the Cash Flow report. You’ll use the Ledger report to confirm the applied fee and to see the impact on account growth. Under the asset in the Ledger, there will be a line for Growth that includes the Account Fee Adjustment calculation.

Interested in learning more? Visit our Advisor and Account Fee user guide.

Have a question? Give us a call at 888-362-8482 or send us an email.