for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreAs an advisor, there are more than a few reasons you might recommend rebalancing the portfolio of an investment account. It might be part of a end-of-the-year tax-loss harvesting effort, or because the investment balance within the account shifted due to growth.

No matter the reason, to support your recommendation, it’s important to know how to model rebalancing the asset allocation in eMoney.

So let’s walk through how to create an Advanced Planning scenario that will reinvest an individual brokerage account from its current asset allocation to a new model portfolio.

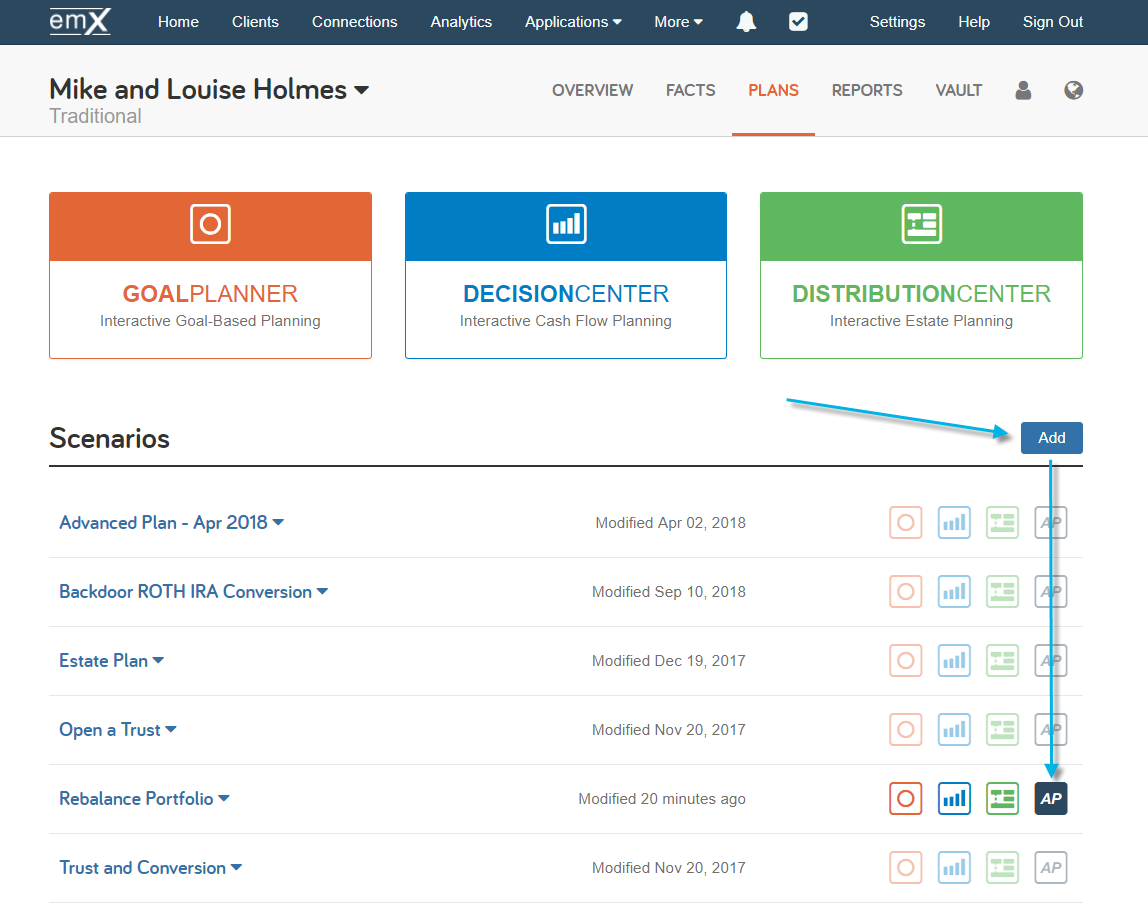

To get started, select the client you’re working with and go to Client Overview – Plans then click Add under Scenarios before jumping into Advanced Planning.

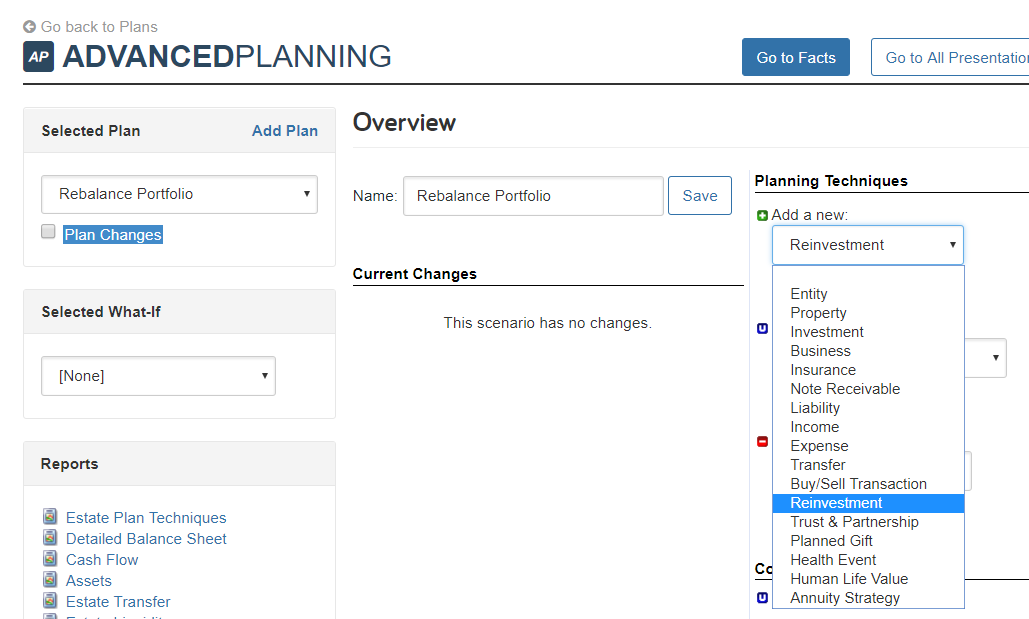

Once you’re in the Advanced Planning module, go to Planning Techniques on the right-hand side of your screen, and select the Add a new – Reinvestment technique. Then click << Add Fact. This will add the Reinvestment technique to your scenario.

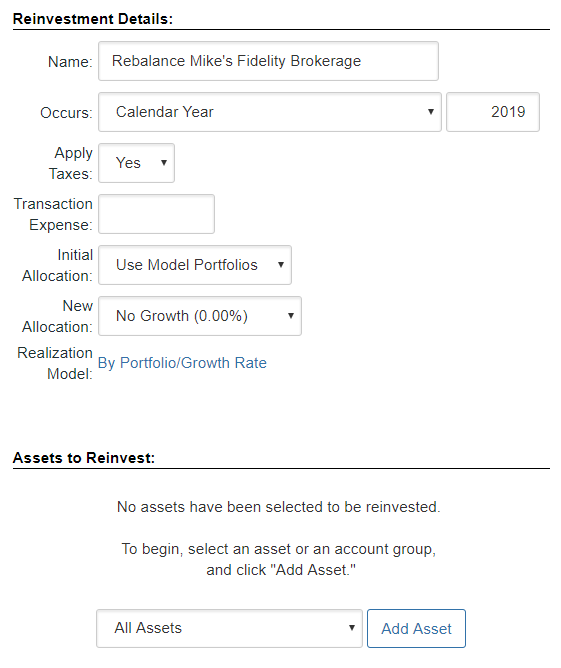

Once the technique has been added, you have a number of options to choose from. Start by naming the scenario using the name of the account you’ll rebalance.

Then, next to Occurs, select when the rebalancing event will occur. This is dependent on the scenario you are attempting to model.

Are you trying to simulate a more risk-averse portfolio or are you looking to shift the investments this year, or something entirely different?

Apply Taxes is used to determine whether the tax implications are considered when reallocating assets with the account. A transaction could generate capital gains or losses or could be considered a transfer at basis depending on the scenario.

Under Transfer Expense, if there is a cost for executing the transaction, enter that cost here as a percent of the asset value.

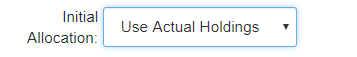

Now choose whether you’ll be using a model portfolio or the actual investment’s asset allocation as the Initial Allocation and starting point for your technique. In this case, since we’re recommending the reinvestment of a connected brokerage account, we’ll be using the actual holdings.

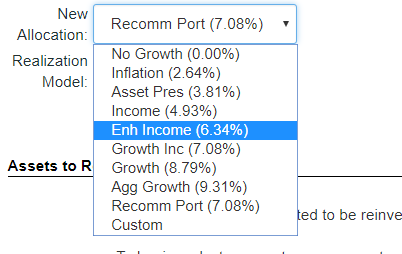

Then, select your recommended asset allocation under New Allocation. These new allocations pull from your existing model scenarios.

Note: We recommend using Model Scenarios for the New Allocation rather than the Custom growth rate option, as the Custom option’s growth is not tied to actual historical market data and will not fluctuate when using atypical market and Monte Carlo simulations.

If you’re looking to model a specific product or investment mix that is not available in your existing Model Portfolios, simply go to your Investment Assumptions to create a new portfolio with your desired asset allocation and it will become available here for your use.

Once you’ve selected your New Allocation, your Realization Model will default to By Portfolio/Growth Rate. We typically recommend leaving this on the default option; however, you can set a custom Realization Model for this technique.

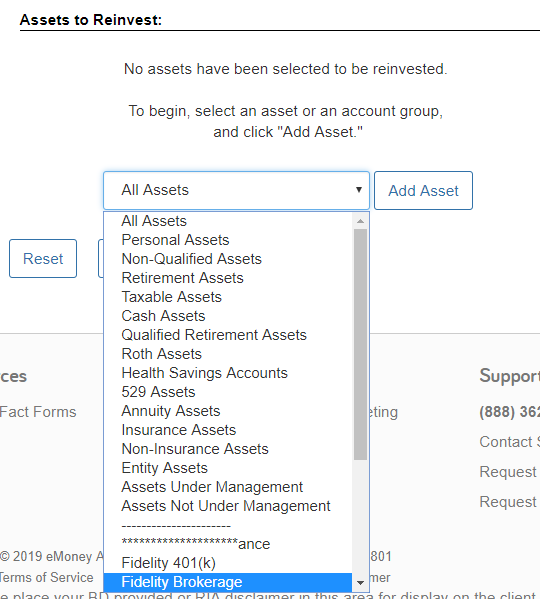

Now you can select the Assets to Reinvest using the drop-down at the bottom of the technique.

The Assets to Reinvest provides a wide variety of options to easily select predefined groups of assets like Retirement Assets, Taxable Assets, or a Custom grouping. We’ll model the reinvestment of an individual brokerage account.

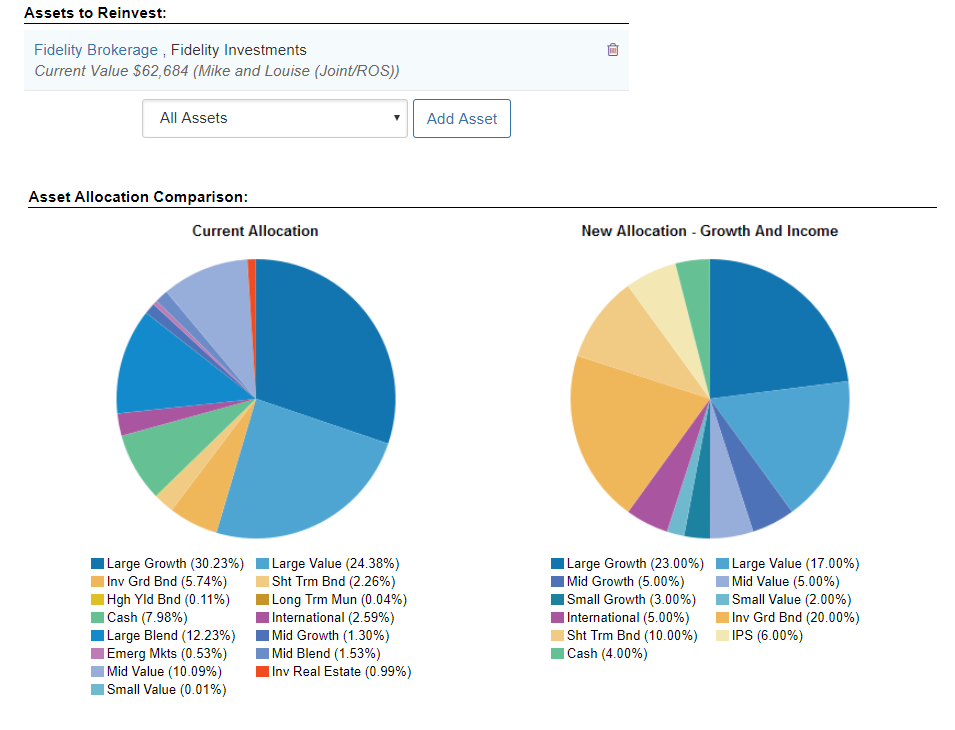

Now, we select the account in the drop-down and click Add Asset to finalize the technique and compare the current and new allocation.

That’s it! You can now use this planning Scenario in the Decision Center to show how the reallocation will impact the client over time, or build out additional changes in the technique.

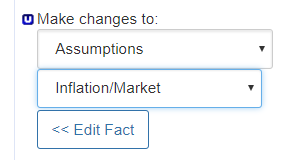

For instance, if you’re looking to use the rebalancing scenario to show how a specific allocation can preserve assets in a time of economic uncertainty, or during a bear market at retirement, remember to add the Make Changes To technique Assumptions – Inflation/Market Returns.

This will allow you to model an atypical market in addition to the rebalancing, and demonstrate the technique in the Decision Center.

The atypical market must be added to the Advanced Planning scenario to demonstrate market instability in the Decision Center. Standard What-If scenarios cannot be applied to Decision Center techniques.

Note: The rates of return and assumptions presented in this best practice are for demonstration purposes only and do not constitute actual recommendations for how assets should be reinvested.

If you have any questions about modeling reallocating assets or a reinvestment technique, give us a call at 888-362-8482 or send us an email!