for expert insights on the most pressing topics financial professionals are facing today.

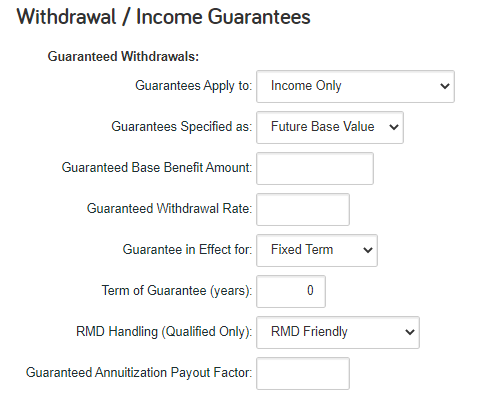

Learn MoreWhen entering an annuity you may define the riders that guarantee withdrawals, income (annuitization), and death benefit by completing the fields under the Guarantees tab. But what do all the fields represent and how can you match them to your annuity rider?

Keep reading below as we break down each individually:

Guarantees Apply to: If you enabled any type of living benefit guarantees rider, this field allows you to select whether they apply to withdrawals from the annuity, or income paid by the annuity due to annuitization, or both.

Guarantees Specified as: If “Future Base Value” is selected, you must enter the specific living benefit base value that you want to assume will exist at the time of the first withdrawal or at the time of annuitization.

Select “Rider Definitions” if you want to have the system project future living benefit base values using the assumptions provided. When High Water Mark Guaranteed is selected in the second section of the Guarantees tab, guaranteed withdrawals and/or annuitization will be based off of the greater of this value or the actual account value.

Guaranteed Base Benefit Amount: If the field Guarantee Specified as is set to “Future Base Value”, enter the future guaranteed base benefit value amount here. If the advisor knows of or wants to assume a specific base value will exist when withdrawals (or income) commences then enter it here.

Guaranteed Withdrawal Rate: Withdrawal percentage that is guaranteed. This percentage applies to the higher of actual account value or any base value riders selected.

Guarantee in Effect for: The guarantee can remain in effect for either a fixed period of time, for a single lifetime, or until death of both client and spouse. Select the proper guarantee period here. If fixed term, the number of years must be entered separately.

Term of Guarantee (years): If guarantee is in effect for a fixed term, enter the number of years remaining in that term.

RMD Handling (Qualified Only): Depending upon the contract, if required minimum distribution (RMD) exceeds the guaranteed withdrawal amount, it may not be considered an excess withdrawal (RMD friendly) or it may be considered excess.

Guaranteed Annuitization Payout Factor: Annuitization payout factor to be applied to the guaranteed base values only. Normal annuity tables will still be applied to the actual value. The result of these two calculations will be compared and the greater will become the estimated annuity payout. The guaranteed annuitization payout factor for any age is typically stated in the policy’s rider. Enter the factor as an annual percentage factor. If your policy uses a factor per $1,000 you must convert that into an annual percentage equivalent.

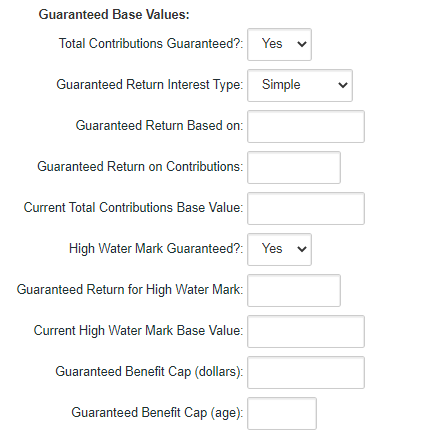

Total Contributions Guaranteed: Answering “Yes” guarantees that withdrawals and/or annuitization will be calculated based on the total contributions less any excess withdrawals (if greater than the actual account balance). If this guarantee also includes a guarantee of return, that is defined below.

Guaranteed Return Interest Type: If a guaranteed return on contributions exists, the rate of return can be applied to the contribution base value in one of three ways: no growth, simple, or compound.

Growth Guaranteed Return Based on: If Guaranteed Return Interest Type is “simple”, enter the contribution base amount the guaranteed return is based upon. This is generally the amount of all contributions minus any excess withdrawals.

Guaranteed Return on Contributions: The guaranteed annual rate of return that is applied to the contribution base value (not applied to actual value). Leaving blank indicates no guaranteed return.

Current Total Contributions Base Value: If total contributions rider is elected, enter the current contribution base value amount.

High Water Mark Guaranteed: Answering “Yes” guarantees that withdrawals and/or annuitization will be calculated based on some past account value less any excess withdrawals on a qualifying date (if this value is greater than the actual value). If this guarantee also includes a guarantee of return, that is defined below.

Guaranteed Return for High Water Mark: Guaranteed annual rate of return on high water mark. Leaving blank indicates no guaranteed return.

Current High Water Mark Base Value: If high water mark rider is elected, enter the current high water mark base value.

Guaranteed Benefit Cap (dollars): Highest achievable guaranteed base value (total contributions or high water mark) allowed. Blank means no cap.

Guaranteed Benefit Cap (age): Age at which the guaranteed base value (total contributions or high water mark) stops growing. Blank means no cap.

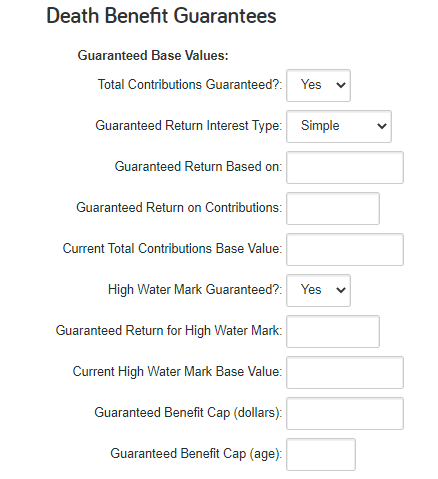

Total Contributions Guaranteed: Answering “Yes” guarantees that death benefit will be calculated based on the total contributions less any withdrawals (if greater than the actual account balance). If this guarantee also includes a guarantee of return, that is defined below.

Guaranteed Return Interest Type: If a guaranteed return on contributions exists, the rate of return can be applied to the contribution value in one of three ways: no growth, simple, or compound.

Guaranteed Return Based on: If guaranteed return interest type is “simple”, enter the contribution base amount the guaranteed return is based upon. This is gradually the amount of all contributions minus any excess withdrawals.

Guaranteed Return on Contributions: The guaranteed annual rate of return that is applied to the contribution base value (not applied to actual value). Blank means no guaranteed return.

Current Total Contributions Base Value: If total contributions rider is elected, enter the current contribution base value amount.

High Water Mark Guaranteed: Answering “Yes” guarantees that death benefit will be calculated based on some past account value less any withdrawals on a qualifying date (if this value is greater than the actual value). If this guarantee also includes a guarantee of return, that is defined in the Guaranteed Return for High Water Mark.

Guaranteed Return for High Water Mark: Guaranteed annual rate of return on high water mark. Blank means no guaranteed return.

Current High Water Mark Base Value: If high water mark rider is elected, enter the current high water mark base value.

Guaranteed Benefit Cap (dollars): Highest achievable guaranteed base value (total contributions or high water mark) allowed. Blank means no cap.

Guaranteed Benefit Cap (age): Age at which the guaranteed base value (total contributions or high water mark) stops growing. Blank means no cap.

———————

Questions about annuities? Log into eMoney check out our Interactive Annuity FAQ under the Help menu.