for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreWhether you’re simulating a scenario in which cash flow begins this month, this year, or later, your settings can impact the results of your clients’ plans. Learn which eMoney cash flow simulation settings can impact your clients’ plans as they transition from one year to the next.

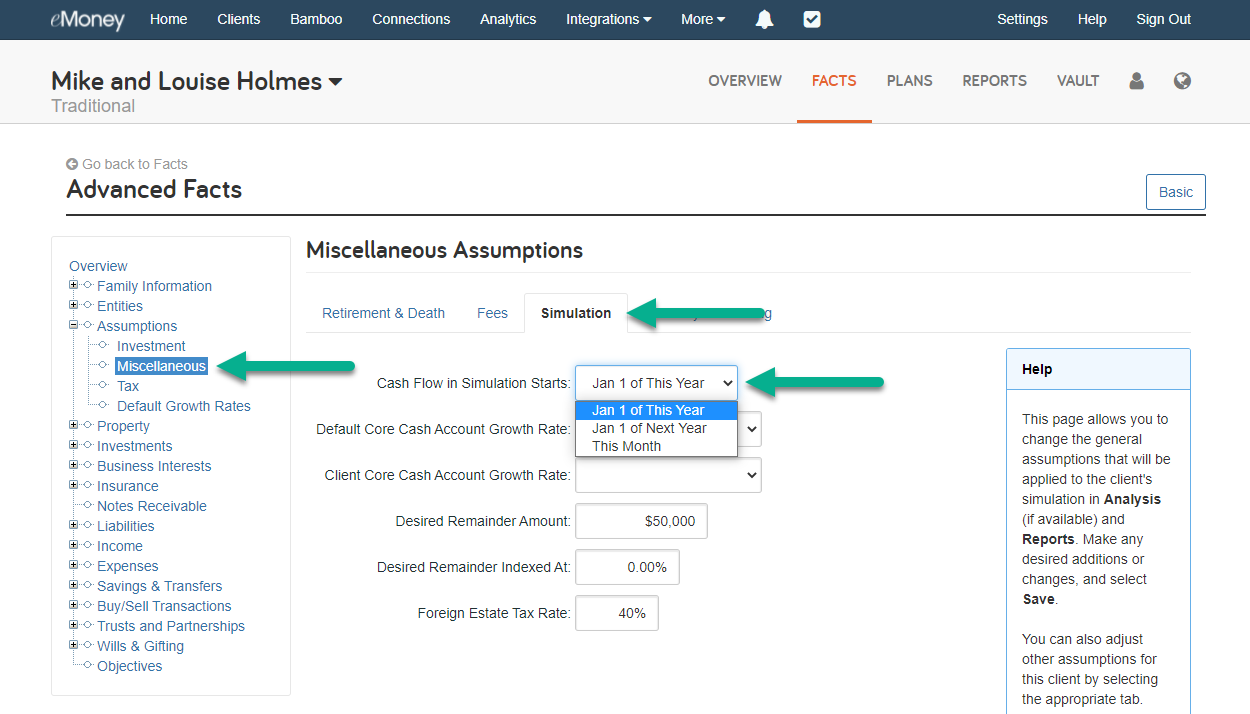

The Simulation settings within Miscellaneous Assumptions, allow you to change the underlying assumptions of your client’s cash flow simulation. With just a few changes to the settings, you can adjust when the cash flow starts based on the time of year or on their financial plan.

Let’s look at where you can find the Simulation settings, how to update them, and when you might use each setting option.

The first option Cash Flow in Simulation Starts provides you with three options:

Select the cash flow setting that works best for your needs and then click Save.

Next, the Core Cash Account Growth Rate allows you to define a growth rate for assets held in the Core Cash Account. When excess cash flow exists, that excess can accumulate in the core cash account, however, it is best practice to transfer that excess cashflow to some other account as the clients would surely do in the real world. This can be done in the Savings and Transfers area of the Fact Finder. The core cash account is meant to operate as the client’s “wallet” and not meant to be an account that builds wealth. Therefore leaving the core cash growth rate blank (0%) is also suggested.

The Desired Remainder Amount corresponds to the Assets Remaining field in the Report Center. Changes made to the Assets Remaining field in a specific report will be applied here and across other reports with this field. This amount also affects the Monte Carlo score. A successful Monte Carlo trial has to have positive portfolio assets all years and meet the desired remainder amount upon the end of the simulation.

Finally, the Foreign Estate Tax Rate is the estate tax rate used for non-resident aliens (selected under Client & Co-Client in the Fact Finder). This rate is not used for U.S. citizens or resident aliens.

Have a question? Give us a call at 888-362-8482 or send us an email.