for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreThe Life Insurance Gap Analysis tool in Foundational Planning makes it easier than ever to deepen your client conversations. With three simple steps, you can quickly determine if their current coverage will adequately protect their families.

Using the information from the client’s Current Situation, run a scenario assuming a premature death for the client and spouse. The analysis will solve for the necessary additional life insurance so the survivor can pay for immediate cash needs, annual living expenses, and any selected future goals.

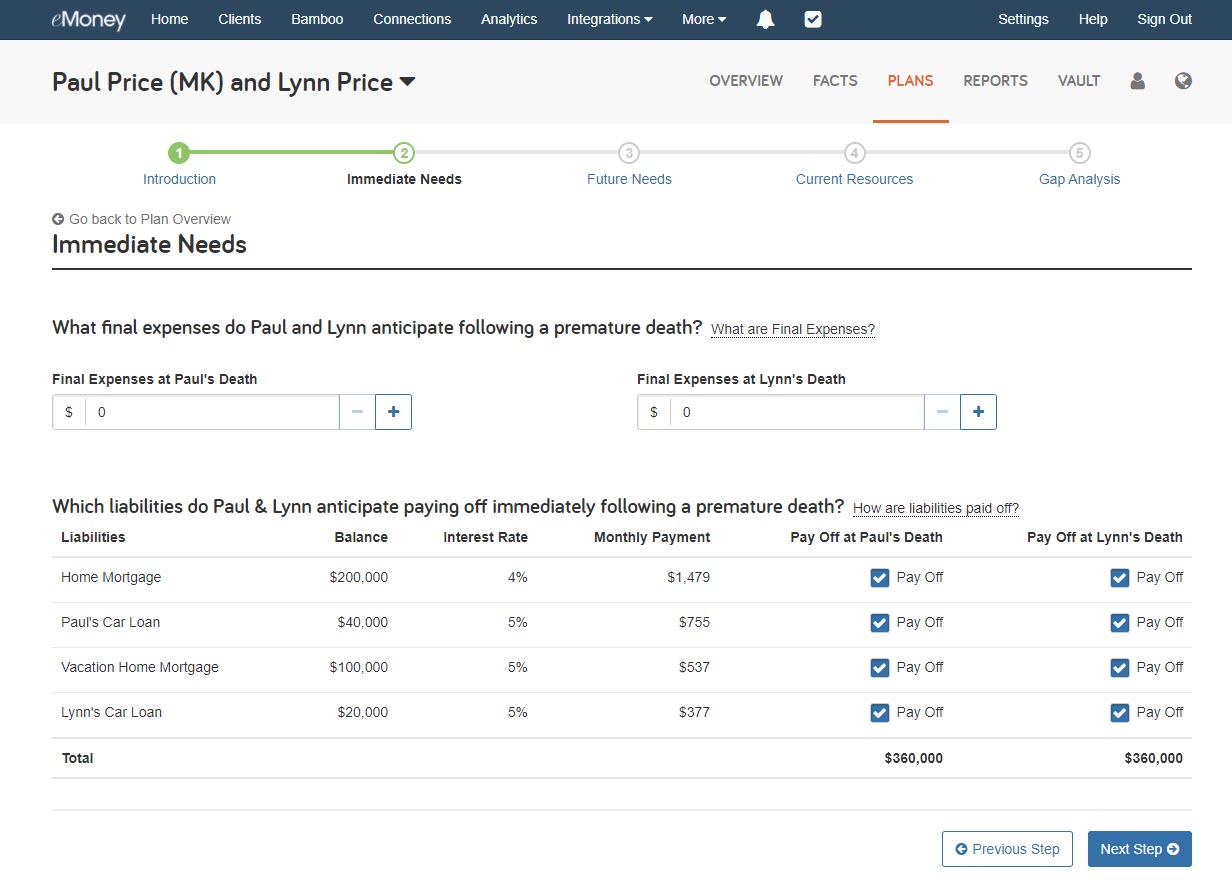

We start by identifying the immediate cash needs that will impact the family. This could include final expenses and liability payoffs. Next, we determine annual needs such as living expenses and taxes. Finally, we identify future needs such as funding for their children’s college education.

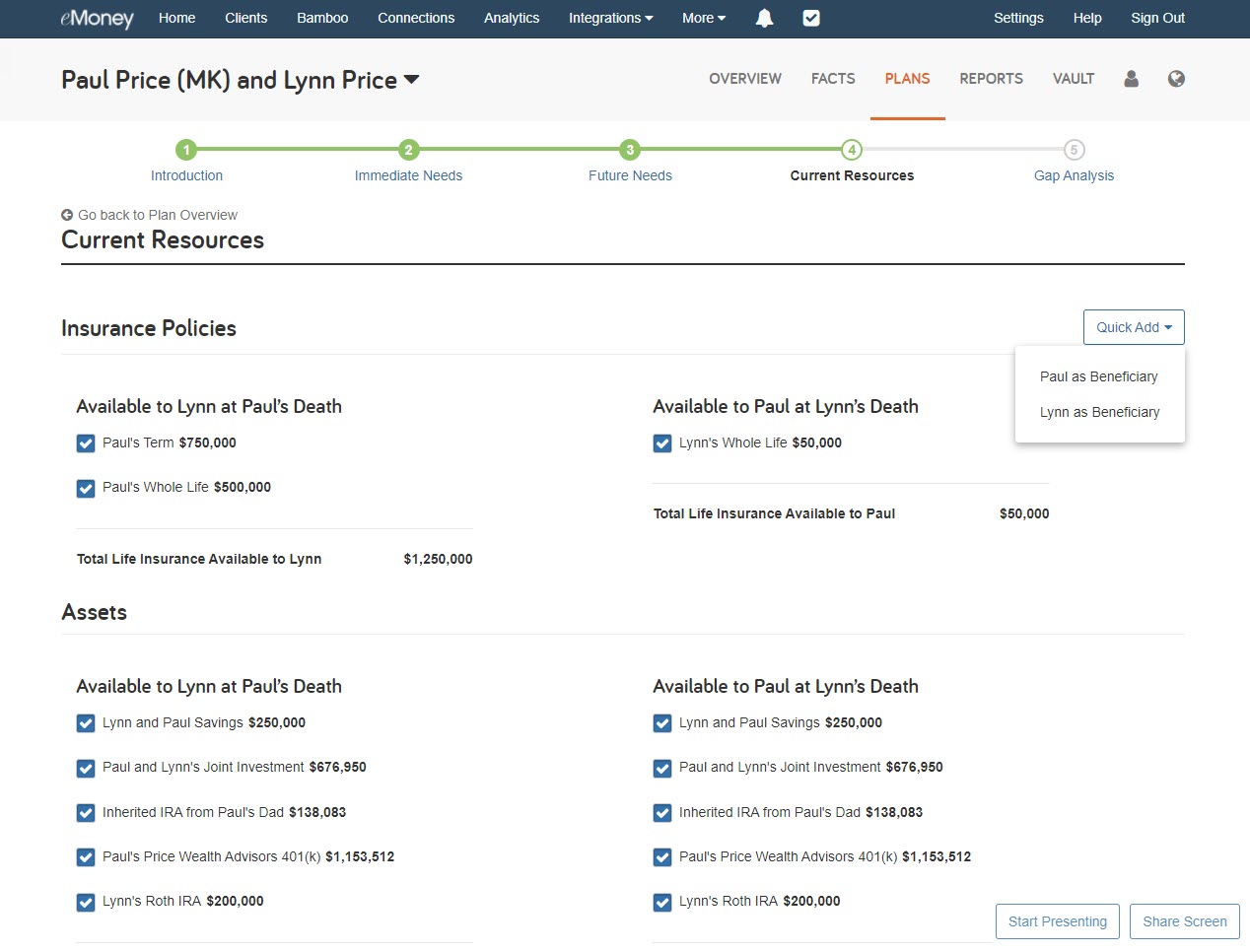

Once we’ve identified the current and future needs, it’s time to review the current resources and ensure you have accounted for everything. Here you can update the Survivor’s income, review all available investment assets, and the death benefits from current life insurance policies.

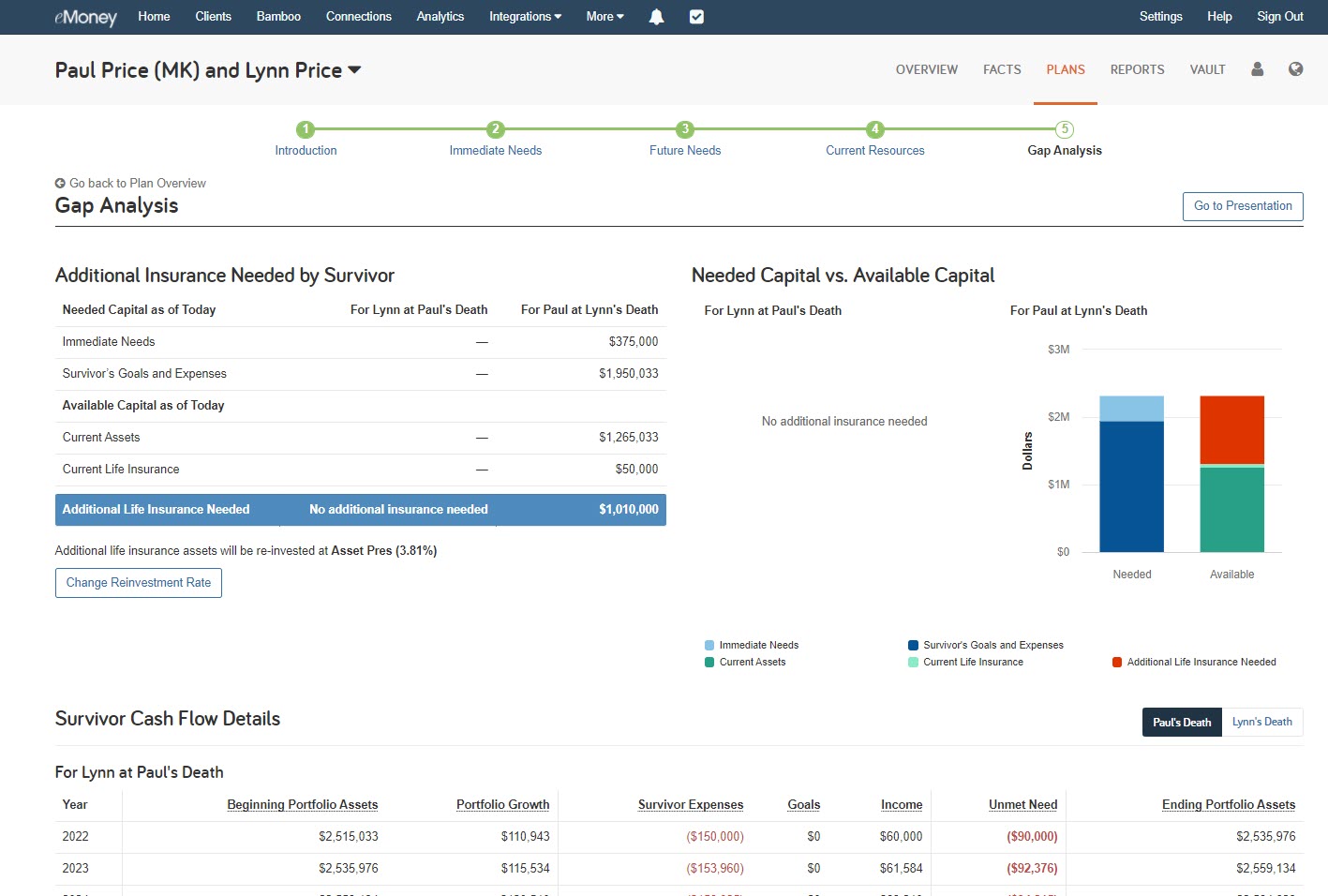

Once you’ve reviewed the client’s needs and resources, you can determine if additional life insurance is needed to provide for surviving family members.

The Gap Analysis report provides a detailed breakdown of Needed and Available Capital, Available Capital as of Today, and the Additional Life Insurance Needed for each spouse. You can also quickly adjust how the additional life insurance assets will be reinvested with Change Reinvestment Rate or dive into the Survivor Cash Flow Details and toggle between year-by-year breakdowns for each spouse’s premature death scenario.

Login and try out the Foundational Planning Gap Analysis tool today!