for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreMillennials are at the ideal age to take action with finances and pave a clear financial picture for retirement. To assist with Millennial planning eMoney allows access to tools and features that can take a Millennial prospect to a Millennial Client in a few simple steps

To engage a young prospect use the client portal as an introduction. Technology is adapted to all ages, however, can play a key part in the millennial generation. Use Onboarding to gather information. The onboarding feature alone will allow your prospect to input financial priorities, goals, and general family and financial information. All of the information is immediately stored in the client profile in eMoney.

The automated Onboarding module streamlines the process of setting up the client website.

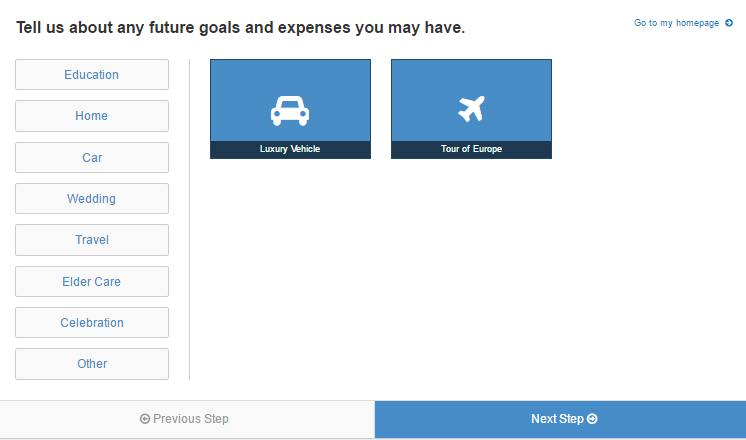

While goals and future expenses help you further define their financial priorities.

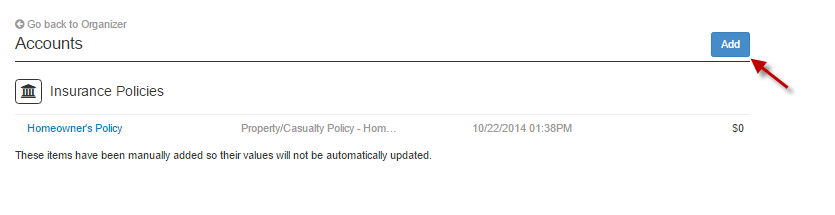

After using the Onboarding for data gathering follow up with your prospect to help them get connected. Connecting accounts allow you to see the most up to date account information and better develop a financial plan for your prospect. Set up a brief call to walk a prospect through connecting accounts.

Demonstrate how to add connected accounts on the client site.

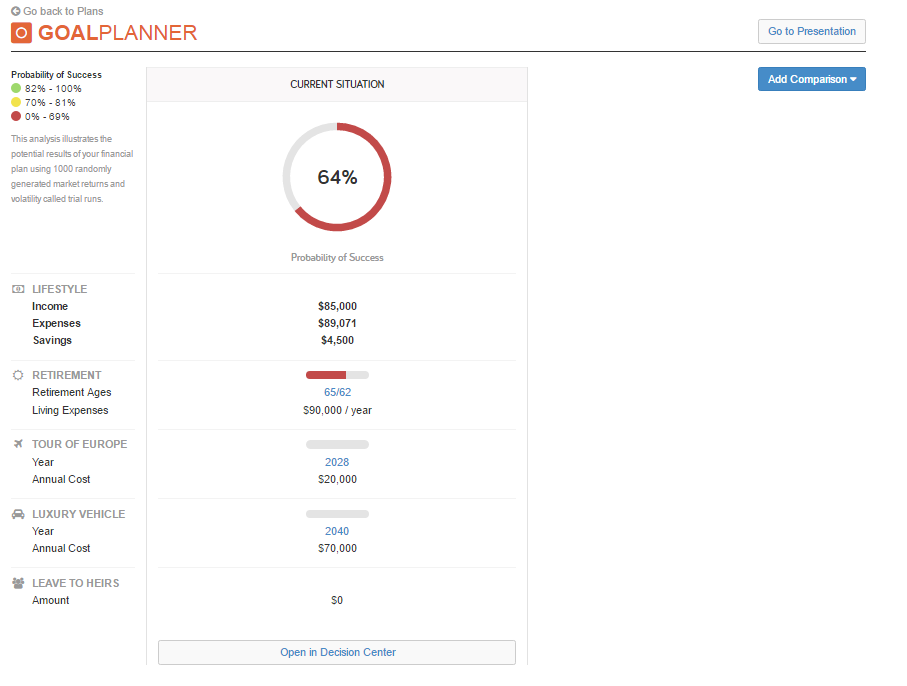

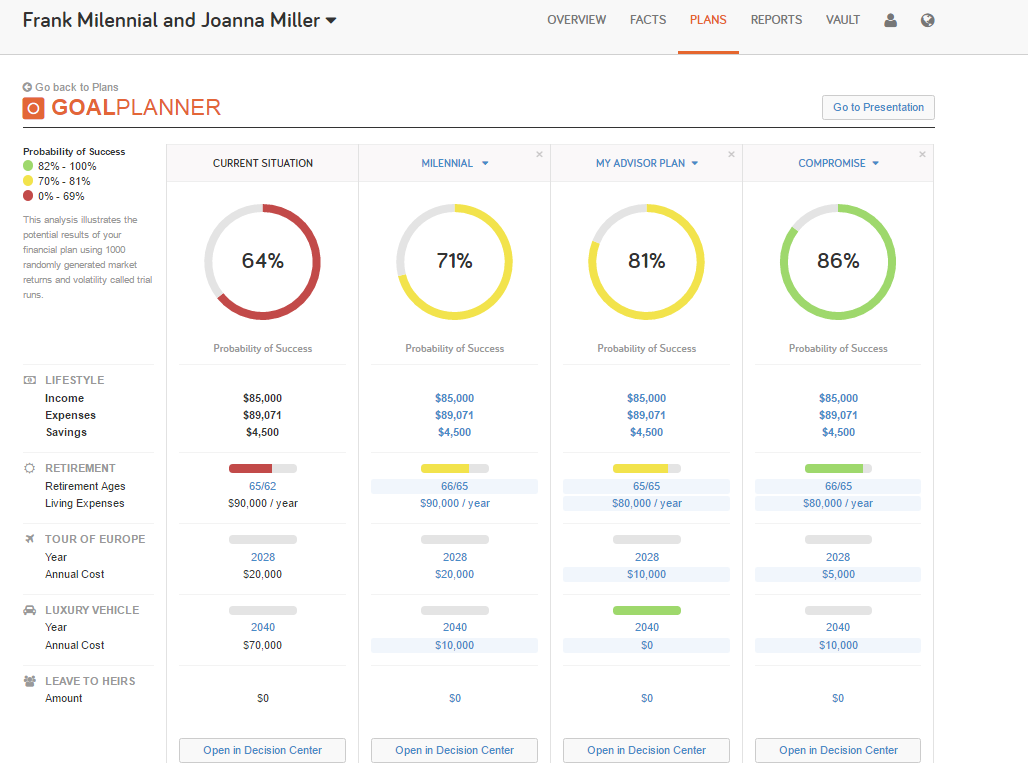

Using the data from onboarding and connections develop a high-level financial plan. The goal planning tool in eMoney is a great way to take a realistic approach to planning with a younger prospect that may not have the most accurate expectations or need to have deeper discussions while staying high level. At first, the goal planner displays the Probability of Success on the current financial condition. It highlights the major future expense goals entered while still running a cash flow simulation.

Use Interactive Planning Tools.

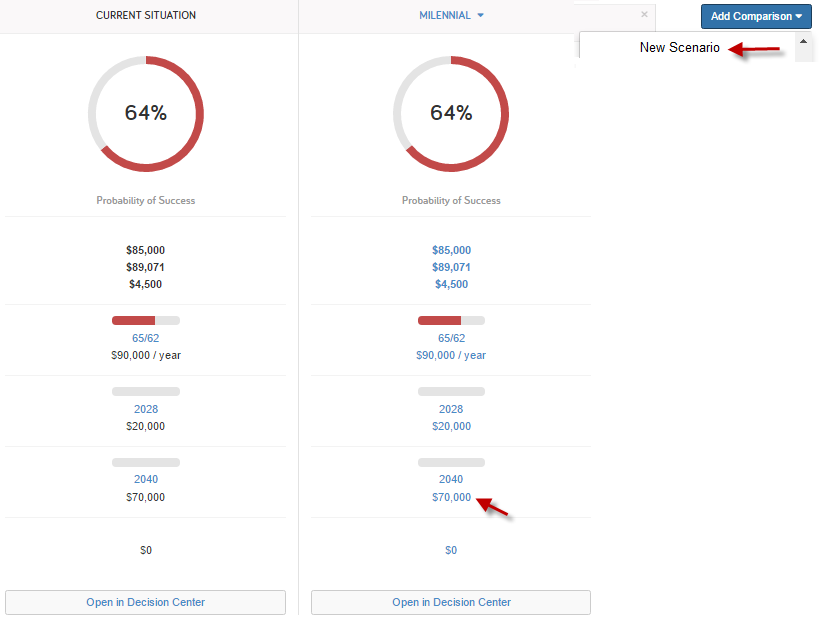

After viewing the current financial condition add a scenario and allow your prospect to inform you of any changes or compromises they are willing to make to increase the success rate. Maybe that luxury car or traveling the world goal is not as achievable along with retirement. By selecting expense goals listed you can make changes on the fly allowing the goal planner to rerun the probability of success to reflect the changes.

Compare planning scenarios using the Goal Planner.

Tip: The goal planner allows up to four side by side comparisons. The first will always show the current situation. Allow your prospect to build the second scenario by informing you of any compromises or changes they are willing to make. Use the third scenario to show your recommendations to your client and the forth to meet in the middle to find the best solution.

Demonstrate how proper planning leads to financial success.

The client portal not only allows your prospect to get organized but places you at the center of their financial life. Assure your prospect that you will be with them every step of the way, not only having the ability to monitor changes but keep them on track to achieve their financial goals. Through positioning the technology and collaboration not only do you gain the trust of your prospect you become the primary advisor as they transition from prospect to client.