To get started with estate planning in eMoney, you’ll first want to add your client’s data into Advanced Facts. Today, we’ll look at how to set up wills, add bequests, and provide an overview of how to execute bequests in eMoney.

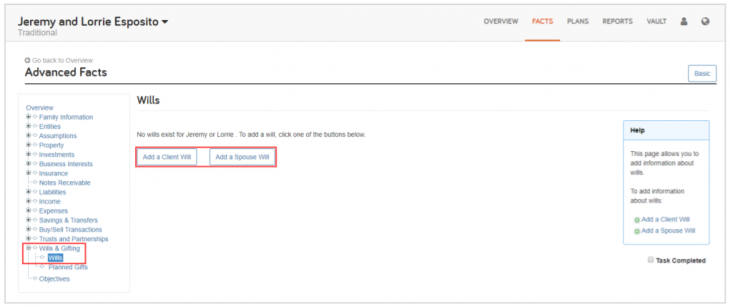

Set Up Wills

First, you’ll navigate to a client’s Advanced Facts and go to Wills & Gifting > Wills to add a client’s and their spouse’s wills.

Here, you’ll have two options to select:

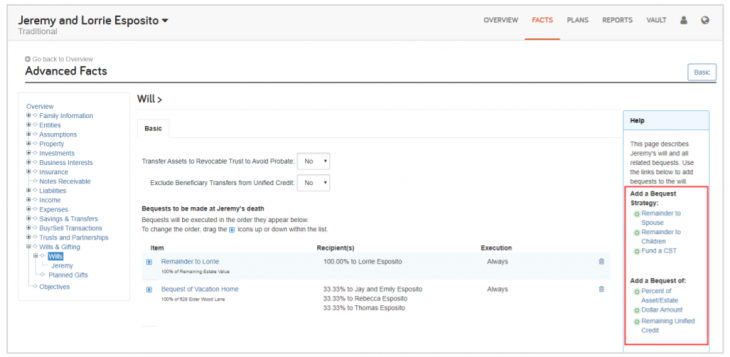

- Transfer assets to revocable trust to avoid probate: By default, the system will not transfer a client’s assets to a revocable trust to avoid probate. If you select Yes, you’re tellingthe system that the assets held in a revocable trust will not be subject to the probate process. Note: If a revocable trust has not been set up in the advanced facts, the system will assume a hypothetical one exists.

- Exclude beneficiary transfers from unified credit: By default, the system will use the client’s unified credit to cover any assets distributed through a beneficiary. To exclude beneficiary transfers from unified credit, select Yes from the drop-down menu.

Add Bequests

Next, you’ll add bequests in a client will by clicking one of the options in the Help box on the right-hand side of your page.

You can add a bequest strategy:

- Remainder to spouse: Bequest 100% of the remainder of the estate to the decedent’s spouse.

- Remainder to children: Bequest 100% of the remainder of the estate equally to the decedent’s children.

- Fund a credit shelter trust (CST): Bequest the remaining unified credit to the decedent’s CST. If no CST has been added for the decedent, one will be created.

Or add a bequest of:

- Percent of asset/estate: Bequest a percentage of a specific asset or the remaining estate value.

- Dollar amount: Bequest of a dollar amount from a specified asset or any available asset.

- Remaining unified credit: Bequest of a percentage of the remaining total estate.

How Bequests are Executed

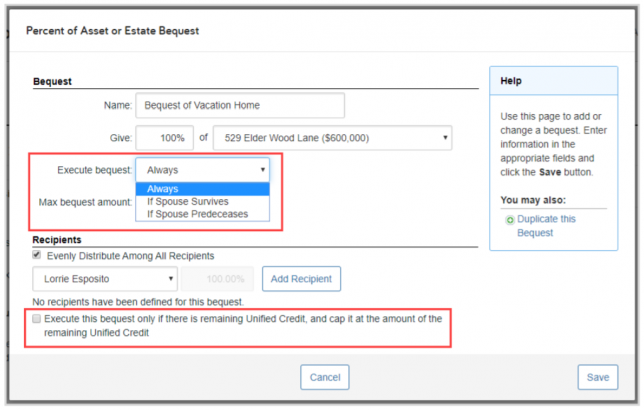

When adding a bequest, you can set the conditions under which a bequest should or should not be executed.

- Execute bequest: Allows you to choose when the bequest should be executed—select one of the following: Always, If Spouse Survives, or If Spouse Predeceases.

- Max bequest amount: Allows the amount of the bequest to be capped at a specific dollar amount.

- Execute this bequest only if there is a remaining unified credit, and cap it at the amount of the remaining unified credit: Allows you to cap the bequest at no more than the amount of the unified credit. The bequest will not execute if the unified credit is $0. This feature can be used to fund a CST with specific assets but not fund beyond the client’s unified credit.

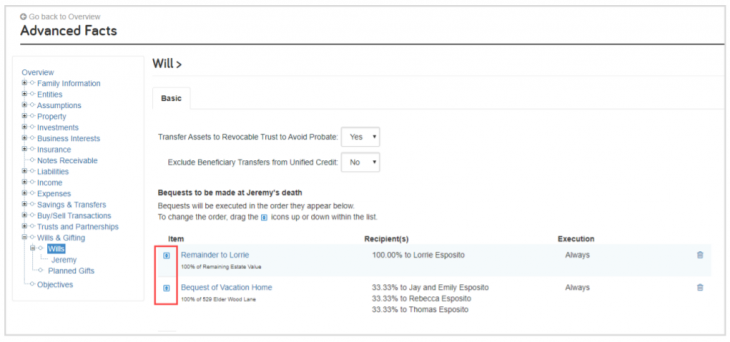

It’s important to note joint/ROS and beneficiary designations on assets supersede the will. Also, bequests are executed in the order you define, as displayed on the wills page. To change the order in which they execute, click the icon and drag the bequest up or down.

Looking for additional resources? Check out the Setting up Wills and Bequests user guide in your Help menu.