for expert insights on the most pressing topics financial professionals are facing today.

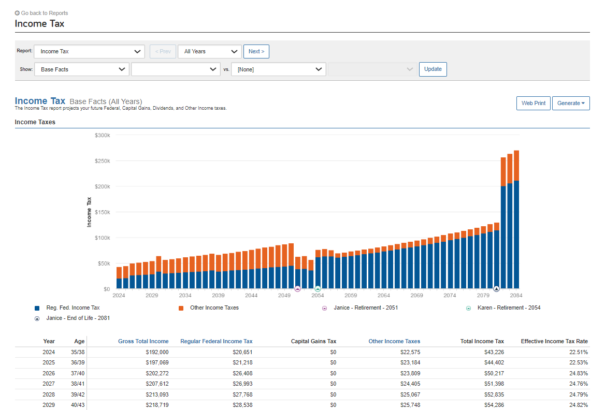

Learn MoreLeveraging the Income Tax report provides clients, Ben and Sally, with a comprehensive overview of their tax obligations throughout their lifetime, offering invaluable insights into their financial landscape. By delving into the Income Tax report, Ben and Sally can navigate intricate tax scenarios with precision and confidence. This empowers them to anticipate and strategize for various tax events, ensuring proactive financial planning tailored to their specific needs and goals.

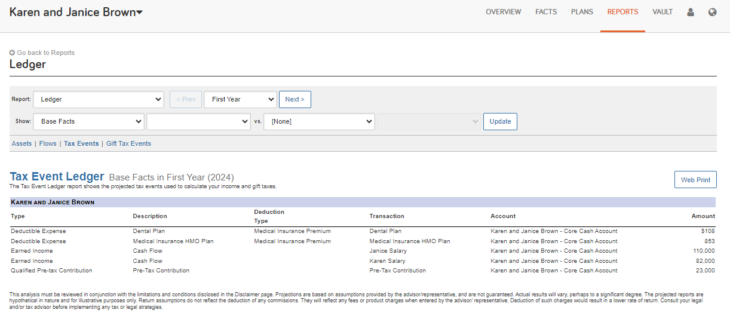

Now that you’ve gained a comprehensive overview of Ben and Sally’s tax obligations, head over to the Tax Event Ledger to dive a bit deeper into the details and specifics.

Advisors find that using this ledger allows them to better identify opportunities, optimize tax strategies, and ultimately, ensure clients like Ben and Sally receive the expert guidance they deserve.

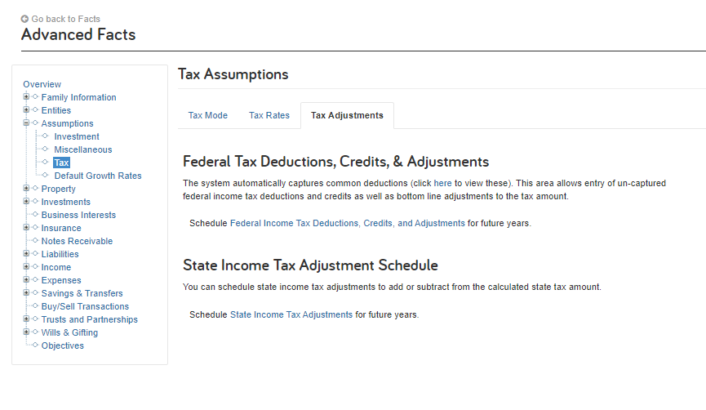

Once you’ve gained a well-rounded understanding of your clients’ financial situation leading into tax season, you might need to account for potential adjustments.

For example, Ben and Sally made a significant investment by purchasing an electric vehicle in 2023. With Tax Adjustments, you can seamlessly incorporate this large purchase decision into their tax planning strategy.

Other tasks you can perform within Tax Adjustments may include scheduling federal tax deductions and credits, along with state income tax adjustments for future years, ensuring that Ben and Sally maximize the benefits of their investment.

By anticipating upcoming adjustments based on your clients’ unique circumstances, you’re providing value now and for their future financial peace of mind.

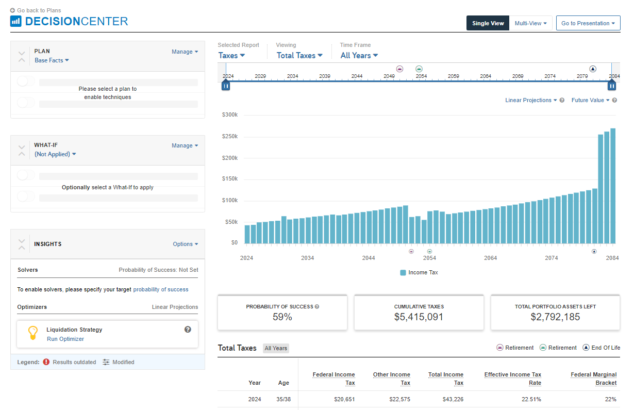

Visualize Ben and Sally’s expected marginal rate taxes over the years by providing them with added clarity and foresight into their tax situation.

In the past, predicting future marginal tax rates or determining the optimal amount for a Roth conversion would have been daunting tasks. With the introduction of the Taxes View in Decision Center, these complexities are now easily navigable.

Additionally, when discussing Roth conversions, you can streamline the process by precisely calculating the conversion amount needed to fill up desired tax brackets.

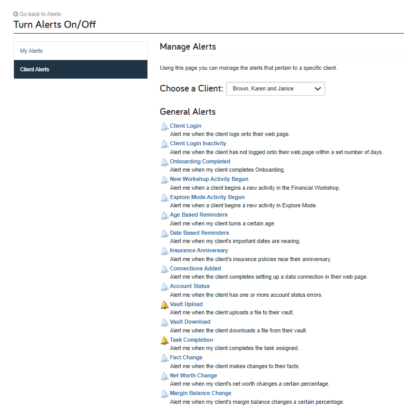

Strong client engagement is crucial to instilling overall confidence and trust between you and your clients. One way to reinforce consistent engagement, especially during tax season, is to utilize the eMoney alert system, tasks, and Vault to streamline their tax preparation process.

For example, once Ben and Sally upload essential documents for their taxes, you’ll receive a Vault Upload alert, or Task Completion alert when they complete an assigned task.

Pro-tip: Send client reminders and task information through the Vault instead of in an email. If you have to send an email, try to include a link to the Client Portal when appropriate. Communicating through the portal is a simple way to get clients to keep logging in and helps aggregate everything in one place.

We hope these recommendations improve your business efficiencies during this tax season!