for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreRetirement is an essential goal for all clients and will always be a major focus of their financial plans. Let’s walk through how to enter a Retirement Goal and set a Proposed Plan in Foundational Planning for your clients.

Note: Additional Foundational Planning training resources are available at the end of this post.

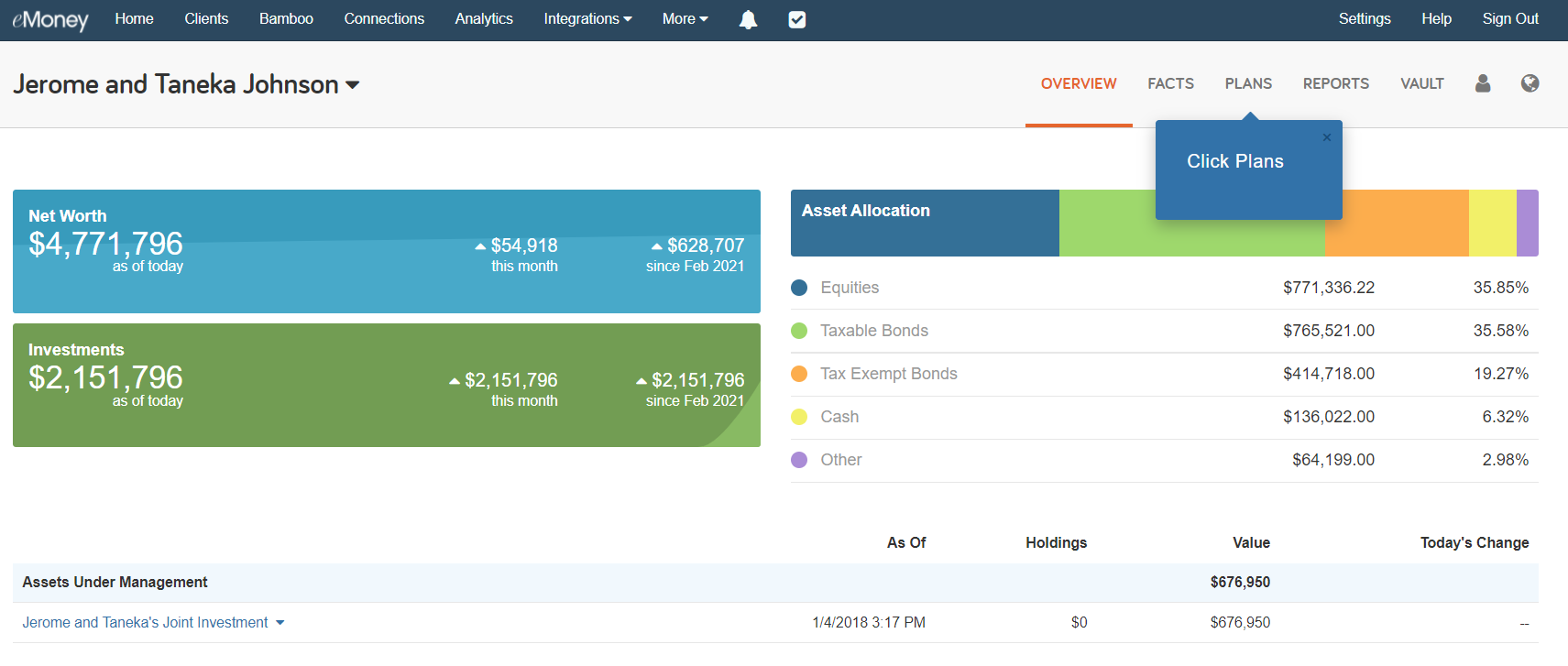

Start by navigating to the Client Overview page. From here click on Plans.

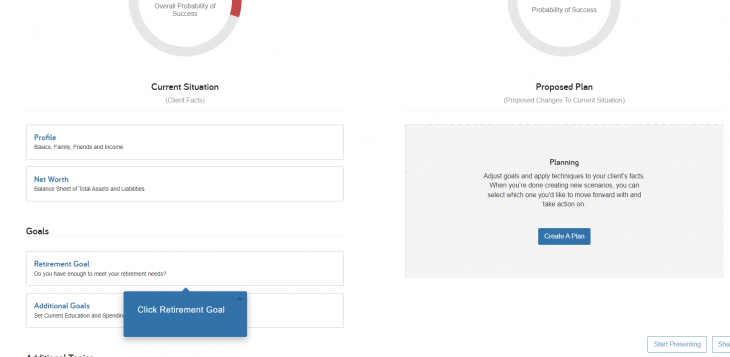

Next, select the Retirement Goal option under Goals.

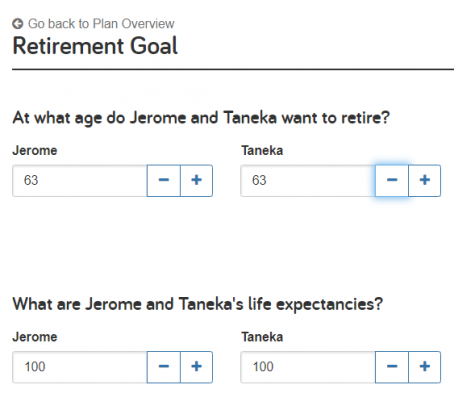

This opens the Retirement Goal module where you can review and update your client’s goal information. Maybe your clients want to retire at 63 instead of 65. Make the necessary adjustments and click Next Step.

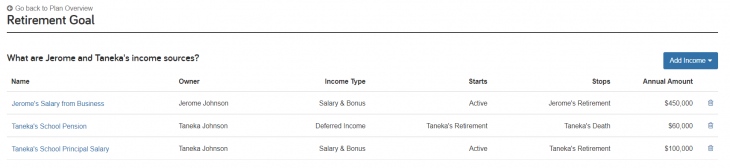

Your client’s current salary and bonus income are used to estimate future social security income and retirement living expenses. Future income can also help fund retirement living expenses. Any existing income from Facts will be present; however, if you want to add additional income, you can do so by clicking Add Income in the blue box in the upper right corner.

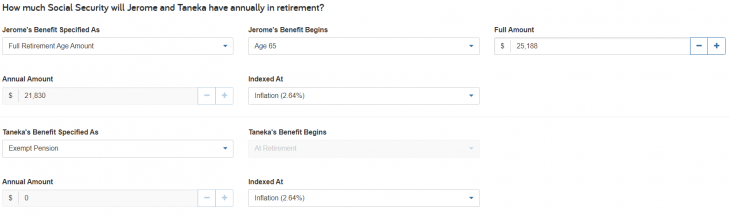

Now scroll down and review your client’s Social Security information. Ensure it accurately reflects your recommendations for how and when they should apply for benefits during retirement.

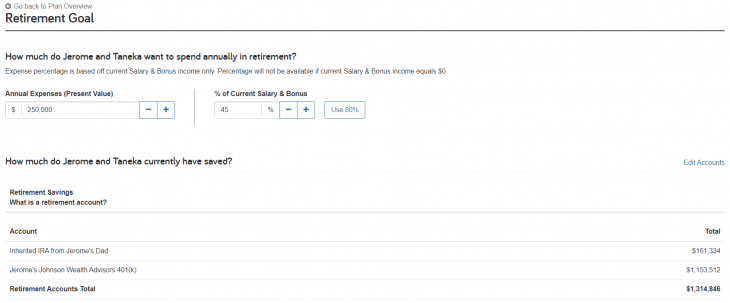

Next, review your client’s retirement and other accounts. All accounts are used for retirement by default, but certain tax-advantaged accounts may be used first.

If you notice any accounts are missing, click Edit Accounts to add current assets that will be used to fund living expenses in retirement.

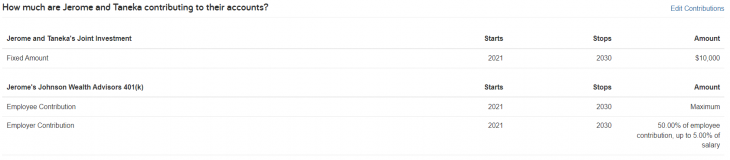

It’s important to review how much your client is contributing to their accounts to fund expenses in retirement. If you notice any contributions are missing below, click Edit Contributions.

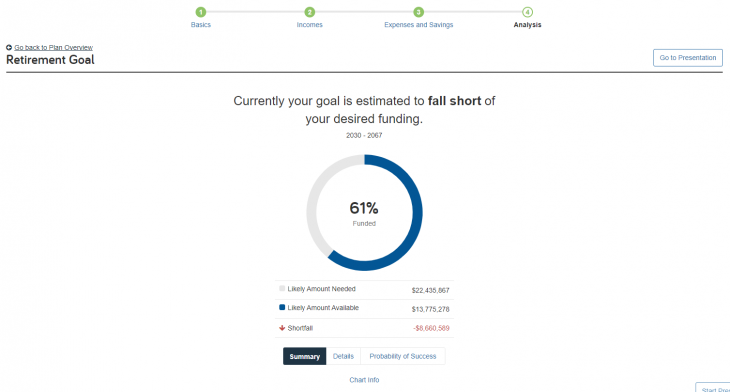

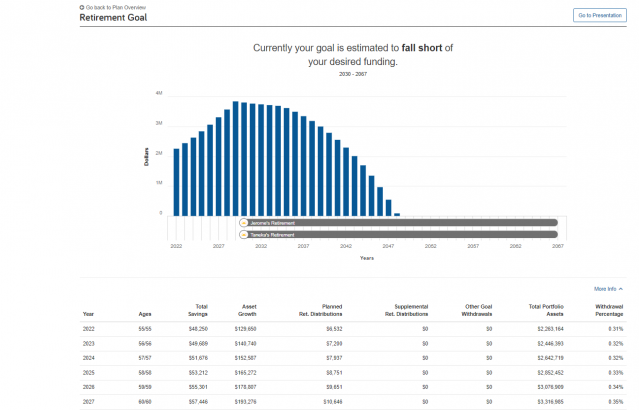

Below you can see the results of your client’s Current Situation based on the information entered in the previous screens. Try toggling between the different chart views to help you fully understand your client’s retirement readiness.

Unfortunately, from this example, the client will fall short. Click on Details and then More Info to see a more detailed breakdown of where the client falls short and gain a better understanding of their needs.

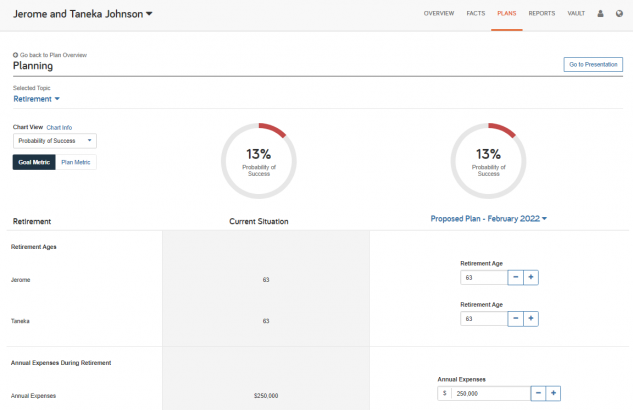

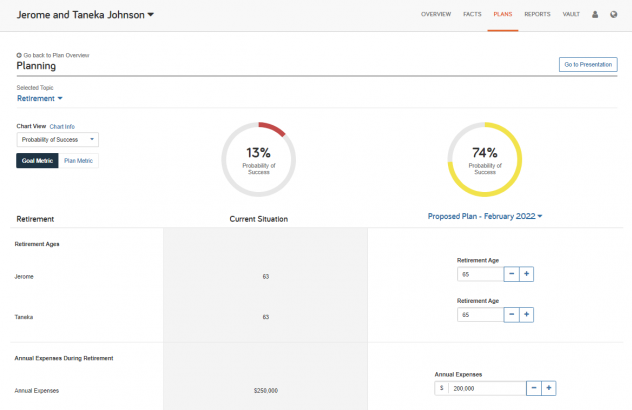

Now, you can click back on the Plans tab, go back to the retirement plan to see a side-by-side view of the Current Situation and the Proposed Plan.

From there, you can make adjustments to the Proposed Plan to maximize their probability of success. See how in this example, by adjusting their retirement age from 63 to 65 and reducing their annual expenses from $250,000 to $200,000 their probability of success went from 13 percent to 74 percent.

Once you make your changes, select Set Plan as Active, on the bottom of the screen, so you can review it with your clients.

Foundational Planning makes it easy to engage prospects and clients in planning-led discussions that can help them prepare for every life stage!

Stay tuned for more best practices on how to deliver more plans for more clients more efficiently. Or click the link below to watch previously recorded webinars from our training team!