for expert insights on the most pressing topics financial professionals are facing today.

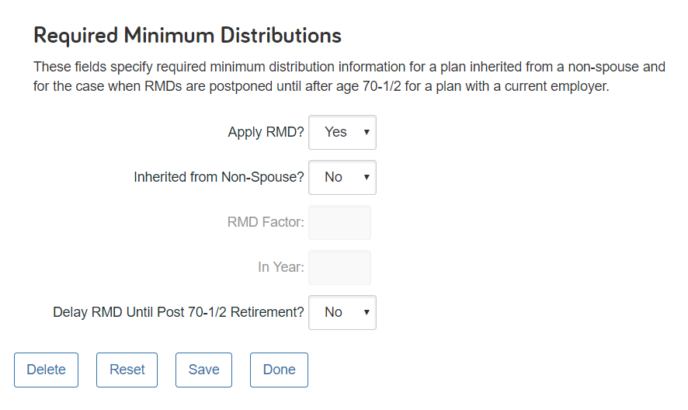

Learn MoreRequired Minimum Distributions (RMDs) in eMoney are automatically calculated and applied. For the current year, we estimate RMDs by taking the current account value divided by the appropriate RMD factor. For future years, we’ll look at the account year- end value and apply the appropriate tables. Once the account owner turns 70.5, RMDs are distributed out of the account.

However, some financial plans require a more custom approach to RMDs, which is why you can change the default settings.

Let’s look at how to manage RMDs in eMoney.

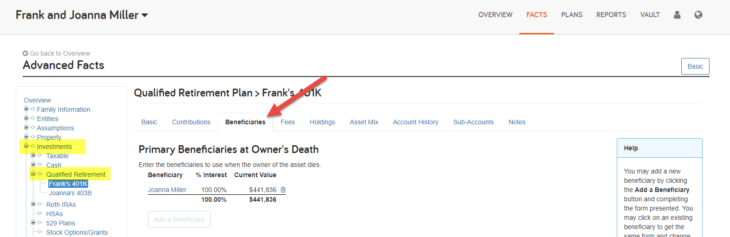

Since the default setting is to automatically apply RMDs, you’ll need to access the qualified retirement account to make any adjustments. The RMD options are located under the Beneficiaries tab under Advanced Facts > Investments > Qualified Retirement. From there, you can choose to disable or delay RMDs or indicate that it’s an inherited asset.

You can view RMDs in both the Cash Flow and Ledger reports. In Cash Flow, RMDs will display under the Planned Distributions column. You can click into Planned Distributions for more detailed information. In the Ledger, you’ll look for each qualified retirement account and see the Minimum Distribution amount for each year starting at age 70.5 or later depending on the selected settings.