for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreLife insurance provides a way for loved ones to pay for debt and expenses in the event of the insured’s death. In eMoney, the proceeds of the policy are deposited into a taxable account and used to cover any negative net cash flow.

But before we look at how the system handles life insurance proceeds, you’ll need to add the life insurance policy into a client’s Advanced Facts. Go to Advanced Facts > Insurance > Life and enter the appropriate information including the Insured, Primary Beneficiary, and Current Death Benefit.

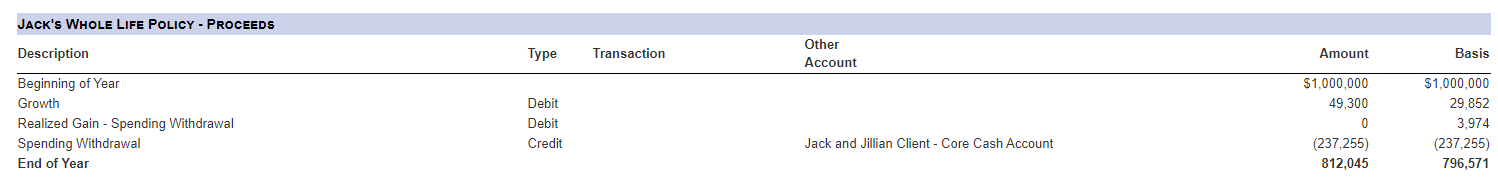

When the insured client or spouse dies, the insurance policy distributes any death benefits. The system automatically creates a taxable account and deposits life insurance proceeds into it. The system also names the account. Look for the policy name that you entered into Facts, followed by – Proceeds.

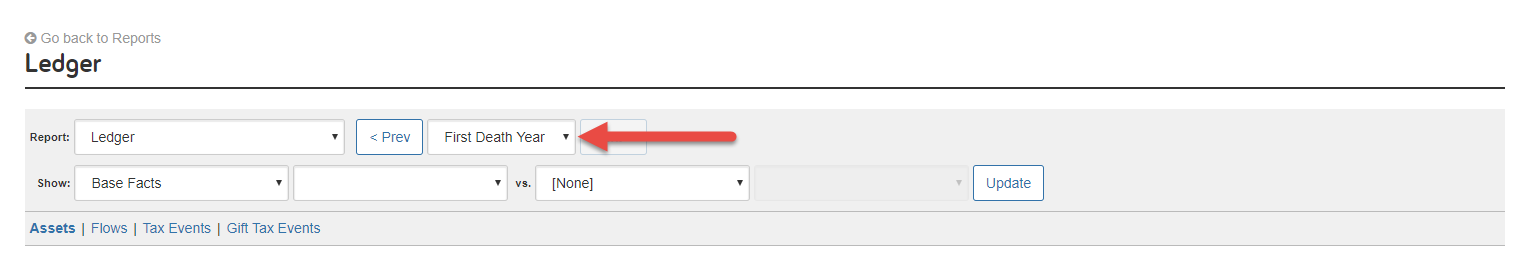

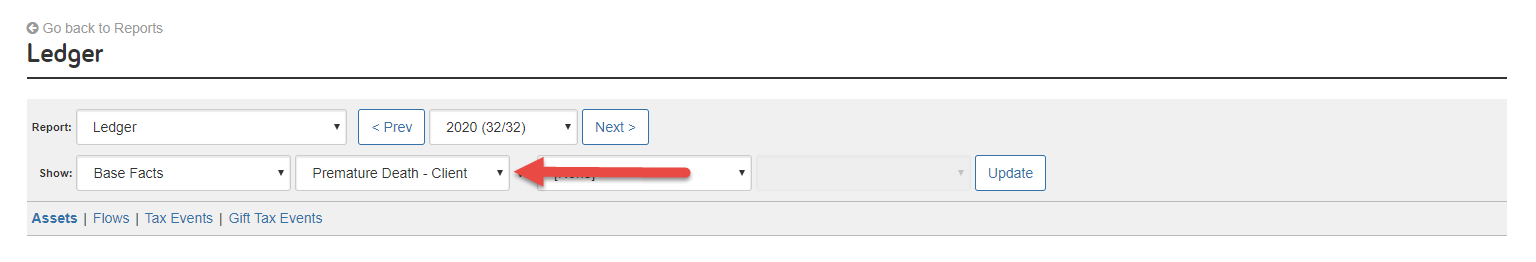

To view the proceeds account, view the Ledger report. Here, you can see the value of the account at death and any activity in the account after the death year. Make sure you select the insured client’s death year or apply the Premature Death what-if at the top of the report to see the proceeds account.

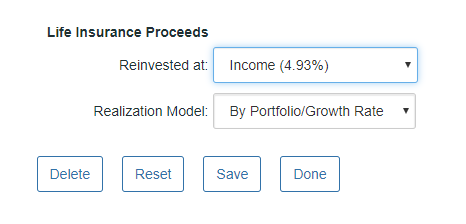

Reinvesting Proceeds

On the Ledger, you may see the account is growing, but when and where did you enter a growth rate? You’ll want to go back into the life insurance fact and scroll to the bottom. Here, you’ll see two fields under Life Insurance Proceeds:

Liquidating Proceeds

You may also notice withdrawals from the account on the Ledger. It’s important to note that if there is a negative net cash flow, the system will liquidate the proceeds account first and the account cannot be excluded from liquidation.

Pro tip: To transfer funds out of the proceeds account, create a scenario in Plans and add a transfer flow. The proceeds account will show as an option under Source.